Reaction to the letter Caroline Lucas, Andrew Simms, Colin Hines (whose name was omitted in error) and I had in the FT yesterday was intriguing, and largely predictable. This being election season those seeking to dismiss a straightforward, easy to comprehend and, for savers, deeply rewarding mechanism for reallocating savings towards funding the Green New Deal were out in force.

What the comments revealed were three things. First, a fair degree of trolling, which I am getting a lot of at present, and which is not worth further comment. The second is a high degree of self-interest, most especially around the withdrawal of tax relief for new ISA contributions of existing style. And third, there is some real confusion about savings. The last is what I am interested in here.

First, some facts. The latest data on UK financial wealth is as follows, and dates from 2016:

Of net financial wealth £600 billion is in ISA arrangements. This means that in total 46.7% of total wealth and 85.3% of all financial wealth, including pensions, is saved in tax incentivised accounts (pensions and ISAs) in the UK. On the basis of this analysis, we think any ISA will have substantial appeal: tax relief is key to investment decision making for most people it seems.

Second, since writing the letter early in the week I have refined my view of a potential interest rate (I stress, my view alone). I suggest 1.85% because the U.K. government Debt Management Office suggests that is the current nominal average net cost of U.K. government debt, and it will attract very large quantities of funds to this ISA in my opinion.

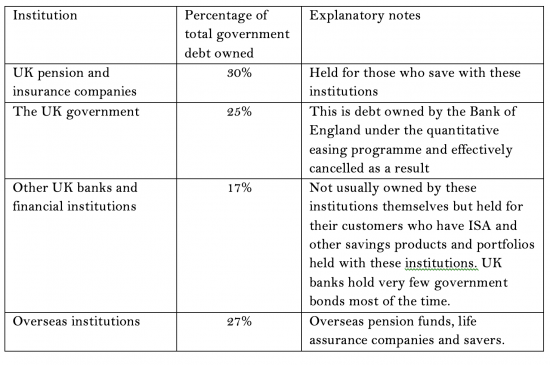

Third, some more facts on people who save using U.K. government debt. According to FullFact, gross UK government debt of about £1.8 trillion is held as follows:

The claim them that people do not trust the government with their savings is not justified in that case. This evidence clearly shows that they do.

And fourth, for those in doubt I suggest that the government can offer a value guarantee on these ISAs. This can be done in a number of ways. Firstly, bonds can be fixed for a varying number of short term periods: shorter periods would necessarily carry lower rates, I suggest. Everyone is used to this in the existing savings market. Even so, secondly, the government could also guarantee but back for any bond at par: the price would be heavy in terms of interest foregone, but it would be effective. Again, the savings market is completely used to this right now. And thirdly on this issue, the government could guarantee these bonds. For those who understand modern monetary theory there will be an awareness that this guarantee is costless. For those who don't, equate this guarantee to the fact that at present the UK has what's called a Financial Services Compensation Scheme. This means that anyone who has up to £85,000 in a bank deposit account is guaranteed to be repaid by the government if that bank fails. This provides a government backstop guarantee for all UK savings. I suggest that the Green New Deal should involve a similar guarantee meaning single Green New Deal approved bond or deposit or loan should be backed up by the government to at least the same limit as that used the Financial Services Compensation Scheme.

So, a Green New Deal ISA will have a guarantee, a competitive interest rate that costs the government no more than other funds, tax relief and flexibility. Those who claim that despite that Green New Deal ISAs will not apparently appeal even though tax incentives are shown to dominate saver decision making and there are already substantial savings deposited with the government have, I think, simply got their analysis wrong. My big fear is that if anything this product may generate too much cash for the government. I won't get overly worried about that as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

But but, how will the millionaires become billionaires if they do that?

I know…..

Wow I was shocked by those wealth numbers and went away to read the ONS report which shocked me even more.

Private pensions must be the biggest financial deceit ever inflicted on the majority of citizens without them realising the injustice.

Over 5 trillion in private pension wealth with 50% owned by the top 10% of households. The bottom 40% with nothing. And those top 10% got their 2.5 trillion tax free! And there it sits invested in fossil fuel companies that spew carbon carbon that is increasingly disrupt the lives of those 40%.

I am sure you have called for this Richard but we really need to make sure that no pension funds can invest in direct polluters or at least to remove their tax break and fast.

Longer term we really need to look at a fair and ethical way to redress the inequality in private pension provision. For example, is there any good reason why the private pension gini should be allowed to be higher than the income gini? Tax policy could be used to engineer a democratically agreed distribution.

Charles

I see this as a big direction fo travel for my work – and am having meetings on possible academic tie-ups for it this week

Generally, I am moving away from tax. I will still use it but the research focus is moving to green / accounting / investment / capital allocation / decision criteria

After 7 academic papers this year (six approved, one in resubmission), five chapters and four working papers I seem popular as a research partner

Dop you ant to join in Charles? That Gini thinking is neat and could be developed into something quite neat

A social policy journal might like it. I have some stuff heading in tat direction right now

Yes would like to contribute. Will email.

Thanks Charles

Will get back to you

You refer to ‘shovel ready’ in the headline.

What do you mean by that? This expression gets bandied about – Rebecca Long Bailey got caught out with it recently in a TV interview.

I assume you don’t mean projects that are ready to start today or in the next 12 months.

There will of course be projects that are shovel ready today – there is always something about to start at a given time. However, those will presumably already have funding allocated to them. So new funding wouldn’t be necessary (and if you brought in new funding, you’d just be displacing existing funding anyway, which would need to find another use).

If your proposal was to be restricted to new projects that don’t yet having funding, I’d suggest that they will be some way off ‘shovel ready’. 12 months is fairly short in the world of infrastructure projects (ie for fairly simple, low value projects).

I meant that the funding is ‘shovel ready’ i.e. it could be done tomorrow if the law was passed

I was not talking about the projects themselves

But in truth, I think they would not take long. we just have to stop thinking motorways and think loft insulation at 47 Sea Drive

Sorry did not phrase that quite right. I can see why the gini for pension wealth would be higher than income but not so much higher. It is the 40% with nothing that is most worrying.

I know we are not supposed to ‘like’ road building, but bypasses have a tendency to be sitting in abeyance waiting for funding allocation for years, and can make huge difference to the quality of life (and breathable air) in small towns. As long as there is car parking for potential customers, so small local businesses can compete with the out of town big store parks.

Love it.

“My big fear is that if anything this product may generate too much cash for the government. ”

Could it raise £1.3 Trillion as the Times & Mail front pages shreiked today? 😉

Maybe not….

Buty that was pure BS…

Just read your letter and a number of others addressing the same issue. You made sense but all I got from the LibDem was negativity. For all their talk about climate and the environment it’s not going to happen on their watch. The other contributor dismissed it with magic money trees and unicorns. Labour need to bring this issue to the fore and keep it there. If this opportunity is missed, that’s it, I’m afraid.

Rod White says:

” Labour need to bring this issue to the fore and keep it there. If this opportunity is missed, that’s it, I’m afraid.”

And it’s no good arguing with climate change denialists. Just call them what they are and keep talking…..

[…] as I showed yesterday, only a quarter of UK government debt is owned outside the country. In other words, the pressure brought to bear by overseas markets is […]

… and it could all be done through NS&I very easily as the infrastructure is already in place. (Yes, private asset managers will whine about losing business they need to ‘get over it’.)

With regard to pension wealth, savings will always be extremely concentrated in such an unequal society – and concentrated to a considerable degree even in a much more equal society. The scandal is that accumulation of savings is tax-advantaged for the very richest in society who would save anyway! There is a place for tax incentives to encourage savers…. but they should be modest.

The issues are related

Tax relief can only continue to be justified if for the GND in my opinion