The reasons why wealth needs to be subject to additional taxation has been discussed in another Tax After Coronavirus (TACs) post, with all links being supplied there and so it will not be repeated here.

What was also discussed in that post was that the necessary short term changes to wealth taxation fall into three groups. They are, firstly, to equalise tax rates on equivalent sources of income or allowances. Second, it is by reconsidering those things that should be taxed that are not but might be if the goal of greater equality is to be achieved, and vice versa. In other words, those parts of available tax bases subject to exemptions and reliefs need to be reviewed. Third, it is about creating a more progressive tax system by changing tax rates without challenging, as far as possible, the first objective.

Restricting pension tax reliefs

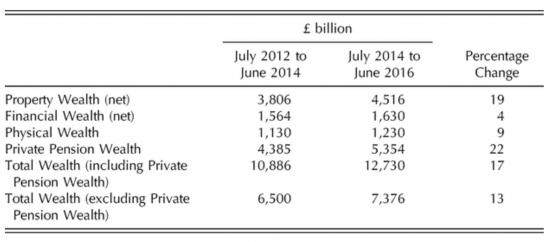

In a recent academic paper co-authored with Prof Andrew Baker of the University of Sheffield we explored issued relating to wealth in the UK and the impact of tax upon it. As we noted, wealth is held as follows, based on the most recently available data at the time we were writing (it's since been updated but with little consequence for the argument made here):

Of that total wealth we noted that most property wealth (in the forms of people's homes), all pension wealth, and about a third of financial wealth at that time, in the form of ISAs, was tax subsidised. As we noted, also drawing attention to an analysis we had prepared on the costs of various tax reliefs in that same paper:

In total, therefore, it is likely that 81 per cent of UK personal wealth is held in heavily tax incentivised assets. The tax system — which incentivises these assets at a cost of more than £86n a year — is not neutral in the process. This analysis suggests that about 20 per cent of tax reliefs might be used in ways that promote inequality in the UK.

The figures can be open to minor reinterpretation, and will change slightly over time, but however we think this analysis is undertaken the same broad conclusion will be reached. In that case if the issue of wealth inequality is to be tackled then so too must tax reliefs be reformed.

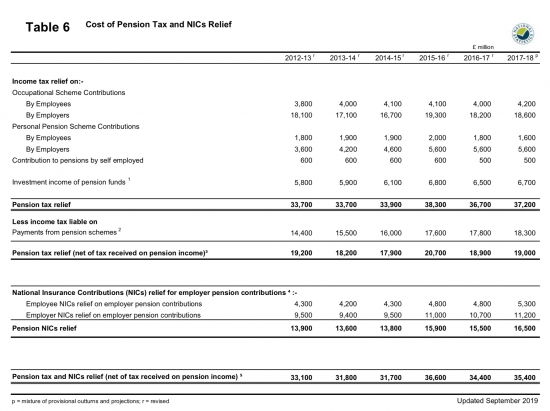

The most egregious of these reliefs is that for pension c0ntributins. The rules in this area are complex, most especially when they are tapered and partially withdrawn in various ways for those who are on the highest incomes (which has, overall, been a welcome step taken in recent years). However, the cost of this relief remains high. This data comes from HM Revenue & Customs:

It is important to note that HM Revenue & Customs like to suggest that tax paid on pensions can be offset against the current cost of pension tax relief, but doing so breaches all the rules of accounting. The tax paid on pensions enjoyed in the current year relates to the tax reliefs given in earlier years, and not those of the current year. As such they cannot be offset. Items must relate to the same year to be offset.

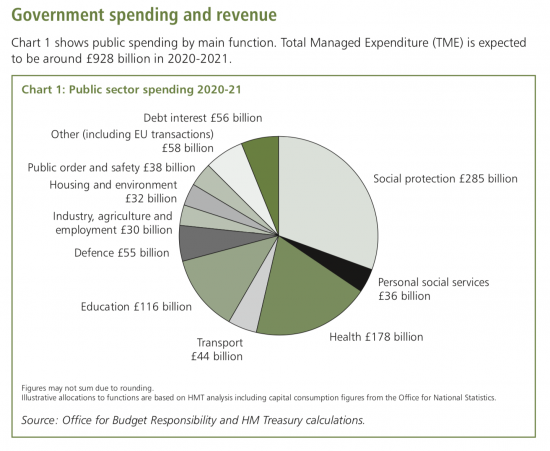

The result is that the most recent estimate of the cost of pension tax reliefs is £37.2 billion for tax plus £16.5 billion of national insurance, or about £53.7 billion a year. That is almost exactly the same as current defence spending:

There is an argument as a result that this relief should be abolished altogether as a cost that cannot be afforded.

That is not suggested here, although it has been proposed that the relief should be made conditional on the use made of at least some of the money invested in pension funds.

Instead the issue that is of concern is that it is still the case that a great many people paying higher rate taxes (who represent approximately 12% of the taxpaying population) enjoy tax relief at 40% on the contributions that they make to pensions when about 88% of the UK population receive tax relief at 20%.

In other words, those who are the highest earners get at least double the tax relief for each pound that they contribute to their pension pot compared to most people, and this is bound to increase wealth inequality in the UK.

This is very obviously inappropriate: subsidising those already best off more than those who are not is contrary to the principle of seeking to reduce inequality that should be inherent in the UK tax system.

The solution is quite simple: no contribution to a pensions fund should enjoy tax relief at a rate greater than the basic rate of UK income tax. Higher rate pension tax relief should be abolished.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thanks Richard – whilst I’ve been working at my understanding of MMT for a few years now, the most difficult pat of that was understanding the role of tax beyond currency a value, and in addition to people like Michael Hudson, you’re writing has been really helpful. What are not so helpful are pieces from business schools like this:

https://theconversation.com/economic-recovery-will-come-with-high-levels-of-unemployment-how-should-governments-respond-136742

Unless I’ve misread it, what continues to anger me (though I ought perhaps not let expected behaviours disappoint) is what looks like a re-application of the wrong medicine (tax breaks) dressed up like so:

“So policy looking to minimise the potential for a jobless recovery should look to increase production in the economy and increase the marginal returns from hiring labour.

For example, cuts to corporate tax rates can help by improving business profits, although cuts to employers’ national insurance contributions would be a more effective approach to directly addressing employment levels. ”

To be fair, the author does go on to say (my highlighting via asterisks):

“Overall, the most significant impact on the economy and employment would come from a complete structural reform to tax and spending policy. In 2011 a comprehensive review of UK tax structure highlighted many inconsistencies and inefficiencies, concluding that the system was “inefficient, overly complex and frequently unfair”.

Since then, some small changes have been made, but these inefficiencies and complexities persist. **If there was ever a good time to initiate truly bold reforms, it is now.**”

But what I’ve seen in the past suggests that the ‘reform the tax system’ message gets replaced by ‘cuts to corporate taxes’.

Anyhow, aside from that, agree re the abolishen of higher rate pension tax relief and also conditionality that pension funds be invested to create productive resources (in the most human sense of that) useful to future generations.

Thanks

“It is important to note that HM Revenue & Customs like to suggest that tax paid on pensions can be offset against the current cost of pension tax relief, but doing so breaches all the rules of accounting. The tax paid on pensions enjoyed in the current year relates to the tax reliefs given in earlier years, and not those of the current year. As such they cannot be offset. Items must relate to the same year to be offset.”

Well, that’s just a complete nonsense. The government is not drawing up a set of accounts. Accounting rules just do not apply here.

Besides which there are plenty of tax rules which go againts accounting rules. AIA being an obvious example where an asset with an economic life of, say, 5 years would, under accouting rules, be offset against profits over its useful economic life whereas under tax rules it is offset in full on the day it is purchased – even if that were one day before the end of an accounting period.

“In other words, those who are the highest earners get at least double the tax relief for each pound that they contribute to their pension pot compared to most people”

And a higher rate tax paying plumber gets double the tax relief for each pound they spend on buying a wrench than does a basic rate taxpayer. If your logic held good, this would also be contributing to inequality and the higher rate tax relief removed. However, you and logic are strangers.

As always, you draw a picture of a world you would like to see rather than the one which actually exists. Inconvenient facts are ignored or misinterpreted or hammered into an unrecognisable shape to fit your picture.

Dave

From your other comments I note you are there to troll

And all you confirm here is that you clearly do not understand accounting or believe that, when it suits your purpose, the government should present data honestly

This data is presented inappropriately: the offset cannot be made in a true and fair fashion

Tax is not true and fair

But the government should be

You clearly are happy for the truth to be misstated

And that is why you are not welcome here

Hello Richard

To help here, could you clarify?

You say “The result is that the most recent estimate of the cost of pension tax reliefs is £37.2 billion for tax plus £16.5 billion of national insurance, or about £53.7 billion a year.”

But you have also said that tax paid on pensions in the future which relate to pension contributions made in 2017-18 is a proper deduction from the cost of those 2017-18 reliefs. So the cost CANNOT be £53.7bn because tax will one day be paid when those pensions are paid. Shoudn’t you be including an estimate of the tax paid in the future in order to get a ‘true and fair’ cost?

If the rules you have said should be applied, you HAVE to include a figure as otherwise that figure of £53.7bn CANNOT be a ‘true and fair’ figure as you are giving a deduction of £0 when we know there will be tax paid on pensions in the future.

Why?

And what is the sum in question?

And how would you value it?

At what rate?

With what discount?

I may be wrong – I am not an accountant – but isn’t the offset calculation done on a cash basis? The tax take this year is reduced by the tax relief given on pension contributions made this year, and the tax take this year is increased by the tax due on pensions paid out this year. It doesn’t anticipate the tax that might be paid when the pension contributions this year are eventually paid out. No doubt an actuary could tell you how to accrue for that if you really wanted.

If you abolish or limit higher rate tax relief for private pension contributions, are you proposing to tax the increase in value of pension rights for higher-paid persons in defined benefit schemes?

Sure they’re both cash

But that does not mean they can be offset

Why should they offset cash flows that do not relate to each other?

Re the latter: no, no more than I am suggesting a tax on the increase in value in defined contribution schemes

I see you have no answer to the point made by another that by your own rules, your calculation of the cost of pension tax relief today should include tax paid on future pensions. Your calculation of the cost as £53.7bn is wrong by your own rules.

You are intellectually dishonest. A fake.

Why not try to make this argument in a forum twhere you cannot control who can point out your miscalculation?

Actually, I asked a series of questions on how to do that

And why future tax is any indication of current cash cost

And why current can cost of current contributions should in any way have tax paid on past contributions offset against them

That was intellectually honest

The dishonesty is all yours

“Why?

And what is the sum in question?

And how would you value it?

At what rate?

With what discount?”

You’re supposed to be the great accountant. Why don’t you tell us?

If you don’t put in a value, then your calculation of the cost is wrong. We WILL get tax on pensions which relate to tax relief given today.

You say it is an accounting principle that pension tax collected must be set against the year in which relief is given to arrive at ‘true and fair’ calculation. Now you are saying “I can’t calculate that, it is too difficult. So I won’t do it”.

First you argue that the pension tax collected must be set against the year in which relief was given. Now you are saying no pension tax collected should ever be set against relief given.

Which would mean we can NEVER get a ‘true and fair’ calculation of the cost of tax relief. So stop going on about how important it is to get a ‘true and fair’ calculation.

I said what the cash cost of this relief was this year in a system where cash accounting is used

I was right

I said a tax revenue relating to another and quite different source could not be offset

I was right

You said I should change my mind

I explained the issues

You cannot explain your reasons

I strongly suspect that’s because you did not realise a) I was comparing cash costs and b) you don’t know the difference between that and the accounting you claim you desire

Either way, you’re trolling and the claims you make do not in any way change the points I have made on higher rate pension tax relief and as such I am not engayi9ng in further pointless debate with you when it is apparent that is not why you are here

I am studiously avoiding the tiresome accusations of dishonesty, in the hope that we can try to discuss this calmly. (Richard, please just block the trolls if you feel the need.)

OK, so you would propose no additional tax on employer contributions to defined *benefit* pension schemes, and no additional tax on increases in value of investments or of pension rights (assuming on doesn’t hit the lifetime allowance, which for defined benefits is broadly 20 times the expected payment). Would the same apply to personal pensions: that is, would income and capital returns on investments held within the pension fund remain free of tax, subject to the lifetime allowance? And would employer contributions to defined *contribution* personal pensions, for example by way of salary sacrifice, remain free of tax?

Yes

I’m just saying limit the tax relief on contributions

I did not mention anything else

Do you think I should have done?

I’m curious…

One thing that stands out to me is that tax relief is very effective in directing savings.

Very

Hence why I say it should be retained to direct funds to the Green New Deal

As a relatively poorly paid public sector worker, no tax relief on pensions would mean that I cannot afford to pay higher contributions for my defined benefit pension, forcing me to come out of the scheme.

This would probably mean I would be a burden on the state in retirement – surely this is the opposite of what the government should be trying to achieve?

If you are a relatively poorly paid public worker what I have said does not have any effect on you

Or is poorly paid in excess of £50,000? In which case you are not poorly paid

I agree there is an issue here needing to be addressed but I’ve never been convinced that this is the solution.

I started in the pensions industry in 1990, so I may we’ll have a blinkered view on it.

When I read your book the joy of tax it was the only topic I struggled to agree with.

I think people should be allowed to defer some of their pay (within defined limits) and that is one of the fundamental merits of a pension. (I think that limit should be average earnings)

To me there are two main problems plus the complicating factor of their being two main contrasting types of pensions systems in the UK. – Trying to program past pension legislation changes was fun for me but costly for schemes.

Problem 1: the annual allowance when added to the tax band is too generous. E.g. you start paying 40% tax at 50K but if you could earn up to 90K without paying 40% tax if you put the extra 40k in a pension. To me the issue was setting the 40% tax band too high rather than setting the annual allowance level much to high. (Or the minimum that should have happened was the tax band should have been set with the annual allowance in mind!)

So I think the 40% rate should start closer to average earnings and the annual allowance should be set closer to that too (so people can defer one years average earnings in any year). This would mean people contributing into a pension scheme can earn twice average earnings before paying the higher rate of tax. It also should mean more tax paid on drawing money out of the pension fund.

Problem 2: the 25% tax free cash. This has become an anomaly. This should have been abolished or severely restricted, maybe to 100k.

I think pensions is a big topic that actually needs to have all unintended consequences looked at before changes are made. But big changes should be considered.

I would abolish the 25% – that will come

But I can still see no equitable reason why the wealthy are entitled to higher tax relief than those who might struggle to save

Can you explain that Ken? Especially when real inequality results?

I will consider all your points

Inequality results from public sector pensions being heavily subsidised by the private sector, but you don’t want to address that, and your proposals will actually make it worse.

I was not addressing that issue

So I, unsurprisingly, made no comment on it

Would you like to provide the data to show it increases inequality when the vast majority of those receiving such pensions are on low incomes?

Thanks Richard

Pensions, I don’t know where to start!

I agree inequality is a problem and it appears unjust to give higher tax relief to wealthier people.

I believe the state pension and pension credit should be made sufficient so those who do not have enough private pension provision are not impoverished (I concede that isn’t the case at the moment) – there was an argument within the pension review which brought simplification that if you are really poor you maybe would be worse off contributing to a pension (and they wanted to try to fix that).

I also think pensions is now a complete mess. Given the right to take your full pot in one go it is no more than a glorified savings plan with tax relief on the way in and some on the way out (25% tax free).

The whole thing needs fixed.

I think the bigger thing to fix is the 25% on the way out.

If you alter the relief to 20% on the way in and remove the 25% on the way out. It is unclear how long pensions for higher tax payers would last.

We know why those on higher income get more relief – it is because you get taxed on your net pay after the deduction of pension contribution. Similar arrangement for employers contribution. It is fairly easy to understand (simplicity is a plus), which doesn’t of course make it right. However it does seem fair if you considering your pension as deferred pay and you will be subject to the tax rules prevalent when you come to withdraw your cash (leaving the issue of preferential treatment to one side).

Other thing to consider:

Pensions are for a lifetime (working life plus retirement) during that working life people don’t tend to start as 40% tax payers but rather their salaries increase over time (above inflation) and may move up the tax bands and then perhaps dropping back a bit. So it is conceivable, and indeed it happened to me, paid no tax, 27% tax, lowering slowly, then 40% tax, being on the cusp of 60% (personal allowance withdrawal rate), before dropping back towards the 20%. During this time my income obviously changed drastically but my net wealth by not so much (as I don’t have property). It seemed fair to me that it was my marginal rate that mattered for the relief.

So I would suggest to understand the impact of your proposed change it would be best to understand the cohorts of workers, their salaries through different life stages to establish how many people stay below the 40% band all their working life (and how many of those actually have often been non income tax payers).

This brings me back to the headache which is the modern pension system and another of the topics you have mentioned recently in your blogs – ISA’s.

It appears to me both are now vehicles for saving for retirement. You pointed out how many have £1million in their ISA pot. I think given that these two saving plans are trying to achieve similar things there might be a case for saying the combined wealth in both should be capped. It is worth a thought?

Very definitely Ken

I have already suggested calling ISAs

But I agree pensions is now a total mess

I will keep your comments in mind

“I said what the cash cost of this relief was this year in a system where cash accounting is used”

Hello Richard

But surely with cash accounting one looks at just that. Cash received and cash paid in that year . In which case the government’s ‘accounting’ of pension tax relief costs are correct. No account is taken of accruals.

If accruals accounting is used then some account must be taken of the future tax to come in from pensions to be paid in later years. That cost may be difficult to calculate but you can’t just not include it.

Either way your figure of the cost of pension tax relief being £53.7bn cannot be correct.

You are an accountant, right, you should see that?

But you cannot compare wholly different items (and these are just that) and claim the result is meaningful.

Th3 presentation made is as useful as comparing the current cost of pension relief with business rate income.

It’s not a valid comparison and further comment on this pointless diversion will be deleted

That’s clearly wrong, only looking at one side of the equation will clearly provide a misleading picture and lead to inappropriate decisions being made.

Just like when we look at investment opportunities, we look at both the upfront costs and the future benefits.

Since most pensions are taxed at lower rate and so any forecast will not change as a result of what I am actually saying what is wrong with my actual proposal?

“But I can still see no equitable reason why the wealthy are entitled to higher tax relief than those who might struggle to save”

Should that principle be applied to all tax deductions? I mean to say, why single out pensions?

Higher rate taxpayers by default get higher tax relief on every tax deductable item. If there’s a principle of equity here, surely it applies everywhere.

I’d be interested in a reasoned explanation as to why the same equitable reason shouldn’t apply to, say, two bakers who decide to spend £1,000 redecorating their bakery. The net cost to the higher rate tax paying baker is only £600. The net cost to the basic rate taxpayer is £800. Is that inequitable?

With respect Paula, if you wish to ignore the other variable in the equation, which is income, you are not seeking to contribute in any meaningful way to debate.