I spent some time yesterday talking to a journalist who was asking about suggestions that the UK national debt should be paid off using a one-off wealth tax. Ed Conway of Sky News is one of those proposing such a charge, but he is far from alone. Because the journalist in question had seen my work on wealth tax as part of the Tax After Coronavirus project, and had noted my suggestion that wealth is undertaxed compared to income by up to £174 billion a year, he presumed I might agree with the suggestion.

I don't. It makes absolutely no sense at all.

First of all, we need a national debt. I stress, we don't just have one as a matter of fact: we actually need one.

That's partly because the national debt is, in effect, a major part of our money supply. One completely accurate way of viewing it is as that part of government spending that has yet to be recovered by tax paid. It is then the money that the government has injected into the economy. And some of that really does look like the most conventional form of money that most people recognise as such: our notes and coin are part of the national debt. Quite literally, the money supply that we need to make the economy function would not exist in the reliable and controlled (i.e. largely at low interest rates and inflation free) form that it does if we did not have the national debt that permits government de facto control of money markets. The national debt delivers stability then, rather than undermine it. Getting rid of it would, then, be a very bad idea.

Second, I pointed out that quantitative easing means that national debt does not have to rise now, and with new QE of £200 billion already happening this year the rise in the real national debt, which is that after QE is offset, may be no more than double the £55bn Rishi Sunak forecast for this year, and not so exceptional after all.

Third, as I also pointed out, at the slightest hint of markets not wishing to buy debt the Bank of England will intervene again by creating more QE to ensure that the market is stabilised: the risk that national debt net of QE is going to rise at anything like the levels being talked about in the press, fuelled by the irresponsibility of those agencies (like the Office for Budget Responsibility and the Bank of England) who insist on talking about gross national debt when net national debt (i.e. with QE offset because the government owing itself is not an issue of concern to anyone) is the only figure of real consequence, is very low indeed.

Then, fourthly, I came to the issue of this tax.

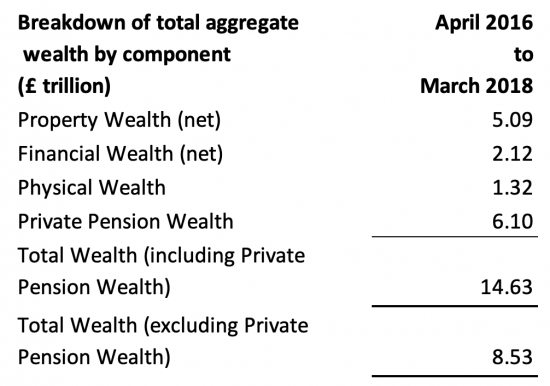

The latest figures for UK national wealth are as follows. They come from the Office for National Statistics and relate to 2018: there is nothing more recent than that.

As the data shows our national wealth is big. It is likely to be more than six times our national income. And because I rather strongly suspect that some of the wealth of some of the wealthiest people was not found by the ONS when undertaking this work, because some will still be located offshore, it may be a bit higher still than the figures noted.

But given the spread of the wealth giving this wealth a ‘haircut' in the form of a one-off tax charge is not going to be that easy.

Most, but not all (admittedly), of the property is family homes. The only way a wealth tax can be charged on many of these would be by requiring people to take out mortgages to pay that tax. That's not going to happen: there is not a hope that any political party will do that.

Nor is any political party going to raid people's pension savings. That's simply not politically possible.

In that case the two biggest pots of wealth, by far, are already beyond reach.

And about one-third of financial assets are in ISAs: again, I suggest that no politician is going to impose a tax on them.

Whilst most physical wealth is the stuff that we own in our homes, plus cars and similar property. I'm not quite sure how that's going to be taxed without, again, forcing people to take out loans to make payment.

So we're left with a part of the financial asset pot potentially available to tax. This could be achieved, so long as the crash in the stock market that would happen when very large numbers of people were simultaneously forced to sell their shares to pay tax on holding them could be tolerated, because that sale would have to happen, and precisely because everyone would be selling share prices would fall heavily. The move would, then, be counter-productive because stock market crashes rarely help economic recovery, and government debt might even actually rise as a result if another recession was triggered.

Which brings me to my key point, which is that since little of this wealth is held in cash and the banking sector would have no desire to create loans to help people pay a one-off wealth tax the reality is that the cash required to settle a wealth tax is unlikely to exist, unless government were to create it to let the tax be paid - which is pretty counterproductive. A tax of this sort simply cannot work in that case, at least without trashing the economy in the process.

So, not only is the tax not needed, because we need the national debt and it's not as big as people keep saying it is, but it is also technically nigh on impossible to levy such a tax without creating economic havoc, which would wholly negate its purpose.

It is not then by chance that I have chosen to focus my work on the taxation of wealth on taxing the income from wealth appropriately when that income is clearly very heavily undertaxed at present.

And it is not by chance that I am also suggesting that in exchange for coronavirus bailouts the government should be taking stakes in the businesses it supports - to be used to establish what I have called a National Wealth Service.

Those stakes in businesses - which could be significant - and which provide asset backing for the loans provided by the government to business, which is a wholly fair exchange - could grow in value even if many of the businesses now saved will fail in time. That is always the way these things work: the whole of private equity investing is about some high gains offsetting many smaller losses.

But this is not taxation: this is the government saying to business that support is not unconditional. There is a price for not having enough capital to weather a crisis, and that price is foregoing part of ownership. I would give business the option of buying those shares back, at a premium which would increase over time. But acting in this way is not unfair. Nor could any business object: it would just have to find funds from elsewhere if it did not like this deal. There is no compulsion to take government money. But we would not then be bailing out business: we would instead be creating an asset fund that this country has long been missing.

This is the real way to deal with the current situation. It's creative, appropriate and meets a need. That is everything that a one-off wealth tax is not.

Which is not to say that I am opposed to wealth taxes: we may well need one, at some time. But not as a crisis measure, but at nothing like the rates and required to pay off the national debt in a go, which is an absurd idea in itself.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What you are suggesting is far too sensible, where on earth will you find a politician willing to accept it?

From a theoretical view point of view if all money comes from government. bank debt and because of interest on this debt, there is not enough money to pay off all this debt. The ancient civilisations who invented debt had a way of correcting this with a debt jubilee.

We do not need to pay off debt

And by definition all money is created by lending there is enough, if it was rather improbably desired, to clear all debt

Ben,

Government debt and private bank debt (or, if you prefer, ‘money’) should not be conflated. In MMT-speak they are, respectively, ‘vertical’ (between the currency issuer and users) and ‘horizontal’ (between currency users).

In the horizontal sense, private bank debt is not impossible to pay off, as the money created can only be extinguished when the loan that created it in the first place is paid off over time. Note that private bank interest does not act like a black hole that then makes it impossible for all private bank debt to be paid off all this debt. This is the ‘treadmill of debt’ fallacy, of which there are plenty of examples in YouTube (very entertaining, but they are all wrong). This is because the interest payments still circulate out the ‘back end’ of private banks back into the economy (via bank wages, bank dividends etc.).

In the vertical sense, government debt can also be paid off, but that would require the government to tax back every last £ it ever created i.e. our national savings (aka government bonds) and bank reserves at the BoE and then every £ and penny of cash and coins. All gone, no more government debt!

“Ben Oldfield says:

May 17 2020 at 11:19 am

From a theoretical view point of view if all money comes from government. bank debt and because of interest on this debt, there is not enough money to pay off all this debt. The ancient civilisations who invented debt had a way of correcting this with a debt jubilee.”

If all money is originated from the government then all money is limitless, potentially. What you failed to realise is no government with its own currency and central bank can ever run out of the stuff. So your line there is not enough money to pay off all the debt is false. The point being why pay off the debt? it just taking money out of the economy and the government will be paying itself and thus have to create more money. Effectively you can not be in debt to what you own.

The interest is also creted, of course….

Ben assumed otherwise but that was a mistake

“The National Debt is nothing more than all the dollars (pounds) spent by the Federal Government that haven’t yet been used to pay taxes.”

Warren Mosler

Perhaps one day the British voter might understand the country has a reserves based monetary system to help the private sector and right-wing Libertarianism will then truly have a stake driven through its selfish heart!

He is right

As I said somewhere else, here today….

Thanks for your recent plethora of insights, explanations, comments, etc. which are greatly appreciated. Hopefully enough seeds will land on fertile ground to eventually grow into the accepted economic wisdom. But, having just read this drivel in HuffPost, there’s clearly still a scarily long way to go – https://www.huffingtonpost.co.uk/entry/uks-coronavirus-debt-explainer_uk_5ebbb49cc5b6bf83abbb5856.

May the force be with you!

Truly terrible!

“I spent some time yesterday talking to a journalist who was asking about suggestions that the UK national debt should be paid off ”

I also heard you being interviewed on Scottish radio. The journalist that was interviewing you seemed puzzled & his comments suggest the had difficulty understanding your explanations probably because they challenged long held beliefs. Did the joruno you spoke to yesterday understand?

Do you think there is a generalised problem with the 4th estate (jorunalists) actually understanding gov’ finance?

The follow up suggestion by the journalist was that I may he asked to write a column….we’ll see

But yes, there is a real,problem of journalist incomprehension

Richard, I seem to recall that our mutual acquaintance, Chris Cook, had actualy suggested renaming the National Debt the National Credit, given that it is certainly the basis (if not the totality?) for money in the economy.

I do hope I haven’t misconstrued what Chris said, and hope he will read this, and correct me, as will you, if I have misunderstood the nature of the National Debt.

Chris is clever, but not always clear in his meaning

But I think you have him right here

But few would understand it

For decades I had taken National Debt to have the same characteristics as my personal debt i.e. due to be fully paid off at some point! Henceforth, National Credit it is, for me anyway.

🙂

I suggested something similar on the Andrew Dickie/Chris Cook lines:

http://www.progressivepulse.org/economics/assets-and-debts-are-simply-a-matter-of-marketing

sorry late to this. I agree Richard on wealth tax, albeit with some thoughts/questions at bottom of comments below

I also think the national debt = household debt piece is how 99.9% including almost every journalist sees this. Tbh, until reading your blog over last few week so did I. I tried this evening to explain it to a friend and failed dismally – his response was “you are making no sense….there is no difference between the govt spending more than it receives in tax, and your family doing the same”.

The huffington post article is how everyone understands it sadly. Because interest rates are low, there is more appetite for debt, but nobody gets the gross national debt vs net national debt piece. Landing this difference and why the latter is the one we need to focus on, is imperative. I think, this requires more than just words, but the power of video/analogies etc. I am under no illusions, this is easy but it is critical.

Re the wealth tax, I agree with your points, albeit with some questions and thoughts I’d Love your pov on;

1. your paper that has been published in guardian I think has been misunderstood by many – they mistake it (and the £174 number) as a wealth tax of the type Ed Conway suggests vs equalizing tax across income and the income from wealth, which is infinitely more sustainable and practical.

2. On the national wealth service is this something only possible now or would it still make sense in the future? Put differently, if present govt ignore idea, but a future labour govt embraces it, will it still make sense in 4 years time? Hoping you say yes, but I am not clear.

3. on wealth taxes, beyond taxing income from wealth, I agree the challenge on family homes and pensions are very challenging, but what are your thoughts on following ideas (i) additional 2 council tax brands beyond current level H – an easier way to do mansion tax than the mansion tax and would hit the properties than are in 2million+ bracket – house prices are 400 index vs 1991 when valuations set and top band was £320,000+ so on average brand H is£1.3M but there are properities in that band that are 5, 10 even 50 million. Hence H could be 320-say 400 and then 2 additional bands on top – much easier to do this then create a seperate wealth or mansion tax and would have same impact (ii) taxing people’s pensions if they had to be pay he money would be a nightmare as it would crash economy and hit the public sector hardest as they are the only really defined benefits pensions left which would be politically very difficult BUT could we impose a one-off levy on pensions like Ireland did after credit crunch – nobody has to pay the money now (so doesn’t crash economy and people don’t need to sell homes or sell shares to fund) but instead if it was a one off 1%, this would be paid from the assets of the Scheme (defined benefit) or retirement savings accounts (defined contribution) and member benefits would be adjusted down 1% accordingly. Hence there would be no issues re liquidity and stalling economic recovery, which would happen with a traditional wealth tax

Sorry for the long one (again!)

Thanks for this

Re your questions

1) Unfortunate – but what happens, inevitably, and if it fuels debate on wealth tax more broadly I have no great problem with it

2) This is a long term issue

3) Council tax and CGT on houses are on the Tax After Coronavirus (TACs) list to do…I will get there. I am not at all excited by pension hair cuts – because there are already caps there

I’m not sure I go along with everything you say about this. Maybe we can drain some water from the bath without disturbing the baby. For a start I think you should acknowledge the damaging effect that high levels of wealth affect the top end of the property market and the knock on consequences to the the property market in general. Stephanie Kelton says we don’t tax the rich because we need their money. We tax them because they have too much money and that gives them too much power to influence governments. Thomas Picketty sees the problems in wealth rather than income. No progress will be made in reducing inequality without tackling wealth so don’t shy away from it.

I am arguing for the taxation of wealth!!!!

I am just saying a one of tax to pay down the national debt is not needed

They’re very different iussues

You have recently suggested, several times, that in return for bailouts the Government should take a stake in the business. How would the size of that stake be calculated. With all sorts of different types of business and great variation in size would there there be any standard method. Could it be simple?

For smaller businesses, I suggest a flat 25/1% with a buy back option at an accumulating price

For bigger businesses more nuanced approaches are possible