As many readers here will now be aware, amongst my other activities I am a columnist for AccountingWEB, of which I was a contributing editor for many years.

I have an article out there for which the headline looks like this:

In summary, my argument is that when lockdown ends and furlough is over a very large number of people will find themselves unemployed and of those quite a lot will realise that they did not want to go back to their jobs anyway. They will, instead, want to go out on their own as self employed people. And they will. I am already meeting people who are telling me that, from a distance of two metres or more, of course.

In that case there could be a rash of new businesses starting in the UK very soon. And they will need help from good accountants.

And let me stress, there are such things. Indeed, much as I often criticise my own profession (and I will continue to do so whenever it is appropriate) the best accountants play an enormously useful social role.

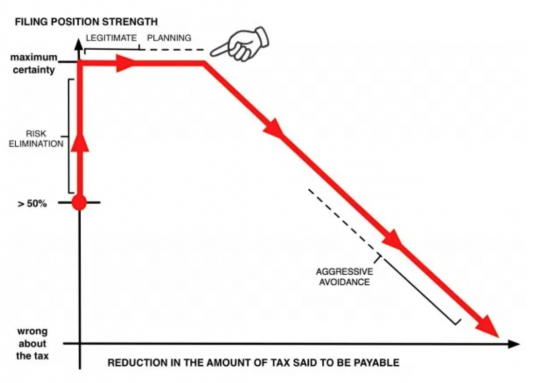

Barrister Claire Quentin (writing as David Quentin at the time) very clearly expressed this in an article on the role of tax advisers which she summarised in this diagram:

A client meeting an accountant for the first time does so at a point midpoint on the Y axis. They do not know what to do to get their business going. The chance that they will make a mistake is high. A good accountant can massively reduce their risk and improve considerably the chance that the person will be tax compliant by driving them up that access by simply ensuring that they comply with all the right tax rules. The risk in the business and for society as a whole is reduced as a result, which is precisely why good accountants are useful.

A client meeting an accountant for the first time does so at a point midpoint on the Y axis. They do not know what to do to get their business going. The chance that they will make a mistake is high. A good accountant can massively reduce their risk and improve considerably the chance that the person will be tax compliant by driving them up that access by simply ensuring that they comply with all the right tax rules. The risk in the business and for society as a whole is reduced as a result, which is precisely why good accountants are useful.

The accountant can then also, wholly legitimately, point out all the rules that are within the spirit of the law that permit that business to reduce its tax bill if it wishes to do so: this is the flat red line at the top of the graph. And I am not condemning this, even when I want those rules changed.

Accountants only become a problem when the tipping point is reached and they begin to adopt what Claire Quentin calls ‘uncertain tax filing positions', which mean that they put in tax returns that include claims that they know are uncertain legally. These can embrace varying degrees if risk, as she shows on her downward sloping line on the chart, which ends in the realm of tax evasion.

The critical point is that an accountant need not advise clients to take these risks. And they can refuse to participate in them. I have not knowingly done so when in practice (I allow for the fact that not every client might have told me the whole truth). Those that won't abuse tax law and who do encourage tax compliance provide a socially valuable service. Sometimes we need to recall that. They deserve to come out of this in a good place.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

As someone who uses an accountant for my small business but doesn’t understand the ins and outs of accounting, how can I identify if what they say is on the flat red line or on the slope?

What would you put on each?

If the government promotes it then it’s in the flat line

If it doesn’t it’s in the sloping one

Just ask “is this explicitly promoted by the law and not some interpretation of it?”

Like many clients, I’ve had mixed experiences with accountants over the decades. As you would expect. Throughout my career with start-ups I had dealings with major corporations and often came into direct contact with their accountants. As a generalisation I’d say the over-riding expectation was how to legally (or quasi-legally!) minimise their tax liability.

In a totally different – and more rewarding – capacity, I once attended a presentation by Dr. Inge Genefke of the International Rehabilitation Council for Torture Victims. I turned to the person sitting next to me to say how moving and inspirational I found her talk. He agreed but said he was now ashamed of his profession. Turned out he was a medical doctor. We had just learned that institutionalised torture can only work if the the victim is kept alive – often requiring the intervention of doctors.

You don’t need me to tell you that all the tax evasion on the planet – for both large and small commercial entities, can only take place with the compliant cooperation of accountants and, of course, lawyers!

While obviously you can’t paint an entire profession with the same brush, clearly the official representative bodies need to clean up their act. Thanks to the efforts of you and

Like many clients, I’ve had mixed experiences with accountants over the decades. As you would expect. Throughout my career with start-ups I had dealings with major corporations and often came into direct contact with their accountants. As a generalisation I’d say the over-riding expectation was how to legally (or quasi-legally!) minimise their tax liability.

In a totally different – and more rewarding – capacity, I once attended a presentation by Dr. Inge Genefke of the International Rehabilitation Council for Torture Victims. I turned to the person sitting next to me to say how moving and inspirational I found her talk. He agreed but said he was now ashamed of his profession. Turned out he was a medical doctor. We had just learned that institutionalised torture can only work if the the victim is kept alive – often requiring the intervention of doctors.

You don’t need me to tell you that all the tax evasion on the planet – for both large and small commercial entities – can only take place with the compliant cooperation of accountants and, of course, lawyers!

While obviously you can’t paint an entire profession with the same brush, clearly the official representative bodies need to clean up their act. Thanks to the enduring efforts of you and others I assume progress has been made, yet tax avoidance is still rife at all levels, isn’t it.

Hmmm …. for some inexplicable reason my reply was truncated. Can’t remember exactly what I was writing. I think I was throwing plaudits your way for the efforts made by you and others to get professional reform but that tax evasion is still as prevalent as it ever was – and maybe even worse. I’m sure you get my drift!

I don’t think “the government promotes it” is a safe test. Sometimes the government changes its mind about what is good. And sometimes HMRC does its best to push one interpretation of its position (including by intimidating people with tribunal actions) when the law is otherwise.

On the first, think about contractors who were encouraged to incorporate, until they weren’t.

On the second, think about the Arctic case, where the settlements legislation was upheld by the court as not catching a gift of shares in a personal company (e.g contracting) to ones spouse, provided the right to the capital went with the income.

And some things are just a matter of judgment. I inherited a farm but HMRC claimed the house was not eligible for agricultural relief because the tenant in it was not paid (which would have been taxed) but was given a rent reduction for watching over the livestock. There was nothing immoral about contesting the decision.

I think the graph that Dave / Claire drew (a friend on mine, by the way) contains its own, much better test. The aggressive avoidance is anything with a <50% chance of succeeding. If you are a rich corporate, why not – you might just get away with it and save a fortune.