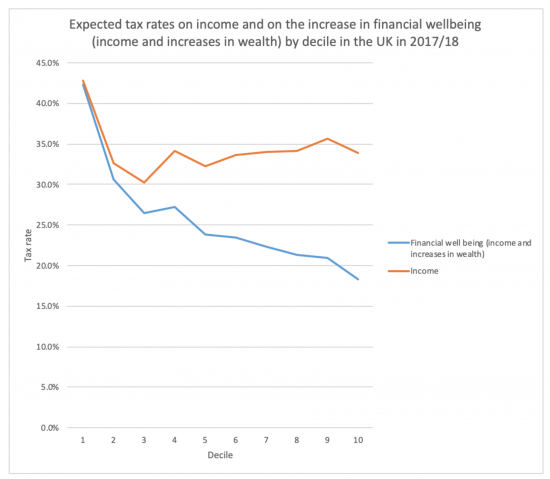

I have argued as part of the Tax After Coronavirus (TACs) series on wealth taxation that there is considerable extra scope for the taxation of wealth in the UK. The overall rates of tax paid by UK income earners, ranked by decile, taking both their income and the taxes paid on or out of income and their average increase in wealth from 2011 to 2018 and the taxes paid on or out of that wealth into account produces a comparison of effective tax rates on the combined increase in the financial well being of these groups that looks like this:

I have argued as part of the Tax After Coronavirus (TACs) series on wealth taxation that there is considerable extra scope for the taxation of wealth in the UK. The overall rates of tax paid by UK income earners, ranked by decile, taking both their income and the taxes paid on or out of income and their average increase in wealth from 2011 to 2018 and the taxes paid on or out of that wealth into account produces a comparison of effective tax rates on the combined increase in the financial well being of these groups that looks like this:

As is apparent, income is taxed much more heavily than wealth.

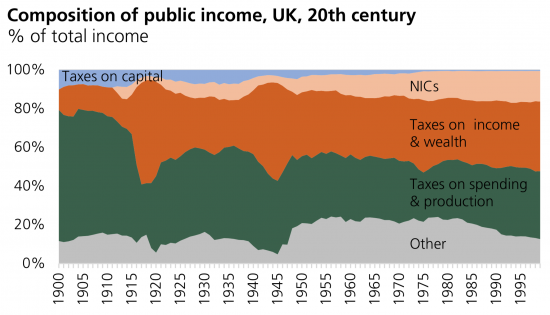

There is further evidence to support this trend in a House of Commons Library report that included the following chart:

Taxes on capital effectively disappeared during the twentieth century.

Taxes on labour replaced them.

But there is nothing to stop us bringing them back, and the rebalancing necessary in our society that requires that wealth inequality be tackled now necessitates doing so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Abolish NI and raise income tax levels would be a start. It would equalise tax on “earned” and “unearned” income. The NI threshold is much lower and works on a weekly basis (rather than annual like income tax) but I doubt this is a huge issue.

Link Capital gains taxes into the income tax system and tax it at you marginal Income tax rate and have very low thresholds. With modern IT systems surely banks and brokers could charge “witholding tax” on capital gains?… and surely the land registry could track the tax owed on property transactions (with people having to claim exemption for their main residence).

I am sure there is more to do but these changes are, I think, technically feasible and politically possible (once this current shower are gone).

I will get to NI soon….I need more time and no weekends (but I sometimes have to take some time off)

A word of caution about timing. The problem is that you have just written a short piece reminding everyone that paying off the national debt is not a good idea, and that applies to those who propose a wealth tax to pay it off; an idea currently being canvased by that particularly dangerous, and too often quite irresponsible species; journalists. I fear the two messages may too easily become conflated and confused, and by the time it is all disentangled, it is too late to persuade anyone.

Common Weal today (Source Direct) has just circulated an article on the rich-list, in which it proposes:

“There is a definite case for at minimum a one-off wealth tax on Scotland’s super-rich, which could be levied at local authority level, to fund the rebuilding of Scotland in wake of the pandemic.”

I think the timing of all this is terrible.

We need capital taxation to address inequality in the UK

As I wrote over the weekend, we emphatically do not need it to pay off the national debt

I appreciate and understand this – I am however, concerned about the contingent fact of the optics of potential mixed messages because, as a matter of fact, both the wealth tax and the wealth-tax to pay off the national debt are being promoted in the press by journalists simultaneously. This unfortunate fact can only created confusion in the public mind (which the lockdown PR demonstrates, can have unfortunate consequences).

I accept that is a risk

Oh, we are currently undertaxed, no doubt, but this is apples and oranges. 2020 is not 1900.

In 1900, taxes and public spending were both about 7% of GDP. In 2020, it is five or six times larger now, approaching 40%.

In 1900, the UK had its imperial possessions around the world, and most of the tax revenues came from customs and excise duties. And that is well before we had VAT, even before the 1940 purchase tax. But the state was much smaller, and life more precarious for most people (workhouses, limited state funded education, no state pensions, no NHS, etc). There were no national insurance contributions, and for most people no income tax as most working people didn’t have much income anyway. But there were effectively no social benefits. Do we want to return to the social structure of 1900? Of course not.

No need to ask what happened in 1914-18 and 1939-45 (and to a lesser extent, the bump as a result of the Boer War). The biggest change, I would argue, is the steady expansion of income tax and NICs, once PAYE made it relatively easy to deduct taxes directly from weekly or monthly pay.

So what were the “taxes on capital” in 1900 that funded, what, 10% of government spending then – that is, less than 1% of GDP? Is that estate duty? If “taxes on capital” remained at that level, they would now be 0.7/40 so about 2% of the tax revenues in 2020. Inheritance tax raises about £5.5 billion a year, from a GDP of about £2,000 billion, so would tripling the revenue from inheritance tax be enough to get us back to where we were? Abolishing APR and BPR would only get you another £3 billion, so you’d need something radical, such as abolishing the nil rate band, or abolishing the exemption for spouse transfers.

What is the difference between “taxes on wealth” (lumped in with “taxes on income”) and “taxes on capital”? Is that CGT?

(The suggestion of a one-off capital levy is a return to 1919, and Labour’s proposal for a levy to pay off the war debt rather than an excess profits tax. You are right: we need something more permanent to address rampant income and wealth inequality.)

As I have shown capital is undertaxed by a massive amnount

I am not saying we could collect it all

I am not even saying we should

But 2%? Why? When the return is so substantial it could be vastly higher than that

And should be

Which is what I want the Tax After Coronavirus (TACs) project to show

Yes Richard, but Andrew’s (and my) question is: What were/are the “Taxes on capital” in the chart from the House of Commons Library report? I looked through the report but cannot find what these “Taxes on capital” refer to – do you know?

It’s a fair question – and I do not know

It’s a question I will seek toi answer

If for no other reason, the fact that the chart goes back as far as 1900 at least shows us that there was “Once upon a Time”a brief moment in History when there was at least some form of taxation on Capital.

I confess to thinking at first that the Blue bit was just the sky peeking over those sunlit hill.