I noted a letter I and others had sent to the OECD on taking tax justice forward yesterday.

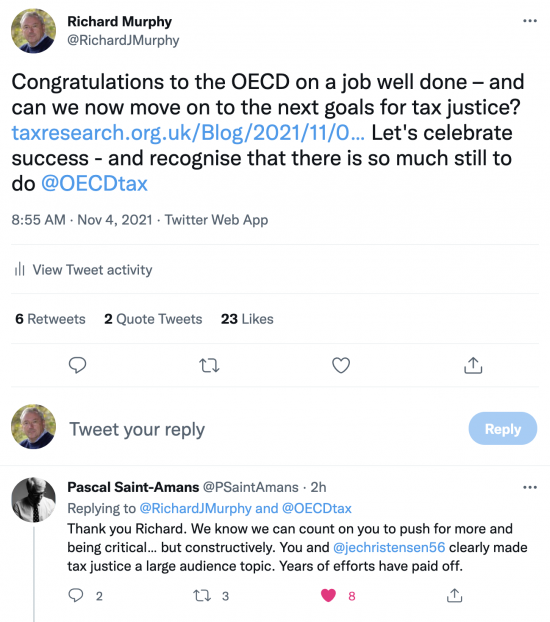

As is my usual practice I tweeted out the post. I admit I was pleased to get this response from Pascal St Amans, the head of tax at the OECD:

The OECD tax directorate also liked and retweeted my tweet. There is an agreement to discuss how progress might be made.

I am, of course, pleased about that. The focus will be on solutions. The letter I wrote made that clear. Just as my engagement with the OECD over a long period was on a solution to a problem we wanted solved (country-by-c0untry reporting helped address the issue of transfer pricing abuse and will now help the new international tax settlement) so too are the issues to be addressed now solutions to real problems.

We want to discuss tax transparency, because this is vital to building effective tax systems in all countries, including developing ones. Tax morale - or the willingness to pay tax - is dependent upon effective tax transparency. The work I have done with Andrew Baker on this issue suggests how this can be delivered.

And other work with Andrew, on tax spillovers, suggests how the issues to be tackled in tax system reform can be effectively identified. It is designed as a system for use by an organisation like the OECD.

We know there are problems. Any number of people can point them out. What we are interested in is in finding solutions. This is how tax justice has to be delivered.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

A gratifying response. Well deserved I’d say.