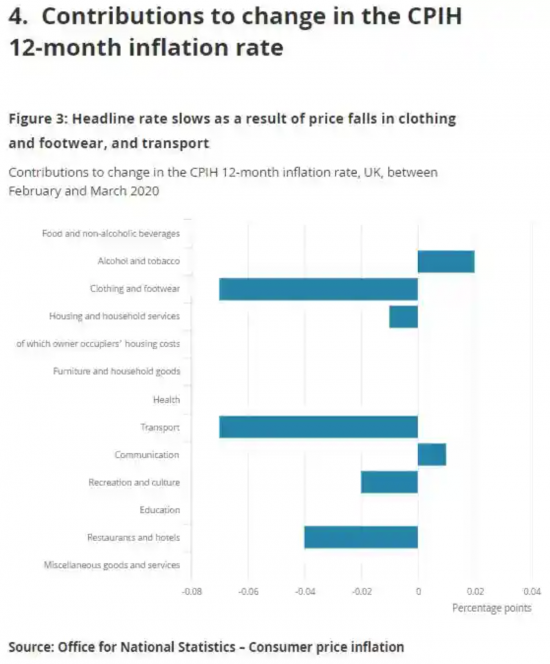

A lot of people seem to be quite excited about the news that inflation has fallen in March as the impact of coronavirus hit. The new rate is 1.5%, which is below the Bank of England target and a fall from February when it was 1.7%. The ONS data shows the moves by economic sector as:

It's hardly surprising that transport, restaurant and clothing have fallen: no one is buying them. The data must have been pretty hard to find, to be candid. And it's not surprising that alcohol and communication are up in a lockdown. But that does not mean people are drinking more: they are just not drinking out.

What is important is that this says nothing about what is to come. For this month and a couple to come lockdown will so distort all data that inflation information will be meaningless. That said, it is also highly likely to be low, because very little is happening and online sales are slashing prices.

Thereafter there will be an increase, almost certainly, simply because that will be a measure of change.

But again, that will also not be meaningful. It will measure reopening, not real change.

In the long term, I cannot see coronavirus and the reaction to it creating inflation. In the short term it's fair to say that the data on this will be unreliable.

In other words, excitement on this data is premature.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Well the markets can get excited about it – bit like BoJo comment about spaffing I guess.

I wrote this yesterday after listening with horror to Andy Haldane being interviewed –

https://www.instituteforgovernment.org.uk/ifg-live

“Coronavirus and the UK Economy”

Bronwen Maddox of the Institute for Government interviews Andy Haldane, Chief Economist at the Bank of England. Most of the interesting questions get asked, and the answers are about as defensive and neoliberal as you’d expect. Haldane expresses concerns about the bank’s balance sheet, is sanguine about whether the markets will keep buying government debt, and attempts to defend the bank’s independence. Says the institutional safeguards of transparency and accountability of the bank gives him, and should give the gilt markets, confidence that this is not monetary financing, this is not helicopter drops.

He seems concerned about rising inflation after exit, which many would disagree with. In his response on inflation, he mentions the price of pasta (not kidding).

Lots of waffle about the shape of the recovery – he avoids the alphabet and goes for a “Nike Swoosh”.

He ducks the question of whether austerity will ensue when the crisis is over on the basis that he’s the monetary policy guy and can’t really comment on fiscal policy – FFS, he’s the Chief Economist!

Bonus point: On productivity, he thinks it will improve post-Covid because low productivity enterprises will not survive. And as we are all having to learn digital during the lockdown, the benefits of a more digital economy will improve productivity. Maybe, at last, he’s onto something there but I wouldn’t bet on it being a major contribution to the Nike Swoosh.

Thanks

I may be wrong, but haven’t previous pandemics, thinking of medieval plague really, caused a shortage in labour supply and so some inflation in wages ?

In the long run

But we are hoping to avoid that scale if death

And the odd thing about this pandemic is it is not hitting working age people much

Excepting those in the NHS

From the Haldane interview it does not sound as though he is exactly owning up to our supposition that they are actually trying something new, and a bit MMTish here. But perhaps that is not too surprising given who he is is and what he represents.

Are there any particular ‘mileposts’ that we should be looking out for as this ‘experiment’ unfurls before us?

I have taken a bet with an ex-banker mate that we will not be treated to a bout of high inflation at the end of this episode (as he fears) but would anyone like to predict what the peak inflation level might be, and at what point in time we might sensibly conclude that ‘The Experiment’ has yielded a verifiable result?

MMT is a fact, not something you try

Quantitative easing is not MMT

Nor is helicopter money

Direct monetary funding (DMF) of government spending by central banks is

So look for DMF

Thanks Richard. Yes DMF is the appropriate title for what I had in mind when referring to the ‘something new that they are trying’, as contrasted to the QE that was applied in the previous crisis.

But what intrigues me is that traditionalists, such as my mate who still believes in ‘Old Monetary Theory’ (OMT) believe that high inflation is inevitable. They believe this because they believe in the oversimplistic and flawed mathematical model PQ=MV (that I would argue its not even an equation but is merely the statement of a truism).

Others (I would probably include myself here) who are informed by MMT, believe that DMF will not produce this undesirable side effect. So in effect, we are seeing an experiment in real time, that tests two conflicting theries. Is that a fair assessment?

If so then my next question is can we quantify the result that we expect to see, in terms of the inflation peak that might be attained and the point in time at which this peak will occur?

I addressed this is a post on inflation and tax increases recently

In haste, can you search for it as I am up against it?

Thanks Richard

Yes there are a couple of particularly useful posts relating to this issue. One was on April 3rd (Answering the Question) and one on March 28th (Tax Justice & MMT). I assume these are the ones you are referring to.

However, I could not see in there any specific reference to the kind of benchmarks I was looking for, to stick into my little wager with my ‘OMT’ friend; but no problem. I might just make some up. Perhaps I will predict ‘inflation will not go above 4% in the next three years even though we have implemented DMF on a significant scale’.

If anyone would like to suggest better (tighter) benchmarks, that would be great.

Sorry – I can do no more now…

I understand. Thanks for all the ammunition you have provided already.