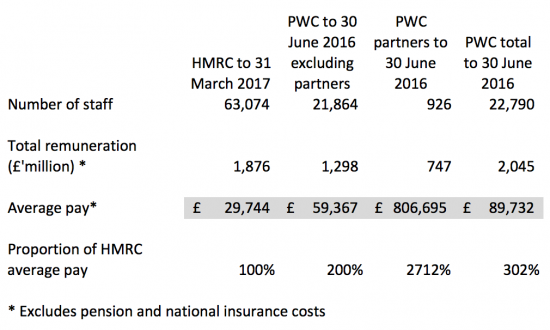

I was reading HMRC's accounts for 2016 - 17 yesterday (as one does on a Saturday afternoon) when a data curiosity hit me with regard to its total pay per employee. I compared HMRC's data with some I had prepared for PWC for use in the report Saila Stausholm and I wrote on the Big Four firms. This is how the data stacks:

It just so happens that average pay for staff, excluding partners, at PWC is almost exactly double that of staff at HMRC, and including partners is almost exactly triple that of staff at HMRC.

Now guess how the odds in the tax abuse game are stacked.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Given that Philip Hammond has said that public sector workers are overpaid compared to private sector workers, and therefore the pay cap stays driving public sector wages down to meet private instead of vise versa. Why then does the reverse not happen for the likes of HMRC and PWC et al?

Government choices and reasoning are all very wrong. Their drive for a smaller state will in the end ruin themselves and us since the state pays private companies huge amounts of money. As I think you’ve said before, neo-liberalsim will eat itself up eventually.

Do you think we can/should break normal civil service pay grades to pay HMRC staff competitively with Big Four? Not everywhere, but in comparable roles? Or even pay some at partner levels?

I think HMRC are under paid

I think the forced relocation of staff is also disastrous

I do not think partner level pay is needed

I do think HMRC’s budget plans are dire and a threat to the economic stability of this country

The word among my former HMRC colleagues is that once HMRC close all the local offices and move to the 13 “super” centres, many experienced staff will be unable or unwillling to move and will leave the department robbing it of a wealth of experience. With Brexit looming and the huge growth in customs declarations that will arise from this where are the staff going to come from to administer this ? I am not 100% sure of this but I have heard there is only one international trade Customs visiting officer left in the whole of East Anglia.

I hear the same thing

Of course people don’t want to be forced to move

Especially when the private sector will pay them more

……… and not forgetting the challenge of coping with MTD wef 2019/20 ( if it survives).

Yes I agree with you Richard

From memory I think the estimates of tax evasion and agressive tax avoidance total in excess of £100 billion. But benefit fraud is measured in the 10’s of millions. Yet HMRC have far fewer staff and resources.

If it were a business, the £100 billion + prize would then make the decision to increase both the number, calibre and pay of HMRC a no brainer

You would think so

But no in Whitehall does

Gareth surely underestimates? I think tax evasion is now running at £250 billion a year. I have no evidence of this but that hardly matters.

No! That is not true in the UK

I estimate around £70 = £80 billion for evasion

There’s an easy way to cut the remuneration of the big accountancy firms – set CGT, SDLT and inheritance tax to the correct level recommended by those who have studied optimal tax theory. Initially the Big 4 staff will be competing for work from fewer clients and over time some will be looking for other jobs entirely in the productive sector.

Optimal tax theory? You mean the supposed theory that says let’s not each the rich and companies? And who funded that?

Um, I guess Mr and Mrs Mirrlees?

Most people would consider pension provisions as part of their salary. Strange that you do not.

It’s rather valuable if you are a civil servant. Much less so as a staff member of PwC.

Having been both (whilst you have been neither) I have experience of this.

I also have experience of the working conditions of both bodies. You do not. HMRC are much better in the HR department in terms of looking after staff. That is good. It is also worth something more than money and I am surprised you think money is all that should be looked at.

Your comparison is superficial and meaningless. Like much of your work.

I have worked at KPMG

And a university

I have also been self employed

I think I have some appreciation of the issues

And I do not think anyone thinks a pension doubles the value of their salary, because it does not

I’d also wager staff morale is higher at PWC than HMRC

So are you just trying to be rude?

Having also worked in the government and big four,I world agree that salary is not comparable when considering hours worked, benefits, Union, liability for work, etc. It can be “fun” to look at salary differences in a simplistic manner but to evaluate meaningfully, more considerations need to be taken.

I agree they’re not the same

But nor is it likely that the ratio is meaningless

If HMRC are so good at looking after their staff, why are they continually near the bottom of the Civil Service staff survey tables?

@ Claude

HMRC staff make a 7.35% contribution to their pensions. And if they don’t want an actuarially reduction of around 5% per year, they have to work until they’re 68 to get it (it’s pegged the to state retirement age).

Doesn’t seem quite so “gold plated” anymore, does it?

What, did you think they were free?

Deary, deary me…

Only in the Alpha scheme is the pension age linked to the state retirement age. In the classic,classic plus and premium retirement age is 60, in nuvos it is usually age 65.

There are, quite literally, millions of current civil servants who will be retiring at 60 on pensions which no private sector worker on the same wages could afford. A pension contribution of 7.35%? Wow. It’s been actuarially calculated that for a private sector worker to get the same pension they’d need to put in nearly 35%. And keep their fingers crossed that the stock market performed well.

If you can find a single civil servant who would swap their pension for a private sector pension acquired for the same payments by the employee, then we’ll see just how gold plated they are.

Every year, we are giving pension promises to civil servants that would cost around £25bn to buy in the open market. And contributions from civil servants amount to around £4.4bn.

As you say. Dearie me.

First, that data does not explain the pay differential which remains large based on that evidence.

Second, your style is, to be kind, contemptuous, verging on nasty. Change it or please don’t post again.