As some will have noticed, there have been those who have disputed my recent tax gap analysis, published here. The first was a person called Jacqueline. I began by patiently explaining what I had done and why her logic was wrong. As quickly became apparent, she did not understand my logic, and had not read that of HMRC either, although she claimed she was defending their position. It also became clear fairly soon, using tests that I can apply to comments, that she was an experienced troll. This was not, then a serious challenge, but was instead the usual politically inspired nonsense.

The someone claiming to be an economist called Jordi appeared. I can say the use an academic email address form a university I know: who they actually are, I have no idea. But the obviously know some of the literature on tax gaps. And he or she (I know not which for sure) very clearly has a strong opinion that I am wrong, using what they think to be economic logic.

And they claim that my opinion is wrong, because most economists disagree with it. This is, of course, a situation I am familiar with. On MMT, the tax gap, tax havens, QE and much else I am wrong. Except I seem to continually be right and economists, with their intensely narrow minded and frankly unreal view of the world, are proved to be wrong. But, this one matters. And so I will defend it, boring as it is to have to do so.

Jordi said in his / her latest comment, the following, and as it is the basis from which I will show that they are wrong, I will repeat their claim at length:

I can already see where you have made your mistakes. You now acknowledge VAT is a transactional tax at least.

“And if VAT is not charged when it should be there is unrecorded trade.”

Partly right. There will be some unrecorded trade. But you have simplified the problem, which leads to your first error.

Because VAT is charged at every level of a production cycle and then can be partly reclaimed, to analyse VAT properly you have to look at input AND output VAT. Not just the last transaction in the chain.

The business not paying VAT on it's output will still have paid VAT on it's it's input in effect, so the whole of the VAT amount of the final transaction in a production chain is not lost. Only a marginal amount. Not only that, but VAT is charged and reclaimed throughout the chain on purpose partly because it makes it much harder for people to cheat. It's a tool tax authorities use heavily for VAT enforcement.

Your second problem comes when you say that unrecorded business means the top line of the business is understated. Unfortunately not paying VAT means nothing of the sort.

The top line of the business means nothing to the tax man. Business taxes are not levied on turnover. They are levied on profit, which is the bottom line. A businesses which has not paid VAT might not be making a profit, which means it might not be liable for any corporation taxes. You simply can't tell from VAT alone.

The same goes for income taxes. That business is going to be paying it's staff and owners, but not paying VAT gives you no evidence regarding any other taxes they may or may not be avoiding.

For your claim “once unrecorded for VAT then this income is unrecorded for all other taxes” to be true ALL of the economic activity of that supply chain would have to remain in the shadow economy. This is a horrible assumption which we know not to be true.

You have also claimed that your average tax rate should be higher because VAT is the top line tax. You allude to the claim here again “And that means it is not just the VAT that is lost — it is the income tax on the receipt of that unrecorded money that is lost, and the NIC that they owe.”

As I have explained, this is simply wrong. Let's take a quick example using your logic, that VAT is a top line tax. This means all of the top line, or revenue must be counted for tax purposes.

A business sells something for £120. They evade paying the VAT (20%).

Of the remaining £100, £18 should go to CT, and for sake of argument £20 should got to income tax and £12 should go to NI.

According to you, because of the VAT evasion none of this gets paid. Top line, right! So the total tax loss is £70, or 58%!. This is how you get to your wild claims that the average tax rate for the shadow economy should be higher.

Of course this is simply incorrect, because you need the input cost as well. How much profit did the company make on the transaction? How much VAT was really avoided?

Let's say the business bought the item they sold for £120 for £90.

Now let's see what that does to your numbers, factoring in the input costs.

VAT is value add, so all previous companies in the chain have paid VAT up to that £90. So HMRC are only missing revenue on the £30 markup, or as we call it “value add” — so only £6.

Businesses pay people out of net revenue, not gross. Even if there was evasion on all of the rest you now only have £5.4 of CT, £3.6 of NI and £6 of IT for a total of £21, or %17.5.

It is important to note that the VAT loss is also not at the headline 20% rate — it is going to be much smaller, because VAT is value added, and applies all the way through a production chain. For you to lose the full 20% every step of the chain would need to be evading.

Quite a difference, no? Even this is a gross simplification as CT, NI and IT are totally unrelated to the payment of VAT. CT might not be liable at all and the VAT tells you nothing about the levels for NI and IT. Like the sole trader who evades VAT but doesn't make enough profit to fall into IT thresholds, or conversely the trader who sells zero rated VAT products and evades no VAT but goes on to evade other taxes. The issue is highly devolved and complex. You can't simplify the problem in the way you have and expect it to be correct — which somehow in the fact of everything that goes on in the real world, you do.

In short, your methodology, logic and assumptions are wrong.

My apologies for the length of the quote. I would not have done it if I did not think it was necessary. And I apologise for the technicality of what follows: trust me again: I would not do this if it was not necessary. But it is because Jordi is hopelessly wrong. And that's because Jordi is missing some very basic but quite essential knowledge that should be at the core of all economics training, but is not in most. And that is double entry book-keeping. If Jordi had understood double entry he or she would not have dug themselves a pit quite as deep as they have.

Let me explain this. And let me make the example just a touch more realistic, because I suspect I have seen many thousand more sets of accounts than Jordi ever has.

Let's assume we have a business owned by a person who wants to take evade. The make sales of £100,000 (for example) a year and so are VAT registered. They only declare £90,000 of this. The scenario is common. The numbers could easily be very much bigger, but let's ignore that.

The business sells a product (unlikely at this scale in reality, but economists can't get their heads around services so let's pretend it does). The gross margin on this is 70%. In other words they buy £30,000 of product to make their sales.

They pay just one person — the owner — a salary. Call it £50,000. There will be an employers NIC charge on that. It will be about £6,000. So the total declared cost of employment is £56,000. They are £4,000 of other overhead costs, excluding VAT. Total costs are then £60,000.

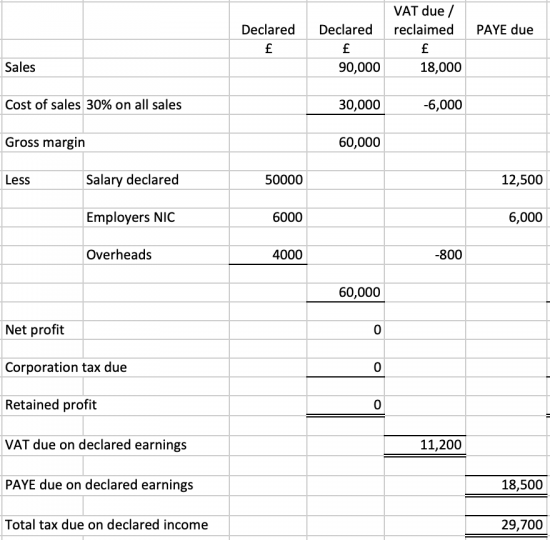

This means the declared profit and loss looks like this:

So, where is Jordi wrong? First he claims I do not understand that VAT is on the supply chain. Yes, I do. And that whole supply chain is in here — including the goods bought to support the unrecorded sales. The gross margin is just a bit deflated as a result — it's not 70% but is actually 66.6% - and so not so wildly out as to draw attention to the inappropriate claim.

And I stress tax is paid. The sums due are likely to be pretty much right, by the way. And I have rigged it so we do not have to worry about corporation tax. I could have allowed for that, but chose to just make things simpler.

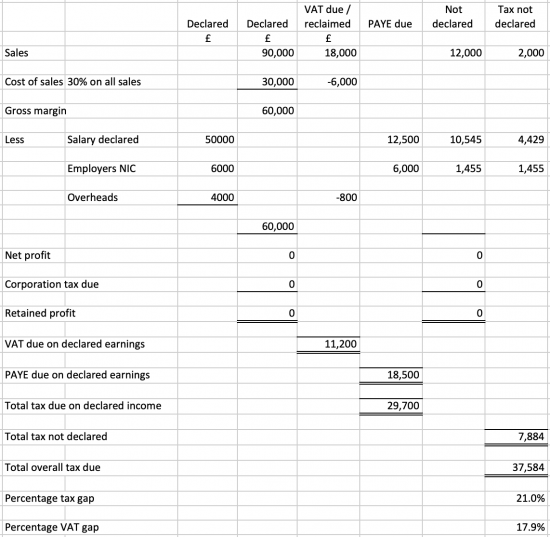

Now let's suppose this business — which I have assumed is run in a limited company (and it always pays to ring fence dodgy business in a limited company because then the unpaid taxes and penalties very often are extinguished with it whilst the owner goes on to form another dodgy enterprise to perpetuate their activities) does have those undeclared sales of £10,000. Except, of course, they will not be £10,000 because the market expects a market price — and that includes VAT so the actual unrecorded sale will be £12,000.

Then we get this:

I have dumped all the data on you at once: I apologise.

Now let's be clear why we have to deem a salary of £10,545 due out of the £12,000 of unrecorded sales, on which VAT of £2,000 is evaded. There are two reasons.

One is double entry. That credit is missing from the books. It's not there. That's what evasion means. But that means that the debit cannot be either. That's a simple fact. There is no such thing as single entry book-keeping. In other words the debit has to be somewhere else too. And by definition that somewhere else has to be outside the business. And when transactions move outside a business a boundary is crossed and that is a transaction — and as a matter of fact all taxes — not just VAT — are transactional. And when the owner of a company takes cash out of it a boundary is crossed and that is a taxable boundary — PAYE is due. It is not a dividend — because that has to be declared as such. It is pay. And so the tax on that pay is due. It cannot but be the case.

And that is true even if the money is (for reasons that defy imagine but which Jordi thinks possible and even likely) returned to the business from which it has just been stolen to meet business expenses. That, to avoid the credit which would give rise to that reinjection being treated as a sale — which would negate the whole exercise — would have to be treated as a loan or share capital from the owner. But to achieve this goal — which is utterly implausible in reality - the cash would have to still be treated as belonging to the owner — and to make it theirs tax would have had to be paid when they got it and by definition in this case it has not been meaning that the evasion has still taken place. And let me assure you, HMRC would have a field day with this — and the fact that it would show up on a balance sheet and look decidedly strange — would be a great reason for opening an investigation.

I say all this simply to prove that my claim that once VAT is evaded all other taxes due on the gross income are also evaded have to evaded as well — which has to be true. The exception, it could be argued, is where the business is wholly illicit and then some input VAT would be suffered — but let's be clear that in that case that would then be swamped by the scale of other evasion.

So, are any of Jordi's accounting claims right? No, they're not. He can't even see that you only pay corporation tax on net profit. He gets just about everything wrong because he cannot do double entry.

I would add though that I do not prove my whole case with this simple example. It is an example. No more. The tax gap is not 33%. But then I only consider some taxes. Especially I ignore excise duties — which are commonly abused and massively compound the losses. I also ignore all illicit business, altogether — and that exists all around us. I saw two drug deals in my own little city yesterday. It also ignores the multiplier impact of tax evasion — which I only hint at in the example. That multiplier effect is big. But what it does show is that Jordi's claim is wrong.

And actually, so are most of the rest of his claims also nonsense for all practical purposes — and that is the reason tax gaps are estimated. For example, if GDP is wrong for this purpose, so what? It's wrong then for all purposes. But we use it nonetheless, because it's the best that we have got. To object to my use of it as if I am wrong to do so is facile in that case. It isn't wrong to us it. It's simply the best approximation for this issue — albeit one with errors in it.

And to say that I cannot compound the tax losses — well, I have shown above why I can.

But let's get to the final point. I never said my tax gap estimate was right. Or not in a range. I made both clear. And I never claimed we could get it all back. We can't. I didn't even say that the shadow economy was the sole explanation for tax evasion — because I clearly included other figures for evasion as well and said they were not GDP based. These objections then are all made up. But so too is the claim that not recording VAT does not mean that other taxes are not evaded. That's just wrong and is at the core of one of my key estimates. And that claim is right. And I have shown why.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Jordi just really doesn’t seem to understand VAT. It is irrelevant if VAT has been paid on all inputs throughout the supply chain, as the tax evader has almost certainly reclaimed all that input VAT. Unless the tax evader records and pays over his output VAT, say in the final business to consumer sale in the chain, HMRC has had no net benefit in the whole chain. This is quite basic stuff.

If the tax evader isn’t claiming all input VAT maybe it is not as you say, but this is a silly assumption for most businesses.

Agreed

Quite right. When I worked in Customs and Excise we had evasion cases in the restaurant trade where zero rated food purchases were supressed and also the takings figures (where output tax was due) were underdeclared, so profit ratios were in theory credible – but we did have other ways of testing credibility which I am not going to disclose !

Thanks

ED COMMENT

There comes a point where I get bored with being abused

I have reached that point

If he actually understood VTTL this ommentator would know why his comment was wrong

And I have had enough of abuse

So this comment has been deleted and so will any others from this person

Richard Murphy

Somebody being critical of what you say and identifying weakness in your argument isn’t abuse.. the fact you see it as such does you n favours. It is clear you enjoy being “cheerleader” and crave the adulation of those who sing to your tune

The language used was

Richard,

I’ve been following this with interest and am disappointed that you aren’t giving Jordi the right to reply. He made some very pertinent points and I think it would be wise to let the reader make up their minds as to who is right.

As it is, you have been fairly rude and abusive to him and anyone else who has dared criticise you. So it seems a bit hypocritical to say that they are being abusive to you. I doubt they have given any worse than they have received at your hands.

It also looks to me that you are not printing his reply for other reasons. Namely that he has made more observations that weaken your case even further. This is just shutting down the debate and dissenting voices, and is the kind of autocratic behavior only the worst in our society choose to display.

I hope you are above that, and therefore publish Jordi’s response to your post in full.

You will note I start respectfully with commentators

And then their true character comes out

I patiently explained – with an example meant to be nothing more than a demonstration – not conclusive proof of anything but the fact that the spare debt was bound to create a tax liability – why I had to be right

I have decided Jodri’s reply was just too rude to be bothered with

And to be candid I have better things to do with life than continue debate with someone like him, and so I won’t be doing so

Sorry – but that’s his fault, and I can’t be bothered to deal with the aggression

Richard,

You are rarely respectful with commentators the moment they have the temerity to disagree with you.

You were insulting to Jacqueline and Jordi, let alone every other economist out there by claiming they don’t know what they are doing.

Because of this I find it very hard to trust you or believe you when you say Jordi was so abusive that you are unable to post his reply. I get the feeling that the real reason is much more likely to be because he exposed you or your arguments in some greater fashion.

Personally, I can already see various problems and inconsistency inconsistency in your argument. I wasn’t going to make my own case but you seem unwilling to let other people make theirs, so I may eventually feel forced to make my points. Until I assume you accuse me of being abusive and block me.

In my experience people who shut down other people’s right to reply have something to hide. This who are unwilling to defend their arguments are more often than not make false or fraudulent claims.

You have already blocked Jaqueline and Jordi – both of whom disagreed with you, but raised many valid points which you were unable to answer properly. You avoided the question, changed the terms of the argument, dissembled or were plain abusive to them.

I am beginning to think you are little more than a charlatan. Prove me wrong and post Jordi’s reply in full, and argue the points he makes. Convince me and the rest of the readers here you are more than a hack.

Lee

You are right. I really do not like trolls.

You will note that I started off very respectfully with Jacqueline. It was deliberate. I had no idea who she was. Why should I not answer her question? But after two questions it became very clear that a) she had no idea what she was really talking about and b) she was simply trying to make ad hominem attacks. She was, in other words trolling. So I blocked. I have a life, and it really does not involve dealing with people who wish to waste my time.

Like you, for example. How do I know you are a troll? You are calling me a charlatan. That is how I know. You are making demands of me as if you have the right to do so. With respect, you have no such right. Not you have the right call me a charlatan, when I am not.

Let me explain where did not post Jordi’s comment. Because I am an entirely reasonable man, and he was claiming to be a knowledgeable person, who clearly did not know how the tax system works and was making wild claims about accountancy, I presented an example, which I took the bother to create, to demonstrate why he was wrong, and patiently laid it out for him. If that is the action of a charlatan, I am a little surprised. I’d say it wa actually the action of a patient person trying to make a point to someone in denial and rather arrogant as to their own self belief.

In response I will tell you what he did. You extrapolated that simple exercise, which was the nothing more than demonstration of the consequence of double entry, and claimed that as a result I had proved my own tax Estimate role. In other words, he extrapolated an exercise to the whole UK tax, and suggested that that was a valid thing to do. In the process he wrote some fairly abusive comments about me. What he actually proved was that he was here to cause trouble, and offence, and that if he really was the economist and statistician that he claimed to be, that he was most certainly not bringing those skills to this exercise, because it was perfectly obvious in that case that he could not do the thing that he claimed. I also, very carefully, points out that I had not made any claim that the exercise proved my overall argument, because I’ve made it quite clear why did not substantiate that, but he ignored all matter was rude instead.

And I have no time for such people. And yes, I show that. And why not? Do we have to live in a world where we have to suffer those – like you – who think they can be rude? And dictate terms to trends without ever revealing why or who they are? Is intimidation something I need? Because that is what you are offering? Can you explain for a moment why I should put up with that? I shall warn you – there is no acceptable answer.

And let me then come to Jordi again. If he’d accepted my point – which was substantiated by my example – but then said he could not extrapolate we might have had something to discuss. To explore how this could be tested – properly – using appropriately informed thinking that accepts accounting realities – would be interesting. You know, it may prove my claim too high. It would also – and I can guarantee this -proved HMRC’s too low. I could li9ve with the proof. I’ve used a best estimate precisely because that is the wisest thing to do. If we could go further that would be good.

But I don’t like working with people who start by being rude.

So very politely, please don’t trouble me again. Because you too seem think it’s your right to be rude. And I call that thuggish. Because it is.

Richard

PS There will be no further discussion on this

As you make clear often the teaching of economics is substantially worse for the exclusion of double-entry and accounting. Can you recommend a good primer?

Alternatively I am involved with writing an economics guide at the moment and would be very interested to have your input on a section relating to this.

I wish I could recommend such a guide

I am asked often…..

I wouyld love to have the time to help

Sorry Richard but your calculation does not reflect the way tax law works in the scenario you describe. The debit is not to remuneration but to the directors loan account. The £10,000 is treated as an asset in the company balance sheet. Additional tax falls due on the overdrawn loan account on the company under s455 but in settling an investigation like this one HMRC would insist the director should repay the loan to the company at which point the tax due under s455 is repaid to the company. The tax paid on the diversion is corporation tax not PAYE and NIC and the rate is much lower.

I have not looked at your figures in detail before and had not appreciated this difference in the way you calculate the gap and HMRC presumably do. This is based on the law I have set out above which reflects my knowledge from 12 years as an Investigator in Inland Revenue and 23 years doing the same job in the private sector for Ernst & Young, Grant Thornton and as a consultant.

I note what you say

I disagree. I could just have easily made it employee pay

Then what would you say?

I think the point I was making stands

Your scenario was a fair one as most small companies are controlled by their directors and it is they who usually defraud their companies. Your example could work for an employee defrauding a company without knowledge or acquiescence of the directors but in such cases no tax usually results as the matter is swept under the carpet by the employer. In a small minority of cases the employee is prosecuted for theft but it is rare for the Revenue to seek to recover tax in those situations as the court deals with it. Thus the debit does not always create a tax liability but it may create a civil or criminal liability for the recalcitrant employee. To be fair if the Revenue has any sense that the employee has received cash in hand for instance, with the employers knowledge then they will tax the employer and because of the “grossing up” rules the liability would be even higher than you suggest.

Your example would also broadly work for a self employed person though the NIC would be lower.

Broadly speaking if the director can’t or won’t repay, the company would be liable to pay the s455 tax. If the company could not pay it,HMRC would have the company liquidated and ask the liquidator to pursue the director for the debt to the company. These matters are often more complex than your scenario and are usually settled by negotiation.

I accept what you say

But the point of my case study was simply yop show there will be a liability arising from the missing credit – and there will be

That was it

But you, usefully confirm something else. And that is that the gap is real, and too often uncollectable, especially when HMRC are too tolerant of the use of limited companies to escape liability associated with fraud – which is something I have long argued

I should also have added that your example literally works in one case

It would not, for example, if this person was self employed

I used an example to make clear the debit would always create a liability and it does

Oh, and what i the director cannot repay? I think you are ignoring that scenario. Why?

I note you give a range for the likely Gap. In most research the writers provide metrics such as the SE, confidence intervals and the like. It might be helpful is some such statistic, (albeit itself probably “a best guess” unless the data were truly accurate), could be provided.

I provided that with regard to the GDP variances

I have nothing more to add

That’s fine. But HMRC must have access to the data, so they could (maybe they do) publish everything, develop ways of estimating statistical errors and confidence levels. Then those who are interested could critique their methodology, assumptions, handling of the data and so on. HMRC are incentivised to produce the lowest possible figures to show how well they are doing. But tax lost has to be made up somewhere and if the figures are wrong then decisions will be wrong.

Too often political decisions are based on faulty conclusions drawn from faulty (or deliberately suspect) data. And too many are based on political prejudice, or downright lies, regardless of what the evidence shows. UK drugs policy is a good example. Austerity is another, as the UN Rapporteur showed.

They do publish a methodology paper

It makes clear how rough and ready their work is

I have read Jordi and Jacqueline’s responses on this topic. I am no tax expert so I cannot say for sure that I understand the technicalities (sorry Richard). So I have looked at the language used.

Their approach in their writing was clearly contemptuous of what Richard was saying (and maybe just contemptuous of Richard generally) – they did not write in a way that was promoting engagement and debate/discussion. You do not approach a technical issue by attacking someone if you think they have got something wrong. You simply point it out and ask questions and resolve something. After that you might conclude that the person to whom you are speaking may not know what they are talking about. But not before. And even then you can disagree without resulting to insults or slights.

Richard’s initial response was in my view very measured. His original piece pointed out its limitations.

It was all about setting the stage for a discussion. How else do you question things? Who is shutting who down here?

Attacking people is too easy on this medium because of the lack of physical proximity. We can all get a bit carried away – I will confess to that as well and Richard has told me off or simply not reproduce my comment if he thinks I’ve gone too far.

Thanks PSR

PSR –

I have read Jordi and Jacqueline’s responses on this topic.

Me too.

I am no tax expert so I cannot say for sure that I understand the technicalities

I am a tax expert. So, here goes…

Richard’s simplistic and very basic illustration of how a tax liability arises where there are undeclared takings in a close company is absolutely and completely bang on. Can’t argue with it and wouldn’t want to.

Phil Espin’s comments re the application of s455 (a very effective piece of anti-avoidance legislation) on an overdrawn director’s loan account is also spot on… (although I would take issue with the claim that HMRC would demand a director repay the loan to the company – they wouldn’t make any such demand. In practice they would simply explain the implications of doing so or not and leave it up to the individual… but that’s not really relevant).

What Richard’s simple example achieves is twofold – firstly, the double entry surrounding missing income means that there will always be a liability when it’s discovered (and good luck to anyone who thinks leaving the purchases in the CoGS of a retail business whilst not declaring sales on those purchases is ever going to lead to anything other than interest and penalties if subject to an enquiry). Secondly, that there is undoubtedly a large amount of tax that goes unassessed and therefore uncollected each year.

Now to the point of it – Richard’s figure for the tax gap – which (despite all the yelping and mewling from some) he has freely accepted is based on estimates and guesstimates and his own point of view – is quite high. HMRC’s is significantly lower. Since both are, to a large extent, the economic equivalent of trying to weigh a pound of leaping mice, I think it’s a distraction and a waste of time to argue over the numbers. Both sets of figures agree one important thing – tax-wise, we have a problem. No, the difference is political.

HMRC’s figure appears (to me) to be one which government can currently work with. it reflects a collection deficit that HMRC can target and manage… and can report to PAC and others that it is so doing.

Richard’s figure says “it’s not manageable, you’re not doing enough… and by sweeping the issue under the carpet you’re sending out the wrong message to evaders and avoiders alike”.

There’s merit in both positions – HMRC seems to pragmatically recognise that you can only work with what you’re given. Under current staffing and funding levels, a larger tax gap estimate would seem to be an admission that HMRC isn’t as fit for purpose as it should be. Richard, on the other hand, seems to be arguing for more resource to be poured into our tax authority so that we can police and control the economy to the max.

The answer probably lies somewhere in the middle. Richard regularly uses terms to commentators such as “get real”, or “I deal with the real world” – and I wholeheartedly agree. Let’s concentrate on what we can influence and manage. That means HMRC needs to be properly resourced so that a reasonable level of care and management of the UK’s finances can be achieved. Even then, that might not reflect a gap as high as Richard has identified – that might appear as if the state is micro-managing by ensuring the location of every single penny is recorded and controlled. But it would also definitely allow HMRC to move towards a tax gap figure based a little more on the assumptions that Richard has made. Which, or what it’s worth, I personally agree with.

See how I said all of that without insulting anyone? It’s not that hard to be polite when you’ve got a valid point to make. If only Jordi and Jacqueline had figured that out.

Oh, well.

Thank you

And thanks for being reasonable

As I have always said, I never think all this will be recovered – bit more can be

I have also said the situation is getting better as the evidence suggests that is the case

And what I really argue is that silos – find an error and not follow through with it – is wrong, so estimates on a single tax basis are always understated

Is my figure right? No, I am sure it is not. It is my current best estimate absent evidence that the missing GDP will be taxed at another aggregate rate – and the evidence that alternative rate is very small is only attractive to those who seem to have no attachment to the state, rather oddly

I’d love to see more work done, but would it change much? Only so far is it increased confidence that it was worth investing more might it do so

And if it focussed resources better it might also do so

And those are the key issues, as you say

Thank you

And thank you for restoring my faith that this is worth doing

Richard

Exactly Geearkay!! Exactly!!

Glad to see Richard found a silver lining in my more detailed comments. I broadly agree with everything Geearkay says about the issues involved in reconciling HMRC’s tax gap with Richard’s estimate. His comments on whether HMRC would seek to get a director to repay a loan are different to my experience. Inland Revenue used to train Inspectors on the FT course that the purpose of the legislation was to deter directors taking loans, which I believe when the legislation was introduced were prohibited by the Companies Act with no real sanction for non compliance. Any specialist will know the situation is more complex than I have gone into because of the impact of the beneficial loans benefits legislation.

There are lots of different types of tax evasion and avoidance with multifarious tax liabilities possible. No one really knows the relative contributions of each kind. I suspect the real figure is closer to Richards than HMRC’s.

Thanks Phil

Your point is valid – there is no precise answer even in a particular situation

In that case macro rather than micro estimates may be even more relevant

……..…..and Phil’s conclusion is valid given what we know about the wider context: austerity has reduced investment and the capacity in the public services including HMRC to work effectively.

Richard has stated in an earlier post his opinion that the tax gap is between £80m and £100m: that is, about £90bn plus or minus about 11%. (Is that one standard deviation?)

I’d be happy to be corrected, but I don’t think we know any of the three important numbers that have been multiplied to create this estimate (GDP, size of shadow economy as percentage of GDP, mean tax rate on shadow economy) to within 3.5% accuracy.

If we knew them all to 10% accuracy – which is perhaps still on the optimistic side – the error would be 33%: that is, £90bn plus/minus £30bn.

If the error in each is 20%, then the estimate would be £90bn plus/minus £60bn. The would be consistent with HMRC’s estimate.

To put this another way, if the tax rate is actually 20% not 33%, and the other two numbers have errors of 15%, then Richard’s estimate would be around £60 billion plus or minus about £20 billion, which is also not far off HMRC’s estimate.

Others have commented on the problems of the methodology, but it is really quite important that we understand how accurately these numbers are known so we can judge how good Richard’s estimate might be.

Andrew

You are a reasonable person, who was commented here often, but I confess I do not wholly understand the logic of your request, not least because I do know that you understand tax.

There are two reasons for this concern. Firstly, you are setting up the HMRC report as if it is the gold standard to which mine must be reconciled. This is not possible. They use fundamentally different methodologies, mine being a wholly top-down approach, and theirs being very largely a bottom-up approach. The two are quite simply different. And, necessarily, the HMRC approach must produce an outcome which is lower than mine because I consider the whole economy, and by definition they only consider a part of it, because some is beyond their methodological reach.

In addition, the HMRC appraoch is littered with estimates – which they call ‘ illustrative’ – and there is little evidence to support any of them. At least I have tried to support mine.

I make the point because a) you are assuming theirs is a gold standard and I would rather strongly contend that it is not and b) this would be an exercise in comparing apples and oranges.

Second, I do not think your approach is correct. GDP may be wrong. But we use it. Applying 10% inaccuracy to it makes not sense: it is all we have. This is the denominator we use in this appraisal: accept it.

And the estimate of tax paid is also related to GDP – you can’t compound your assumption by saying the same error exists twice.

And third, you can only say that the estimate is wrong unless there is an alternative that may be better – and what is it when considering this missing GDP? Why is it taxed less than the rest of GDP when much of evasion (even at the bottom end – where benefits are also invariably being claimed) is the top slice of income and taxable at the payers highest marginal rate as a result – which will usually be above 33%? Some critical sense has to be applied here.

And that is my final point, and the one I always go back to. If we have about 10% shadow economy (the range I note in my workings) then that credit is missing from the national accounts. And as I have shown that means the debit is not taxed too. In other words there are other tax consequences, and their rate is invariably greater than the VAT loss. Why are we then expecting a result so far below what seems logical? And why seek to prove what seems implausible?

Richard

Dear Richard,

I think Andrew has a point.

HMRC’s report currently is the Gold standard. As said so by the IMF, OECD and even the EU says their tax gap work is currently the best there is. I know you place a lot of store in your work, but it hasn’t had the same level of backing or confidence from people.

I’d like to make a few other points.

HMRC call their estimates illustrative when there is a greater than 5% level of uncertainty in the data they use. They still publish the methods they use and the data to get there, as well as how large they think there errors are. So to say they don’t have evidence to support their data is just not true. You can download the data and methods they have used from the internet.

Andrew also makes a very important point regarding errors. We know that HMRC’s estimates have errors ranging from 5-10%.

You can’t say that because we all use GDP you can then ignore the error on it in your calculation. You do also compound errors twice if you use that data twice – that’s the mathematically correct way. Using the range of GDPs you have done, you already have an error of about 5% there (from the midpoint of your range).

We also know estimates of the size of the shadow economy are very rough. Errors of 15-20% in it’s size are normally quoted.

Finally, we get to the point Andrew was making about your average tax rate. You have used 33% but the error on this is likely to be very large. I don’t agree with the claim you are making “Why is it taxed less than the rest of GDP when much of evasion (even at the bottom end — where benefits are also invariably being claimed) is the top slice of income and taxable at the payers highest marginal rate as a result — which will usually be above 33%?”. Other people have pointed out that the shadow economy is mostly on the lower side in terms of scale, so is unlikely to be taxed at such high rates.

We can even see this from your example. You have used an example with quite a high turnover, VERY large profit margins and the employee earning twice the median wage. All of which are likely to be unrepresentative of the shadow economy as a whole according to the data we have (it would be in the top 3% or so of the shadow economy).

Not only that, your own example above makes your 33% rate suspect. If you say that the VAT gap is 10%, which we can accept from HMRC as well, then your example only gets a 21% overall tax gap despite a VAT gap of 18%. Which suggests that even at the higher rates of evasion, if you only have a VAT of 10% you aren’t going to see a hugely greater overall tax gap. Not the 33% you are claiming.

Your example above surely must lead you to question the 33% average tax rate you use? If it is wrong for one example – and very wrong in this case, then the chances are it is going to be very wrong for the majority of examples.

To make your claim that the average take rate is 33% you really need to present some hard evidence and data. As it is, you have just argued that it should be the same as the rest of the economy, but presented it as a fait accompli.

SO, using your example’s tax gap of 21%, you get a 36% error. If you normalise your example’s VAT gap to 10% you would get an overall tax gap of 11.7%, giving you are error in your tax rate of 65%.

Plugging the numbers in, using a 5% error for GDP, a 15% for the size of the economy we already are getting to an error of 21%. That is before adding in the error for your average tax rate.

Using the numbers from our example (36%) error we now have an overall error of 64%. Which means your 66.7bn number from this calculation has a range of +/- 42.7bn. If you use the normalised error of 65% then you get to an overall error rate of 99%. So a tax gap of near zero would be within the range of uncertainty for your estimate.

The errors are also likely to be heavily weighted to the downside – it is very hard to imagine a scenario where the average tax the shadow economy should be paying is higher than the rest of the economy as a whole, and to make the error range equidistant around your 33% midpoint you would have to be assuming taxes can get to over 50% depending on the error rate.

Whilst I’m not saying the tax gap is zero, you can’t simply ignore the uncertainty in your estimates. The scale of which make your estimate very unreliable at best. I can’t see how you claim that, despite this, your estimate is better than that of HMRCs, which lets for sake of argument has a 10% error – still a lot lower than your own?

With respect, you are using an example prepared for one reason and extrapolating it wholly inappropriately

If you knew about stats you’d know you can’t do that

With respect, Richard, this is not about tax at all. No part of the law or practice of tax tells you how to calculate the tax gap. It is about measurement and statistics.

I have not set up HMRC’s report as a gold standard. I know they have spent some effort in looking at the data to work out their numbers, and to work out where there may be flaws. But I dare say (without convincing evidence either way ) that HMRC’s estimate is likely an underestimate, given the way it is compiled and used.

Your approach is very different. Nothing wrong with that, and I’ll leave it to others to comment on the methodology and the explicit and implicit assumptions it makes. One might hope the two measurements would agree, and if they don’t one would want to understand why. It would be nice to see something official from HMRC, engaging with your method and explaining why they think it is not appropriate, even if their conclusion is that we don’t know the three components in your calculation well enough to have confidence in the final number. It is at least a post in the sand.

In broad terms, much of your estimate comes from multiplying three numbers together. So, one has to ask, how accurate are the estimates of those numbers, because the reliability of your result depends directly on them. It is really not good enough to say they are the only numbers we have, so we have to use them as they are. What systematic errors, and what errors in measurement, might there be? How can we estimate those errors?

* How accurate are GDP estimates, for example? Within a few percent at best, perhaps?

* You’ve quoted a range of “shadow economy” from 8.3 to 10.8%, and picked 10%, which seems to imply an error of about 15% in measurement.

* And then you have assumed the 33% rate applies, but it could be 20% or it could be 40%, so that looks like a potential error of about a third.

Then you have claimed £90bn with a 10% error either way. How is an independent observer to judge whether or not that is reasonable?

The above suggests your result might have an error of say 50%, so perhaps it is £90bn plus or minus £45bn? An estimate of £45bn to £130bn is still considerably higher than HMRC’s estimate, of course. Whether that difference has any statistical significance will depend on the errors in each estimate. Most scientists would look for a three-sigma level difference before having much confidence that their results are real (a particle physicist would look for five-sigma).

I am not expecting any particular result – perhaps it is £30bn, perhaps it is £200bn – and I don’t need to provide a better alternative to ask questions about your estimate. The conclusion may well be that we just don’t have a reliable estimate. I *am* asking you to consider what statistical errors might be included in the three numbers you have used, and whether you really think we know each of them to sufficient accuracy to claim £80bn to £100bn is the correct number.

I am not sure where further discussion takes us

We still get a figure bigger than HMRC

They gave a duty to go further

The IMF suggested they should

They have not

I agree with you, engagement would be desirable

Dear Richard,

I used your example because you used it. I’m claiming that it will be right in every situation. That is the point though!

You have taken an average tax rate of 33% and assumed it it right in every occasion, and that there is no error on it.

Just looking at your example, we can see that in that particular case we have a 36% error between the examples tax gap and your 33% average rate.

That is before taking into account the fact that you say the VAT gap is 10%. If the VAT gap is lower that would also bring the average tax gap in your example down a large amount.

You have said to others that VAT is a top line tax and everything else is proportional to it. SO by extending that very logic, is the VAT gap is 10% not 18%, then the overall tax gap is likely to be lower than 21% (from your example) as well.

This means your estimates have a VERY high level of uncertainty. As I said, 65% or more. Making them very unreliable, especially compared to HMRC’s.

Responding to your conversation with Andrew:

The IMF did say HMRC can do more work on the tax gap, but they still say their work is the best in the world. Which would suggest it is the most reliable in the world.

You haven’t done as much work as HMRC and as discussed, your errors are going to be far higher by default (not least because you start with more unreliable data) and as far as I know no external party has taken your work and given it a rigourous exploration and a seal of approval based on that.

Wouldn’t this suggest that HMRC’s work is likely to be more accurate than yours, which is what various have people posting have been saying, and that you shouldn’t be claiming that their work is wrong whilst yours is right?

I have no clue what you ropening comment is meant to mean

And as I have said – IO am happy to explore this issue further

But do then apply the same consideration to the HMRC gap

And why top down may well be better – as the IMF said – and which you ignore

If you want to ignore things it is very hard to debate and right no0w you[re extrapolating an example and ignoring facts and that makes everything else very hard to discuss

Dear Richard,

My opening comment refers to your example because in making a particular example you have also highlighted that there is going to be a very significant error in the average tax rate of 33% you used for your tax gap estimate.

In the example, an 18% VAT gap leads to a 21% overall tax gap. This is not 33%, and to get to this 21% you have already had to use an example which would be placed at the very top end of the scale of activity in the shadow economy.

You also claim that VAT gaps lead to other tax gaps, which might well be true, but your estimate goes from a 10% VAT gap to 33% overall tax gap, where your example doesn’t show escalation in the same proportion. In fact, it shows that the VAT gap and overall tax gap are roughly the same in this case.

Either way, the important point I was trying to make is that the errors in your estimate are likely to be very large. 5% from GDP, 15% from the shadow economy and a large error from your average tax rate – and there is definitely an uncertainty there. This means your total error is going to be large, and larger than HMRC’s.

I am specifically considering HMRC’s error rate as well – which is no worse than 10%, and for much of their data much lower. They quantify their errors and estimations in the data they provide, so one can check their methods.

I am not saying their data is error free, but it is statistically likely to be more so, and therefore more accurate, than yours.

The IMF have said some top-down approaches may well be better, but this is not the same as saying all top down approaches are good, or that yours is.

They have also said that many top down approaches are not very good – and they have specifically said this when talking about the size of shadow economies and even when consider VAT gaps.

I am not ignoring things, but you seem to be avoiding the real question at hand here – both from myself and Andrew. We are both asking you to consider the statistical errors in your estimate. How big are they?

I have taken you example merely as limited proof that there is an error in the 33% average tax rate you used to calculate your estimate, and we now there are error in GDP and shadow economy size estimates.

Could you please just answer the question? I would certainly appreciate it.

How big are your errors and what does this imply for your estimate and methods?

Your presumption is that there is an error in my tax rate

I do not accept your presumption because you have no justifi9cation for it, and I do for mine, as explained often

And as I have made clear time and again, you simply cannot extrapolate an example created for one purpose as if it is a model of the economy, which it is not, and which it is absurd of you to suggest that it is

So your assumptions are wrong and in that case, because I have already made these points to you and you have ignored them, which shows you really are not interested in informed debate, I am not engaging further with you on them

There will be no point you posting again. Repetition is not permitted under this blog’s moderation policy

Dear Richard,

Yes I am presuming there is an error in your average tax rate.

Are you seriously suggesting that your 33.1% number is 100% accurate?

My use of your example was illustrative not definitive. If we know there is an error in one example, there are going to be errors in more examples. This by definition means your average tax rate is not 100% accurate.

We also have lots of other information which suggests that you cannot simply use an average tax rate. We know the shadow economy operates at small scale, with other posters here saying 50% of it would not be taxable. We know that VAT gaps from top down methods give the MAXIMUM theoretical liability – not a mid point. We know, again from your example, that VAT gaps and total gaps are much in line, so we know that a 10% VAT gap is unlikely to create a 33% overall rate.

As far as I can see, all you have done to work out your average tax rate is divide tax receipts by GDP. This immediately implies a 5% error rate (from GDP itself). You don’t have any other evidence to show that this rate is applicable for the shadow economy.

You say I am extrapolating, but this is exactly what you have done. You have take the economy as a whole, and extrapolated to the shadow economy. If you can do that, what is wrong with me extrapolating?

I am very interested in informed debate. But by you threatening to block me, it seems you are not so much. It is also very hard to have an informed debate when you are unwilling to inform us of the thing we are seeking so much – the error on your 33% average tax rate.

I am starting to think you are not willing to tell us because you know if makes you estimates look unrealistic. But I would be pleasantly surprised if you could simply answer the question for us all.

I would very strongly suggest that my 33% error is an underestimate

The shadow economy is always the top part of income – and most will engaged in it will already have an income. Find me marginal tax rates much less than that over the largest taxes please?

And then say why we cannot assume an average which looks low if that is a fair thing to do for the sake of caution?

And then engage with the issues as noted in a comment just posted – and stop seeking to divert attention from them – because that does not solve anything

If you cannot engage with the issues, then please don’t waste my time

Of, and I have not extrapolated the shadow economy. Are you saying it does not exist? Really? That’s what you’re seeking to say.

And if you want to say why the 33% rate is wrong – you show me why marginal rates on top income are lower than – taking all sources into account

Richard,

I assume you publish these estimates because you are trying to campaign for a policy change of some kind.

This is all fair and well, but having spent almost 25 years in the civil service, mostly working with policy planning and development in various departments (including HM Treasury), the estimates you use are very important.

Bad estimates more often than not lead to bad policy. Which is why from the perspective of government so much care is taken.

For your estimate to be taken at all seriously, you really do have to give a breakdown of the range and scale of errors your estimate might incur, as well as a breakdown of the potential problems with your methods and the assumptions you have made.

Peter

I have given perfectly fair indication of the issues and ranges for concern – in my opinion

And all I can see are people making up quite absurd claims on the risks

Maybe they’d like to ask HMRC the same questions, and why they do not do top down estimates when the IMF suggested they should?

Of course I could be wrong – but all I am doing is suggesting that there is ample evidence that on the basis of quite reasonable assumptions (like GDP is right, IMF and EU peer reviewed work represents good indication on an issue and that if there is an average tax rate it is just as likely to apply to unreorded GDP as it is to recorded GDP) that there is an issue to face

What I get in exchange is a refusal to face the issue because apparently GDP is wrong, but only in this case and for this purpose, peer review is unacceptable as a basis for accepting work is reasonable, but again only in this case and for this purpose, and marginal tax rates on the top part of income will be lower than on all income, even though no one can explain why. Why not deal with the issues and not find excuses for dismissing the uncomfortable conclusion that HMRC may be wrong?

Of course I have presented an estimate. Of course it is wrong. But why are you ducking the issues? Because that is what it looks like. And that’s what economists have done to defend the unsustainable status quo for a very long time no0w – and look where it has got us.

So, now please engage with the issue.

Dear Richard,

Strongly suggesting is not evidence. It is your opinion. You need data to make your case, otherwise an opinion is no more or less valid than anyone else’s. It certainly should be a major part of a piece of research though – the whole point of research is that it is supposed to be neutral, bereft of opinion.

The shadow economy is not always the top part of income. HMRC’s data on it shows that 44% of it would fall under all tax brackets, and only around 3% would fall in the top tax brackets. That is evidence and data collected from the real world.

You cannot assume an average without also calculating what the likely error margin on that assumption is. That is what I and others have been asking you to do.

I am engaging with you, directly about the issues. I am not diverting attention – if anyone is, you are.

You have extrapolated the size of the shadow economy from GDP (itself uncertain) and an estimate of the size of the shadow economy as a percentage of GDP as a whole.

You then extrapolate the average tax rate for the shadow economy by assuming it is the same as the rest of the economy.

This is the very definition of extrapolation, and extrapolation ALWAYS means you have a level or error and uncertainty. To not be extrapolating, you would have to be measuring the shadow economy directly (by going and investigating it, finding data etc) and then working out from that sample what tax rates should have been as opposed to what they are.

I am saying the 33% is wrong. The question is by how much. But let me give you a few reasons as to why.

1. There is an upper limit on the percentage tax gap overall. Even if you assume ALL tax is evaded, using your method someone earning the median wage (£26k) would be 32%. To get higher than this you would have to claim that the shadow economy is more productive and more wealthy that the rest of the economy – which you can’t.

2. Bulk of shadow economy is at the lower end of the income scale – under median wage.

3. Not paying VAT does not mean all tax is not otherwise paid. Some will be and some won’t be. You can’t assume that because one tax is evaded all are.

4. Tax substitution and the profit margin. You have assumed that VAT evasion is ALL taxable and ALL profit. In reality it won’t be. A sale of X does not mean a profit of X, which does not mean a tax at a fixed, unaltering percentage of X

5. The VAT gap as calculated via a top down VTTL approach gives the MAXIMUM possible amount for the VAT gap. An upper limit. So real VAT gap is likely to be lower, which reduces your average tax rate by turn.

You run or have run businesses, right? Surely the amount of tax paid between you in your personal capacity (IT etc) and the business itself has varied year to year depending on how much the business has made?

The fact that there are so many variables to the problem should make you suspicious that is not as simple as extrapolating from another data source.

This still takes us back to the original point though. We know there is a 5% error on GDP, 15% on the size of the economy and we know there are as yet unaccounted for errors in your average tax rate. All I am asking you to do is tell us how big, in percentage terms, those errors are – because they are DEFINITELY non-zero.

Even with the impossible zero error, have have a bigger level of uncertainty than HMRC.

I have more comment on this tomorrow

Suffice to say, your logic is simeting I disagree with.

To give an example, of course the VTTL is a maximum. What else would you expect? When argument is this superficial it is ridiculous.

And I have shown why your claim on VAT has to wrong. You clearly cannot do double entry.

And I will also address the absurdity of your claim that the tax gap is only due to the lower paid – which I suggest is untrue, as does Gabriel Zucman.

And even if I have a bigger uncertainty than HMRC – and I do not agree with that – we still have a bigger tax gap than they say. And thank you in that case for agreeing with me.

Unless you have anything credible to say another time I suggest you don’t call again.

Richard,

I’m afraid I don’t see the claims people are making about your methods as absurd.

I can quite clearly see that from the starting point of your calculation you are already subject to larger errors and more assumptions than the data and methods used by HMRC.

You are also twisting the truth when you say that HMRC don’t use top down estimates. They certainly do for VAT, and I believe so for certain other indirect taxes. They also view (as do the IMF) these estimates as the weakest part of their tax gap work. I would also point out that even in their top down estimates, HMRC break down the data as much as possible by sector to improve the quality of their work – something you haven’t done.

I actually know this firsthand, as at HM Treasury we requested an independent analysis of both HMRC’s methodology and other available methods in 2006. I believe the paper is still online somewhere (unfortunately I can’t remember the author off the top of my head).

We also, with HMRC, undertook a study on the shadow economy which has since been repeated (last in 2011/12 I think – I had just left HMT by then. It might have been repeated since). This is not a simple process – specifically because the size of the shadow economy depends on many other variables. The level of extant taxation, social security (both availability and contributions), economic growth, availability of jobs etc. It is not a simple problem.

We did this for two reasons: To try and determine the optimum levels of taxation (plucking the goose with the fewest hisses) and also to provide a cost/benefit analysis of enforcement. Both were linked to the policy motive of maximising tax revenue (Mr. Brown was rather keen on this).

The results (again available I believe) suggested that most of the shadow economy operates at the marginal level, enforcement would not be practical or cost effective for most cases and that the tax lost to this activity was lower than 10% of the economic activity in GDP terms. It did lead to new initiatives on the small number of larger scale tax evaders – which have made certain types of evasion much more difficult. Missing trader and vehicle duty frauds have been clamped down on hard, but it simply isn’t realistic or cost effective to chase the small scale cash in hand transactions – not least because the bulk will end up non-taxable at any rate.

It might be galling to hear that people are evading tax like this, but the reality is that there are limits to what can be policed, what can be recovered and how much it costs to do so.

Most importantly in terms of this discussion, it put your 33% average tax rate in a difficult position when collected data exists to show the losses are of a magnitude lower – 10% as I say.

You are creating a straw man argument with regards to GDP and other “accepted” data. It is accepted as reasonable, to a degree of error. That does not mean it is 100% accurate. I don’t think people are arguing with the fact that you used an estimate for GDP, the size of the shadow economy or an average tax rate. I do however think they have a point that you have presented these as fact, without attributing what uncertainty lies within these estimates. As other people have pointed out, these errors compound, so the overall error in your estimate is going to be very large.

Certainly to the point that for making policy decisions it would be useless.

HMRC (try) and avoid this problem by directly collecting as much data as possible. Doing so is basic scientific method. Minimising the amount of assumptions you make means a lower error rate. It means the errors you get are from your data, not from the compounding of a series of uncertain aggregates.

I feel that I have covered the issues in a degree of depth. I certainly haven’t ducked anything, which you are accusing me of. HMRC might well be wrong, to a degree. The point though, which I think others are trying to make, is that the chance of them being wrong is much lower than the chance of you being wrong.

Thanks for making it clear that you are presenting a Treasury view

I think might rest my case

What else might I expect? I have met too many Treasury officials too often to expect anything else. Sorry, but ‘the Treasury view’ is the problem here, and not the answer.

And I think you really are making up claims, not least about the IMF.

Just as your claims on GDP are slightly laughable, given the Treasury obsession with this measure. You can not accuse me of using your problem.

But what really intrigues me is how you think I might reproduce the HMRC method when very clearly I could not have access to the data.

I think I can leave it at that.

Richard,

I am honestly stunned by what you are saying.

In my long experience, civil servants including those at the treasury are motivated, highly skilled and intent on producing work to the highest standards possible. You are slandering them all. I sense that this is personal for you, as they have probably in the past taken a look at some of your work and heavily criticised it.

As for my claims:

The IMF have definitely stated that HMR’s tax gap analysis is currently the best in the world.

I quote:

“The International Monetary Fund (IMF) reviewed HMRC’s tax gap

estimate in 2013 and concluded that HMRC produced one of the

most comprehensive studies of the tax gap available

internationally. They viewed that the methodologies HMRC used

to estimate the tax gap are sound.”

The IMF, OECD and others have stated that top down approaches to calculating VAT gaps are highly inaccurate.

The INGSWA have stated that measurement of the sizes of shadow economies is highly inaccurate.

I don’t see the IMF promoting your work. Or indeed anyone but yourself. Why don’t you submit it to the IMF and/or an academic journal so it can be peer-reviewed properly. That should surely settle the question. If it is as good and as revolutionary as you say it is, with no errors then surely it should sail through with flying colours.

I would bet though that the reason you are so defensive is that various people on these comment threads have exposed the simply enormous problems with your methods, so you will make some excuse as to why you can’t do it.

HMT does focus a great deal on GDP. it is a leading indicator for the health of the economy, and much fiscal and policy depends on it. Huge effort is taken to get as accurate a picture as possible.

That doesn’t mean that GDP data is assumed to be perfect. It is understood that there is an amount of uncertainty. This is why there are three initial revisions to GDP releases, and more over time. Even then the error margin is never zero.

“how you think I might reproduce the HMRC method when very clearly I could not have access to the data.”

The data is freely available from HMRC and the OBR. Much of it is contained within the blue book. Had you bothered to look, you would have found.

Around 20 people work full time at HMRC on analysing data to prepare tax gap estimate. It costs HMRC around £10m a year to do this work.

Clearly though we don’t need them or their accumulated knowledge and experience. Or the thousands of man hours of effort they put in. All we need is you in your living room with a pocket calculator.

Peter

In my opinion the merger to create HMRC was a disaster

Moving HMRC under HM Tresaury influence was even worse and you prove why

Oddly the tax inspectors who have commented on my work have no issues with it – because like me they know who the real world works. They can follow the logic without any difficulty.

The Tresaury follows neoclassical economics – easily the most irrational of all human endeavours and one much inclined to using faux science to prove what is likely impossible whilst simultaneously ignoring what is entirely possible because false probability assumptions say it is not. Little explains the crisis in the U.K. economy better than the curse of the Treasury

Hence why I suggested Scotland should have a separate Minsury of Tax if ever it was to be independent.

I will spend little time then in your claims, which are wrong.

The data is not available

The IMF only said HMRC was b3st because it was the only one trying at the time

But most of all, what you say is that spending a great deal of time doing the wrong thing makes it right. No it does not. And what you dismiss is the idea that different methods might work. I happen to have experience if this. The Treasury said CBCR and AIE would not work. I promoted both. And guess what, they do work. But I will remember being told they never could and We’re unnescarry. Forgive my cynicism. It is very well based.

I know the Treasury gets these things wrong

And you are just parroting the line

Richa4d

I know that I have just admitted to sometimes being too belligerent on line but look at this as evidence for what a bunch of a*******s the HMRC are (sorry but I’m fuming here):

https://www.theguardian.com/politics/2019/jun/24/hmrc-pushes-massive-vat-increase-for-new-solar-battery-systems

So here we are – HMRC avoiding going after the big boys on tax and bearing down on ordinary people because its easier and more convenient, not to mention that the adoption of green energy should be encouraged and not penalised or capitalsied on at this time.

Honestly – what a country! WHAT A COUNTRY!

Ha – see my blog on the same issue!

I will just remind people of how challenged I am in understanding the methodologies in the above post.

But I will say one thing with certainty: we know that HMRC is underfunded and undermanned as are nearly all public sector services because of Tory austerity.

And secondly, Richard has not produced an estimate of his own to have it pawed over by contributors.

I felt that all he was doing was hoping to start a debate on the efficacy and accuracy of HMRC’s figures and estimates.

I think we have lost our way a bit on this one.

We have

It seems the aim of some is to claim HMRC on right on every occasion – when I strongly suspect the same people also applaud tax avoiders