I get bored hearing of the supposed Laffer effect in UK corporation tax receipts. The argument is that because the UK corporation tax rate for large companies has fallen tax take has increased.

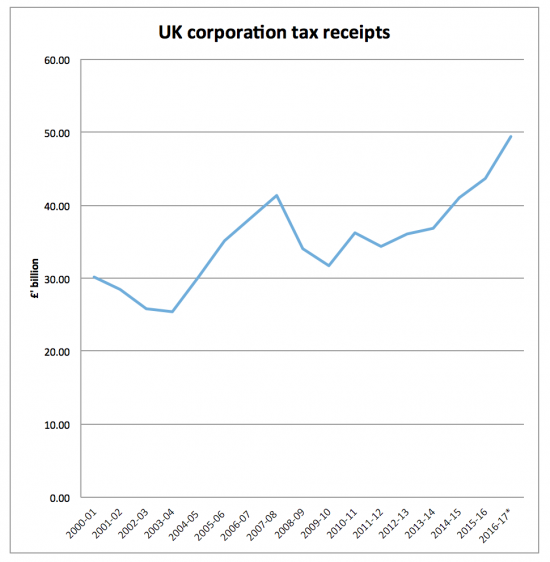

For the record, this is the data on corporation tax yield since 2000:

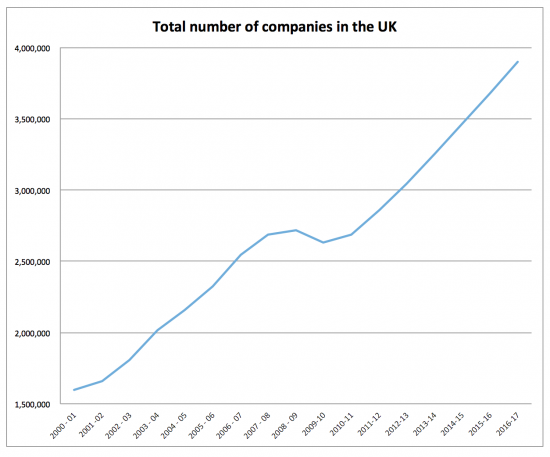

I should probably have adjusted for inflation: if I had the 2000 receipts would have been £35.5 billion and the whole chart would be somewhat flatter. But there would still have been an increase. But you'd expect that. This is the increase in the number of companies over the same period:

The number of companies has well over doubled.

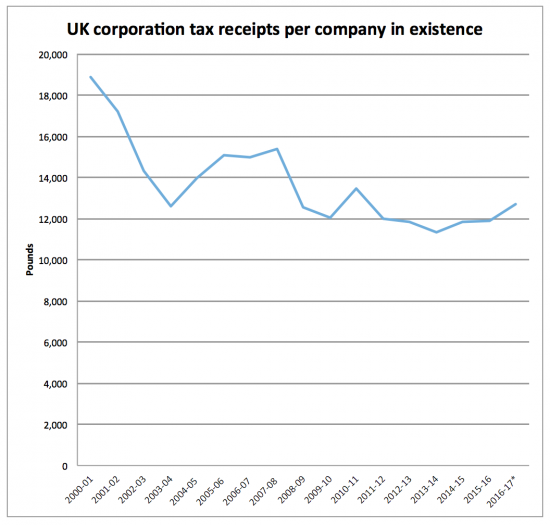

And that means that the yield per company has fallen dramatically (my calculation based on this data):

Adjust that for inflation and in current terms the 2000 yield would be about £23,000. In other words, yield per company has fallen by almost half. But the tax rate has only fallen for a minority of companies (less than 10%) and then by only 37%. So in fact, the fall in yield per company is greater than the cut in the tax rate, by some way.

So much for the Laffer argument that a fall in rates increases tax yield. In the case of UK corporation tax when adjusted for the number of tax payers and inflation it very clearly does not. The cut in rate has actually delivered an adjusted yield decline larger than the fall in the tax rate. Those suggesting otherwise are talking nonsense.

NB: There has been quite a lot of the usual tedious neoliberal nitpicking nonsense posted in response to this blog. I have tolerated that until 20.00 on 25.7.17 but I think there's been more than enough now and any more will just be deleted

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The Laffer effect is alive and well. The inverse correlation of corporation tax rates and number of corporations is not merely a coincidence, it’s causal.

The Laffer effect says yield will rise

It did not when adjusted for base

Tax avoidance was causal, not Laffer

I do wish people would try and understand what Laffer actually said. All he said was that there was an optimum point above and below which tax take would fall. He did NOT say that in the UK if you lowered tax rates then the amount of tax per company would rise.

Yours is such a simplistic analysis. What’s the relevance of average yield anyway? One company £20k tax or 2 companies £15k each and you say that is bad? Idiotic.

Of course now that SCR has been abolished there is one less and significant barrier to deriding by creating subsidiaries and having down different businesses from the same company. I guess you never got involved with such planning so this is all a bit of a mystery to you.

I am showing a simplistic analysis is nonsense

No statistic can be considered without considering the base from which is calculated

With a constant base (which is what adjusting by company achieves) the claim of a Laffer effect is to justified

And if it is claimed CT rose then it is at cost iof greater fall to IT

So again Laffer does not work

And I do know what he said

“With a constant base (which is what adjusting by company achieves)”

This is a TERRIBLE assumption. Statistically it’s nonsense to simply assume that number of companies is directly correlated to the amount of tax they pay.

Your suggestion that yield per company falling therefore disproves the Laffer effect (which you don’t seem to understand fully either) has no statistical basis given the information you have presented. I would hope a Professor of economics understood basic statistics?

I am not saying that the number of companies is correlated to tax

I said I was correcting for a broadened tax base to check yield in relation to it

That is what is statistically appropriate

It’s you who seems to be willing to compare apples and oranges and declare a relationship, which is nonsense

“I am not saying that the number of companies is correlated to tax”

No, you are saying that tax cuts have reduced tax yield. But, your evidence for this is from the “tax receipts per company chart”. You have done no statistical analysis of what makes up those companies or the increase in number. You have treated them as entirely homogeneous – which by any stretch of the imagination is wholly ridiculous. So you have data in where the number of companies is important, and are making an (incorrect) assumption thereafter.

“I said I was correcting for a broadened tax base to check yield in relation to it.

That is what is statistically appropriate.”

As far as I can see – and correct me if I am wrong – but all you have done is take total tax receipts and divide it by the number of companies to get your tax receipt per company chart. This is not statistics. It is division. My 8 year old can do that.

If you were to do a statistical or econometric model, you might start by categorising for size of companies, change is size of companies, new incorporations, and any other data effects. Just factoring in the the drop in North Sea Oil revenues will make a major difference to the results – making the first chart much steeper. Then you might to test your errors, correlations etc. But of course that would require a lot of work – if you knew how to treat this data properly in the first place, which I am starting to doubt.

If you knew anything about statistics you would know that if you want to discern the impact of one variable you hold the others constant

So I corrected for the number of companies

That’s what you do

Sure I could do it in other ways but I don’t need to: it’s enough to show the crass claim that cutting tax rates increased yield is crass

And that’s all I was seeking to do

And I did exclude North Sea revenues, obviously

Thereafter all you’re suggesting is just irrelevant

But for the record, this is some work I did earlier that showed the trend for large and small companies http://www.taxresearch.org.uk/Blog/2014/01/30/george-osbornes-10-billion-a-year-tax-giveaway-to-big-companies/

“If you knew anything about statistics you would know that if you want to discern the impact of one variable you hold the others constant”

Have a degree in it. You?

Moreover, you haven’t held one variable constant – because we are not trying to measure the amount of tax per company. Which tells us nothing useful, in economic, financial and statistical terms, unless we know the nature of those companies. You have simply assumed that the growth in number of companies is exactly proportional to it’s base level. This is, of course, nonsense. Companies don’t start big – so there will always be growth in the bottom end of the scale well before the top grows. The FTSE hasn’t suddenly doubled the number of companies making it up, for example.

What we are trying to measure, which seems to elude you, is the rate of change of tax collection dependent on the tax rate. This has absolutely nothing to do with the number of companies there are. Nothing at all. By your logic, EVERY TIME a new company starts up (and is therefore unlikely to be making any profit initially, let alone paying any tax) the corporation tax per company decreases. Apart from not having anything to do with the Laffer effect, it is also pretty stupid.

So all in all, your claim is just a claim – you have no evidence to back it up. The “statistics” you have put forward are not, in any sense of the word, statistics. Not least because you aren’t asking the right question.

I had a brief look at your other, older blog. Again, it seems you haven’t applied any statistics – you have just made assumptions and extrapolated to come to pre-ordained conclusions. There is certainly no mathematical rigour in your work.

What the previous work showed is large company yield was falling and small company yield rising – in other words your claims don’t hold, and that the Laffer effect, which could only apply to large companies emphatically did not hold true.

But apparently evidence does not matter to you.

Don’t bother to call again because it’s clear a) you are not engaging with the issue but are offering only pedantry b) for the required claim the evidence is unambiguous

Aren’t there other big contributing factors too? Such as a greater number of successfulf international enitities operating in our economy who pay less and less UK tax regardless of the UK corporation tax rate. Just the move in advertising industry revenue to Google and Facebook alone must represent a lot of tax and if replicated across sectors would lower the take yield per company. I’m not disagreeing with the general sentiment though.

Tax avoidance may well be a factor

But Laffer fans say Laffer tax cuts stop that

Clearly they don’t

Sorry to be critical, but maybe some other factors should be taken into account, notably how many of those companies are actually self-employed individuals doing the best they can? We know there has been a steady increase in this sector, but for many of them the objective will just be to pay the bills and put food on the table rather than make loadsamoney, some of which will go to HMRC. So normalising the global tax take by dividing by the number of companies might just show that a lot of new companies pay little tax.

I guess the tax take could be normalised in a more complicated way involving company size as well as the number of companies, but perhaps the acid test would be whether the tax take from a selection of existing companies has changed as the tax rates have changed.

Let’s also take tax avoidance into account

I agree there are many factors

But Laffer is not evident

“But Laffer is not evident”

We have reduced tax rates. We are pulling in more tax.

Laffer himself would not say this was inevitable.

Unless tax rates were higher than the optimal amount.

Because that’s all Laffer said. There’s an optimal point and that below and above that you bring in less tax.

That is so self-evidently true that denying it is a bit like denying that gravity exists.

Hold a hammer above your foot, Richard. Then drop the hammer. See what happens.

Respectfully you really do not understand data

Suppose there was a tax at 50% that applied to one tax payer only

It yielded £100 million

Then the tax was extended to 1 million taxpayers at 1%

It yielded £50 million

Are you really saying this would prove Laffer and that other factors need not be taken into account?

If you are then Laffer is nonsense

But then, we already knew that at rates that apply to any UK tax

I think it depends on what you define as ‘yield’. Overall in CT there has been a rise in CT take – tick for the Laffer argument. However, your analysis shows this is because of the increase in numbers of companies. Why is this? Because the reduction in CT vs increase in income tax rates means that there is a greater incentive for people to choose incorporation. How have overall yields moved for the OMB taxpaying population (including income tax and NIC). Probably not such a tick for the Laffer enthusiasts

No, that proves there is a tax avoidance motive and fall in yield in income tax as a result

So Laffer still does not work

So if Laffer ‘does not work’ you are saying that for every 1% rise or fall in tax rates there will be an exact match in tax take?

That a 90% tax rate will bring in 3 times as much tax as a 30% tax rate?

No, of course not

Nor am I saying 100% taxes yield no revenue (they do)

What I am saying is that no current UK tax rate for any tax is a Ladffer effect observable I.e. that a cut in rate would increase yield, which is what Laffer said and with which I disagree. The rest you made up

No. That isn’t what Laffer said. Laffer put forward his ideas in the USA back in the 1980s. So he was not Likely to know much about UK taxes in 2017. So, no. Laffer made no comment on current UK tax rates.

And if tax rates are at an optimal point or below that Laffer would NOT say that a cut would bring in more tax.

Either you just don’t understand what Laffer actually said or you are wilfully distorting what he said. Which is it?

With respect I have fairly reflected Laffer on this issue and you’re getting rather boring and typically pedantic

No one seriously doubts that the Laffer curve has some basis in reality, the only debate is where the tax -maximising rate is.

Way higher than any rate we now have is the answer to that

Well done Richard. After trying to deny Laffer’s point. Here you are accepting it.

I don’t think so

Think about what I said and you will find you can’t draw that conclusion

So what do you think the tax optimising rate is, Richard ?

No idea

But then nor has anyone else

If you mean the inflexion point, somewhat over 50% as Piketty et al have suggested

Plenty of people have analysed where the revenue maximising point of Corporate Taxation might be. But I suppose the researches of a handful of Romanian economists on sites like ideas.recep.org doesn’t interest you.

That might be because you don’t like foreigners knowing more than you, you don’t like real academics knowing more than you or because your basic MO is basically a gig ( my preferred view ). Whichever way, the analysis is out there.

I am well aware of this stuff, and the hardline market based assumptions that underpin it, most of which are wholly unrealistic, as I have been happy to say in conferences.

But I am not willing to engage with trolls like you on it. Your time is over here.

“Way higher than any rate we now have is the answer to that”

So you have just admitted that the Laffer curve does exist, and that the matter for debate is which rate yields the most tax.

Something approximating to a Laffer curve exists, although a 100% rare does not equate to no tax in all cases

What I dispute is that knowing this gas any relevance at any rate under consideration in most countries, as academic research has suggested

In other words, the suggestion that a Laffer effect might be seen in the UK is nonsense

This is patchy stuff at best………the number of companies is due to a host of reasons, shift to self employed, NI avoidance etc and will not be down to Corp Tax rates solely or even as a main reason.

The fact remains that as Corp Tax has been cut the amount collected has not dropped but increased. Now that may be down to other reasons or a complicated balance of reasons but a 25% drop in tax rate has not resulted in a 25% drop in revenue.

The question is for people like RM who want to go back to 25% or higher……do you think a 25% increase in the rate would increase revenue by 25%?

Not necessarily

But it would increase revenue. We are on the upward sloping part of any Laffer curve

It might increase revenue overall (ie some goes to income tax) but it would not increase Corp Tax receipts as much as some would hope or maybe at all.

This would be a political problem (not as such a problem for RM as you think higher Corp Tax rates are a good thing in themselves) because if the party proposing them predicted an increase in percentage revenue terms or a certain amount they could fail to achieve that.

Then you open yourself up to damaging the economy for nothing (Companies would complain, hold investment, layoffs etc).

I think from a political view you will have to be very careful with promises over raising Corp Tax rates, if you fail to get the increase you want or predict then you could lock in the low rates for decades!

What a lot of economically incoherent nonsense, if I might be so polite?

Higher tax rates encourage investment and spending to save tax…

High rates of tax encourage spending to save tax?

Talk about incoherent nonsense!

In the real world a return on investment is wanted. In the real world profits are needed for this.

Whatever level of tax, there would be something left from £1,000 profit. If the company spends a £1,000 for no other reason than to save tax there is nothing left.

You are the only person I know who is capable of holding half a dozen concepts at the same time which are both contradictory and nonsensical.

With current low rates of tax businesses are not investing: most large businesses are sitting on cash piles. So low tax is not encouraging invetsment

Now increase the tax rate and increase allowances and then you’ll see exactly the behaviour I predict

And I know that’s true based on discussion with many businesses as a practicing chartered accountant. It used to work all the time.

Do you have any evidence for this?

As far as I can tell, you are simply stating this as fact, whilst you have not provided any evidence. You analysis above is so basic as to be worthless – and is still nonetheless flawed.

whilst companies like apple have a lot of cash reserves this enables them to weather the next storm. so on one hand a lot of jobs are safe when the next difficulty happens, which some say is a few years time. interest rates being low have slowed a lot of things down.

apple still invests in new products and things we dont know we need yet.

could some cash be given back to shareholders and staff possibly. but then what happens if the next big idea needs more investment or the economy collapses.

many cfos having lived through the past 17 years are a bit worried about getting finance from banks and bonds.

I think we need to go back to Eisenhower’s tax policy:

https://s-media-cache-ak0.pinimg.com/736x/66/9b/f9/669bf983e26761bd41ee21595177c698.jpg

It was enlightened

Richard

The increase in the number of companies and the decrease in average CT paid are surely related to the decrease in unemployment.

I suggest that many of these new companies will be small one man limited companies.

It has been well commented that the profitability of self employment (and I include here these one person limited companies) has fallen.

Many part time/hobby type businesses will have incorporated.

In conclusion I would suggest that those companies formed in the last 7 years are on average smaller and less profitable than those formed longer ago

I thought Regan and Thatcher proved long ago that if you reduce tax rates the tax take goes up?

This might be true

But the large company yield fell and the small company yield rose

And Thatcher / Reagon proved no such thing. You will recall the cut in CT rates from 52% was linked to the end of stock relief and 100% FYAs. That is why yields rose. They created taxable profits where there had been none

Basic accounting let’s me readily dismiss their false claim

Oooh! Magic. Profits where there were no profits before!

My basic accounting tells me the changes were timing differences and so could never have a long term difference. But your special accounting creates magical profits out of nothing to create more tax. Amazed they don’t try it again now. No doubt the source of fertiliser for the magic money tree.

You might think it was timing differences

But those differences were more than enough to create the myth referred to

No wonder they are manoeuvring you away from teaching. It would be little short of an education crime to teach students this garbage

I assure you I will be teaching just as much next year as last

The only crime is that I let people like you waste my reader’s time with your ridiculous comments that show a) you do not understand Laffer (which is not hard to do) and b) that you do not understand that to ensure statistical relevance you have to compare like with like, a concept clearly beyond you