I wrote the blog post that follows this introduction in April 2020. I was anticipating the fact that there would be a furious debate when the coronavirus pandemic was supposedly over as to how to pay for it with additional taxation.

Let's ignore for a moment that the coronavirus crisis has already been paid for with quantitative easing.

Let's also ignore the fact that tax never pays for government spending because it is always paid for in the first instance on Bank of England overdraft and the role of tax is to clear that deficit.

Let's instead note that the debate has begun, and that what I wrote right at the start of this pandemic remains wholly relevant. We do need additional taxation of wealth. And we need it now. What is more, the data I revealed then showed that this is not only where the capacity to pay tax is but is what is required if inequality is to be addressed - as was recognised as essential at that time. The impact of coronavirus quantitative easing will only have made this need more urgent.

The debate is now on. But the only acceptable answer is already apparent.

Introduction

In the aftermath of the [emergence of the] coronavirus crisis there appears to be a widely held opinion that taxes on wealth should increase. Both the Pope and Archbishop of Canterbury appear to share this view, for example. They do so with the objective of reducing inequality in society.

They are not alone. There have been many demands that this be an objective for the After Coronavirus era. For example, the Financial Times has said:

Radical reforms – reversing the prevailing policy direction of the last four decades – will need to be put on the table. …. Policies until recently considered eccentric, such as basic income and wealth taxes, will have to be in the mix.

In this context it is appropriate to test data on the existing tax system that operates in the UK to see whether this demand for increased taxation of wealth is reasonable at this time.

Summary

To achieve this goal a report has been prepared to appraise data on whether or not there is the capacity for those with wealth to pay more tax in the UK, or not. Having appraised data from the Office for National Statistics, HM Treasury and HM Revenue & Customs four main conclusions are reached.

The first is that in the period 2011 — 18 the national income of the UK was £13.1 trillion, and in that same period the increase in net wealth was £5.1 trillion. It is stressed, that this figure is not for total wealth, but the increase in the value of that net wealth in that period.

Second, the overall effective tax rates on income during this period were unlikely to have averaged more than 29.4%, but those on wealth increases did not exceed 3.4%.

Third, if these rates had been equalised it would, at least in principle, have been possible to raise an additional £174 billion in tax revenue per annum from the owners of wealth.

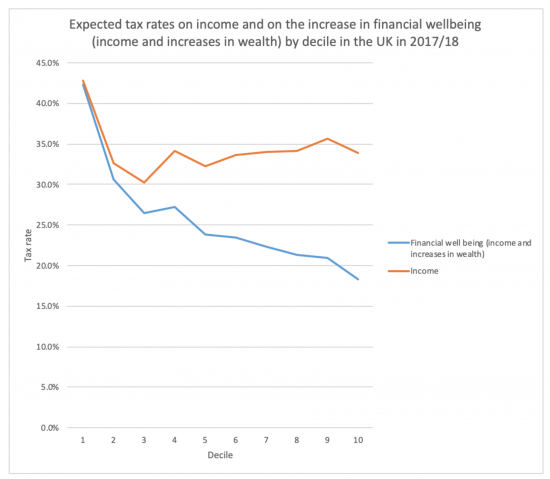

Fourth, because there has been no attempt at equalisation and because the distribution of the ownership of wealth varies substantially across the UK, which variation is reinforced by factors such as age and gender where substantial inequalities exist, the effective tax rate of the 10% of those in the UK who are in the lowest earning group of taxpayers exceeds 42% of their combined income and wealth gains in a year, but the equivalent effective tax rate for those in the highest ten per cent of UK taxpayers ranked by earnings is less than half that at just over 18 per cent. This is summarised in this chart:

It is, as a result, suggested that there is considerable additional capacity for tax to be raised from those who own most of the wealth in the UK, many of whom are in that top ten per cent of income earners.

Whether or not it would be desirable, or even technically feasible, to raise £174 billion of additional tax from additional tax charges on wealth is not the primary issue addressed by the paper. Nor does it concern itself with the issue of whether that sum should be redistributed simply to redress wealth inequality. A value judgement is not being offered on the matter of wealth holding, as such. Instead the issue of concern being addressed is that those most vulnerable to precarity within the UK are also those paying the highest overall effective rates of tax.

Whether that is appropriate is the first question raised as a consequence, with the second being whether, if that is the case, any tax increases that might arise in future should have any impact upon those with lower income or earnings. In the context of the coronavirus crisis and the debates that will, inevitably, occur at some point on whether and if taxes should be raised to contribute towards its cost, these appear to be issues of considerable significance.

This evidence in the paper suggests that those with substantially higher income and wealth should bear the majority or all of that cost if it was thought appropriate that anyone should.

That does, however, then suggest that it might also be important that the disparity in the relative tax payments made by those on high and low earnings in the UK should be addressed whether or not overall net additional tax revenue is required, or not. That is because there is now ample evidence that inequality creates significant social costs within any society, and it is apparent that the UK tax system is contributing to this problem.

A manifesto for change that could result from this understanding might include suggestion that:

- The considerable scope for increasing the effective tax rates on wealth and income derived from it should now be very firmly on the UK policy agenda;

- Any such increase must be targeted at those with the greatest capacity to pay, which would be those in the top deciles of income earners and wealth owners in the UK;

- Tax increases impacting the income of those in other deciles would be very hard to justify if measures to increase tax on wealth and income derived from it did not also happen;

- Inequality in the UK could be considerably reduced by taking the taxation of wealth into greater account. Which taxes should be cut for those on lower income levels to help achieve this goal also needs extensive consideration especially given the stresses that have emerged as a result of the coronavirus crisis.

These issues will be addressed in further posts on how this matter should be tackled in practice.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The elderly hold most of the assets, the elderly vote Tory. To keep them on side, they will be taxed as lightly as possible. Witness the latest idea to use NI (falling as you rightly say, most heavily on the poor and the poorly paid) to “pay” for social care.

I am looking forward to the state pension uplift decision to see what the government thinks it can get away with, facing strong opposition from silver pressure groups.

This country, in keeping with its other miserly practices, “gives” the elderly one of the lowest pensions in Europe. Our pensioners are amongst those living precariously in poverty (along with others, many of whom are in work but not earning a living wage, therefore dependent on “benefits”). Naturally those who ought to be paying more tax want the attention to be on this vulnerable and resented group (they are not economically productive, after all, and they are unattractively wrinkly) and not on them: it is playing the “divide and conquer” game the right always resorts to. “Let’s have a generational war instead of a class war” suits a great many people who don’t want to look at the real nature of inequality because it would challenge their attitudes to tax and the redistribution of wealth. It is time to dump the assumption that the old are to blame for everything.

Oh, and I am now old but I can say with pride I have never voted Tory in my life.

Most sane people would agree with you, but it is hard to see a Tory government choosing to tax wealth rather than turning the screws on ordinary people.

Council, VAT tax an NI are 3 that spring to mind.

Council TAX takes no account of a person’s income, and is capped. In my view it’s utterly unjust, and is more like tribute than tax, poorer people pay more, wealthier people are let off the hook. Power is so obviously central to how much someone pays. I’d prefer this to be abolished, or at a push replaced by a progressive unearned income tax.

NI, as you’ve said is charged below the income tax threshold and then magically effectively disappears on higher incomes. Getting rid of this and having a single much more progressive income tax would be better. I think very high marginal rates need to be reintroduced.

VAT needs to be abolished, again it’s regressive.

I think UBI, UBS, an increased minimum wage, well-paid job guarantee are all needed.

Also, I don’t see why unearned income should only be taxed at equal rates with earned income, since it’s free money to the unearner. A higher rate would make sense. And it should be called what it is: income from someone else’s work (IFSEW) – it’s earned income, just not by the person receiving it.

The only way to tackle inequality is to actually tackle it. People with millions and billions show how far away we are from dealing with this. There are ideological hurdles, such as the cosmic justice people believe inherent to people’s wealth (self-made men myths, the risk-taking entrepreneur, the wealth creator, the idea that whatever someone has they must have earned it), and these beliefs are reinforced every day, as are ideas of envy: like it’s envy that underpins the call for equality, that envy drives calls for higher taxes, and so on – if you want more, go out and get it. Bookshops are stacked with get rich self-help books, all further reinforcing the notion (with no basis in evidence) that wealth outcomes are down to individual ability and effort.

And then there’s the fear-mongering of “brain drains” and go-getters and “talent” emigrating if taxes get too high, which happens precisely nowhere in the world. The ideological context in which these arguments about tax and income occur are massively skewed in favour of wealth as it creates the very ideological context. Neoliberalism hasn’t helped, but inequality has always been a gigantic, hardly addressed problem. It’s not like things were fine until 2008, or austerity in 2012, or Covid-19. Things are worse now but to say they were better before is only saying they were slightly less hideous.

I live in a £50k house in County Durham and pay just over £1000 in Council Tax a year.

You live in a £330k house in Cambridgeshire and pay just under £2000 in Council Tax a year.

I’m just saying that I think you should acknowledge that you benefit from regressive taxation in the UK. I could make the same point about the unaccountable TV licence. I wonder if subconsciously you avoid writing about local taxation and Land Value Taxes as you benefit from the current system.

Anyway, at least I have a Greggs in my town so it’s not all a bed of thorns here.

I do!

Dammit, I call for higher rates

And I argue for council tax reform

But I also find your interest in my affairs really rather strange

In 2010, council tax paid for about 35% of local authority spending, and the rest (about 65%, or £40 billion) from central government (including retained business rates). By 2019 it was about 50% council tax, and 50% from central government. Meanwhile, the total amount has decreased from about £60 billion to about £50 billion, and social care has gone from about 40% of the total local government expenditure (about £24 billion) to about 60% (about £30 billion). It is hardly surprising that everything else has been squeezed.

* Where it comes from – https://www.instituteforgovernment.org.uk/explainers/local-government-funding-england

* Where it goes – https://www.local.gov.uk/sites/default/files/documents/A4%20STATIC%20IMAGE_04_1.pdf

Why are local governments still responsibly for social care, as if we still live in the age of the poor law and the workhouse with responsibility falling on the parish? Imagine trying to run the NHS if it were dominated by a constellation of cottage hospitals run by each local council. Obviously in a modern centralised state, running the the national infrastructure of social care should be a central government responsibility.

Equally obviously, in an integrated modern state, local government needs a significant element funded from central government to even out inequality across different geographical regions of the country. We can’t expect deprived areas to pay for all of the additional services that they need.

And then the rank stupidity of council tax still being based on 1991 values, 30 years later – needing notional historic values for houses built in the last 30 years – it just beggars belief.

Agree with all that

I was reminded that the Poplar Rates Rebellion was almost exactly 100 years ago. https://en.wikipedia.org/wiki/Poplar_Rates_Rebellion

Labour councillors refused to collect the precept for the London County Council, Metropolitan Police, Metropolitan Asylums Board and the Metropolitan Water Board, from its hard-pressed ratepayers, on top of all the other things they had to pay for locally, particularly poverty relief under the Poor Law. In essence, the poor were being asked to bear too much of the burden. The councillors were imprisoned for contempt of court, for refusing to obey a court order, but ultimately the Poor Law was abolished.

Local councils remaining responsible for social care, and needing to find the funding from council tax revenues, is an exact parallel. Welcome to the new ’20s and ’30s.

As a member of the “silver brigade,” I think that abandoning the “triple lock” guarantee for pensions would hardly affect the very wealthy at all because that part of their income is insignificant. True, lower-paid pensioners will be poorer but not all of these would necessarily vote Tory. However, it is important that any tax changes help towards equality and that ideas such as a basic income and increase in wealth taxes should no longer be regarded as “eccentric”.

Getty’s Law: How much money is enough? Just a little more than you have.

Many of the significantly rich use their bus passes, so they will feel bitter and twisted if the manifesto commitment is not adhered to.

Ok, introduce a land value tax. The benefits: Impossible to dodge. Curb speculation on land. Lower the value of unused land and increase the valuation of properly utilized land.

The point is that you tax monopolies because they are harmful. A blanket tax on wealth will not discourage harmful behavior. I do not care if Bill Gates owns Microsoft, I care if he owns the farmland my food comes from or the land on which the apartment I live in was built. Speculation on land makes food and housing more expensive.

I would go beyond a land value tax though. A yearly tax on patents, radio spectrum for mobile internet, tax on regional ISP monopolies, and so on.

You overclaim the benefits of LVT

And it is not true there would be no evasion: any tax has to have rules and all can be arbitraged

As for taxes on rents, of course.

But again, regulation is better in many cases

Tax is good, but not the answer to everything

It might be comforting for some people to consider the accounts of a government the same as a household, but they are not.

The idea that money is not a “thing” but in fact a “token” jars with the lived reality of the public, myself included. I need money to pay my way. I need to balance my spending with my income.

The idea that this is somehow not true for government gives most people the willies.

Given that HMG spends its own unit of account into existence, we do not need any specific amount of tax.

In point of fact, your tax money is destroyed on receipt.

The only reason for taxation is to suppress inflation & prevent the rise of a multi-generational plutocracy.