One of the perennial questions surrounding what is supposedly called government debt is the 'how are you going to repay the borrowing?' question. The media is obsessed with it at the moment.

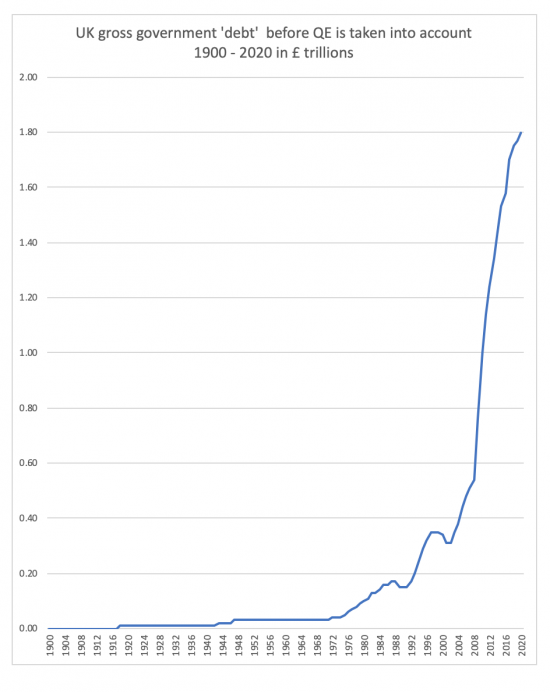

They appear wholly unaware that we have never made any serious attempt to repay this supposed debt:

It has not mattered that we have not repaid debt to date. There is good reason for that: people want to own UK government debt: it's a great asset to have right now (and pretty much anytime else in history too: read the novels of Jane Austen to appreciate that).

It has not mattered that we have not repaid debt to date. There is good reason for that: people want to own UK government debt: it's a great asset to have right now (and pretty much anytime else in history too: read the novels of Jane Austen to appreciate that).

But the question persists. I heard an interview of a UCL economists by Adrian Chiles on Friday: it was chronically painful because much of the economics that was discussed used ancient historical perceptions of banking (banks are still intermediaries, apparently) but also because of the inability to answer the question 'how are we going to repay this?'

I faced the same problem on BBC Radio Scotland with John Beattie last week, and he was clearly baffled by my response when I said we did not need to do so.

I explained that people are very happy to hold zero interest rate government perpetual bonds. As I told him, he only needed a £20 note in his pocket to see one (and yes, that's true, even in Scotland as all Scottish notes are backed pound for pound with Bank of England deposits). In other words, people are already completely happy to hold part fo the national 'debt' on which there is no repayment date.

But Beattie insisted to me that all debt has to be repaid or people won't 'invest' in it. I should, of course, have also asked him why in that case he thought people bought shares, because they are not repaid. The reason is simple: they do so because there is a market in them and the same is true for government bonds as well. They do not need to be repaid because they can be sold.

However, the real answer to this question comes in the form of perpetual bonds. I have already discussed these. Will Hutton also did so, when picking up on a number of themes previously discussed herein the Observer yesterday, saying:

The government has to start funding its deficit with “perpetual” bonds, never to be repaid but which carry a higher interest rate, so recognising the abnormality of its plight.

He is right. But I would add that the higher interest rate need only be marginal. And in any case, the best reason for these bonds, as I previously noted, is that they are perfect for being subject to quantitative easing as the issue of rolling them over then never arises, and the interest rate is irrelevant as interest is not paid on QE debt since it would only be the government paying itself, and that is pointless.

Issue such debt then and the question of 'how are you going to repay the debt?' simply goes away.

The time for perpeptual bonds has arrived.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Its painful indeed that all these seemingly bright people seem to equate government with a household. Have they really never heard the phrase “government is not like a household” uttered? Surely not. So why does it not ring alarm bells in their head when they say really stupid things like government needs investors or that government debt needs paid off?

Worthy of note is that John Beattie is a former Scotland internal rugby player (who later trained as a chartered accountant!). Surely John would get that the Scottish Rugby Union (SRU) doesn’t need for to go with a begging bowl to Biggar (a team he used to coach) to ‘invest’ in the SRU before it could issue points. Of course he knows that’s nonsense as a rugby club, a mere SRU point user, is ‘not like’ the SRU, the issuer of SRU points.

And as for John’s desire to see “all debt has to be repaid or people won’t ‘invest’ in it”, how would he have felt, as the manager of Biggar, when, mid-way through the season, the SRU decided to do exactly that i.e. it proceeded to take all the points back off all the teams in the league. Debt paid! Party!….er…perhaps not.

But he is a chartered accountant…..

The books have to balance, you know

As I mentioned (he retrained as one after retiring from rugby).

He is also an engineer. They solve real practical problems using the techniques of mathematical physics.

But as a chartered accountant, he must realise the books are already balanced. Liability on one side and asset on the other.

But accountants split the Credit side…

Could you address the question of: Who has the government actually borrowed from?

It’s treated like there is someone out there with a huge stack of GBP which we’re borrowing from. But it’s not like that, is it? Perhaps coming at the question from this angle would show up that what’s going on isn’t borrowing “as we know it”.

I address this here – I do not see much change happening except the state holding will rise

https://www.taxresearch.org.uk/Blog/2020/05/15/uk-government-debt-some-facts/

The buyers of long dated gilts don’t really care if they are 50 year or perpetual but if perpetual bonds get some people”over the line” in their understanding/acceptance then bring ’em on……

and would we call them ‘Rona Loan?

In answer to Stephen’s question “do they really not understand?” I would merely quote J K Galbraith (again – but it is good!)…… “The modern conservative is engaged in one of man’s oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness.”

I know that this might be unfair….. there are many lovely, generous folk who shy away from debt and believe that we, as a nation should, too…. but our political masters understand very clearly.

I am aware that they make little difference in reality – but perceptions matter

I sometimes wonder if this could be explained using a physics analogy?

Newton’s third law of motion? To every action there’s an equal and opposite reaction.

Law of conservation of energy? Total energy in an isolated system is and remains constant.

First law of thermodynamics? Energy passing into an isolated system causes the system’s internal energy to change in accordance with the law of conservation of energy.

There are probably analogies with Special/General Relativity and Quantum Theory too, but they tend to test the limits of people’s understanding (not least the people doing the explaining!)

The action/reaction idea makes most sense to me. We’re not just pushing on the earth when we walk, the earth is pushing back at us, supporting our feet.

Cheers

Nick

I’m a bear of little brain, Richard. I arrived here in the good old days of Corbynomics ‘in search of answers’ (Grasshopper!)

I say Corbynomics but perhaps it was when Cameron was caught out, and slapped for, claiming that he’d ‘paid down the debt’, when even the casual reader could look it up and see that not only had he not done so – but that it was now rather larger than the ‘Labour’s mess’ that he’d ‘inherited’. He was borrowing…maxing out the credit card…to pay the gas bill, and was telling us he’d balanced the books!!

And when the casual reader looked at the size of that debt and asked himself the ‘But how ARE we going to repay it?’ question, he arrived at ‘…but that would mean perhaps a hundred years of crippling austerity!’, and then ‘…but while we’re repaying that money we’re not spending it in the High Street…b-b-but that’s ridiculous’. (And my old Mum, whose life-savings provided her with the bit of interest for a lunch out, or coach trip, or a night at the theatre with ‘the girls’ after Dad died, suddenly found the interest, and thus her ‘spending money’, cut and cut…and the economy where she spent it had to go without…and she had to sit indoors and stare at the tv -because the capital was for if she needed to go into a home because she didnt want to be a ‘burden on the state’! – What was the sense in that?!)

The casual reader…the bear of little brain…and the average punter are, as you highlight here, not helped by their daily news sources and their own lamentable failure to grapple with their ‘how?…’ and move on to the ‘…but why…WHY would we want to repay this if in so doing we, and our children, live 100 joyless years?!’.

The failure of Labour to try to explain any of this …to challenge Thatcher’s teachings on how the economy works…has allowed it to embed itself in the national psyche. (‘Yes, but if you owned your own bank and could borrow from it at 0.5%…or less…and could defer repaying quite a lot of it…would you borrow to buy the kids shoes (and protein!) or would you carry on serving belt stew?’) And now all those ‘think tanks’ are urging spending ‘because the cost of borrowing is at a ‘historic low’! Well, how bloody dare they?!

That’s how and why I ended up here. Thank you for all you do to shine a light…how I wish that sometimes in could be in their faces!

Thanks

Ask these questioners where they think the “money” came from in the beginning at the dawn of the money universe. In the beginning was the void. Money came into existence because society willed it. No one was sitting with a big pile of it waiting to be used and that would at some point have to be repaid…

Money is a mechanism needed for an economy to function not a thing itself.

I think Simon might have touched on a very simple way of explaining this to people.

Once upon a time there was no ‘money’ – so it had to be created. And as economies have grown, we’ve needed more it to be created to enable economies to function and grow. If the supply of money was the same as it was say 500 years ago, we’d have an economy that size!

Sometimes thats unhelpful – banks are allowed to create money (out of thin air) and when they use that to lend indiscriminately on property they help to fuel property inflation. (Even the point about banks creating money is lost on most people). When that money is used to fuel speculation in other assets that too does little except fuel inflation in those assets, benefiting the asset holders who are mostly the wealthy.

Where it is helpful is when that money is deployed to create jobs that we need to deliver infrastructure and services that we need – the green new deal being a case in point.

Or is that impossibly simplistic? We need to find ways to explain this simply as there is such a huge education problem. Its a bit like Galileo’s time, challenging the church and views that the sun revolved around the earth…

We still struggle for that simplistic line

I am not yet sure we have found it

I have tried to explain that money is created by the banks and the govt out of nothing. All i get is i am not into politics. I said it is not that, it is about economics. The simple answer is they feel rather foolish for borrowing money which was created out of nothing to buy a house with it. Again taxes are destroyed though not council tax it seems, so if you tell them the former has gone to St Peter you get a blank stare and which awfully looks like “your nuts mate”. “Have you been listening to Trump again ?”

That’s the trouble of trying to change things

First they ignore you

Then they ridicule you

Then they get angry

Then you were right all along

Take courage: at least we’re at stage 2

The point at which most voters brains stop working is the failure to ask where do the funds as an exchange medium actually come from to pay taxes and buy government treasury bonds. For most people it’s my employer gives it to me because I do work! It’s the absence of inquisitiveness that does the self-harming which raises the question how do you promote inquisitiveness in schools!

And they, horizontally, got the funds through exchange created bank loans

But the currency itself – that cam from government

OK – so correct me if I am wrong – what you are talking about is the State using its sovereignty (sovereign power) to make the debt go away in as much as the ancient rulers depicted by Michael Hudson issued debt jubilees – because they could (I’m not talking like for like debt situations because a debt jubiliee is different to what you are proposing – {or is it?} – but on the operative means – the power so to speak, makes the debt go away).

In effect, the British State is saying about the debt ‘Leave that to us, don’t worry about it’ because they have the power (as the effective owner and operator of the currency) to do so.

I still think that this business about State sovereignty — absolute power — is underplayed too much in this arena. It has to be part of the answer.

So, my situation is having read and digested John F Weeks, who apparently is ‘not quite there’ in terms of MMT, I’m now waiting hear what Stephanie Kelton has to say in her new book in June about all this and hoping the she has definitive account that Tax Research UK and Progressive Pulse can recommend to MMT infantry like me who wish engage with the sceptical masses I rub shoulders with on a daily basis.

We seem to veer one minute from saying that money is an ephemeral concept and ‘just a promise to pay’ to something like bonds which are actual tangible pieces of paper but are also ‘a promise to pay (the principle plus interest)’. Confused? Yes!

Is there a debt created by MMT or direct funding or not?

Or is it real, but not to be worried about? Because the Government, via the ways and means of the State, can sort it out and not impose austerity, for example?

OK — taxes — yes, I can totally see how they cool an economy by destroying money in this cash injection context (compare money to fuel – an engine burns fuel but also has to be cooled to ensure that it does not overheat) but is that always the case or is it confined to just crises like Covid-19? Are taxes just recycled into the economy like transfer payments/benefits in normal times? But just destroy money to curb inflation at times of mass investment?

There seems be a lot of loose ends from where I’m standing.

If we want to take this debate from online into wider society (and it HAS to be made wider, because otherwise those voting will just not be convinced) then those of us prepared to have go need something to believe in, an account that stands up and is robust.

I think we are some way off that yet. And it is all very well traditional neo-liberal organs getting MMT at last but if the public do not get it then, then that could still be a major hurdle in getting change.

I am struggling to think what is not robust….

But I will muse on it

The problem is you still think taxes are recycled. No they’re not. They cancel debt from the gov’t to the BoE. That’s it

I think that’s where your issue lies…..

How does council tax fit into this Richard?

I had a conversation with someone about this and they mentioned that council tax is revenue used for spending by councils, so presumably is not “tax” in the truest sense then?

Councils are not currency creators and so they do use council tax to pay for servcies

For them the household analogy applies – unless central government chooses to lift it, which they don’t

OK – I’ll roll with that Richard – that I think taxes are recycled and that is my problem (but also is it John F Week’s problem too that leads him to being – in your opinion – to not really being quite there?).

From my time in social housing, we are taught that benefits constitute technically as ‘transfer payments’ where taxes are used in their redistributive way from those with sufficient to those with insufficient means. For example Housing Benefit.

This is a powerful idea – especially to progressives – you know, it’s helping people.

However, I have also learnt that taxes do not have to pay for these sort of services – that the Government can instruct the BoE/Treasury to print the money instead. Fair enough – understood, accepted and evidenced ably by this blog as well as other outlets.

But is that always the case? Is it a matter of CHOICE as to whether a Government reallocates taxes or just destroys the tax receipt money and prints new cash into the benefits system instead?

Is it a matter of WHEN they do either – if the economy is ticking over nicely, are they more likely to recycle taxes than inject new money and if the economy is in crisis, are they more likely to inject new cash and destroy receipts? Is the use of tax to destroy money to combat inflation the key principle as to why tax exists (alongside the others you mention in TJoT)?

I honestly don’t know Richard. Is it about choices or is the injection of new money followed by the tax destruction of that money the supposed regular order of the day – how Government operates (or should)?

If it is a choice matter, then the public need to know so that they can weigh up which politicians they know will help them and which are more likely to help the rentier class. People need to know that – as you say rightly – the Government CAN print the money we need. At any time.

Again. I’m not here to argue, but if I have faults in my understanding then I’m damn sure others will too. It’s about ironing out the wrinkles, especially for the big battles ahead.

All money is a promise

All money is destroyed when the promise is fulfilled

Cash never cycles as such – even the notes are new promises every time they are used – and their physical appearance is simply a token of the promise reused to make it more acceptable, but nonetheless continually different each time it is used

A “debt jubilee” is when debts on the POPULATION are cancelled, but that’s completely the opposite situation in this case – as ‘the debt’ is the government’s debt TO all of us. If somebody owes you something, that’s generally a good thing, so cancelling ‘the debt’ would not be in the population’s best interest.

And yes it is VERY confusing what people mean when they say the word “debt”, which is why talking about the dirt-dumb ‘IOU’ is far more useful as (a) people instantly get it and (b) it states explicitly who the ‘I’ and the ‘U’ are. So I really sympathise when you say people “veer one minute” from saying one thing and the next minute saying another.

I realise the difference Stephen between a debt jubilee and the willingness to print money – all I’m concerned with is that the Government is using its power to actually do it – constructively and for all the people (Government power or ‘will’ applies in both cases – they’ve got to want to do a jubilee or print money or they falsely believe that it is a choice and won’t).

And, if money is a promise to pay – then this Tory Government (and past Labour Governments too) have simply not been promising us enough it seems, in order to get the money that we need.

I think that the state of our country and its services tell us that we don’t have enough money. The reason why we can’t build much needed affordable houses on brownfield sites is that no one wants to pay to remediate it – including HMG.

Interesting……………………………………..

So, it indicates to me then just how stupid Tory neo-liberalism really is. Thatcher – in the early 80’s, thought that by just toying with the interest rate and cruelly creating a reserve of unemployed people she could control inflation. But she didn’t. She couldn’t.

Why?

She didn’t because she was ideologically cutting taxes too – the best means of controlling inflation.

As I said – very interesting, and maybe a lot of recent history needs rewriting too.

Maybe I’ve got my cunning plan to convert the masses after all!?

🙂

Im musing on PSR’s ‘MMT infantry’ … the Baldricks of the MMT world, looking for a cunning plan we can understand before we go over the top!

On the other hand, that might position Richard as General Sir Anthony Cecil Hogmany Melchett which would of course be a gross calumny

You can go off people Robin – I’m not leading from 35 miles behind the front 🙂

More like 35 miles in front and behind enemy lines!

🙂

One perspective changing phrase I came across yesterday was that a sovereign government running a deficit is the “natural state of equilibrium!” This can be found on page 4 of Eric Tymoigne’s 2014 paper “Modern Money Theory and Interrelations between the Treasury and the Central Bank: The Case of the United States” :-

http://www.levyinstitute.org/pubs/wp_788.pdf

He is writing about government fiscal operations in the Massachusetts Bay Colonies and he states the governments discovered the following:-

“Private economic agents desire to hold bills for other purposes than the payment of tax liabilities, namely daily expenses, private debt settlements, and precautionary savings.

The problem today is, of course, finding a way to get voters (particularly the Libertarians) to do the balance sheet accounting so they can discover and be convinced why private sector bank loans don’t provide the net financial assets (savings) they need.

Of course it is the natural state of things – if there was no such debt there would be no government-created money in circulation

And that’s what people find really hard to understand it seems

It seems few people want to be concerned about the role played by reserves in modern human society. Savings clearly are a form of reserves and government being a monopoly creator of reserves was the only way to get stability in the payments settlement system.

Its all kind of smoke and mirrors rubbish anyhow.

It is presented as

“The government needs to borrow in order to spend, and those debts will ultimately need to be paid off”. But, as is painfully clear over the last few weeks, the government does not need to borrow, since the BoE, who are part of the government, will step in to buy gilts directly. They still call it borrowing though.

However, they even this is kind of misleading.

The government does not borrow anything, when it spends – It just spends.

The balance on the Consolidated Fund at the Bank of England (the account which all taxes are paid, and all spending originates) can, and does go negative, it’s only at the end of the day that any remaining balance is transferred to the DMO and sold off as gilts. So where do the investors get the money to buy the gilts sold the next day? From the spending the government made the previous day, which has now ended up as increased BoE reserves.

You can not call this borrowing, in any sense of the term. Borrowing is when you get the money first, and then spend it. This is just spending the money, and then swapping that spent money, for gilts. An asset swap.