The Guardian, in an ineffectual review of Tory claims about Labour spending plans, shows its ignorance of UK government accounts by claiming:

A danger for both Labour and Conservatives is that pushing up borrowing could lead to higher interest payments on government debts. Britain pays about £40bn a year to service a debt pile of about £1.8tn (84% of GDP). Adding to that, with higher annual deficits, could make the UK a more risky prospect for international investors, driving up borrowing costs.

There are fundamental problems with this claim.

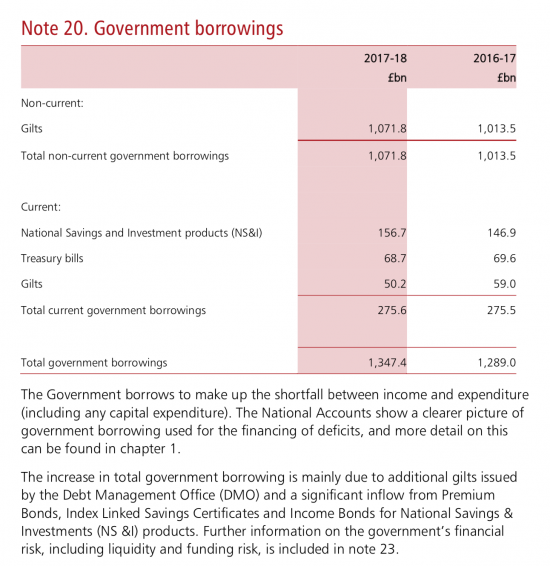

The glaringly obvious one is that the UK does not have national debt of £1.8 trillion. How do I know? Because the national accounts say so. This is the note on UK government debt from the UK government's own latest accounts:

Nothing much has changed since then: the figure will have gone up by £30 billion or s0.

In other words, there is national debt of less than £1.4 trillion. What's the difference? It's quantitative easing, of course. And as the accounts show, and as politicians persistently deny, you cannot owe yourself a debt. So it cannot be claimed that we owe £435 billion of quantitative easing debt when the government owes it to itself, and recognises that fact by not paying interest on it. So why does the Guardian go along with politicians lies on this issue? I wish I could answer that question

Second, as I showed yesterday, only a quarter of UK government debt is owned outside the country. In other words, the pressure brought to bear by overseas markets is small.

And, third, as I have also shown, all future debt demand could be met from the UK, meaning we are not exposed to risk for this reason at all. You cannot be exposed to interest rate risk from overseas if you are borrowing in your own currency from a domestic market. Japan proves that.

And fourth, if there is such risk quantitative easing can be used to tackle it: problem debt could simply be cancelled. Why deny this reality?

Finally, note that there is big demand to save with the government already - £156 billion of savings held with NS&I proves it. This could increase, significantly.

It really is time that the country's journalists stopped supporting the government's lies on debt. We owe vastly less than is claimed. The cost is low - at under 2%. And the capacity to borrow more, in sterling, without any pressure on interest rates is very high. So might we have less fear-mongering please, not least from sources that should know better?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] University posted this on Progressive Pulse on Saturday. It is well worth sharing here. I have already tackled one of the falsehoods perpetuated about the UK economy this morning, which is that the UK has debt of £1.8 trillion when […]

So all this is telling us is that the Government (even under the Tories) has spent £1.4 trillion of its own money.

It is just a ledger entry.

However, the real problem is that this is £1.4 trillion of interest bearing debt that would need to serviced that the private banks can’t get their hands on. That is why there are so many lies and mendacity about this issue.

How is this issued? I gather it no longer issues from the Ways&Means account (the EU stopped that) and I don’t think it comes from the DMO either. I’ve heard it issues from the Govt Banking Service, which is a network of the high street banks. It seems difficult to think interest wouldn’t be payable then, to the banks in question. How is it spent into the economy?

The government spends from the Bank of England. It’s really not very hard to work out

It clears its accounts via DMO operations

What do we pay interest on £1.8 trillion or £1.4 trillion?

£1.4 trillion

The government gave up paying itself for obvious reasons

Which does rather prove the debt does not exist……

Excuse me if I’m missing something here: Richard says the government is paying interest on £1.4 trillion, but if only 25% of the total national debt is owned outside the country, then the other 75% represents private savings which are an internal matter. Are the real interest costs (i.e. the real cost to the nation/government) not just payable on 25% of £1.4 trillion which is externally held, and the other 75% paid on private UK savings simply goes round the UK internal monetary cycle and gives the government the opportunity to claw it back when the investments are spent into the economy?

In essence, yes Ken

But the 25% is of the gross sum

The rest never leaves the U.K.

And we only owe in sterling, barring a tiny amount

You have the 2017-18 whole of government accounts. The ONS says national debt on 31 March 2019 was £1.8 trillion. See https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicspending/bulletins/ukgovernmentdebtanddeficitforeurostatmaast/march2019

It was, ore QE

The ONS peddles the government lie

The accounts call it out for what it is

Who are you, I don’t recognize you as any official sources of information. Taxresearch.org.uk sort of like the think tank tax payers alliance? Who funds you and your research. Why are your figures so 2018 in near 2020?

The data is all on this site

And published accounts

All voluntarily disclosed

I am inclined to the view that the more telling point is the fact that the Conservative Party has abandoned austerity, in spite of the fact that it has failed to meet the targets to eliminate the deficit and thus cap or reduce the national debt; according to the deliberately chosen measures of both that the Conservative Government selected and used (ONS measures of gross borrowing and deficit); and very assiduously identified as the justification of Austerity for ten consecutive years. The Conservatives have failed according to their own measures, and responded in the now conventional populist way: declare a phony triumph and deflect attention somewhere else. We should be directing attention back to this abject Conservative failure, rather than inviting a complex debate about different economic measures delighted Conservatives will attempt to cover in a fog of ‘evidential’ obscurity that will quickly turn off the electorate.

The failure of Conservative policy on Austerity and the failure of Conservative competence, that is manifest measured by its own standards of evidence is a much more effective way of tackling this, in my opinion; because the measures are simple and uncomfortably close to what the public hold dear. The effect of a public realisation of this failure will be sobering. What Boris Johnson, Theresa May and David Cameron have proved is that by their own chosen tests Britain has had ten years of Austerity – for precisely nothing. The Conservatives are quite obviously not competent managers of the economy, and have seriously failed the country for a decade. Brexit was never more than the Conservative Party attempting to save itself from the Conservative Party; in part an operation in deflection, not least from the Failure of Austerity and of being Found Out by the electorate for the folly they indulged in Economic management.

Earlier in Germany, what paved the way for the rise of the far right in the form of Hitler was austerity. The pattern seems to be being repeated here. Perhaps that was the intention, with a side order of replacing social security and the NHS with a multibillion-dollar private insurance model.

You are making a basic mistake here. The £435bn of debt held at the BoE is still a government liability. It is included in the “Deposits by Banks” line.

So the government does indeed have £1.8trn of outstanding debt. The £1.35trn you are stating is only the wholesale debt.

It’s probably more sensible to look at the total government net liability position, rather than just the debt. This stands at £2.6trn. This is a better real indication of what the government “owes”.

No, that’s central bank reserves held by clearing banks

Sure it’s a liability, technically. But it’s not even one we need pay interest on and which is wholly under BoE control

So I am right

I’m afraid you aren’t right here.

Those central bank reserves grew by £435bn because of QE (which is in part designed to increase bank reserves) so that debt hasn’t disappeared or been cancelled as you are claiming. You can easily verify this. Simply, in the government whole accounts the QE holdings are moved out of the wholesale (market available) debt into the banking reserves.

As others have pointed out, the ONS doesn’t do this and total debt is, as expected, £1.8trn.

Either way, that excludes a lot of other liabilities.

They are not national debt though

They are bank deposits

Are yo seriously saying they are the same thing?

I assure you they are not

And no one claiming U.K. national debt is £1.8 trn, including the ONS, is conflating the two

How do these figures (published in May 2019 and showing the position as at 31 March 2018) square with the latest figures published by the ONS? https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/bulletins/publicsectorfinances/september2019

The ONS says:

* “Debt (public sector net debt excluding public sector banks) at the end of September 2019 was £1,790.9 billion …”

* “Debt at the end of September 2019 excluding the Bank of England (mainly quantitative easing) was £1,611.1 billion …”

Is there another £200m somewhere that needs to be deducted?

And then, if the government pays £40bn of interest each year on debt of £1,400bn, isn’t that an average interest rate of 2.85%? So why is the “current average cost of UK government borrowing” – quoted in your post on GND and ISAs – just 1.85%? It that the rate for new gilt issuances? I imagine quite a lot of people would be quite willing to invest in government-guaranteed debt instruments carrying nearly 3% interest!

The £1,790 is gross

We did £435bn of QE

I have no idea how they lost the rest

And the rate figure is from the Debt Management Office: they should know. I suspect the £40bn is gross, not net

Why are you suspicious over the amounts? Is it because you don’t know, or because you don’t care to check for yourself? Just askin’

Or maybe because the figures are as per the accounts I have noted?

Even Arlene Foster would struggle to lose track of £400 billion.

But a question:

How has the 400:1,400 ratio changed over the last 10 years?

Sorry, re what?

Cash is also a liability of the government and is included in the national debt which is no different to reserves created as a result of QE.

The national debt also includes other liabilities such as commitments that have not been realised.

None of the above attract interest and if it did, the government sets the rate via monetary policy, it could be set to 0%.

All money is a liability of the issuer. So the national ‘debt’ is a rather irrelevant measure.

In a sense you are right

But that ignores that politicians fret about the issue

And the issue they fret about is misstated at £1/8 trillion at present

What is misleadingly called the public debt is really just the private sector’s savings. It is not a burden on the UK Government or on taxpayers. It is just UK Government currency that the government has spent into existence and has not taxed away yet. People should stop pretending that it is a problem.

UK Government bond sales do not finance the UK government. They are not a borrowing operation for the UK Government. They merely provide the non-government sector with a completely safe interest-bearing financial asset in the form of a tradable security. The currency that the non-government sector uses to pay taxes and buy bonds comes from previous government spending. The UK Government funds the non-government sector. Not the other way around.

Agreed

Please consider adding my recently published article through the Campbell Law Review journal entitled, “The United States’ National Debt and the Necessity to Prepare for its Default” to your web site. Here is the link: https://scholarship.law.campbell.edu/clr/vol41/iss2/3/ .

Abstract:

In many ways, the 2008 financial crisis seems like a distant memory one that many would just as soon forget. Another financial crisis is coming that will make the 2008 crisis pale in comparison. The future financial crisis lies in the massive national debt that has now passed the $22 trillion mark. The national debt continues to grow dramatically and, within the next few years, will surpass $25 trillion. Its growth is fueled by the inability of members of Congress and the Executive to address Social Security, Medicare, defense spending, and taxes. The resulting crisis may portend the collapse of the largely unregulated derivative markets that, by some estimates, are between $600 trillion and over $1 quadrillion. The future of the United States lies in the members of Congress and the Executive’s ability to be prepared to default on its debt under domestic and international law so that, when this event happens, the crisis can be mitigated.

Best wishes,

Dr. Donald D.A. Schaefer

Well,to really wasted your time, didn’t you

The US cannot default. It just creates more dollars

And the dollar is the world’s reserve currency

What else did you get wrong?