The International Financial Reporting Standard Foundation is holding a consultation right now. The suggestion is that the Foundation create a new Sustainability Standards Board to promote new Sustainability Standards that would replace the plethora of other standards now being promoted around the world by a range of other organisations including the Global Reporting Initiative, Task Force on Climate-related Financial Disclosures, Sustainability Accounting Standards Board and others.

Why are they doing this? Because they say they are the premier accounting standards setter. And that's true: their accounting standards are used in more than 100 countries, including all the EU and the UK. Which is not surprising, This is a body that is dominated by people with links to the Big 4 firms of accountants - PWC, EY, Deloitte and KPMG. As a result they say they are the people who can set universal sustainability standards.

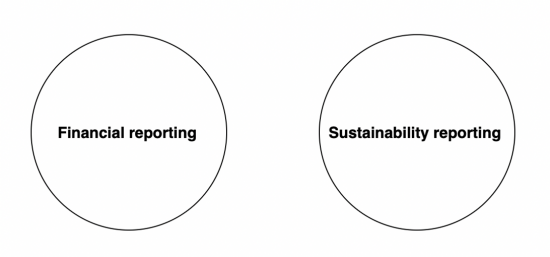

But there is a really big problem with their proposal. They're not suggesting that their Sustainability Standards be a part of their accounting standards regime. They're suggesting that they be entirely separate from those accounting standards and that a new Board creates them. This, they suggest, should be entirely separate from their International Accounting Standards Board, which issues the accounting standards. It's as if they think that these are unrelated issues:

Of course, they're not. At the very least the two are related:

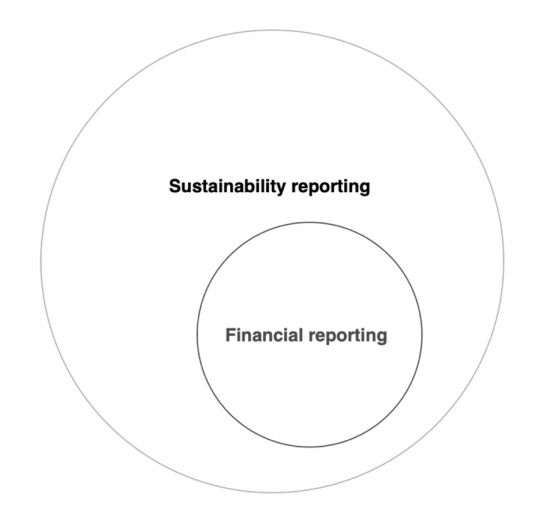

I would, in fact, go further. I would suggest that this is the true relationship now:

That's a big claim. So why do I think it's true? Prof Adam Leaver of Sheffield University Management School and I have submitted a letter to the International Financial Reporting Standard Foundation on this issue today. It's not on their website yet, but you can read it here. In this we make the following arguments (and I hope you'll excuse the length):

We have a number of significant concerns with the proposal to create a Sustainability Standards Board put forward by you in your consultation paper. We note these under a number of headings. We answer the specific questions raised in the consultation document in an appendix to this letter.

Failure to take into consideration all the stakeholders of a corporation

The concept of stakeholder reporting has been in existence for a considerable time now. We note that despite this that you suggest that the stakeholders who might have interest in the sustainability reporting of a corporate entity might be:

- Investors;

- The corporate sector;

- Central banks;

- Market regulators;

- Public policy makers;

- Auditing firms and other service providers, including index providers.

We are surprised by the limited scope of those that you think might have interest in this issue. It is our suggestion that the range of stakeholders who might wish to have and use data on the sustainability of a corporation is much broader than you suggest. It is our belief that the stakeholders of corporations who would expect sustainability reports to meet their needs might include:

- The suppliers of capital to a company, and their advisors;

- The trading partners of the entity;

- The past, present and future employees of the company;

- Regulators;

- Tax authorities;

- Civil society, in all its forms, from individuals to NGOs, to local authorities and those researchers, journalists and others who hold those engaged in reporting to account.

We note that many of the stakeholders to whom we refer will not have their needs met if only the needs of the stakeholders to whom you refer are addressed. We would, therefore, suggest that your proposal is inadequate for this reason: if sustainability reporting is to be comprehensive and unified into a single set of standards then those whose needs are to be addressed must include all the stakeholders of a corporation rather than the subset of users that you are planning to consider. By definition, sustainability is a universal concern. Reporting on it must be similarly comprehensive.

The failure to integrate reporting

We are concerned that the IFRS Foundation is proposing to create a separate board to promote consistent sustainability reporting. By implication this suggests that you see this activity as an issue distinct from financial reporting. This is not a view that we share.

It is our belief that accounting and sustainability are related issues. We do, in fact, go further: it is our opinion that given the current requirement to transform the economy to achieve sustainability that the future of financial reporting is not as a discipline distinct from sustainability but that it is, if anything, a subset of the latter. The failure to appreciate this requirement is, we suggest, the most significant failing in your proposal.

Sustainability and accounting: the interrelationships

We relate the issues of accounting and sustainability in two significant ways.

a) Going concern

Firstly, we relate accounting and sustainability through the concept of going concern. We see these issues as intimately related. Unless an entity can now prove that it has the ability to adapt to the demands imposed by the imminent era when sustainability will be the pre-condition of economic activity it does not now have the ability to survive in the long term. As such the concept of going concern, which is at the very core of accounting, is by necessity brought into focus by issues relating to sustainability.

In this context, we view going concern as it relates to sustainability through the lens of prudence as interpreted for this purpose by a precautionary principle, using that term in the way commonly defined in the sustainability community.

In practice what we think that this interpretation of going concern requires is that a company demonstrate its ability to survive as an operating entity in an era when net zero carbon emissions will be required of it within the constraint that it can only forecast that survival on the basis of currently proven technologies. It is our belief that all the stakeholders that we have identified, plus those that you have too, will share this concern.

It is our suggestion that this concern can only be addressed with a holistic, integrated approach to accounting as if it forms a part of sustainability reporting. To achieve that it is essential that reporting embrace these issues in combination, rather than separate them.

We think that this goal can only be achieved if the full potential cost of a corporation meeting its net zero carbon and, if appropriate, biodiversity sustainability goals is reflected as an up-front provision for those costs within its general ledger, and so in its financial reporting. We then suggest annual reporting on the movement in that provision as the entity moves towards achieving its goal. This approach will provide the opportunity for the ongoing integration of these issues in a way that we suggest nothing else can. It will also disclose the capital required to achieve sustainability targets. In addition, it will reveal how over time the reporting entity moves towards achieving that goal, and its success, or otherwise, in managing that process.

Because this approach will be integrated within the financial statements, it will necessarily require that the resulting provision and movements within it be audited. There will be no duality in audit approaches, goals or materiality measures. To achieve this goal it would be necessary for the entity to report on why that provision has been made, how it has been estimated, and over what time period it is to be expended to achieve the stated sustainability goals it has set for itself, which must be specified and justified as to their completeness. By necessity this combines financial and sustainability reporting in a way that suggests our proposal for integrated reporting is possible, and makes clear that it can be audited.

By implication this integrated approach and the requirement to provision the cost of the transition to sustainability will also create the concept of carbon insolvency. If the reporting entity could not see a way to achieve a pathway to viable sustainability it would, by definition, become carbon insolvent. This will be the case whether the obstacle to progress is technical inability to adapt or the likelihood of a lack of capital to achieve the process. We suggest that this is now at least as significant a concept within the accounting for going concern as is that of financial solvency.

b) The allocation of capital

This necessarily brings to the fore the question of capital allocation. Very few reporting entities will be able to achieve caron solvency without undertaking investment to eliminate carbon from their processes, or to adapt to the demands that maintaining biodiversity imposes upon them. Deciding which reporting entities might make best use of capital is a function that the IFRS has long thought to be at the core of accounting. We suggest that integrating financial and sustainability reporting provides a critical new dimension to this reporting that is vital in the era that we are now entering. We suggest separate reporting cannot meet that need.

We place this idea within a particular context. There was a time when economic theory, accounting practice and the prevailing norm in society reflected the idea that there were ‘free gifts of nature' that were available to human beings to use and enjoy without limit. We now know two things. The first is that there are limits to the extent to which we might use natural resources without consequence arising. The second is that our past abuse of what we thought to be the free gifts of nature has come at a cost. The prevailing norm in society is now reflecting this fact. It is open to debate as to whether much economic theory is doing so, or not. What we think is unavoidable is that as an applied discipline accounting must do so.

What this means is that it is vital that accounting now reflect within a single framework of reporting all that information that is intended to provide the basis for the informed decision making that is required by all the users of financial statements so that they can decide whether they wish to engage with a reporting entity or not, or to break that association if they now have it. In other words, an integrated tool that embraces the use and past abuse that an entity might have made of natural resources must be made available, and that integrated tool must be built around integrated financial accounting and sustainability reporting.

It is not possible to suggest that there be two reports prepared on different bases, with different assumed stakeholders in mind and with different criterion for auditing as is implicit within the current IFRS proposal. Nor can the stakeholder then be left to decide what, if any, relationship there might be between two reports from the organisation, with there being potential for conflict, or at least misinterpretation, between the two if this goal of integrated reporting for capital allocation purposes is to be achieved. Separate reporting would not assist informed decision making; it would instead be an exercise in bemusing the decision maker. For precisely this reason we do not believe the IFRS proposal a viable basis for future sustainability reporting. If, as the IFRS has suggested, its primary task is to provide information intended to influence the rational allocation if capital within society then the proposal you have made fails to meet that objective.

Building anew

For exactly the same reason we do not see any good reason for the IFRS Foundation, or the IASB if this matter were to progress, to consider building proposed new standards on the basis of proposals already made for sustainability reporting. None of the proposals now made for sustainability reporting mentioned by you in your proposal bring the cost of addressing climate and biodiversity related changes within the general ledger of a corporation. That is not to criticise those proposals: to date your own refusal to address this issue has made achievement of this goal a near impossibility for those campaigning for the integration of financial and sustainability reporting. As such those presenting proposals have not tried to offer opinion on what they felt could not be achieved.

However, to now perpetuate what was not possible because of the position of indifference that you adopted to this issue would be a fundamental mistake to make now you are willing to embrace sustainability issues. As such, whilst we recommend that lessons be learned from what has been done by other agencies on this issue we cannot suggest that their work be the basis for sustainability reporting if this issue is adopted by the IFRS Foundation. As we have already noted, progress resulting from that suggestion has to bring accounting into the general ledger framework and that requires a significant development of new work that departs from past norms for reporting in this area.

In conclusion

We have raised significant concerns with regard to the proposals that you make, which we think inappropriate as a basis for meeting the needs of society at large at this moment. We shall be pleased to provide elaboration on any of these issues and to meet with you to discuss the matters that we raise if you think that might be of use.

I will; shortly be publishing a post on ways you can support the demand that the International Financial Reporting Standard change its approach to this issue. We need sustainability reporting, of course. But we must have that integrated within the financial statements of a company. Nothing less will do.

I hope this is something you will be able to support.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] have already posted a blog this morning on why the International Financial Reporting Standard Foundation has got its proposal for a […]

[…] You may have never heard of the IFRS, but it's really important. The IFRS sets the accounting rules for most of the large companies in the world – including in the UK and EU. And – this is the crucial but – their standards have the force of law in the countries where they apply. Companies have to comply with them. And it has noted there is a market for sustainability reports. As a result it is making an audacious bid to take over that space and create its own sustainability standards to replace all the others that now exist. The details are here. […]

PDF submitted to IFRS, a very slow and tedious process when working with an old ipad!

Thank you

Really appreciated