A number of recent discussions, including the comments made by Alex Cobham to the Scottish parliament on the psychology of tax payment and discussion of potential tax increases after the election, made me think of something I wrote in chapter 2 of The Joy of Tax:

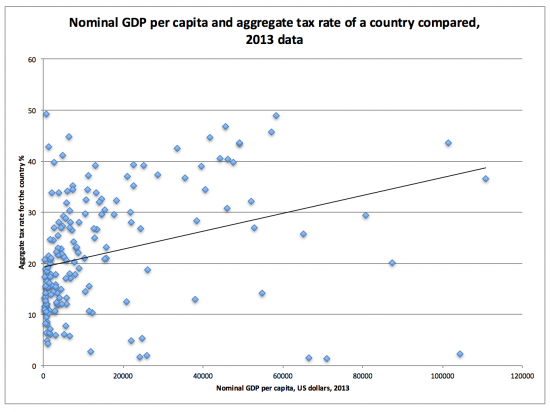

The following graph shows the relationship between nominal GDP per head of population in 175 countries according to the CIA Factbook (a reliable source) and aggregate taxation as a proportion of that GDP (source, The Heritage Foundation, which seems reliable on this occasion). I added the linear trend line.

As GDP per capita rises so does the aggregate tax rate. Or vice versa, of course. The relationship holds if average incomes below $5,000 a year, $10,000 and $20,000 a year are excluded, although the trend line begins to flatten a little as the rate of exclusion increases, perhaps unsurprisingly.

I also tested the relationship of states with very low tax rates (often tax havens or places heavily dependent upon oil revenues) were excluded from the sample. In that case the relationship is very strong if countries with aggregate tax rates of less than 10% are excluded: as tax rates rise thereafter so does GDP per capita markedly increase on average. Even when considering countries with aggregate tax rates of over 39% (the UK's rate) (but with Zimbabwe excluded as an aberration in the data) the relationship is positive i.e. income still rises with the aggregate tax rate.

Now that does not of itself prove anything: correlation is not proof of causation, but it does seem to suggest that higher taxed states are better off and it's my suspicion that most people know this. They realise that there is in fact a relationship between tax and well-being and that it is strongly positive for a country and so, in turn, for them. And that is why, as HM Revenue & Customs have put it, the vast majority of tax is paid without them having to do (almost) anything.

I now think that the graph is even more telling than I did in 2015 when I wrote that book. The reality is that higher tax payment does simply reflect greater government spending. To some degree, both in my theory of modern taxation and as observed in practice, this has to be the case. But that also means that higher government spending is reflected in higher GDP, which is hardly surprising when GDP is defined as the aggregate of spending on consumption, investment, exports less imports and that by the government. And when, as Keynes noted, markets are rarely good at establishing equilibria for the economy as a whole meaning that unemployment is normal without government intervention then increased government spending results in increased well being without any risk that it might prevent any activity that markets might have thought desirable; indeed the opposite is probable and markets are highly likely to do more because of that government spending because of what are called multiplier effects.

To put it another way, countries are well off because their tax to GDP ratios are high because those in turn reflect high government spending and high government spending is the surest indicator that there is that a country is using its resources to best effect, including the capacity of all in its population to earn to the best of their ability as a result of education, training and investment in productivity (which, of course, includes health services). And I think, as Alex Cobham suggested people know that, and if they believe that the outcome is just they willingly pay tax as a result.

The whole rhetoric of tax burdens, austerity, and so much more has been designed to undermine this understanding. But the only proven way to destroy the dominant belief that what government does is by and large good for us (and I say that because of course there will always be exceptions) has been found to be the delivery of dire government services so that we do not think that the outcome of paying tax is just. So, education, healthcare, benefits, social care and so much more is being undermined by the government precisely so that we think it cannot deliver so that it can persuade a majority to deliver big tax cuts for a minority.

That policy of destruction is working to a degree. And it needs to be countered. That counter-narrative is what I am looking for from the combined opposition parties in this election.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I did something similar at work a few months ago, plotting HDI (Human Development Index) against Tax as a % of GDP.

Unsurprisingly, there was a very obvious positive relationship, both against HDI and HDI ranking. The few outliers were all either flawed democracies or authoritarian regimes, and mostly oil-dependent low-tax states.

Regardless of the direction of causation, one can conclude that civilisation demands taxation.

Thanks

Any links to the work?

I’ve emailed it to your City.ac.uk address.

(sorry for the delay)

I’m not sure that talking about tax in a general election is a good idea.

Only because out here all I see is the same attitude – tax is to be avoided. It is already a ‘burden’ on people who are low paid, whose living costs are going up and are also having to service debt or are over leveraged.

Your blog highlights to me the paucity of public debate about the joys of tax prior to the election by HM opposition. Sorry but the horse has bolted.

My view would be that the opposition parties should always be selling the benefits of the fair and effective taxation discussed in your books and elsewhere. This is the only way to change attitudes. Over time – persistently.

All elections do is ramp up emotions and feed off existing bias. Labour will not want to talk about tax because it is scared of falling victim to hysterical claims by the Tories even though they have actually done more to increase hardship than any government in living memory for me anyway.

And as you have noted peoples’ attitudes to this election will be along the lines of wanting to get it over with rather than engaging with debates about new ideas.

I agree with your thought that tax is considered a burden but this could well be due to the lack of rational discussion about what it is used for. Maybe not likely during an election but it ought to be taking place openly. Only by doing so can tax dodgers be made to feel the effects of their abuse and become more sensitised to the effects on consumers in the case of corporations.

I’m sorry but I don’t see how Labour have done more harm than the tories. They were in government when the legislation to limit banking excesses was proposed but it was abandoned, partly because it was not seen as a priority (hindsight is a great teacher) and partly because of tory hysteria about the “interference” in the city. Both parties share responsibility for not limiting the Monte Carlo activities of bankers. But it is the bankers themselves who, in full knowledge of what they were doing, chose to impoverish the country in the name of greed.

PSR is spot on. Not much mor to add. So long as political parties can win votes by peddling snake-oil they’re not going to change – even though they know it doesn’t work. It’s the same old, same old ‘household budget’ narrative. And without an effctive opposition to challenge it, the public will always be short-changed.

The thing is … it takes a while before long-term negative trends become a tangible reality felt by the 80% – by which time it’s then too late to prevent the outcome, viz. the 2007 crash. The evidence was there a decade before it happened.

It’s really difficult to be positive about the future of the UK. It takes courage to stand up and shout that the emperor has no clothes!

Statistics on country-by-country data are a bit tricky because so many countries are exceptions to the any rule, e.g. oil states and especially small states. So I decided to redo your analysis and see what I found. I have sent you a version of your plot where the country data point size are scaled by population and I use a log-log scale. My interpretation is that the correlation is even stronger than you might guess from a bare country-by-country plot. Saudi and US are the main large exceptions, so I label them. Please feel free to post my plot if you like it.

Will be up today

[…] Charles Adams of Durham University played with the data I used yesterday to show the relationship between tax and GDP and recast the data as […]

Interested in your views on the news about buy-to-let landlords exiting the market due to changes to the tax regime. Is this a good example of tax as a progressive policy instrument?

Yes!

rebalancing has been required and tax has been used to reprice capital, the previous subsidy for which was driving prices up and pricing first time buyers out of the market

I would suggest the move has some way to go as yet….

[…] discussion on tax and GDP over the last day or so (see here and here) Prof Charles Adams of Durham University has done some more research, linked aggregate tax rates […]