The Tax After Coronavirus (TACs) project intends to suggest those reforms to the UK tax system that might be necessary to meet the demands of our economy over the coming years whilst simultaneously delivering tax justice. This demands that criteria for appraising the existing tax system be used as the basis for suggesting reform.

The Tax After Coronavirus (TACs) project intends to suggest those reforms to the UK tax system that might be necessary to meet the demands of our economy over the coming years whilst simultaneously delivering tax justice. This demands that criteria for appraising the existing tax system be used as the basis for suggesting reform.

Over the last couple of years I have, with my colleague Andrew Baker of the University of Sheffield, put a lot of time and effort into developing a new mechanism to identify the risks that are inherent in any tax system. We call the resulting methodology tax spillover analysis. It was created as part of the EU funded Horizon 2020 Combating Financial Fraud and Empowering Regulators (COFFERS) project.

Tax spillovers are the deliberate or inadvertent risks created both within and between tax systems because one part of that system undermines the objectives of another part of that same system or of the tax system of another country.

Examples of tax spillovers are easy to find. For example, tax haven secrecy when coupled with low or no taxes in such places clearly encourages the relocation of money and assets (at least for tax reporting purposes) from the tax jurisdiction to which they really belong to the tax haven. That is, of course, why so much effort has been put into this issue in recent years by the OECD, and others.

There are, however, many more risks that exist. As the methodology makes clear, these can either be domestic, which means that a country's tax system undermines itself; or they can be international in nature and be created by the tax jurisdiction, which is what the tax haven in the previous example does; or they can be imposed from another jurisdiction, as happens to the location that suffers tax haven abuse in that same example. All three risks are rated separately in tax spillover analysis.

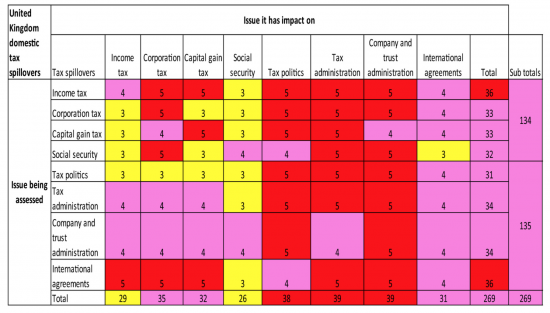

The ranking is done on a risk scale from 1 to 5, where 1 mean that the systems are reinforcing of each other, 5 means that they deeply undermine each other, and 3 is broadly neutral.

In pilot studies risks were appraised across eight taxes and features of tax administration, because long observation of the tax systems of many countries suggests that the latter are at least as important to the creation of tax spillover risks as poor tax design is by itself. Those categories are:

- Income taxes;

- Corporate profits taxes;

- Social security (national insurance in the UK context);

- Capital gains tax as a proxy for wealth taxes;

- The tax politics of the jurisdiction i.e. whether it is supportive of tax compliance and the policies that flow from that, or not (and it is easy to see that tax havens are not supportive of tax in this way and the Nordic states are, for example);

- The quality of the tax administration;

- The quality of the company and trust administration;

- The impact of and commitment to international tax cooperation.

An example tax spillover risk assessment prepared using this methodology for the UK domestic tax system resulted in this spillover risk analysis:

More information on how this chart was developed can be found here, here and here.

The chart has been colour coded to indicate risk. Red is maximum risk. Green represents a reinforcing system. The absence of green and the prevalence of red is apparent. The UK tax system deeply undermines itself as a result of having:

- lax company regulation that provides significant opportunity for tax abuse;

- many varying and deeply conflicting tax rates that provide massive opportunity for tax avoidance;

- a weak tax administration that has been starved of resources by successive governments over a period of about fifteen years:

- governments that have in recent years been quite hostile to tax compliance. This has been evidenced in particular by support for the UK's many tax havens and by the creation of many arrangements that have provided those with high income and wealth, in particular, the chance to avoid tax.

In the current economic climate this is a matter of considerable significance. It is very likely that the coronavirus crisis will leave the UK government with a considerable financial deficit and an increase in what is described as government debt. There have already been calls for new austerity measures to tackle this issue once the crisis is over. This work shows that this is not the only option available to the government. Simply by tackling the ‘low hanging fruit' in the spillover risk assessment the government could raise considerable additional revenues simply by closing the opportunities for abuse within the existing tax system, ensuring as a result that all those who do owe tax do actually pay it. In addition, tax justice could be substantially enhanced and inequality could be tackled.

It is the logic of this methodology that the Tax After Coronavirus (TACs) will be using to underpin its work. Further posts to explain this methodology in more detail will be published soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

would it be possible to rename to: Tax After Quarantine: TAQ’s ?

I don’t quibble the measures or reasoning within your proposals in the slightest but find the use of ‘after coronavirus’ misleading,

the virus isn’t going anywhere in a hurry,

there won’t be an effective degree of herd immunity,

a vaccine is still a long way off and will probably be ineffective,

we need to find a way of ending the quarantine to be able to bring the economy back to a more normal level of activity,

without ending the quarantine there won’t be much of an economy to tax,

the measures required to end the quarantine without triggering a second wave will be reasonably costly and ongoing,

reforms to the taxation system can help raise sufficient revenue from a muted economy to make the ongoing measures affordable,

the new economic reality is that the economy won’t be able to be as active as ‘before corona’ & the additional costs of operating within a ‘corona world’ will be ongoing and carried both by govt. and business alike.

currently my greatest concerns are focussed on whether the quarantine is lifted too early and/or with insufficient preparations being put in hand to stop infection rates rising again,

the worst scenario being the need for a second quarantine period,

it is indisputable that the primary means of virus transmission is by aerosol,

it’s obvious that this virus is much more infectious than previous ones encountered,

for a lifting of quarantine to be successful the infection rate must have fallen sufficiently,

upon lifting the wearing of masks by all members of public in all public situations must be mandatory along with a continuation of social distancing measures,

aggressive testing, tracing and individual quarantine, as required, must be pursued at all costs,

mass gatherings will be impossible,

regional & international travel should be limited as much as possible,

those currently working from home should continue to do so,

currently we have no national source of mask manufacture or major stockpile,

the bare minimum standard of improvised & home made masks must be mandated as a starting point with the govt. making every effort to rapidly improve the quality of masks available to the public at large as soon as possible, either free or at cost price,

my belief is that without these measures you won’t have much of an economy to tax, probably even another quarantine period to face.

for reference: A rational plan to come out of lockdown by Marc Wathelet

https://www.paulcraigroberts.org/2020/04/25/coming-out-of-lockdown-unprepared/

I found this short video of how China has re-opened it’s schools both informative and amusing : )

https://www.liveleak.com/view?t=CgnLH_1587986464

Much to think about

I entirely agree that we will have a shrunken economy

But that means managing tax is even more important, I would suggest

certainly managing tax properly will be vital,

there just won’t be any slack in the system to tolerate lax collection of taxes,

avoidance & evasion will only erode our ability to fund measures that allow the economy to function even in a shrunken state.

the FAANG group of companies, Facebook, Apple, Amazon, Netflix & Google are the ones least effected by corona, arguably actually benefitting from it, yet they have a track record of avoidance, evasion and sweetheart deals in respect to taxation,

if they can’t step up and pay their share in this environment then they don’t deserve a place in our economy.

footnote: my conception of evasion is willful avoidance, I use the term as commonly understood not legally defined.

You may find the link to a Euractiv article on Austria and tax of interest. Deeply conservative country -= but they seem to be heading in the right direction.

https://www.euractiv.com/section/economy-jobs/news/austrias-kurz-pledges-less-tax-for-workers-more-for-multinationals/

& for the record various EU countries are moving towards coming out of lock-down.

oh, another point on taxation and trans national companies,

it is true that MMT allows us to print the money that we need to spend and then taxation is used to recoup that spending and balance the books,

spend first, tax afterwards,

but that is within a national model,

when we print the money we need to spend and it finds it’s way to trans national companies that them spirit the money abroad and outside of our taxation system without having paid their due share of tax then the rationale of MMT is subverted,

for MMT to be sustainable we can’t allow profits to escape our national economy untaxed.

Let’s keep this in perspective: the issue is important but if the loss is 1% of UK tax I would be surprised. Domestic tax evasion is vastly bigger.

[…] Based on this logic the TACs project has already shown that there is considerable capacity to tax wealth to a greater extent than has been the case to date. It has, however, been argued that a wealth tax is not the solution to this problem, at least for the time being. Instead, shorter-term solutions are being sought. The way that these have been identified is via a tax spillover analysis. […]