This page refers to and links where possible to my major publications, largely to shut up those trolls who say I have never written anything.

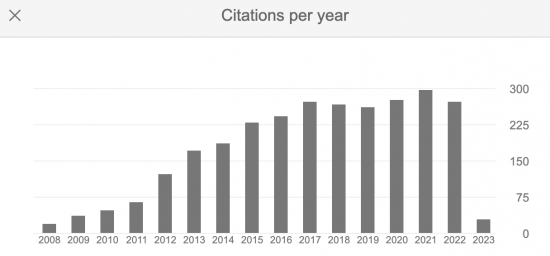

For those interested, the impact of the publications can be found on my Google Scholar ranking, which In February 2023 looks like this:

That's not bad for a part-time academic.

Books

Murphy, R. (2021). Money for nothing and my tweets for free. Ely: The Finance Press.

Murphy, R. (2017). Dirty Secrets. London: Verso Books.

Murphy, R. (2015). The Joy of Tax. London: Transworld.

Murphy, R. (2013). Over Here and Undertaxed: Multinationals, Tax Avoidance and You. London: Random House.

Murphy, R. (2011). The Courageous State. Cambridge: Searching Finance.

Palan, R., Murphy, R. and Chavagneux, C. (2010). Tax havens: How globalization really works. Cornell University Press.

Murphy, R., Deeks, S. and Nolan, S. (1991), Money Matters: The artist's financial guide. Sunderland: AN Publications.

In press (book chapters)

Murphy, R. (2022) Financial Reporting Standard: Accounting for environmental change. Draft published for discussion March 2022. Corporate Accountability Network and Centre for Research into Accounting and Finance in Context (CRAFiC), Sheffield University Management School

Murphy, R. (2021). Reappraising the Tax Gap. In Unger, B., Rossel, L. and Ferwerda, J. (Eds.), Combating Financial Fraud and Empowering Regulators (pp. 61-74). Oxford: Oxford University Press.

Murphy, R. (2019). Tax justice and the challenges of measuring illicit financial flows. In Evans, J., Ruane, S. and Southall, H. (Eds.), Data in society: challenging statistics in an age of globalisation (pp. 103–114). Bristol: Policy Press.

Murphy, R. (2019). Rethinking Britain Edited by Sue Konzelmann, Susan Himmelweit, Jeremy Smith and John Weeks. In Konzelmann, S., Himmelweit, S., Smith, J. and Weeks, J. (Eds.), Rethinking Britain (pp. 46–48). Bristol: Policy Press. ISBN 978-1-4473-5252-5.

Murphy, R. (2019). Taxation - A Philosophy. In Scott, D. (Ed.), Manifestos policies and practices: an equalities agenda (pp. 191–216). London: UCL Institute of Education Press. ISBN 978-1-78277-285-9.

Baker, A. and Murphy, R. (2018). Systemic stabilization and a new social contract. In Hay, C. and Hunt, T. (Eds.) Building a Sustainable Political Economy: SPERI Research and Policy. London: Palgrave Pivot.

Murphy, R., Moreno-Dodson, B. and Zolt, E.M. (2017). Wealth Taxes in Developing Countries. In Moreno-Dodson, B., Alepin, B. and Otis, L. (Eds.), Winning the Tax Wars: Tax Competition and Cooperation. Washington DC: Kluwer Law International. ISBN 978-90-411-9460-2.

Murphy, R. and Sikka, P. (2017). Unitary Taxation: the Tax Base and the Role of Accounting. In Picciotto, S. (Ed.), Taxing Multinational Enterprises as Unitary Firms (pp. 75–88). Brighton: ICTD. ISBN 978-1-78118-341-0.

Murphy, (2016). Country-by-country Reporting. In Pogge, T., and Mehta, K. (Eds.), Global Tax Fairness (pp. 96–112). Oxford: Oxford University Press. ISBN 978-0-19-103862-4.

Murphy, (2015). Institutional Interests. In Srblin, D. (Ed.), Tax for our Times; How the left can reinvent taxation (pp. 25–30). London: Fabian Society. ISBN 978-0-7163-0640-5.

Murphy, (2015). Tax Competition: A Case of Winner takes all? In Christensen, J. (Ed.), The Greatest Invention: Tax and the Campaign for a Just Society. (pp81 – 84) Margate: Commonwealth Publishing.

Murphy, (2015). How to make multinationals more transparent. In Christensen, J. (Ed.), The Greatest Invention: Tax and the Campaign for a Just Society. (pp 99 – 103) Margate: Commonwealth Publishing.

Murphy, R. (2012). Accounting for the missing billions. In Reuter, P. (Ed.) Draining Development. (pp265 – 308). Washington DC: The World Bank.

Murphy, (2012). Tax at the heart of Labour left. In Clarke, E. and Garnder, O. (Eds.). The Red Book (pp 99-107). Cambridge: Searching Finance.

Meinzer, M. and Murphy, R. (2010). The tax gap at the core of the current financial crisis. In: Watt, A. and Botsch, A. (Eds.), After the crisis: towards a sustainable growth model. (pp. 130-134). Brussels: The European Trade Union Institute.

In press (Reports and similar style publications)

Haslam, C., Leaver, A., Murphy, R and Tsitisanis, N. (2021) Assessing the impact of shareholder primacy and value extraction: Performance and financial resilience in the FTSE350. Sheffield: Centre for Research into Accounting and Finance in Context (CRAFiC), University of Sheffield, forthcoming.

Leaver, A. and Murphy, R. (2021) How hollowed-out firms manufacture their distributable profits. Sheffield: Centre for Research into Accounting and Finance in Context (CRAFiC), University of Sheffield.

Leaver, A. and Murphy, R. (2020) Financial engineering and the productivity crisis. Sheffield: Centre for Research into Accounting and Finance in Context (CRAFiC), University of Sheffield. http://eprints.whiterose.ac.uk/163162/1/Final_Report_Leaver-and-Murphy.pdf

Baker, A., Haslam, C., Leaver, A., Murphy, R., Seabrooke, L., Stausholm, S. and Wigan, D. (2020) Against hollow firms : repurposing the corporation for a more resilient economy. Sheffield: Centre for Research into Accounting and Finance in Context (CRAFiC), University of Sheffield https://www.sheffield.ac.uk/media/15425/download

Murphy, R., Seabrooke, L and Stausholm, S. (2019) A Tax Map of Global Professional Service Firms: Where Expert Services are Located and Why. Copenhagen: Copenhagen Business School. https://openaccess.city.ac.uk/id/eprint/21868/7/

Murphy, R. (2019) The European Tax Gap: A report for the Socialists and Democrats Group in the European. Ely: Tax Research LLP https://socialistsanddemocrats.eu/sites/default/files/2019-01/the_european_tax_gap_en_190123.pdf

Baker, A. and Murphy, R. (2019) The Political Economy of ‘Tax Spillover': A New Multilateral Framework. Global Policy. https://onlinelibrary.wiley.com/doi/full/10.1111/1758-5899.12655

Murphy, R. (2019). Sustainable cost accounting: The case for building climate reporting into financial accounting. Ely: Corporate Accountability Network. http://www.corporateaccountabilitynet.work/wp-content/uploads/2019/12/SCANov2019.pdf

Murphy, R. and Guter-Sandu, A. (2018) Resources allocated to tackling the tax gap: a comparative EU study. London: City, University of London. https://openaccess.city.ac.uk/id/eprint/21460/1/

Cobham, A., Gray, J. and Murphy R. (2017) What do they pay? London: Data for Tax Justice. https://datafortaxjustice.net/what-do-they-pay/

Murphy, R. and Stausholm, S.N. (2017). The Big Four - A Study of Opacity. Cambridgeshire: GUE/NGL - European United Left/Nordic Green Left. Brussels: GUE/NGL. https://www.guengl.eu/content/uploads/2017/07/GUENGL_Big_Four.pdf

Murphy, R. and Palan, R. (2015) Why the UK's Fiscal Charter is Doomed to Fail: An analysis of Austerity Economics during the First and the Second Cameron Governments. London: City University. https://openaccess.city.ac.uk/id/eprint/16445/1/

Murphy, R. (2014). In the Shade: Research on the UK's missing economy. Downham Market: Tax Research LLP. http://www.taxresearch.org.uk/Documents/Intheshadesummary.pdf

Murphy, R. (2014). The Tax Gap. Tax Evasion in 2014 - and what can be done about it. Downham Market: Tax Research LLP. https://www.taxresearch.org.uk/Documents/PCSTaxGap2014Full.pdf

Murphy, R. and Reed, H. (2013). Financing the Social State: Towards a full employment economy. London: CLASS. http://classonline.org.uk/pubs/item/financing-the-social-state

Murphy, R., and Christensen, J. (2012). Tax us if you can. London: The Tax Justice Network. https://www.taxjustice.net/cms/upload/pdf/TUIYC_2012_FINAL.pdf

Murphy, R. (2012) Closing the European Tax Gap: A Report for Group of the Progressive Alliance of Socialists Et Democrats in the European Parliament. Brussels. https://www.socialistsanddemocrats.eu/sites/default/files/120229_richard_murphy_eu_tax_gap_en.pdf

Murphy, R. (2012). Country-by-Country Reporting: Accounting for globalisation locally Downham Market. http://www.taxresearch.org.uk/Documents/CBC2012.pdf

Murphy, R. (2011). The Cost of Tax Abuse. A Briefing Paper on the Cost of Tax Evasion Worldwide. London: The Tax Justice Network. https://www.taxjustice.net/wp-content/uploads/2014/04/Cost-of-Tax-Abuse-TJN-2011.pdf

Murphy, R. (2011). 500,000 missing people: £16 billion of lost tax. How the UK mismanages its companies. Downham Market: Tax Research LLP. https://www.taxresearch.org.uk/Documents/500000Final.pdf

Murphy, R. (2010). Making Pensions Work. Downham Market: Finance for the Future. http://www.financeforthefuture.com/MakingPensionsWork.pdf

Murphy, R. (2010). Green quantitative easing: Paying for the economy we need. Finance for the Future. Downham Market: Tax Research LLP. http://www.financeforthefuture.com/GreenQuEasing.pdf

Murphy, R. (2008). The Missing Billions: The UK Tax Gap. The Trades Union Congress, London.

Murphy, R. (2008) Finding the secrecy world: rethinking the language of ‘Offshore'' London: Tax Research LLP and the Tax Justice Network.

Murphy, R. et al (2008) A green new deal. London: new economics foundation. https://greennewdealgroup.org/wp-content/uploads/2019/06/a-green-new-deal.pdf

Murphy, R., Christensen, J., Kapoor, S., Spencer, D., and Pak, S. (2007) Closing the Floodgates: Collecting tax to pay for development. Lodoon: Tax Justice Network. http://www.taxjustice.net/cms/upload/pdf/Closing_the_Floodgates_-_1-FEB-2007.pdf

Van Dijk, M., Weyzig, F., Murphy, R. (2006). The Netherlands: a tax haven? Amsterdam: SOMO. https://www.somo.nl/the-netherlands-a-tax-haven/#:~:text=All%20the%20empirical%20evidence%20indicates,gains%20income%20from%20foreign%20subsidiaries.

Murphy, R. (2003) A proposed international accounting standard: reporting turnover and tax by location. Basildon: Association for Accountancy & Business Affairs. http://visar.csustan.edu/aaba/ProposedAccstd.pdf

Murphy, R., Hines, C. and Simpson, A. (2002) People's Pensions. London: New Economics Foundation. https://neweconomics.org/uploads/files/5ddea38e3ffca8bef3_com6y1pby.pdf

Journal Articles

Baker, A. and Murphy, R. (2020) Creating a race to the top in global tax governance: the political case for tax spillover assessments. Globalizations, 18(1), pp. 22-38. DOI: 10.1080/14747731.2020.1774324

Baker, A and Murphy, R (2020). Modern Monetary Theory and the Changing Role of Tax in Society. Social Policy & Society, 19:3, pp. 454-469. DOI: https://doi.org/10.1017/S1474746420000056

Murphy, R., Janský, P. and Shah, A. (2020). BEPS Policy Failure—The Case of EU Country-By-Country Reporting. Nordic Tax Journal, 2019(1), pp. 63–86. doi:10.1515/ntaxj-2019-0005.

Baker, A. and Murphy, R. (2019). The Political Economy of ‘Tax Spillover': A New Multilateral Framework. Global Policy, 10(2), pp. 178-192. https://onlinelibrary.wiley.com/doi/full/10.1111/1758-5899.12655

Murphy, R. and Seabrooke, L. (2019). The case for building climate reporting into financial accounting. SAMFUNDSØKONOMEN, December 2019, pp. 95–101.

Murphy, R. (2019). Tax and modern monetary theory. Real World Economic Review, 89(89), pp. 138–147.

Murphy, R. (2019). ‘Corporate tax avoidance: is tax transparency the solution?': a practitioner view. Accounting and Business Research, 49(5), pp. 584–586. doi:10.1080/00014788.2019.1611728.

Palan, R., Murphy, R., Chavagneux, C. and Mousli, M. (2009). Les paradis fiscaux : entre évasion fiscale, contournement des règles et inégalités mondiales. L Economie politique, 42(2), pp. 22–22. doi:10.3917/leco.042.0022.

Christensen, J. and Murphy, R. (2004). The Social Irresponsibility of Corporate Tax Avoidance: Taking CSR to the bottom line. Development, 47(3), pp. 37–44. doi:10.1057/palgrave.development.1100066.

Newspaper articles/Media

More than 20,000 posts on the Tax Research UK blog http://www.taxresearch.org.uk/Blog/ 2006 - 2023. That is 3 posts a day on average, 365 days a year, for 16 years. 3.2 million reads in 2020.

More than 200,000 comments have been made on the Tax Research LLP blog.

Numerous (i.e hundreds) of newspaper and professional journal articles over many years (the first in 1985).

Numerous (i.e hundreds) of television, radio and other broadcasts over many years

Regular budget commentary on BBC Radio 2 (for the last decade).

227,000 Twitter followers