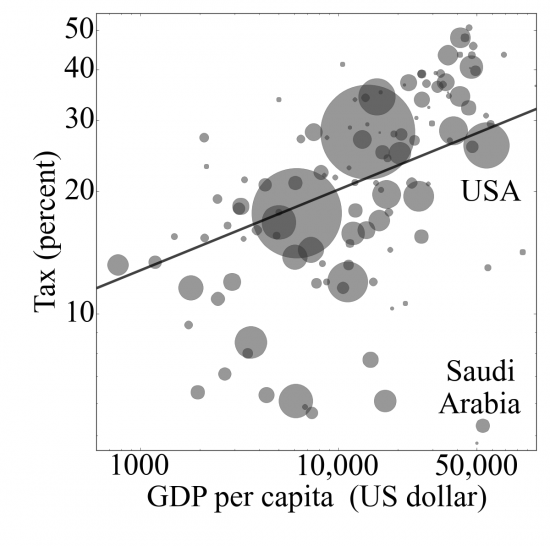

Prof Charles Adams of Durham University played with the data I used yesterday to show the relationship between tax and GDP and recast the data as follows:

As Charles noted to me:

Tax data is Heritage Foundation (2015). "2015 Macro-economic Data".

GDP per capita is IMF 2016.

Pop data from UN 2015 is used to scale size of point (using a log scale or else you can hardly see anyone except China and India).

I added a power law fit (like Zipf's law) with all countries weighted equally. I cannot really justify any other weighting.

And, as is clear from the line of best fit that Charles has added, the trend is very obvious: as tax rates increase so does GDP. You could argue it's the other way round but I would very strongly challenge that because government spending is part of GDP and whilst the link between government spending and tax is not direct, what is apparent is that the spending comes before the tax (as I have argued in The Joy of Tax, for example) and so it is GDP that drives the tax flows and not vice versa.

In which case when you have under employment, low productivity and low inflation why on earth would you want a low tax economy?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Is the GDP per capita nominal or PPP?

I am struggling to get the point: tax is not restated PPP ever that I know of

But GDP is.

No matter, using excel trend lines to prove a hypothesis isn’t something a professor should use. Do some proper statistics and come up with a confidence level for the hypothesis. Using an excel trend line I can show that tax havens also give higher GDP per capita based on the TJN index. You can even “prove” with the same trend line that the more letters in a country name the higher the GDP!

And a you note, Charles used PPP as I did

As for using excel trend lines: of yes professors can use them. This one does when they are of use and I can assure you that when they communicate a point with clarity then I have not the slightest problem in doing so

You can do the ‘real statistics’ if you wish. You know the sources.

And of course you will find tax havens have a high GDP per capita. We know that. The reason is illicit profits located in those places that are wholly unrelated to local economic activity. nSo maybe next time you’d like to think before offering crass commentary?

If you do not like the trend line just look at the data and decide for yourself if you think there is a trend.

And by the way I do not use excel!

Yes GDP per capita is PPP from IMF data.

Thanks, Richard’s data links to GDP per capita (nominal) on Wikipedia hence the different slope.

So I understated the trend

Charles, thanks nice visualiation. I would normally however try to estimate the standard error on the slope or some other form of confidence interval. Hopefully we have 99% confidence that the slope is positive but the Pearson correlation coefficient seems a bit lower than I would like.

Interesting to hear the factions within the Tory party wanting to keep the frozen tax pledge in the manifesto and those who do not

The Pearson r-value is 0.4 for tax vs. log of GDP.

It rises to 0.74 if instead tax as percent of GDP is plotted vs human development index (HDI). I think a high HDI might be one of things we want to achieve via the tax system.

Clearly the state has to play a major role if we want to achieve a high HDI.

I will post HDI soon…

I am not a statistician but I wondered if Noel also told off Professor Kenneth Rogoff when he apparently used spreadsheets to describe the ‘perfect’ ratio of debt for the public sector in an economy? And how George Osbourne used this faulty logic from some ‘experts’ to debase the public sector?

http://www.newyorker.com/news/john-cassidy/the-reinhart-and-rogoff-controversy-a-summing-up

My view is that this blog is onto something since taxation is a flow of money just like profits and loss and transactions are. When you reduce (or more rightly retard effective taxation as this bunch of Tory reprobates are doing), it stands to sense there is less cash as tax in the economy and less cash being produced by government tax income re-spent on services and goods, so therefore you will see this reflected in GDP surely? Forgive me if I am wrong. I am not really a numbers man, but I’m getting there – maybe).

And when you consider that we have had problems in this country even since Thatcher with GDP you have to wonder what an earth is going on? The Tories will try to boost GDP by any means except the one which we know will work. How’s that for incompetence?

Surely, there’s an optimal point – somewhere between 0% and 100% tax – where gdp is maximised by government spending; but above or below that point,taxation doesn’t maximise gdp. Also, surely tax is not a good thing in itself: rather, it is what it is spent on that is good or bad. If government spent all tax revenues on something futile — eg catapulting red shoes into space — then that would be bad, not good.

” Surely, there’s an optimal point — somewhere between 0% and 100% tax — where gdp is maximised by government spending”

Yes, there may be

But a) we dont know where it is

b) The so-called Rahn curve is political mumbo-jumbo on this issue

c) There is no reason at all why the point is in the same place for all countries

d) The ballot box is the best determinant of the issue

e) Government spending and tax are unrelated issues except for the need to control inflation and you are conflating them

Those things apart your argument works

My reasoning is in The Joy of Tax

[…] discussion on tax and GDP over the last day or so (see here and here) Prof Charles Adams of Durham University has done some more research, linked aggregate tax […]

Quite a few voters might. It is hard to win an election with a promise of higher taxes for most of those voting.

Apparently not

Look at the evidence

I suppose the forthcoming election will answer your question – one way or the other. In the real world however the significant majority don’t really want to pay more tax.i think the forthcoming election will be decided by how that significant majority decide to vote. You may be right and they will vote for a high tax , left wing agenda. On the other hand they may not. Who knows , never underestimate the intelligence of the voting public. A mistake made by many politicians and academics. I suspect a lot of those who who voted to leave the EU are a bit teed off by being described as a bit thick by those who did not. It seems to me that this election is more of a Brexit Part 2. That gives the remainers a second shot if they play their cards right. But I,suspect Corbyn is a leaver anyway. Why anyone would think the SNP in some sort of coalition is a good idea amazes me. They are obsessed with independence and care little about the wellbeing of the rest of the U.K. They are not currently running Scotland very well such is their determination for another referendum ( and then as many as they need till we get the right answer).

High tax is not a left wing agenda

Big business wants a well qualified, healthy work force. They want infrastructure. They want social care and good pensions so that there is a safety net. And caring for the elderly is not left wing. It’s basic dececny

This is not about left wing. It’s about whether we have a society or not

And the basis on which business can work

Surely it is quite possible to have a low tax rate and decent public services (by public services I generally mean those which the private sector deem insufficiently profitable to engage with).

Provided that government spending cycles within the economy, even with low tax rates, the spending will eventually end up back at the treasury?

I might be mistaken in thinking this falls under the “velocity of money” definition.

Obviously, if government spending leaks out to tax havens, then this will not work.

(wealth capture). Apologies if you’ve covered this already.

I have dealt with all those issues

But low tax rates and decent public services do not go together

That’s a right wing oxymoron that you repeat

Is it? “eg Tax and Spend, or Spend and Tax? An International Study”

http://www.sciencedirect.com/science/article/pii/S0161893896000737

I would suggest that the question the paper asks is fundamentally different from the point I have made

In Germany and Nordics, big business don’t mind relatively high taxes (notably higher NIC) as they get more productive workers there than in the UK given better vocational education, and much more R & D spending from the government helping manufacturing companies (as it has an impact in the private sector spinoffs), and better infrastructure (faster railways, broadband, urban transport) that the UK. Other sector that don’t need all of this infrastructure thrive in the UK (accounting, finance, banking) but those don’t employ the whole country, and the UK ends up having pockets of private sector funded success rather than a whole country where success is better spread out with state directed R and D, and infrastructure.

Came to this a bit late and, not being an economist, cannot comment on the technicalities. Just to say there is a cultural issue, with an element of cognitive dissonance. At the time of 2010 election I recall a news interview with a Dane who said he and most Danes are happy to pay ‘high’ taxes in exchange for efficient public services. And back in the heyday of Swedish Socialism there was a general concensus that high progrssive tax was a basic requirement for a well-run society. Do you sell many copies of ‘The Joy of Tax’ in Scandinavia?

Tax, like government debt, has become an inuitively negative term – irrespective of logical and proven positive outcomes. As Bll Mitchell tirelessly repeats, unless the ‘framing’ vocabularly is changed it’s going to be a Sisyphean task to persuade voters to reprogramme their subconscious minds. And the longer progressive politicians shy away from the challenge, the longer it will take for the truth to prevail.

Naturally it suits controlling reactionary politicans to maintain the status quo as it enhances their authority. Labour is not guilt-free. In an age of genuine complexity there are situations when the KISS principle is not appropriate. The only long-term solution is in education.

On this Bill is right

Data from Heritage Foundation?! Seriously? Poor showing Richard!

No, deliberately

They can’t argue with it