As the Guardian has noted this morning:

The highest paid 1% of British earners received nearly 17% of all the country's income ahead of the Covid-19 crisis, according to a study making allowance for the concentration of taxable capital gains among the better off.

Analysis by Warwick University, the London School of Economics and the Resolution Foundation of previously confidential HMRC data showed that the top 1% had a growing and much bigger slice of income than previously thought.

The study said that some taxable capital gains were really sources of income and were heavily concentrated among the well off.

Official data showed that in 2017-18 there were £55bn of taxable capital gains recorded — a more than doubling of the figure five years earlier once inflation was taken into account. The majority of the taxable capital gains (£34bn) were received by 9,000 individuals, who each made gains of £1m or more.

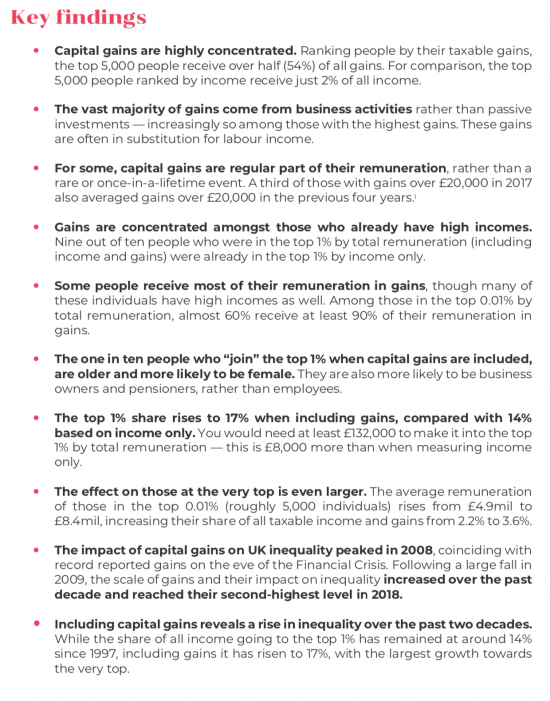

The summary of findings in the actual report (of which I had an advance copy) was:

This, of course, confirms why I have found that the effective tax rate of the best off is much lower than that which appears to be the case based on income alone, which is a finding that underpins the Tax After Coronavirus (TACs) project.

This is good work from Andy Summers at the LSE and Arun Advani at Warwick that helps shatter some of the myths around this issue and makes it very clear that alignment of income tax and capital gains tax rates is essential, as is an investment income surcharge.

-------

For those watching on 21 May there is a webinar at 11am UK time on this issue here.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buffet was astonished to learn his secretary paid a higher rate of tax than himself some years ago and that was to do with capital gains – nothing has changed in those years. I have some sympathy for the distributism theory, so I can think of no good reason why gains or any other way in which money arrives in a persons bank account, including gifts, should not be subject to income tax.

And for the truly obscene amounts of money that tax should veer towards the almost confiscatory rates we had until Thatcher decided the rich needed more money to encourage them to work, and create wealth to trickle down to the plebs, while the poor needed less money to encourage them to work harder.

Time to aspire to some truly radical solutions.

Thanks

[…] I've noted this morning suggests underpayment by the wealthy may well be greater than many have […]

The webinar today was all booked up when I looked earlier – perhaps the RF will upload the slides or a recording later.

The LSE is holding another event on 15 June: http://www.lse.ac.uk/Events/2020/06/202006151600/how-much-tax They usually record the event and release a podcast version in due course.

I absolutely agree that the capital gains regime in this country is in desperate need of reform in order to promote equality and tax justice.

But there’s more. I would suggest that the UK tax system should also be drastically reformed to remove the enormous bias that exists as regards the taxation of income from capital compared to income from employment (or self-employment).

Here’s a clear example. 2018/19 an employee in England and Wales earning £56,550 would have paid a total of £15,733 income tax and NICs. If the director of his own company paid himself a salary of £11,850 [equal to the personal allowance] and the company declared a dividend of £44,700 to him he would have the same £56,550 total income. The total tax and NIC payable by the second individual in those circumstances would have only been £6164 [£2000 @ 0%, £32,500 @ 7.5%, £10,200 @ 32.5%, plus a small amount of NICs as the threshold is less than the tax personal allowance].

So the dividend route would save a company director £9569 in those specific circumstances, compared to a “normal” employee. Now I know the apologists will point out that Corporation Tax on the £44,700 dividends should be taken into account, but if that is the case, then so should secondary NICs. The difference in the overall tax burden as between the two scenarios would then not be £9569, but would still be about £7000 [difference only reduced by the difference between CT and secondary NICs on £44,700].

Roy

I am addressing these issues in the Tax After Coronavirus (TACs) series – NIC is next to do…