The House of Commons Library is a much overlooked and valuable source of information. When I was looking for data on a related issue this morning I came across a briefing it had prepared this year in government debt. The following tables come from it.

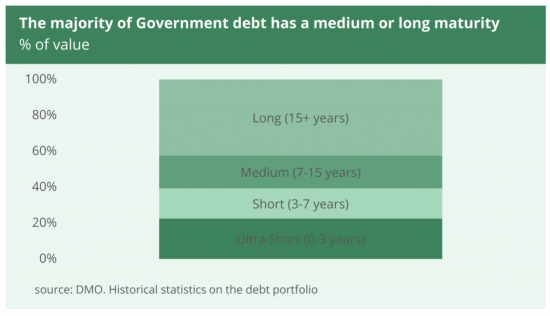

What most people don't realise is how long it is before much of UK government debt has to be repaid. This is the age profile:

You can't make a debt crisis out of debt that is, on average, that old in anything like a hurry. So people need to calm down about that issue.

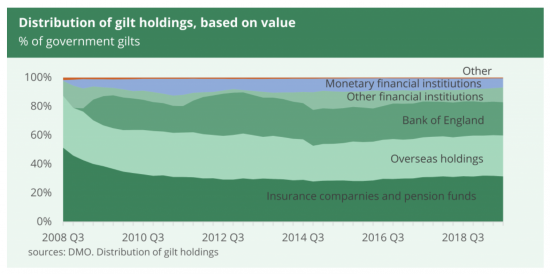

Second, there's the question of who owns the debt:

23% of government debt is owned by the government.

28% is held overseas. The rest (almost half) is held by organisations that need it for regulatory purposes and functional need in the main, so they won't be selling.

And historically, the overseas sector has been keen to save in the UK. Whenever anyone talks of a debt crisis coming it might be good to ask who is going to create it? Especially when the government can increase its holding whenever it wishes.

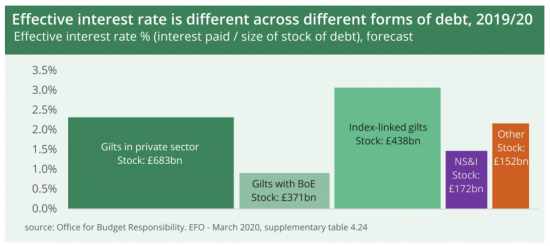

Then there's the question of the interest rate:

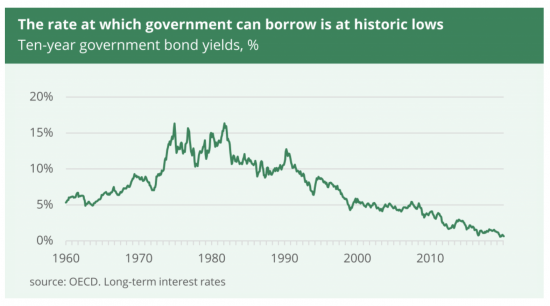

But before you think that's high, it's because so much of the debt is old. This is the trend:

That right-hand end is called 'next to nothing' - it's about 0.2% right now.

In other words, the cost of new debt is very low, and will remain that way.

So before anyone says 'debt crisis' please give them some facts.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Which institutions need to hold government debt for ‘regulatory reasons’?

Banks in particular usually need a holding to satisfy their regulatory requirements

Many institutions have restrictions on the funds in which they can invest and government bonds almost invariably are suitable for their needs

This is not true in the Netherlands at least, are you sure it is true in the UK?

While there may be reasons why institutional investors such as UK banks, insurance companies and pension funds choose to invest in UK Gilts, there is no regulatory requirement for them to do so.

As Clive Parry notes – the de facto consequence of regulation is that they hold gilts

Banks operate under strict liquidity rules to prevent “bank runs” (like Northern Rock). These are quite complicated but in short, they must be able to stay afloat for 30 days if they lose all access to wholesale funding. A key part of this is owning a good chunk of gilts that can ALWAYS be turned into cash via Repo. To minimise interest rate risk they tend to dominate the short and medium maturities.

Insurance companies need liquid assets for similar reasons. Insurers hold reserves against potential claims and it is important that these investments are not correlated with the risk they insure (Eg. If you are insuring against oil spills you would not want your reserves held in Exxon or Shell shares or bonds). So, insurers always have a good chunk of gilts.

Pension funds are the major owner of long term gilts – mainly against Defined Benefit Schemes. Companies have to mark-to-market their pension assets and liabilities and their liabilities are all a long way in the future and to work out what they are worth today you discount at the long term interest rate. So, the only way to avoid huge volatility in your net position (assets minus liabilities) is to own assets that move in the same way as the liabilities…. and that is long term gilts.

Much is made of overseas holdings of gilts. Yes, they are substantial but (1) Sterling is still a significant part of many countries’ FX reserves…. and this will be invested in gilts. Whilst, they can always alter the composition of reserves they would always be anxious not to ‘make a scene’ and do it during a crisis. (2) Some may be held ‘overseas’ but the the owners will have Sterling liabilities or even be UK based. So, they are unlikely to be sellers.

In summary, please feel free to ignore all I have said as the REAL message is in the price 50 year gilts yield less than 0.5%.

Thanks Clive

Clive,

What you are saying is true – there are many reasons why banks, pension funds and insurance companies would CHOOSE to hold government bonds amongst their assets. That does not mean that they have a regulatory requirement to do so. THEY DO NOT.

Any of these institutions could legally operate in the UK without holding any UK Gilts whatever.

Alexis De Ruffee says:

“……. That does not mean that they have a regulatory requirement to do so. THEY DO NOT.

Any of these institutions could legally operate in the UK without holding any UK Gilts whatever….”

Interesting. I was under the impression that pension funds were required to hold a proportion of government bonds since the Blair Brown days….. I wonder if that has changed or was never so in the first place….?

That have to hold safe assets

They, I accept, need not be government bonds

The data shows that in many cases they do, however, hold them

Alexis

Banks have to hold high quality liquid assets. If I remember correctly only central bank reserves, goverment debt and covered bonds are at the highest level tier 1 of liquid reserves. So they are certainly going to be held to meet regulatory liquidity requirements. Lloyds has a liquidity portfolio of 118bn, of which 64bn is govt bonds, the majority of which is UK. It also has 49bn of central bank reserves which will be partially backing the BoE holding of gilts. So it would be practically impossible to meet UK LCR requirement without holding gilts directly or indirectly.

This and the earlier post comparing borrowings by Labour and Conservative governments refute a lot of the Tory narrative around debt – a narrative that Labour too usually buys into. But maybe I am missing something; I’m not sure entirely understand and the question in my mind is this.

If MMT is right isn’t it kind of irrelevant? And if it is not, why not?

Government debt is not irrelevant: it is the mechanism a government uses to control interest rates

The 23% held overseas is the only part of the debt over which the Government has little control. This presumably is therefore the only part of the debt which would provide any cause for real concern. This raises the question (which I raised on another thread), why if the Government had legitimate grounds for believing that this level of overseas debt could be a cause for concern, it allowed that debt to grow to 23% of the total?

No doubt the reply to this would be to throw up technical foreign exchange or broader national interest concerns; but that would be a case of committing the fallacy of ‘petitito principii’ (begging the question). It is for the Government to decide what are the most critical factors in arriving at the nature of the national interest. The security of the people and state come first. Ensuring overseas debt does not carry a serious threat to the stability of the nation’s finances is a fundamental, non-disposable responsibility of Government. It is fixable by Government fiat.

Therefore, either there is no problem with the overseas debt, if the Government is doing its job; or there is a problem, and the Government is to blame. QED.

But that debt is owed in sterling – so it does remain in government control

In order to hold the debt overseas investors have to acquire sterling. I was thinking of that process in the framework of trade and foreign exchange informing the anxiety of those who wish to defend the proposition that the level of debt is an imminent problem.

It’s good to see that block labelled National Savings and Investments (NS&I) in a government table of DEBT.

A tiny bit of that is mine and if the government paid it off it would be my crisis rather than theirs.

Also you do need foreign currency to pay for imports. In a country that does not have a trade surplus like the UK it is inevitable that some debt will come from overseas. Trade imbalances is one area that MMT needs greater thought.

You seem to be confirming my comments that there are NO regulatory requirements for these institutions to hold gilts, but it is often convenient to do so.

So your ‘facts’ abut government debt are not really facts at all!

De facto it’s a fact

As Clive has succinctly explained, the regulations don’t say “hold gilts”: they say something like “maintain sufficient liquidity or “hold sufficient liquid reserves” or “hold enough assets to meet your liabilities”. In practice, they way they do it is by significant holdings of gilts.

If the banks, insurance companies, pension funds, etc, could find a better way of maintaining liquidity/holding reserves/matching long term liabilities with long term assets, they would be doing it. So do feel free to suggest other, more effective, cheaper ways of achieving the same ends. Even better – try selling your ideas to the financial institutions and see how far you get.

The substance (and as an accountant that’s what matters to me) is that the regulations say hold gilts

“there are NO regulatory requirements for these institutions to hold gilts”

This seems to assume that ‘regulation’ means the regulator functions by public decree. Regulation in the UK does not operate solely in this way; but much more by influence, persuasion and finding a way of guiding regulation by unobtrusive guidance. This has a long tradition. The problem with this approach is that there is a risk that the regulator becomes too close to the industry it is regulating, and goes ‘native’; or even becomes the industry’s creature. The proof of this is that quite regularly the regulator in the UK has failed completely in a crisis, and the Government is simply obliged to put it out of its misery (and end the Government embarrassment) by extinguishing it: most spectacularly after the 2007-8 financial crash, when the Financial Services Authority (FSA) had obviously spectacularly failed. It was repalced by not one, but two regulators: FCA and PRA. Ironically, the FSA was only set up in 2000, following the failure of self-regulation in banking after the collapse of the venerable Barings Bank in 1995. And so it goes…….

John S Warren raises some interesting issues relating to the effectiveness or otherwise of regulation in the UK by referencing the failures of the FSA and others by pursuing a modus vivendi of influence, persuasion and finding a way of guiding regulation by unobtrusive guidance.

I go along with that, but wonder if this “light touch” approach comes about because of an unrealistic belief in British exceptionalism, or because of misguided belief that a light touch enables the supposedly free markets to exercise their mythical efficiency and efficacy better, or indeed simply because nobody can be bothered to undertake the hard work of designing, testing, implementing and overseeing a robust control system (perhaps because “we Brits always muddle through somehow anyway”, so why bother?).

I’ve no idea whether the light touch results from one of these reasons or a combination of all of them, but it is clearly commonplace across a wide range of institutions. How else to explain the inevitable GFC of 2008, the Grenfell disaster, the recent PPE Stockpile fiasco, the failures of the Care Commission Inspectorate to ensure rectification of unacceptable standards in Care Homes, the audit failings that led to major company collapses like Carillion? The same could be said of many public enquiries like the Chilcot and Leveson Inquiries.

The result is that nobody is surprised when regulation fails and it is simply accepted as normal, even though its failure inevitably carries a huge cost, be it in financial terms or in human lives.

I would speculate that it may perhaps be because the obsession that individual freedom must prevail over everything is essential to neo-liberalism (for the best in the best of all possible worlds, that also defines British exceptionalism); notably that individual rights do not carry any reciprocal duties, and therefore the point of regulation is that it is only legitimate if ‘de jure’ regulation in the interest of the communtiy is reduced ‘de facto’ by regulatory guidance and negotiation into what is nothing more than personal (including corporate, as a ‘person’) self-regulation under the patronage of individual freedom. Responsibility for others becomes a personal gift.

As a P.S. to my post at 11:33pm on 16 May, other examples of failure/absence of UK regulation I could have cited include Companies House (who is responsible for its regulation?) and, perhaps the most glaring and most harmful of all, the absence of a properly codified UK Constitution. Such a constitution should define the limits of politicians’ powers and protects citizens’ civil liberties and its absence in the UK in the 21st century seems to me to be entirely intentional.

Companies House frequently seems beyond the law to me

BEIS is supposedly responsible but denies it has any regulatory role meaning no one regulates company law in the UK

You could not make it up

The regulators have very much pushed the Life & Pensions companies into holding more gilts and less equities over the past 20 years or so. For example in 2004 Standard Life sold £7.5 billion of shares pretty much at a low point of the market in order to ‘de-risk’ the portfolio.

https://www.theguardian.com/money/2004/feb/19/standardlife.business

23% of government debt is not owned by the government through the BoE. That debt is owed to the banks in the form of reserves. The recent BoE that you linked said exactly that. QE is a marvellous slight of hand where they have shifted a large part of the govt debt onto the banks at base rate and with no maturity. And because of liquidity requirement increase, the banks have to sit with it on their balance sheets.

As a matter of fact the debt is owned by the gov’t

As a matter of fact post 2008 central bank reserves of other banks had to be increased due to the failure of trust in interbank lending

As a matter of fact that required increased deposits at the BoE on which interest is, by concession, paid, currently at 0.1%

As a result the banking system has greater strength

Are you saying you gave a problem with that?

Why?

You want zombie banks?