I know accounting is not everyone's idea of excitement. As a chartered accountant I have had to live with that for almost four decades. But, as one, quite well-informed journalist put it to me recently, when it comes to climate change accounting is now absolutely out there in the forefront of the issue. Frankly, this is where the barricades need to be mounted if business is going to be forced to change its ways.

Let me explain. The issue is really quite straightforward. After all, we all know now that unless we get to zero net carbon we're in pretty big trouble. We also know the importance of maintaining biodiversity. Companies have, as a result, got the message. Around the world a plethora of sustainability reports are being produced to tell us just what big business thinks we want to know about how green they are.

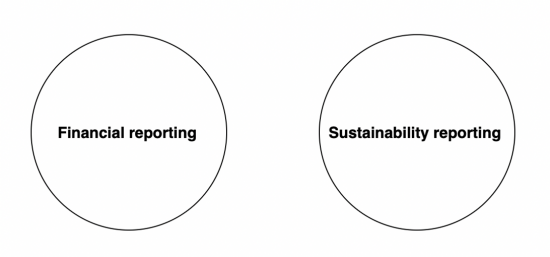

But there is a problem. Simply put it is that the sustainability reports are quite separate from any company's accounts at present. It's as if business still thinks that making money and being green are separate issues, and that this environmental stuff is all very nice but the hardcore activity of making money should be unsullied by it. This is their world view:

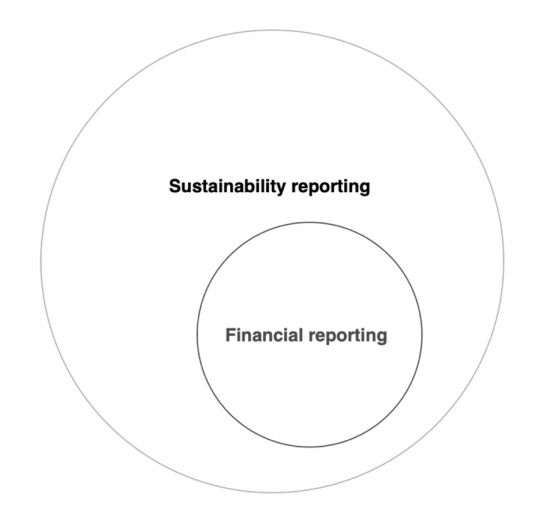

There is, of course, a problem with that attitude. Unless business goes green then there is no chance of net-zero carbon targets being met. But business won't go green until it is a bottom line, profit and loss issue. And it will not become a bottom-line issue until climate change is forced onto a businesses' balance sheet and into its profit and loss account. This is what we need:

There is, of course, a problem with that attitude. Unless business goes green then there is no chance of net-zero carbon targets being met. But business won't go green until it is a bottom line, profit and loss issue. And it will not become a bottom-line issue until climate change is forced onto a businesses' balance sheet and into its profit and loss account. This is what we need:

The Corporate Accountability Network, which I direct, has come up with the only proposal there currently is to make this happen. What we propose is that the full potential cost of a corporation meeting its net-zero carbon goals is reflected as an up-front provision for those costs within its accounting system, and so in its financial reporting. We then suggest annual reporting on the movement in that provision as the entity moves towards achieving its goal. This approach will provide the opportunity for the ongoing integration of these issues into the accounting and financial reporting in a way that we suggest nothing else can. It will also disclose the full cost of the capital that the company will require to achieve its sustainability targets. In addition, it will reveal how over time the reporting entity moves towards achieving that goal, and its success, or otherwise, in managing that process.

But a massive impediment to progress on this issue has now appeared. It comes in the form of the International Financial Reporting Standards Foundation - the IFRS.

You may have never heard of the IFRS, but it's really important. The IFRS sets the accounting rules for most of the large companies in the world - including in the UK and EU. And - this is the crucial but - their standards have the force of law in the countries where they apply. Companies have to comply with them. And it has noted there is a market for sustainability reports. As a result it is making an audacious bid to take over that space and create its own sustainability standards to replace all the others that now exist. The details are here.

Now it has to be said that one set of sustainability standards might be good.

One set of sustainability standards that do, however, keep the costs of getting to net-zero carbon out of corporate financial accounting is definitely bad. And that is what the IFRS is proposing.

Just to emphasise the point, the IFRS is also suggesting that sustainability reporting standards should be created by a separate body to accounting standards, just to make sure the two should never mix.

And worse still, it is also suggesting that these sustainability standards should only be produced with the needs of the investment community in mind. All the rest of us, with our multifarious green concerns, can apparently whistle for the information that we need from the largest companies in the world.

My University of Sheffield accounting colleague, Prof Adam Leaver, and I have written a pretty wonky submission to the IFRS on why this is wrong. It is here. But if sustainability reporting is to really go to the bottom line, and so count, its cost will have to impact on the profits that companies report. And to achieve that goal we need support.

There is an opportunity to submit comments on this really deeply flawed IFRS proposal until 31 December. You can find it here, although you do have to register first, but that does not take long.

What I am asking is, might you submit a letter to the IFRS? This is the chance to effectively change the law on this issue and to force companies to really begin to account for how they will get to be net-zero carbon. But, just to make it awkward, emails won't do. Something like this would be great, but please alter it a bit. A Word version is available here.

Dear IFRS Foundation

Sustainability Reporting

I have noticed your consultation on the above subject. I am concerned about this issue because xxxx (please add a short explanation).

I have real concern about your proposal. I think that:

- Sustainability reports should be for the benefit of all stakeholders of a company and not just those in the financial community, who seem to be your main concern;

- Sustainability reporting should be built into mainstream financial reporting, and not be treated as a separate issue, as you propose. It will forever remain peripheral, and at risk of being treated as ‘greenwash' if your proposal for a separate Sustainability Standards Board is adopted;

- Companies should now be required to disclose their likely costs of becoming net zero carbon compliant, and to account for these costs as they make the transition to achieving that goal over the years to come. These costs must be on the balance sheet now and in the profit and loss account as they are expended. How else are we to know who is really walking the talk on this issue? As someone with a stake in the world I really need to know this.

You have the option to make this issue the biggest issue in accounting for decades to come, which is what it should be given the urgency of climate change. Instead your proposal sweeps it to one side and treats it as peripheral. This will no longer do. I urge you to rethink, and to propose integrated financial and sustainability reporting as the way forward for accounting standards.

Yours etc

Thanks for reading.

And thanks too if you can do this.

We need to hold the world's corporations to account for their impact on climate change. Telling the IFRS to do so is a way to achieve this goal. And every voice will count, whether from an individual or an organisation, and in that case whether large or small. And please don't wait. We need to get letters in now.

There's more technical stuff on this issue here.

And this might help too:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Done

Many thanks

I have a few questions for you:

1. How would this work in practice. Could you give us an example set of accounts and environmental calculations?

2. What would happen to all the companies and indeed industries that by their very nature can never be 100% carbon neutral?

3. Why does it matter if an individual company is carbon neutral when what is important is the overall system being so?

Re 1, a blog coming tomorrow

Re 2, they cease to exist unless approved by the government, who can then arrange offset. Let’s be clear, this is going to happen and it’s entirely normal

Re 3, unless we aim for carbon neutrality for all how can we ever get to it? Otherwise, everyone freerides and I presume you don’t want that

1. I will await tomorrow’s post.

2. Are you suggesting that a company would have to either be totally carbon neutral or be “approved” by government to be allowed to offset emissions?

3. I asked this question as very few industries (if any) are totally carbon neutral, as a follow on to question 2. If no individual company is carbon neutral, and you disallow carbon offsetting (which seems to be the case from what you are saying) then you are essentially calling for the end of most businesses.

My point is why does the amount of carbon produced by an individual business matter as long as that carbon is offset somewhere else? You can charge that business a carbon tax for the emissions it produces to prevent freeriding, as you call it. This is what most serious economists are calling for including Nobel prize winners.

1. Ok

2. Yes, why not? How much else requires licensing in life?

3. I am saying licensing has to decide this

4. Yes, of course it does. And, no I do not believe in carbon taxes. The aim is zero carbon

Alex he said a provision, he’s not calling for end to industries just a cost ranking system.

Only issue I see Richard is that analysts and investors just see it as another item they add back to the profit figure. Maybe a good old EU wide carbon corporate tax surcharge will do them some good too

1. Any update on this?

2/3. This isn’t what you suggested though, unless I am greatly mistaken.

You said:

“Re 2, they cease to exist unless approved by the government, who can then arrange offset. Let’s be clear, this is going to happen and it’s entirely normal”

I read this as if a company can’t become carbon neutral it would cease to exist or have to have some “approval” more than simple licensing.

Almost every industry in isolation is not carbon neutral and can never be without offsetting. Your suggestion suggests that either:

a) most industry should be shut down

b) government should pick approved companies to continue and shut the rest – which essentially means national control of output

c) licensing, but if every company can be licensed (as all companies will emit without the ability to offset) then the licensing seems pointless.

4. Surely the aim is NET zero carbon, not zero carbon in each company.

There are things we as society desire that generate emissions, but as long as those emissions are offset elsewhere then we have a net benefit?

Also, why only target private companies, when residential and public/government emissions combined are equivalent to that of all business and industrial emissions?

At which point carbon taxes seem like a much simpler and fairer way to manage the problem. You pay for what you emit.This is what Nordhaus and Romer won a Nobel prize for.

Your solution seems to be shut down individual companies, regardless of their benefit or utility, unless they can achieve zero emissions without offsetting. Which for many companies and industrial processes (including most manufacturing, construction, transport and even agriculture) is literally impossible – without offsetting.

@ James

Richard is going a bit further than making a provision or a cost ranking system. He is saying that companies should take the full cost of becoming carbon neutral along their whole value chain on the balance sheet, disallowing any offsetting, then be declared bankrupt if they can’t meet that cost or find a way to make their entire value chain totally carbon neutral – which as I point out above is impossible for most.

1. No – I have been distracted by other work. It will take on ger than I planned as that other work really should be finished. People are noticing deadlines. But since it has been promised elsewhere now as well it will be done

2. You miss the whole point: unless businesses can adapt they will fail anyway. And the claim of offset will fail unless an offset can be found – and there are limited opportunities. No accounting will shut these businesses down. It will simply expose in advance who can, and cannot, survive and force government to decide what to do and who to support. In other words, it will support capital allocation decisions exactly as good accounting data should. Why wouldn’t you want that?

4. Net zero requires every company excepting those licenced not to do so to be net-zero. How else can it be achieved, as promised? And of course I am targeting private emissions – the plan includes what I call Scopes 3 and 4 – business is responsible for the sessions they enable in my plan – not just those made to the point of sale. You clearly;y have not read it. And as fort carbon taxes – how do they cross borders? And how do you deal with their massive regressive imnpacts? As for the Nobel prize, James Buchannan got one – I wouldn’t suggest that proves much.

And re your comment to James – you have this wrong (why choose to misstate, I wonder?). The cost is that of the business itself eliminating caron from its activities – including onward sale. And the carbon insolvency may take 20 years to come. So why not tell it as it is?

1. Please do. It would be illuminating to see how this would work in practice.

2. Businesses are already adapting – and would likely adapt even faster with an emissions tax.

What you suggest would inevitably shut a lot of companies down as you are front loading the cost of a transition and denying them the chance to offset emissions. In your idea, only 100% carbon neutral businesses would be allowed unless they are government sanctioned. This would preclude all construction and most even a lot of agriculture, for example.

What I find quite chilling is the idea of government deciding which companies should and should not survive. This would allow for massive political interference and poor decision making. We only have to look at the history of state managed industries here and abroad as examples. It would be tantamount to nationalization by the back door as a company could only operate by government decree unless it was carbon neutral – which as I have said, would be impossible in many areas without the ability to offset. It would also benefit huge businesses with large balance sheets, strong government contacts and would likely lead to corruption, but definitely reduce competition (which in turn would raise prices) and lead to much higher barriers to entry for new entrants. It’s an awful idea.

4. I deal with the licensing above, but I feel you haven’t really considered the problem in full given your focus solely on private companies.

Most emissions are caused by residential and transport sectors. Not directly by private business. Government is another major contributor. Your plan seems to aim to push the entirety of the cost of emissions on to business by including scope 3. Yet how is it fair to burden a business with emissions they have no control over?

A car manufacturer can’t control how much it’s products are used, but it can account for the emissions created in manufacturing that car. So shouldn’t the user and creator of emissions pay for them? Under your plan, you would be responsible for the emissions I create as I type this reply to you, which doesn’t seem practical or fair.

Regarding carbon taxes. Other Pigou taxes exist, so I’m pretty sure methods could be agreed for carbon taxation.

The same problem exists for your idea. I’d argue on a level much more difficult to solve. What is there to stop a company relocating to another jurisdiction which doesn’t force them to put a huge cost on their balance sheet, close down, go bankrupt or accept government control? At which point all you have achieved is exporting your emissions to somewhere else, and decimating your own economy.

At least with a carbon tax, you could apply it as a value added style tax, for example, which whilst not perfect at least means it becomes an issue at point of sale rather. Much easier to manage as VAT, fuel duty etc have proven.

I understand your point regarding the regressive nature of value added taxes, but your idea itself is regressive as it massively favors big business with the means to change over smaller business.

Nobel prize winners are probably worth listening to. Their work tends to be of a high quality and will have been heavily vetted and scrutinized. To a level your work will certainly not have been.

Regarding my comment to James:

You are taking the present value of the cost of eliminating emissions over the long term, and then placing them on the balance sheet a a liability. This will likely be a very large number. There are no corresponding assets, so by doing this you will simply be writing down corporate balance sheets. THis will wipe a huge amount of value off companies and shareholders.

More to the point, in simple accounting terms, if a company has more liabilities than assets, it is bankrupt. Inevitably this would happen to a lot of companies that you apply this change to.

They would be bankrupt now, not in 20 years time. There is no provision for “you will be bankrupt in 20 years time” in accounting or legal terms.

1. Noted

2. You clearly unaware of licencing issues now. Government already has the power to decide which businesses survive or not in a very wide range of sectors. If you are unaware of how licensing works over so many issues you really do not have very much to add to debate here, and are raising entirely false objections based on what is becoming, increasingly apparently, a false belief in market narratives. Believe it or not, most public officials are not only not corrupt, but are incorruptible. This year’s fisv=cois have been politically led and show how market logic fails.

4. Business have to eliminate carbon in what they sell. If they doing;t how do you ever imagine we can achieve zero net carbon. Taxes eliminate not a single tonne of carbon. Regulation backed. by reporting can do that – hence what I propose. So, tell me, how do you think people can stop buying carbon driven products unless business is forced to change. And please do recall – most demand is created by advertising. Take that into account please.

James. I never said any number should be discounted, I said provide in full. I dd not allow for discounting because in the case of climate costs increase over time and do not fall. Discounting pretends otherwise. Hence why full provision is required. And of course I am writing down corporate balance sheets. That’s what provisions for failing businesses require. And of course that will wipe out value. That’s what’s going to happen. Are you really denying that? And no, carbon insolvency will not require immediate winding up. It seems like amongst the many things you lack is an understanding that rules can be re-written and carbon insolvency would require that re-writing. I also strongly suspect that you are not aware how corporate solvency is also determined for legal purposes. If you are, please explain how Aracdia kept trading for so long.

3.

2. Licensing would suggest that ALL companies able to meet the requirements would be able to obtain such a license equitably.

Your version of licensing is the government choosing only a select few companies able to receive such a license. Which would mean at best favoritism, but at worst, as experience has shown repeatedly, cronyism and possible corruption.

It would also hand government huge control over industry and enable monopolies to readily form, which are bad for consumers and highly regressive.

I believe in market narratives because they have been shown to work far better than any other alternative. Centralized government economic control and command economies have been abject failures every time they have been tried.

4. That is impossible for most products. You simply can’t eliminate emissions from everything. This includes almost every item we use in modern life, from housing to electronics, transport and even the food we eat.

Once again, it seems you don’t understand that there are advantages to many of the things we produce, so the aim would be to offset those emissions, not eliminate them at source.

Carbon taxes don’t directly remove emissions, but they do make emissions less economical. Which means that behaviors will change to reduce emissions as it has a cost. Cars have become more economical as fuel prices have risen – which is mostly tax, for example. To say carbon taxes can’t reduce emissions is obviously incorrect.

I don’t think you understand what discounting means. £100 today is worth more than £100 in the future. So if you are saying that there will be future climate costs, those costs will be discounted. Those future costs can still rise, which is different to present value discounting.

I am also not sure you understand insolvency. If you take a business and then apply climate costs to it’s balance sheet (and especially if they increase over time) that business will have negative equity. I assume you would have these costs paid for at some point, otherwise there is no purpose for your idea. If the costs are such that the company will not be able to meet those obligations (which for many industries will be impossible by their very nature, as producing most things requires some emissions) then they will be insolvent.

How would a carbon insolvent company not require immediate winding up, if it’s basic business (as well as all it’s suppliers and consumers, so scope 3 emissions as well) is only possible with some emissions?

Arcadia became insolvent when it could no longer meet it’s debt repayments and other liabilities. There is nothing special about that in itself. Your idea falls apart because most companies can never meet those liabilities, because producing things by it’s very nature leaves a byproduct – one of the most common of which is C02.

Which is why offsetting is so important – yet for some reason you seem totally unwilling to even consider it.

This is getting kind of tedious.

I presume you are aware that we have to get to net carbon zero or our emissions basically kill us?

That we are, therefore, seeking to control the most toxic chemical we know (assume nuclear waste can be kept in its bunker)?

And you realise that all toxic materials tend to be licenced?

So of course offsetting will only be by permission. But whoever said that had to be only to large businesses? Have you no clue?

And ye, we can eliminate emissions: it’s now agreed that is possible

Sure it’s hard in some products e.g. cement. But in steel it’s said to be possible.

So let’s dismiss that noinsesne.

And my logic on discounting may be hard for you – and of course costs can cha nge, but discounting encourages deferral, and that will not do. So it will not be permitted.

As will be carbon insolvecny, which is a new form of insolvency, which I fully understand. Let me tell you, some very senior accountants got this immediately. The ICAEW is being very supportive of this work. They see exactly what I am saying. You don’t. But you are not trying. They are.

I think we’ll leave it at that.

Please do not repost similar comments. They will be deleted.

Yes, will study the issues closely and send the IFRS relevant comments as you suggest.

Thanks

Appreciated

Thanks for this. I shall write and also forward to other accounting friends.

Many thanks

Much appreciated