The reasons why wealth needs to be subject to additional taxation has been discussed in another Tax After Coronavirus (TACs) post, with all links being supplied there and so it will not be repeated here.

The reasons why wealth needs to be subject to additional taxation has been discussed in another Tax After Coronavirus (TACs) post, with all links being supplied there and so it will not be repeated here.

What was also discussed in that post was that the necessary short term changes to wealth taxation fall into three groups. They are, firstly, to equalise tax rates on equivalent sources of income or allowances. Second, it is by reconsidering those things that should be taxed that are not but might be if the goal of greater equality is to be achieved, and vice versa. In other words, those parts of available tax bases subject to exemptions and reliefs need to be reviewed. Third, it is about creating a more progressive tax system by changing tax rates without challenging, as far as possible, the first objective.

An investment income surcharge

There is a major problem within the UK tax system as a result of the fundamentally different levels of tax paid on income from work and income from investments.

The difference results from the fact that the UK has throughout the whole post-war era had a social security system that is supposedly funded by national insurance contributions (NIC). The reality is that NIC does not fund that social security system now: NIC is now simply a tax, However, the suggestion that this is both a form of insurance and that contributions from those in employment are required as a result has persisted despite that fact. As a consequence an anomaly has been created within the UK tax system.

A detailed numerical explanation of the consequences arising from this disparity is hard to provide, precisely because the NIC system is complex, and rates vary heavily across income scales. However, for employees broadly speaking NIC is paid at 12% on the equivalent of earnings between £9,500 and £50,000 per annum from each employment, and at 2% on earnings above that sum whilst employers pay NIC at 13.8% on the earnings of their employees over the equivalent of £8,788 per annum. Investment income suffers no such charges.

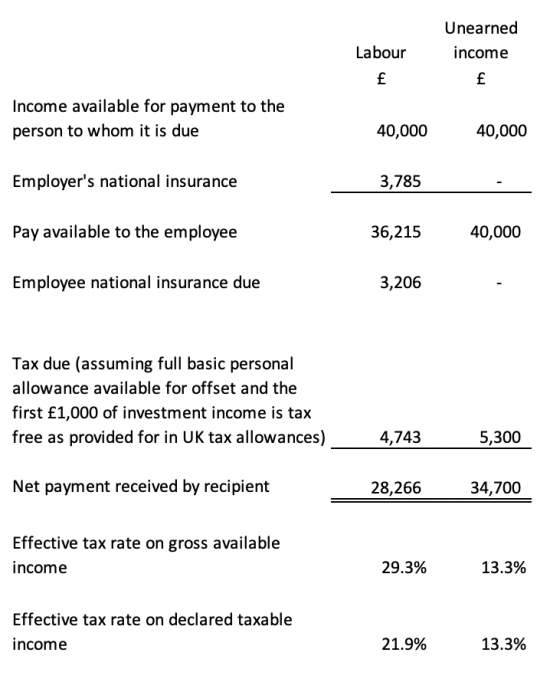

As example of the resulting disparity, assuming £40,000 is available to pay a recipient to whom it is owed, then comparing the tax due on that sum if paid as a salary or as investment income produces the following comparison:

The example is indicative. It is also the case that if the investment income is from dividends a different tax regime applies, and the tax rates can be slightly higher, but are still less than those on labour. The point, however, is very clear, and is that earnings from employment are substantially more heavily taxed than are those from investment income.

For a very long time the UK tax system addressed this issue. Until 1973 the solution was called surtax: an additional tax rate on the wealthiest. Thereafter as the Institute for Fiscal Studies noted in 2002 (and note, this quotation has been edited to highlight the relevant points):

In 1973, the system was overhauled, integrating the surtax on high incomes, which dated back to 1911, into the main income tax and simplifying the operation of the rate structure. During the 1973 reform, the very top rate of income tax on earnings was left at 75 per cent. In 1974, the top rate on earnings was actually increased, to 83 per cent.

Throughout these years, the highest feasible rate on investment income was higher still. These very high tax rates became the focus for discontent over the possible disincentive effects of taxation, even though they affected very few individuals and the theoretical impact on labour supply was ambiguous.

As they noted of the investment income surcharge:

The investment income surcharge [was] an additional income tax charge on unearned income. As this had a maximum rate of 15 per cent, in the second half of the 1970s it combined with the 83 per cent top main income tax rate to give a top feasible marginal rate of 98 per cent on unearned income. Very few individuals were actually charged at this marginal rate. The investment income surcharge was abolished in 1984.

Tax rates had, of course, fallen by 1984, to a maximum 60% rate, excluding this charge.

Since 1984 the bias in favour of unearned has existed.

It could easily be corrected. If, as data shows, those who derive their income from increases in wealth or returns from it are taxed a great deal more lightly than are those who derive all their income from work, then the reintroduction of an investment income surcharge makes a gear deal of sense.

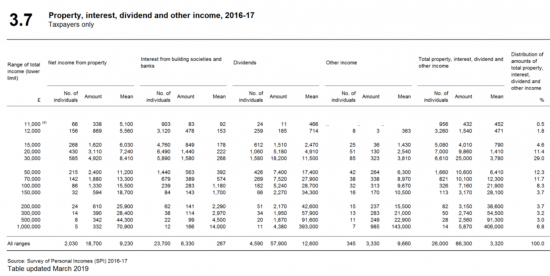

The way in which HMRC supplies data on income tax paid on investment income makes it very difficult to estimate how much additional tax would be due as a result of this change in rate, not least because some figures are stated net of allowances. However, for 2016-17, which is the most recent year for which much of the data is available, investment income was as follows:

Total investment income for those earning over £50,000 was £45 billion. If an investment income surcharge for all those below the age of 60 (when retirement becomes more commonplace) of 15% on all investment income exceeding £2,000 a year was introduced a significant step towards addressing this imbalance would have been created. The yield might exceed £4 billion, but some variation is possible and would require better data before any estimate could be refined.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

i often hear that shareholders dividends have already being taxed once through Corporation tax so the real tax rate on dividend income is actually higher than earned income. What are your thoughts?

Would you like to demonstrate that?

Real world evidence please

Do companies pay dividends from gross earnings or net earnings?

Net earnings

But given the dividend has a deemed credit attached to it in most cases (but not all) no income tax is due and the corporation tax rate is below the income tax rate

“But given the dividend has a deemed credit attached to it”

Wow. I mean, just wow.

The deemed tax credit was removed in April 2016. Dividends have been taxed on a gross basis since then.

You’re putting yourself out there as a tax expert and you don’t even know the basics of dividend taxation.

You’re right

In a busy day I forgot that

Dammit, I’m human after all

There are instead extra now extra tax credits and preferential rates of tax

Most taxpayers might pay 7.5% tax as a result in less income than they would if they were earning

But, what the heck when, let’s be clear, that’s still a massively preferential rate that hardly makes up for the low effective rates of tax in companies

But you’re right on the credit

Thank you

Tess,

The tax rate on UK corporate profits is 19%. Any dividends paid to shareholders are then taxed at 7.5%, 32.5% and 38.1% for a basic, higher and additional rate taxpayer respectively. None of the corporate tax is imputed to the shareholder, but every taxpayer gets a fairly modest exempt dividend amount of £2,000.

So the effective rate of tax on corporate profits distributed to shareholders is 25.075% for a basic rate taxpayer, 45.325% for a higher rate taxpayer and 49.861% for an additional rate taxpayer. As you would expect, all these effective rates are higher than the individual income tax rates of 20%, 40% and 45% respectively.

But ate lower than the tax rates on work

National insurance makes a big difference, but you also need to take into account the business’s tax deduction for employment costs.

For small businesses, when the choice is between whether to incorporate or not, and then whether to take out profits as dividends or bonus, there is no real rational explanation why the tax treatment of dividends, employment income, and self-employment income are so different. And that is without factoring in commercial factors, and other issues such as employment rights and entitlement to pensions.

I’ll get to that eventually….work is a bit overwhelming right now

I have not managed a Tax After Coronavirus (TACs) post today

If you are hearing this often, you are moving in some strange circles. This is no more true for dividend income than it would be for any other income.

I am not an accountant. i was asking for your opinion as to whether corporation tax on company profits and then income tax on dividends represents double taxation or not. I cant demonstrate anything. If it doesn’t then great.

It doesn’t

[…] part of the Tax After Coronavirus (TACs) project I suggested yesterday that there should be an investment income surcharge of 15% on incomes for all those below the age […]