The Office for Budget Responsibility says of itself that:

The OBR was created in 2010 to increase the transparency of the public finances and to provide independent analysis of the fiscal outlook and the uncertainties lying around it.

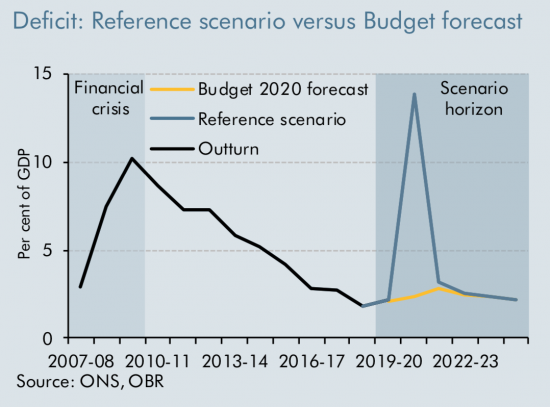

It's announcements on the impact of coronavirus today make clear how far that is far from the truth. In summary their scenario analysis relies on these assumptions:

This is stuff from the world of fantasy. Tolkien and C S Lewis could not do better. The idea that we will lockdown for three months and then 'bounce back quickly' is, frankly, absurd. So too is the idea that there may be 2 million unemployed during this quarter.

What they are predicting is a V-shaped crisis. In other words, and as they plot it (upside down from the way many people might imagine things, hence the usual V description which is inverted here):

They claim we will have a little disruption that will add around £260bn permanently to public debt, but otherwise everything will go back to normal quite soon.

Politely, I think that is impossible. It need not be impossible. That could have happened. Indeed, it might well have happened if the government had guaranteed loans of 100% to smaller businesses, in particular, on Budget day on 11 March; the self-employed had been protected straight away as they were in Germany; mortgage, loans and rent holidays had been legally required, with an absolute loss arising on rents to landlords and on interest to banks and other lenders; and if the so-called furlough scheme had paid out soon enough to actually save businesses under stress. But none of those things happened.

We know that so far 1.4% of businesses applying for government backed loans have got them and less than £1bn of the promised £330bn has been paid out.

We know that the furlough scheme will not open to claims for another week as yet, and heaven knows how long payment will take thereafter.

We know that the self-employed will see no money until June.

We know that literally millions are falling in the cracks between schemes or have been deliberately excluded.

We know that millions are already claiming additional benefits as a result.

And we know that after a crisis people stop spending: demand will not recover because that will be impossible, especially as non-waived rent and loan arrears will be oppressing people, whilst businesses will be burdened by new debts that will crush those still in operation.

But it's alright because we also know that by and large banks and landlords are doing just fine.

In the meantime it's hard to guess how many small businesses will fail. Even if re-opening starts in June, and is gradual, I suspect it will be hundreds of thousands that may not make it. They will have simply become insolvent in the meantime and in the process of trying to start again will run out of capital: what re-opening will create is the classic problem of over-trading with too few resources and those that get through the immediate crisis will then fail without help - which will have to be grants and not loans by then.

So what is the chance that real unemployment is 2 million this quarter, ignoring those furloughed? Zero, I would say.

I think David Blanchflower is much more likely to be accurate with an estimate of 6 million - which has been my ballpark estimate for a while now.

And the magnitude difference of three is significant: the government thought three million would be furloughed and nine million are: another magnitude difference of three.

So the OBR estimate is wildly inaccurate and hopelessly optimistic.

We will not lose 35% for a quarter: we are facing a long term recession, if not a depression or slump without government action. 20% loss for some time is entirely possible.

And the impact on the government finances will be vastly bigger than the OBR suggests. It took a decade to get from £1 trillion to £2 trillion of gross debt (before QE) after the last recession. This time expect it in a couple of years, at most.

So what is the OBR doing here? It's being a propagandist for the Treasury. And in the process it has blown apart for ever the idea that it is an objective or independent commentator on the public finances. It's nothing of the sort.

NB I am discussing this on LBC at 3.30pm this afternoon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

My thoughts exactly to a T, and i am not an economist by training. So if i can say the OBR is smoking crack and cheerleading for the tories, why does no one else say so?(apart from you Richard)

Two is a start….

Speaking to fellow public sector workers on a large conference call consensus was we are expecting further real term pay cuts and worsening of T&C’s to reflect new austerity so we will be tightening our belts as much as we can for the foreseeable future.

I fear you are right…

I have to say that I’m finding it really hard to come to terms with the fact that the post Covid-19 ‘we have got to pay for it’ brigade could very well win.

If that does happen, and if the the so-called progressives let it happen, then I think the time will be right for more extreme action to take place of some kind because the sado-austerity mob should not be allowed to get away with it.

My brothers live in Eire, and even though the Left wing Sinn Fein had the majority of votes, the two establishment parties are now carving up the country for themselves. From what they tell me, the Irish people are very angry about this. Sinn Fein should not be locked out based on their share of the vote.

This is not democracy as I see it. It is as if anything truly progressive emerges, cunning ways are found to lock it down. The same could happen here.

It is getting to the point where one can think that only extreme measures can be brought into play to counteract this. However, these can be repugnant to oneself and the consequences on one’s family too much to bear so the only option is to walk away and find something else to do with one’s life.

As a minor plus we are actually, for one of the first times ever, getting to do a ‘real science’ economic test. So on the one hand we have the neo-liberal / neo-classical / rational expectations lot who surely predict that a 15% state deficit must inevitably lead to investors taking flight, a run on the pound, the private sector being ‘crowded out’, interest rates shooting up and hyper-inflation by Christmas. On the MMT / Keynes side it is not enough so there will be a huge slump in demand, 6 million unemployed, interest rates at zero, deflation and little effect on the currency.

We will soon know which theory works and which does not! The fact that it is so extreme compared to the normal changes from quarter to quarter are also not going to leave any doubt or room for argument.

We should really insist all the right wing economists commit their detailed predictions to paper now. Perhaps everyone should do a sealed envelope and we will then have a public opening of them all on Dec 31st on TV. Whoever is furthest from reality gets a leftover turkey as the prize.

And they won’t fiddle the figures?

Bill Mitchell skewered OBR way back in 2011 when he revealed their entire economic strategy was largely based on a substantial increase in consumer debt for a sector that was already heavily indebted:-

http://bilbo.economicoutlook.net/blog/?p=14325

He wasn’t alone….

increasing consumer debt has to be the number one toxic policy that perpetuates poverty

No this is not a ‘ recession, depression, slump’; those are terms taken from an out of date economics textbook . This is a reset . The growth model is dead. Even if we aren’t conscious of it we are readjusting to that ( by a pause in consumption let alone anything else ) and some will suffer a great deal more than others . And as has been the case historically these will be the poor. That’s already happening . The big question is : what comes after this politically . Given that the party system is dead ( don’t take my word for it name one person in any party you would say that’s the person I can get behind in this crisis ) how can we reconfigure politics post the pandemic.

Caroline Lucas comes to mind. So far as I am aware, no other MP has demonstrated a realistic awareness of the environmental challenges that will be forced back into the news very soon. Most commentators seem delighted with the warm weather – Who, for instance, has mentioned the absence of ‘April showers’? Where is our food to come from and who will pick it? And then Forbes asks, “What do countries with the best coronovirus responses have in common? Women leaders.” https://www.forbes.com/sites/avivahwittenbergcox/2020/04/13/what-do-countries-with-the-best-coronavirus-reponses-have-in-common-women-leaders/?fbclid=IwAR0G4YjftctUPRO9NJ06EVcFNovJ3KDXT-L1HC4saWYkQDC2VVIgyXEk3B8#5d4e52723dec

She would be my prime minister for national unity

Of course the OBR is factoring into its predictive scenario the roaring success that will be Brexit. You seem to be forgetting what a triumph that is going to be , Richard 🙂

[…] for the number made unemployed range from an optimistic two million from the OBR to six million from economist David Blanchflower. Looking further afield to the Global South or the warzones of the Middle East, the prognosis is […]