As I have already explained this morning, there is no Covid debt crisis. The UK national debt hardly increased in 2020/21. And the cost of servicing the debt from Covid could be virtually nothing, if the government so chose. There is, in other words, no excuse for the government to impose 'Cuts for Covid' as if somehow the crisis needs paying for, when that is not the case.

This, though, is not to say that there isn't an economic problem resulting from Covid. There most definitely is a real problem arising from the crisis. That is the result of the very high level of government spending during 2020/21.

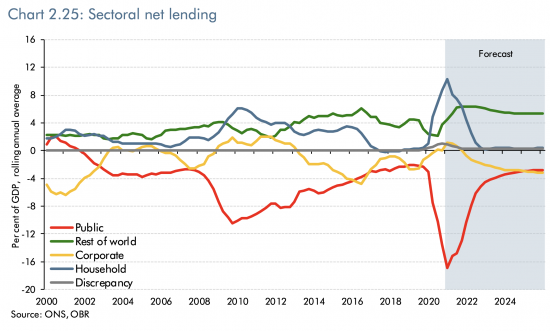

That spending is explained by this chart of the so-called 'sectoral balances within the economy. This version comes from the March 2021 budget forecasts from the Office for Budget Responsibility:

What this shows is which parts of the economy are borrowing at any time, and which are lending (which in these terms is the same as saving, because whether you appreciate it or not, if you save with a bank (for example) you are actually lending it your money, which they then owe back to you).

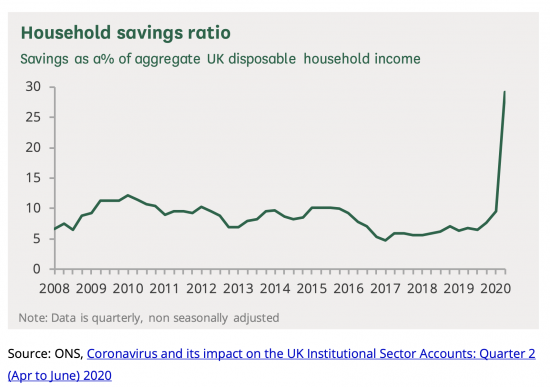

As is apparent, the government borrowed massively in the last year, and entirely appropriately so, and at no real cost because almost all of that was covered by money creation which need not have interest paid in it. The result was that all other sectors within the economy as a whole saved, with households doing more saving than anyone else. The House of Commons Library showed the change like this:

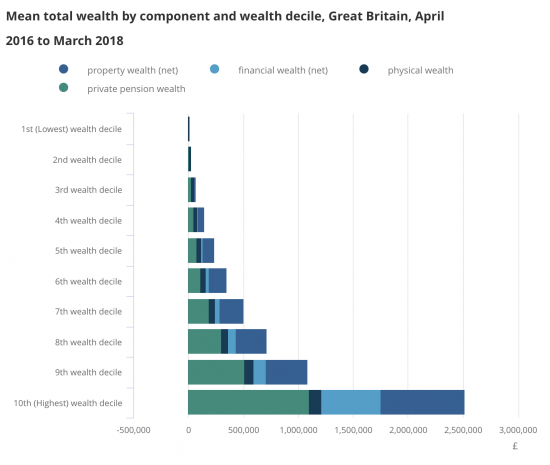

We do not know who precisely saved the most as yet: the data is not available. Past trends show, however, that the already-wealthy will have saved the most. The simple consequence is that inequality will have grown considerably.

The evidence of this is all around us. House prices are at record levels. And stock markets are pushing at all-time high levels.

The fact is that the money the government created to meet very real need during the crisis has to go somewhere if it is not taxed or claimed back through additional government borrowing - which it has not been. So it has gone into asset bubbles as well. And before it is said that most of the subsidy did not go to the wealthy, I know that is the case. But those who received the spending from the government, by and large, spent it, because most people on what might be called ordinary levels of income have what are called as high marginal propensities to consume - which means that almost all they get in income is spent again. We know that because they have very low savings:

The spend keeps going until it meets someone from a higher income bracket who need not spend it. Then it becomes saving. And that is what has happened during Covid.

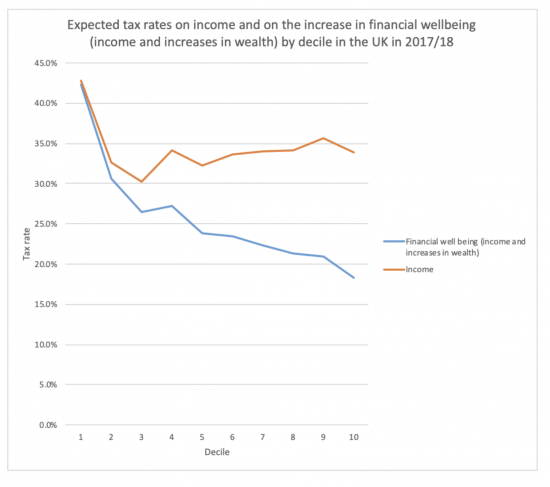

As I have shown, there was massive capacity to tax wealth more in the UK economy before Covid because the effective tax rate on income is about ten times that on wealth, on average, meaning that when both increases in wealth and income are taken into account the true UK tax rate across income deciles is:

The wealthy can simply afford to pay more. This is not because there is anything to be paid for. There isn't. It's simply because they are wealthy and we need to tackle that inequality which is harmful to the cohesiveness of society.

I tackled this a year ago in my Tax After Coronavirus (TACs) project. I listed the options then. The posts on that issue included:

- There is significant room for wealth taxation in the UK

- The UK could tax wealth more

- The relationship between income, wealth and tax

- The TACS approach to wealth taxation

- Reforming taxes on wealth by equalising capital gains and income tax rates

- The need for an investment income surcharge

- Capping total ISA contributions

- Abolishing the personal savings tax allowance

- Restricting pension tax relief

- Abolishing higher rate tax relief on gifts to charity

- Reforming council tax

Other related data includes:

- Capital gains increase income inequality in the UK: the time to align income tax and capital gains tax rates has arrived

I stand by all those recommendations. We are creating a massive wealth imbalance in the UK that right now only more tax can address.

But, and I stress this very strongly: there is no reason for the government to save the resulting revenue. It has nothing to pay for from Covid. What it needs to do are three things:

- Reduce tax rates on those on lower incomes;

- Increase benefits;

- Spend more.

This is not paid for from additional tax: the additional tax removes the impact from the economy. And it really is vital that the left get its collective heads around this. Only then can we build the sustainable economy we need post-Covid.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“restricting pension tax relief”

How much further can it be restricted? And what would the point be? Under the last Labour government a multi-millionaire could put £325,000 into their pension and get top rate tax relief on it. At the moment that’s been reduced to £10,000. Restricting the relief to basic rate would cost a very wealthy person £2,500. Is that your answer to reducing wealth inequality between a multi-millionaire and someone on benefits?

“Wealth taxes”

Denis Healey in his autobiography remarked that in 5 years in office he could never formulate a wealth tax that was worth the administrative hassle and cost of implementation. And that was someone with all the resources of HMIT and the civil service at his command. Many countries that have introduced wealth taxes have abandoned them as they never bring much in. I suppose you think you know better than all these people with practical experience and in depth expertise.

I have nothing against pension saving

But why should the wealthy be so heavily subsidised by society – way beyond anyone else?

Please explain

Go on, try

Might I politely suggest here that, just as excessive wealth accumulation has been enabled by the tools of globalised digital finance, so the panlopy of digital tools available to HMG – when we finally work out how to deploy them in the service of transparent, accountable governance – far, far exceeds the capabilities available to Denis Healey in the ‘seventies.

I think Dennis Healey’s remarks are beside the point. Once it is accepted that the purpose of tax is not to finance the government’s spending, the question of how much a wealth tax would raise is irrelevant. There is plenty of empirical evidence that In a healthy society there would not be great disparities of wealth and it seems to me that the mere fact that people have excessive wealth is reason enough to tax them. Whatever value wealth may have it only has that value in virtue of the government’s ability to tax. If the wealthy are not taxed, the government is, in effect, supporting that value by taxing others less able to pay.

It should also be born in mind that wealth brings with it much more than the ability to surround oneself with nice things. It also brings political power, for instance the ability to affect local authority spending by distorting the local property market or the ability to affect public services though such things as public/private partnerships to say nothing of the ability to control the press and other media, and with great wealth comes great political power.

There are six reasons to tax:

1) To ratify the value of the currency: this means that by demanding payment of tax in the currency it has to be used for transactions in a jurisdiction;

2) To reclaim the money the government has spent into the economy in fulfilment of its democratic mandate;

3) To redistribute income and wealth;

4) To reprice goods and services;

5) To raise democratic representation – people who pay tax vote;

6) To reorganise the economy i.e. fiscal policy.

To presume revenue-raising predominates is simply wrong

How does increasing wealth taxation reduce inequality – e.g. health inequality or educational inequality. What is the mechanism?

You did note I said spend the revenue I presume?

Is it really that hard to follow the logical consequences?

At the macro level that boils down to the following two things surely:

Taxation funding spending

And spending being spent well by the government

Taxation does not fund spending

You really are wasting my time

@Tom

Because removing the excess accumulated wealth from the rich few in the economy allows the government more fiscal ‘space’ to invest in health and infrastructure and to not have this expenditure lead to inflation.

It’s really quite simple. The super rich do not spend all of their income. They spend hardly any of it. They tend to invest it unproductive and rentierist assets. So they end up extracting wealth; they don’t create it. This is a vicious cycle that needs to be reformed. Even Adam Smith knew this to be the case.

If we stop this nonsensical hoarding of the sovereign medium of transfer and allow a government the space to spend in the public interest as a whole, then the lives and livelihoods of the many, and most importantly the poorest, can be markedly improved.

Unless you have a Thatcherite idea to offer to the contrary? Shall we try a bit more ‘trickle down’ for a laugh?

This talk “ The Political Significance of the Ontology of Money” by Graham Hubbs is not directly related to the “Covid financial crisis” but I thought it might interest you or readers of this blog. It is aimed at an audience of philosophers. If you have the time to watch it I would be interested in your opinion of it.

https://www.youtube.com/watch?v=9aE13VoFd4U

Agreed.

It would also be necessary in order to curb their extra -curricula activities like funding low tax parties and those who open up nationalised services to their ‘investment’.

Worth having a look at this

https://www.politico.com/magazine/story/2014/06/the-pitchforks-are-coming-for-us-plutocrats-108014/

Basically if the wealthy dont agree to ‘Become less wealthy’ by whatever means (Higher wages for their staff, pay themselves less etc etc) then they might find themselves ‘Less Wealthy’ in a rather uncontrolled and potentially nasty fashion.

I am not convinced that the wealthy have got wealthier due to accumulating the extra money that the government has pumped into the economy. Most of my family/friends have got wealthier over the past year because they have simply spent less – the direct result of lockdowns and WFH. This reduced expenditure has impacted the incomes of the people that that money would have been spent on. The government expenditure has largely topped up this lost income.

The net result is, of course, largely the same – the wealthy have got richer. However, an important consideration is that this increase in wealth has happened due to a reduction in their lifestyle (ie it is not impact free). As we come out of lockdown, it is unclear whether this additional wealth will be spent or saved. There is some evidence that some of it is being spent (especially on home improvements), however, it is also likely that due to continued economic uncertainty, some of it will remain saved. If most if it eventually gets spent, then it will be taxed at the time (through VAT) so reducing the argument for the need of wealth taxes.

An argument against wealth taxes is that there is no point having wealth if it is never spent – it is the act of spending that gives it value. Taxes can simply be focused on the spending part. However, that also assumes that you sensibly tax capital gains that arise from having wealth (not currently the case)

Smon

First, don’t extrapolate a micro position is the first rule of macroeconomics. That is what you are doing.

Second, excess wealth does not exist to be spent: it exists to be bragged about, Hence the obsession with house prices. Read Veblen on this

Third, wealth is not spent – much of it cannot be – like second homes

You have most of your logic very wrong