A year ago there was uproar when Facebook said it had paid just £4,327 in tax in the UK in 2014. I offered analysis in this blog and in The Guardian. Now Facebook has published its 2015 UK accounts. It's 2015 global accounts are already available. I thought it worth having a look at what we know as a result, and to use the exercise the considerable amount we do not know but which I think should be made available to us.

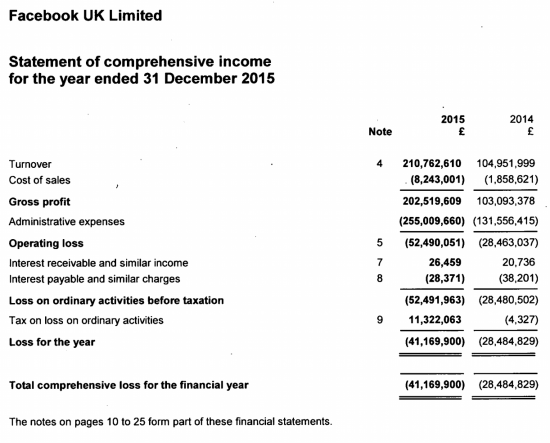

First though, an overview of the result just to get a feel for what w are looking at:

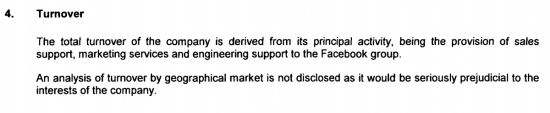

Facebook has apparently said in a press release that the significant increase in its turnover in the year is because it is doing much more business in the UK. Actually, we have no idea of that is true or not. That is because note 4 to the accounts says:

To put it another way, Facebook refuses to say if it is doing more business in the UK or not. All we do know is it is incurring more costs in the UK and is recharging more of these to other Facebook companies. This recharging implies Facebook has near enough doubled the apparent level of UK costs in a year.

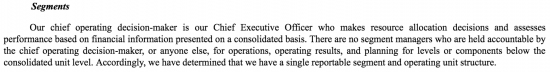

The US accounts are no more helpful in providing any information on where the company really makes its sales. The company would disclose this information under what is called segment data. The segment data a company has to publish is that which the key decision makes in the company use to determine the success or otherwise of the company in the various markets in which it operates. On this issue Facebook Inc says in its 2015 filing:

What Facebook would have you believe as a result is that its geographical market data is so sensitive that it would severely prejudice its interests if anyone was to know it, and they're so sure of this that they don't even report it to the CEO who can manage the business without it as a result. The dichotomy between the two claims is, I think, apparent.

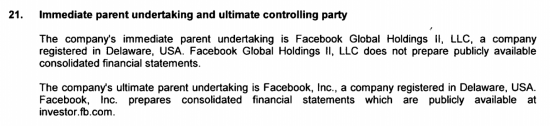

The problem is compounded by the fact that we do not know who Facebook UK does actually make sales to. The only reported facts with regard to its relationship with the rest of Facebook come in this note to the UK accounts:

How the ownership is actually exercised, and whether there are other intermediate owners between Facebook Global Holding II, LLC and Facebook, Inc is simply not known. Nor do we have any clue, at all, as to where the companies to which sales are made are located.

In fact, what we are left with is a set of accounts which do not represent anything more than a statement of costs incurred by Facebook in the UK to which some taxable profit has been added (see below).

This then suggests a first series of recommendations on changes required to UK accounting law if it is to come in any way close to providing the information we need on the accounting of a company like this:

Recommendation 1: Ownership data

Any company that is owned or controlled by another legal entity must disclose a) who the ultimate beneficial owner is b) how they exercise their control and c) the identity of any intermediate ownership that might exist. In each case if there are material other parties with an ownership interest (material being defined as owning 10% or more of the equity of any of the companies involved in the ownership structure) then the identity of those other parties should also be published.

Recommendation 2: Sales data: intra-group and other sales

The turnover of a company should always be reported so that the part that is made to related group entities and the part made to independent third parties should be separately identifiable. The identity and location of related group entities to whom sales are made should be disclosed without exception, stating the value of the sale made to them.

Recommendation 3: Sales data: geographical analysis

The geographic analysis of the sales of any company is always material data of use to its management and as such of significance to those supplying it with capital (in any form) as well as to other stakeholders of the company and as such must always be disclosed, without exception being made, in the annual audited financial statements. The analysis should be split between intra-group and third party sales. This is, of course, the corollary of country-by-country reporting in a single set of company accounts.

Recommendation 4: Material contracts

If the results of the company are impacted by material contracts whose performance is of significance to an understanding of its financial results for a period then the nature of the contract in question, the basis on which a charge is made, the annual value of the sales in question and the identity of the other party must be disclosed.

Without this information it's important to note that any analysis of Facebook UK's accounts is very hard: we have no idea who it is selling to, or why, or what for, or what the basis of charging is and whether this is sustainable or not. Almost everything of relevance about the actual environment in which it is operating is therefore unknown to us and the accounts, which are intended to protect the creditors of the company, cannot do so as a result.

Moving on there is much we also do not know about the company's tax bill.

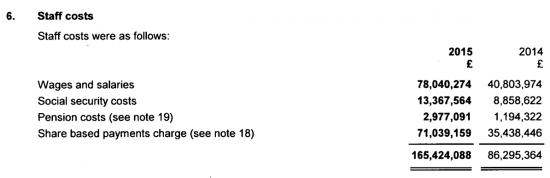

First, it's important to note that the company has reported a loss and has reported that it will enjoy a tax credit of over £11 million as a result, at an effective apparent tax rate of 21.5%. This is deeply misleading. Two things suggest this. The first is note three to the accounts:

As is apparent from the accounts, it seems likely that a substantial part of the £71 million of share based payments to staff are not tax allowable against the income of the UK company in 2015. What this actually means then is that the company has not got a tax loss in the year, but a taxable profit instead. This adjustment alone would suggest that is £71 million is added back to the loss of £52 million a taxable profit of around £19 million would arise.

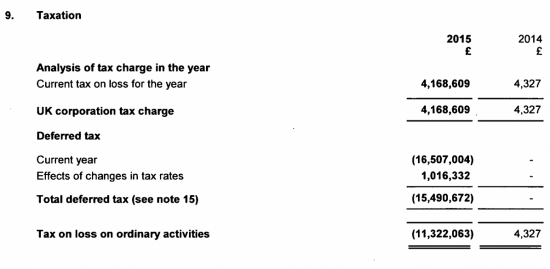

Note 9 explains the tax what might be due on this:

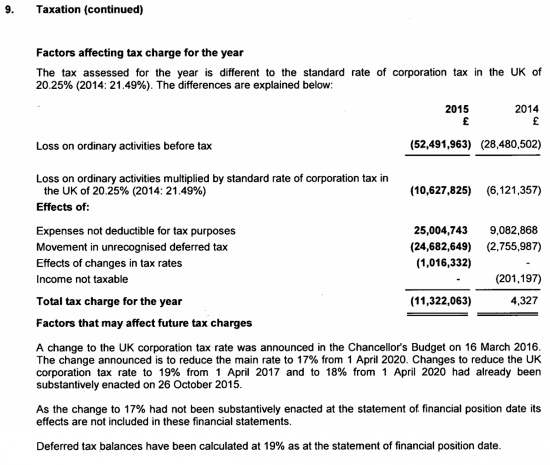

The suggestion is that almost £4.2 million is payable. As the rest of the note makes clear, the effective tax rate in the year is 20.25% :

Applying this rate to the tax due (£4,168,609) suggests taxable profit was £20,585,723. This is £73,077,686 different from the declared accounting loss: you can see why I think the £71,039,159 of shared based payments may be significant.

But let's be clear, the notes to the accounts do their utmost to hide what is really going on.

They do not reconcile accounting and taxable profits.

The terminology used in the tax reconciliation is an exercise in maximum opacity: so, there is no explanation of what costs are not allowable for tax, or why.

£24,682,649 of deferred tax has appeared from out of the blue without any explanation as to why, and yet some pretty significant decisions must have been made to ensure this figure could be included in the accounts.

But it was thought worth explaining a £1 million movement arising from changes in tax rates, as if to prove how bizarre the omission of data on the other movements might be.

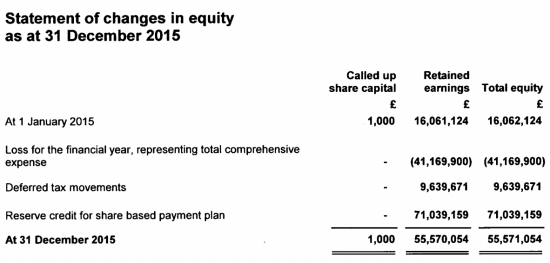

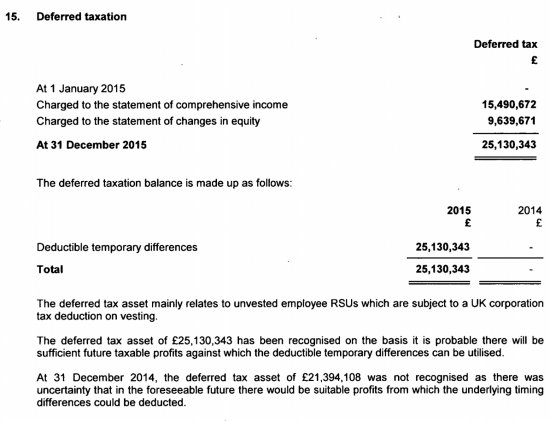

And as if that opacity was insufficient more than £9 million of the total deferred tax movement went through the statement of changes in equity:

So we have £9,639,671 of deferred tax movement here and £16,507,004 in note 9 relating to profit and loss movements, which together come to £26,146,675 but the total deferred tax movement as per the tax reconciliation is £24,682,649 and as per the deferred tax note is £25,130,343. The latter figure does not appear elsewhere in the accounts, but is £26,146,675 less the tax movement relating to changes in tax rates of £1,016,332 (but nowhere is that stated explicitly for the uninitiated). Where £24,682,649 comes from remains something of a mystery I cannot as yet solve: the deferred tax note puts it at a lower figure and changes in tax rates can't be used twice.

To put it another way, the tax notes to these accounts are another massive exercise in opacity.

One say of understanding that is to note that the taxable profit of the company just happens to be very close to 10% of the turnover. We are aware that HMRC now agree fixed 'cost-plus' ratios for some companies supplying agency services. Might that be the case here? Is the similarity between a neat round sum and taxable profit just chance? Who knows? We aren't told, but I think we should be if that is the case, as I suspect.

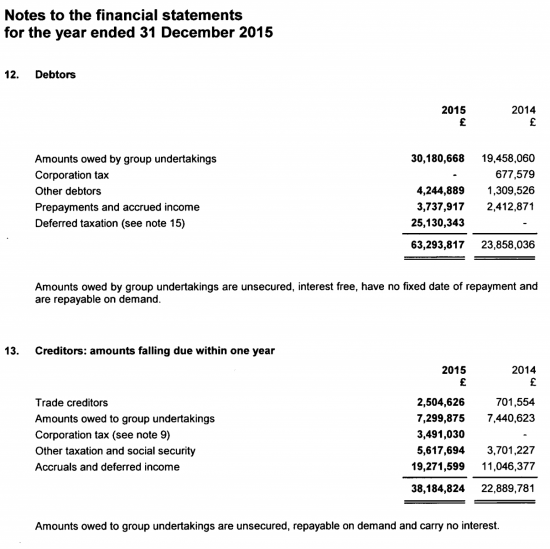

As if to demonstrate this point on opacity further, take another issue, drawn from the notes on debtors and creditors in the accounts:

Note the corporation tax debtor in 2014. Then note the corporation tax creditor in 2015. Add them together and you get the current year tax bill in 2015. But what this says is that the year end debtor from 2014 has not been repaid by HMRC. Now there must be good reason for that, but no hint of it is given. Why? The accounts are riddled with this missing data. What this might imply is that Facebook and HMRC are in dispute. If so it is not said, but I think it should be if that is the case.

I would also add two things. First this means Facebook paid no tax in the year: last year's £4,237 liability was not settled. And second, but for the fact that this structure was so simple we could not have worked this out because there is no cash flow statement, which is a massive deficit in any set of accounts because it leaves tax paid unstated.

There is a final point on the deferred tax. £25 million is stated to be recoverable but no indication at all is given as to when this might turn into a tax saving. The quality of this significant asset cannot be appraised as a result, leaving considerable doubt about the accounts as a whole as a result.

This then suggests a further series of recommendations:

Recommendation 5: Reconciliation of taxable profits

The accounting and taxable profits of a company for a year must be reconciled with all reconciling items sufficiently described so that their cause can be properly understood. Generic terms must be avoided.

Recommendation 6: Tax reconciliations

Tax reconciliations must first explain current tax liabilities and then deferred tax liabilities: mixing the two together results in incomprehensible data being presented.

Recommendation 7: Material tax agreements

If there are material agreements relating to the tax that the company owes they should be disclosed.

Recommendation 8: Tax disputes

If there are tax disputes in progress they should be disclosed.

Recommendation 9. Cash flow: statement of tax paid

All accounts, irrespective of size, must state the amount of tax paid by a company in a year.

Recommendation 10: Overall tax presentation

A company must show that its opening tax liability, plus its tax charge for the year, less its tax paid in the year equals its closing tax liability or explain the difference.

Recommendation 11: Deferred tax

All deferred tax movements must be explained in plain language. The timing of assets and liabilities having cash consequences must be estimated and stated, with assumptions being provided.

So where does this leave us?

In essence what the Facebook UK accounts provide are a limited view of that organisations costs in the UK, but tell very little at all about its revenues.

The statements it makes on why it will not disclose its revenues are dichotomous, at best.

The information on the trading of this company and the real risks within it are scant.

Worse, given that tax is known to be the focus of concern for this company we are left guessing as to many issues relating to its tax because of a lack of disclosure.

And on all this the auditors had nothing to say.

Whilst UK accounting standards, which are essentially set by the auditing profession for the convenience of its clients, permit all this to happen.

The result is that we have a conspiracy of opacity when the virtue of transparency is required.

If the profession will not act to reform this then a government committed to tackling tax abuse should.

I look forward to their statement on the issue.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The accounts do not reveal the amount of income tax paid by managers and workers, nor the amount of employer’s NI, employee’s NI, business rates and VAT that HMRC and the local authorities hosting facebook have received.

Should data about these also be included in your ‘recommendations’?

If I was to broaden the taxes, yes…

Surprised you haven’t banned this chap on account of his username, along with Mike Littris.

Both are now

It take me a while to cotton on to Mr Littris

There is one possibility you need to consider – namely that the reason for opacity may not be entirely to do with tax. It may simply be that if the business model underneath Facebook were made clear to the general public, people would walk away and the bubble would burst.

So?

Why not disclose that?

Hi Richard,

I’d recommend your sending your analysis to Nick Abbott. He is a unique presenter on LBC who talks at length about the likes of Facebook and Google. He does the shows between 10 p.m and 1 a.m on Fridays and Saturdays. LBC presenters are overwhelmingly right wing; however, Nick Abbott breaks this mould. To listen to his show helps to understand why LBC’s owners tolerate his presentation. He would have a field day with your conclusion that Facebook haven’t even settled the infinitessimally small tax liability of £4,237. Indeed, he has mentioned this liability in his shows on many occasions. He links this small amount of tax and other corporations limiting their tax liability to the underfunding of our NHS and other services. Your sentence was: “First this means Facebook paid no tax in the year: last year’s £4,237 liability was not settled.”

What he would also draw attention to, is that Facebook do not include a cashflow statement in their accounts which would show the tax paid as you state. Finally, I believe Nick Abbott would borrow your excellent phrase of ‘another massive exercise in opacity.”

I’ll search him out

Hi Richard, I’ve just emailed a comment to the BBC specifically requesting it be sent to Chris Johnston, Business Reporter. I’ve recommended he contact you for on their homepage he has written an article entitled ‘Facebook paid £4.1m in UK Tax last year.’ Given your conclusion that Facebook has still to settle its 2014 tax liability of £4,327, I suspect it highly unlikely FB has settled its 2015 liability of £4.1m. Thus the BBC headline is incorrect. Also, this afternoon on BBC News a reporter (almost certainly the same Mr Johnston) stated Facebook would be paying much more tax in future. I suspect that claim would obtain an F in a Critical Thinking ‘A’ Level paper. I’ve seen you speak on the BBC before so you will have contacts there. May I recommend you contact Mr Johnston and set him straight, particularly on your point that FB is yet to settle its 2014 tax bill with HMRC.

I have just recorded for the BBC, will be doing 5 Luve at 5.55 but bad to turn down Today

You might like to refresh your memory on the accounting for tax on share-based payments.

I’ve not had a chance to review the accounts as yet, but everything you point out as being anomalous seems to be perfectly ordinary tax accounting, right down to the accounts charge being shown as a permanent difference in the tax reconciliation.

The size of the adjustments suggests that Facebook’s stock price will have gone up significantly over the course of the period of account, giving an accounts charge that significantly exceeds the deduction on vesting.

And checking the figures, I do indeed find a significant increase in stock price – it’s been going up steadily since 2013, in fact.

Oops – computer has picked up old login details. That was me 🙂

It’s not shown as a permanent difference

Start reading Andrew

It is quite clearly shown as a permanent difference, right there in the tax reconciliation in note 9 🙂

The reconciliation is to total tax charge, not to the current tax charge – this is of course the new fashion, as I’m sure you’re aware. If it were a temporary difference it would go through deferred tax, and so wouldn’t show up at all in the reconciliation.

Large permanent differences which almost (but not entirely) cancel each other out are well known as obvious indicators of share-based payments. Having part of the deferred tax go through equity is another indicator.

If you’re rusty on this sort of thing I believe the ICAEW has some useful guides available online.

Matched by a new deferred tax asset….

And an even more obvious indicator of share-based payments is a note to the accounts setting out the details of the RSU scheme 🙂

Now that I read the accounts, I see it’s all laid out there in note 18, in plenty of detail. Shame you didn’t copy that note into your post, really 🙂

I did all that last year in a blog I linked to

As usual, you didn’t notice

Of course it’s matched by a new deferred tax asset – that’s how the accounting for these things works! It’s been like this for years… 🙂

So your facetious comment was pure nonsense – as I always thought

One day you’ll make an observation of worth Andrew

But I am pretty sure it won’t be here

Which facetious comment?

You complained that it’s not at all clear what the tax figures relate to: “£24,682,649 of deferred tax has appeared from out of the blue without any explanation as to why”, for example.

I first had a look at the information you provided in your post, and came up with entirely sensible answers that you seem to have missed.

I then had a chance to look at the accounts themselves, and found corroboration of those answers. In fact, the answers are set out entirely clearly. I’d assumed from your comments that it was all rather obscure, and that you’d given all the information that was available, but in fact you missed out the part of the accounts which clearly answers the question you though had been left opaque.

Your confusion about why the deferred tax figure per the reconciliation differs from that in the deferred tax note has an equally clear resolution: the reconciliation shows a permanent difference, and the deferred tax notes includes both permanent differences and temporary differences (the movement in the pensions accrual, for example). You’re complaining that (A) is not the same as (A+B).

The opacity to refer to, in connection with the deferred tax, is simply that you’ve not noticed that the reconciliation is to total tax, even though accounting standards now require it and it clearly says so in the reconciliation.

I’d be happy to talk you through the tax and tax accounting principles, if you want to brush up on them sometime.

Oh, and you also seem to have missed the obvious implication (well actually they do explicitly state it, but hey ho) of recognising £25m of deferred tax asset, which is that the company is expecting to have enough taxable profits to absorb those losses in the foreseeable future. So the implication is that there will be much more of the way of profit in 2016, presumably as a result of the reorganisation following the DPT. *That* is the interesting thing that the accounts are saying. And saying it pretty clearly, too 🙂

There are other areas in your post that have some merits, but your comments on deferred tax (which is what I’ve confined myself to) are very much wide of the mark.

Andrew

I missed none of that….

I even referred to the nature of the tax rec, but you missed that

But feel free to entertain yourself

Richard

Not missed anything?

You said: “£24,682,649 of deferred tax has appeared from out of the blue without any explanation as to why”.

The accounts quite clearly say “The deferred tax asset mainly relates to unvested employee RSUs which are subject to a UK corporation tax deduction on vesting”, and the figures are entirely consistent with that position.

How is that not an explanation of where the deferred tax came from? It’s not exactly ambiguous, is it? It not only tells you the source of the deferred tax asset, it sets out the tax treatment for you in simple language 🙂

What explanation would you suit you better?

Andrew

Nothing I wrote contradicts that is bless you are really are trying to be stupid

The point I made us that £24 million is unexplained: it is £3 million different from the figure disclosed the previous year, as i noted

So the figure has come out if nowhere, exactly as I said. But at no point did I suggest I did not know the underlying cause it related to

But you apparently can’t spot the inconsistency I was referring to

The problem, as ever, is all of your own making Andrew

You really should learn to read accounts

Richard

PS please don’t bother to reply: I am bored by your small mindedness

It is quite simple if you are an accountant.

The £21,394,108 is the unrecognised deferred tax asset (mainly due to share based payments) at December 2014 per the 2014 accounts and prior year notes in the 2015 accounts. In the 2015 accounts the OPENING position was reappraised as £24,682,649 based on the better information then available.

There is no prior year adjustment (for the circa £3m difference between the closing in 2014 and the revised opening in 2015) as the position was previously unrecognised and so the full amount of the revised OPENING DTA is brought onto the balance sheet for the first time in the 2015 accounts. This asset was recognised due to there being more confidence that the DTA would be realised as a result of expected future taxable profits (as explained in the note).

The £26,146,675 (less rate adjustment of £1,016,332) is the CLOSING position at 2015. So the difference between the closing and the revised opening position is simple the new deferred tax that arose in the year in question.

It is all really standard DT accounting (although admittedly not easy for the layman but should be bread and butter for a chartered accountant)

You may think a £3 million unexplained adjustment is OK. I do not

You may think bringing £24 million into account with adequate explanation is OK. I don’t

You may offer excuses. I think they are trite

There is no £3m adjustment as it relates to an UNRECOGNISED amount. The adjustment was £24m as that was the amount recognised and this amount was described. Only recognised adjustments affect the profit and loss account or balance sheet of the business.

And you think introducing an asset whose value is uncertain into the accounts without explanation at the change in circumstance that permits this is OK?

That is what I questioned in my blog

You have utterly ignored that point, like a typical accounting pedant who can only see trees

They brought it onto the balance sheet when there was sufficient certainty to do so. The value will have been audited in detail. There is no mischief here.

But there is opacity

So we do not know if there is mischief

We do.know you are wasting my time

We do know there’s no mischief as deferred tax accounting for share based payments has no impact on the tax computations of the company. The company will receive a corporate tax deduction when and to the extent that the recipients of the awards get taxed on them.

Unless you are clairvoyant, no one can no what the employees will be taxed on or the tax deduction the company will receive until the shares vest. That tax deduction will depend on the share price in the future at the time of vesting not the price at the balance sheet date that drives the deferred tax accounting.

All of which is a complete red herring because it does not explain why the nebulous asset is recognised now

But it’s absolutely clear where the profits are coming from that would allow the deferred tax asset to be used.

£20m of them have already arisen: a carry-back claim from 2016 would deal with them. We also know from the accounts that the scale of operations is increasing, and that the company is going to start selling services in the UK which is going to bring more profit in.

If we take £20m of profit from existing operations in 2015, and assume another increase in 2016, then we’ve got close to half the DT asset used already. Bring in a new and more lucrative line of business and you’ve got some pretty confident predictions, all disclosed in the accounts.

So the accounts tell us that profits are expected to arise, and that this increase in profits means we think we’re going to get to use the losses against them. That’s pretty comprehensive, and entirely in accordance not only with generally accepted accounting principles, but with common sense as well.

What more do you want – a detailed five-year plan with full budgets across all profit centres? 🙂

So what we know they plan to sell in the UK and pay less tax?

Is that what you are saying?

Where does I say that?

Why doesn’t it say that?

Tell me

We know they have more of their existing business because the accounts show the increase in the number of engineers.

We know they have a new reseller business because it says so in the strategic report, on the very first page of the accounts (not counting the contents page).

We know they expect to make a lot of pre-tax profit out of this, because they say so when they recognise the deferred tax asset.

We know that they expect not to pay tax on that pre-tax profit, because they say they are expecting relief for the RSUs. That is, the accounting profit they expect to make in the future is sheltered from tax by the dirty great loss they have already disclosed in the accounts.

And we know that this is a reasonable result, because although they are expecting to make a lot of money, we can see that they have already committed to giving it away to their employees via RSUs. As the value goes to the employees rather than the company, we would expect the employees to be the ones who are taxed on it.

QED

No

We know none if those things at all

Because the accounts don’t sy any of them

You just made that up to fit your theory

But you don’t know any of that because they, fir a start, refused to say anything about their UK sales

So stop talking BS Andrew

My take is that Facebook took a commercial decision to pay more UK corporation tax, for PR reasons, so had to find a way of increasing its taxable profits. To that end, it increased its UK taxable revenues (turnover up) and declined to claim some tax deductions (on its shares based payments).

The possibility of changing its mind might explain the deferred tax (if that is a deferred tax asset, which seems to be the case as it is added to retained earnings – if it is a deferred tax liability then who knows).

I think it really expanded its costs

The deferred tax asset is more interesting

But I see no PR in here

You can’t decline deductions on share-based payments: the deduction is one which happens without a claim, based purely on when the employee acquires shares. In the case of a large corporation like Facebook, that will be a mixture of regular grants (of restricted stock units) and of share options: options are exercised at the employees’ discretion, and RSUs tend to be fixed by custom, and so the company has little effective choice about when they are made.

The deferred tax asset is quite clearly the deferred deduction in respect of RSUs which have not yet vested, and options which have not yet been exercised.

“You can’t decline deductions” – eh? If the company wants to report it’s gross revenue as taxable income, do you think HMRC will object?

That said, I think you have comprehensively explained the deferred tax position above. (Good thing I don’t claim to be an accountant!) But I would not be at all surprised to find that Facebook started with an amount of tax that it wanted to pay for PR reasons, and found a way to recognise the appropriate amount of taxable profit.

Blimey. Given your confusion over deferred tax and share based payments, is our CPE up to date?

There’s not one iota of confusion in what I wrote

Read it and the linked blog

The claim is just bizarre

But then, your comments always are

http://www.theregister.co.uk/2016/10/10/in_conservative_britain_hmrc_pays_you_er_gives_facebook_11m/