I had a piece on Comment is Free on the scandal surrounding Facebook's tax payments. Except that I say I have no idea if there is any such scandal. That's because, as I argue in the piece, Facebook UK Limited's accounts provide no clue as to whether that is the case, or not. To put it another way, they are so far from providing what I consider to be a really true and fair view of what Facebook has been doing in the UK that I cannot tell what is going on.

Let me stress straightaway, and not just for legal reasons, that this does not mean that I am saying that there is any wrong doing going on here: there is no evidence that there is. The accounts do, I am sure, comply with the law and, because the world's leading auditors have so managed the setting of auditing standards that a true and fair view by and large means that the right boxes can be ticked with regard to that legal compliance, however, nonsensical the resulting data, then those auditors are also technically off the hook.

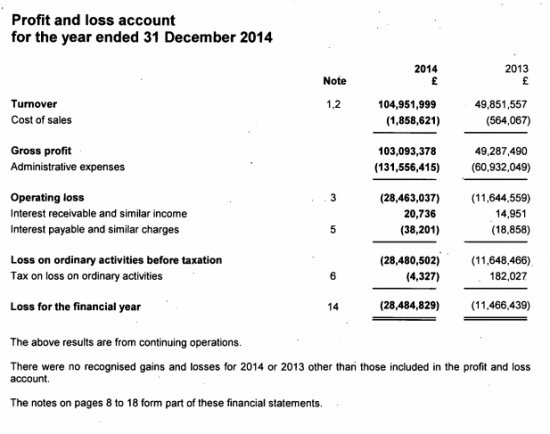

But that does not mean that I think that the accounts are true and fair. Let's start with the sales figure. What Facebook UK Limited (which can be called Facebook or Facebook UK for the purposes of this blog) say is that they have made sales of over £104 million in 2014. This is the profit and loss account:

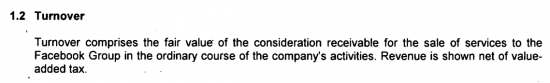

Except we have no idea whether this is true or not, because the accounts say that the reported turnover is:

In other words, Facebook UK is billing some other part of Facebook (the location of which is not disclosed, quite extraordinarily and I do wonder whether in contravention of IFRS 8) for the services supplied and that other entity is, presumably, billing Facebook's UK's customers. So, to put it another way, Facebook offers no account at all of what sales it makes in the UK. The data supplied is based on a contract that they have written internally which may or may not have some bearing to the economic reality of what is really going on in the UK, but we just don't know.

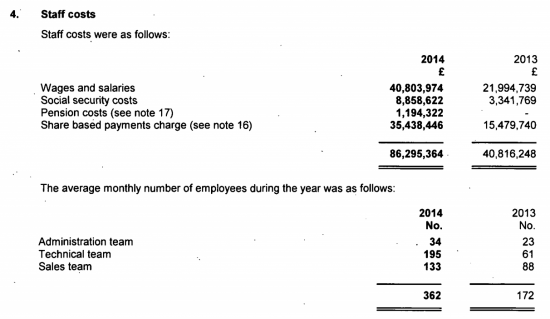

Why don't we know? There are two reasons for that. First, Facebook does not have to publish country-by-country reports for the UK so we have no way of knowing what its real sales are here. And second we don't know what s really happening because Facebook has taken advantage of a legal loophole not to disclose the level of its trading with other Facebook entities. I stress this note is legal:

I also stress that the exemption referred to means that most of the really important data we want to know from these accounts is hidden from view.

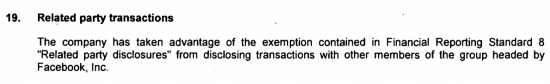

What else is wrong with the Facebook accounts? Well, let's take the profit (or rather, loss) figure again (above). Note there is a loss of £28 million. But then take a look at Note 4 which analyses employee costs, which is as follows:

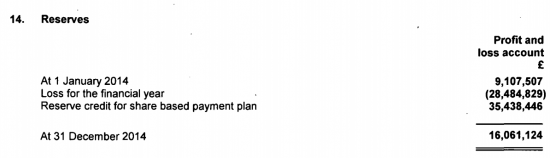

Ignore the fact that average pay is £210,000. Note that £35 million of share based payments. They reappear in note XX to the accounts on reserves, which looks like this:

The loss as per the profit and loss account now has that £35 million added back: it disappears from view as a result. And the result is that the reserves, and so the value of the company went up by £7 million in the year. If you don't believe me look at the shareholders' funds on the balance sheet:

The reserves have in increased by £7 million. That's the difference between the £28 million reported loss and the £35 million of share-based payments which have now disappeared as apparently the company does not owe them at all. To explain this go to note 14 where it (sort of) becomes clear that these options are issued by the parent company, Facebook Inc, and effectively are at cost to it. So, when it comes to shareholder's funds the cost is not being counted. Or in other words these accounts have two figures for profit (or loss) in them. One is a loss of £28 million. The other is a profit of £7 million. And the auditors sign off both. But which is right? Who knows?

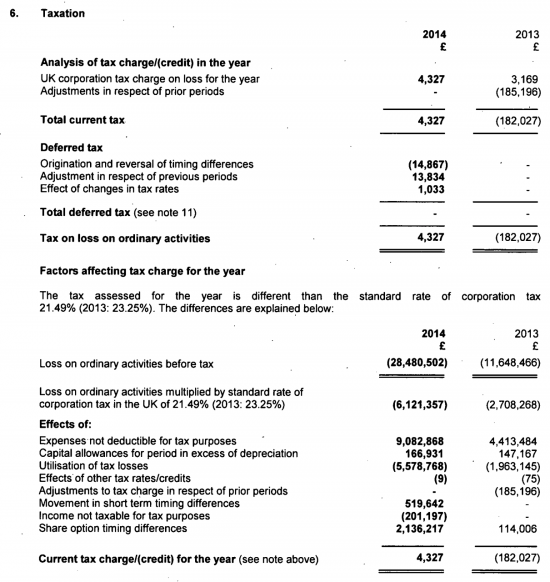

Then turn to tax. The claimed tax bill for the years is £4,327. This is the tax note:

Does that make sense to you? If it does, well done. I've prepared more sets of accounts than most people in my life, and I can make little sense of a lot of that, precisely because Facebook have gone through the process of complying with the letter of the law and yet say almost nothing. I love the adjustment of £9 though: that can apparently be included when adjustments for millions (like the expenses not deductible for tax, which are not just the share payments) are not explained.

And nor, for the record, do we have any indication of whether any tax was paid, or not. Because of another legal loophole Facebook does not have to publish a cash flow statement in the UK saying whether or not it has actually paid tax. We just don't know.

So, the accounts are, to be polite, nonsense. They probably do not disclose the right level of sales for Facebook in the UK, but only that part that the group has chosen to account for in this country. They do not give a clear indication of costs because not all the cost of the share based payments will be incurred in the UK. They disclose an ambiguous figure for a loss that may be a profit. The tax liability is not adequately explained in my opinion and yet the accounts are, I stress, completely legal and the auditors can properly sign them off.

How did we get to such an absurd position as that? What was it that permitted companies to give us such hard to understand data and get away with it? There are several reasons.

First, the corporate world spends a fortune to make sure things are maintained in this way so that they are as little accountable as possible. How do I know this? I have seen the legions lined up to oppose country-by-country reporting at the OECD, for a start. The cost expended must have been enormous. They won: the OECD's recommendation on country-by-country reporting is that it be reported to tax authorities but strictly off any public record. A lot of money secured that result.

Then we know that the same legions of the world's major corporations and accountants also lined up to oppose changes in the law to require companies to record where they make their sales for tax purposes. Whether the new OECD recommendations on this issue, just published, will really change this and whether those recommendations will be properly implemented are both open to doubt for this reason. Countless sums have already been expended to already undermine the recommendation: no doubt millions more will be spent to prevent implementation.

Second, the capture of the accounting standard-setting process and the auditing standard-setting process by the big firms of accountants so that they, almost alone, determine what shall now be included in a set of accounts and how those accounts shall reported upon by their auditors means that democratic control of both processes has been lost any and with it any connection to the public interest. From top to bottom the whole agenda is now set by the Big 4 firms and their clients.

Third, the EU is guilty in facilitating this loss of control. When it was desperate to find a common standard for European reporting it adopted International Financial Reporting Standards as a de facto European standard when they did not reflect (in my opinion) current European thinking on many issues and when this meant undue influence was ceded to the US accounting firm dominated processes as a result. It has now been shown, quite convincingly, that IFRS does not comply with the UK company law expectation of what a true and fair view is.

And, bluntly, it would seem that successive UK Business Secretaries (and there have been very many of them, a lot lasting little time in post) have more than happily washed their hands of responsibility for accounting disclosure. Political demands have instead been to relax the so called burdens on business, whilst ignoring that accounting is meant to be for the benefit of society. To be candid, there has been a democratic failure here.

So, what can be done? This is an issue that I cannot address in depth in an already long blog. I will do so in more depth over time as this is an issue close to my heart right now. This list will have to do for the moment.

First, we need compulsory country-by-country reporting for all multinational corporations, Facebook included. Yes that will need US cooperation, but we can set the precedent in the UK.

Second, we need to drop the absurd rules that mean intra-group transactions do not need to be disclosed in accounts such as these. If related party transactions are important (and they are fundamental to a lot of the current problems in tax, in particular) then they have to be disclosed.

Third, there is no excuse for cash flows to not be published in all large company accounts. The exemption has to be removed.

Fourth, the accounting for share based payments is clearly deeply misleading: revision is needed if accounts are to show a true and fair view so that only the actual liabilities to be expensed are included in a P & L account.

Fifth: tax disclosures designed many years ago now are very obviously not meeting stakeholder needs in a new era of interest. More explanation within tax reconciliations is needed. Terms like 'tax disallowable items' are just not good enough to impart useful information. New narrative requirements are essential if tax is to be properly understood.

Sixth, the boundaries between deferred and current taxation need to be more clearly delineated: the transfer of tax losses into account in Facebook UK is an example of where more explanation of this interaction is required.

In summary: the assumption that minimal disclosure is consistent with a true and fair view and that financial statements are only for the use of the providers of capital to a company have to be consigned to history. A new era of accounting disclosure is now needed, and these accounts are the evidence of that. They're legal, but they don't do the job we expect of them, and that's why reform is needed.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Very interesting, thanks. It is astonishing that Facebook can just make up a turnover figure for the UK.

That is truly unbelievable, and just shows how the UK tax authorities have been captured by the big corporates and the big accountancy firms.

Clearly the UK tax authorities are being taken for a ride, and it is time to change that.

The annual accounts of Facebook Inc for 2014 show a $12.5bn turnover, and PBIT (profit before interest and tax) of $5.0bn, PBT (Profit before tax) of $4.9bn on which $2.0bn becomes “provision for income tax”.

Now, Facebook’s European turnover is $3.4bn. You can find that figure in the consolidated accounts. I would guess the UK is one of the major Facebook markets in Europe. Maybe accounting for 20% of European sales, would be my guess. So that would mean $680 million (£450m) is the UK turnover, rather than the £105bn they report in their UK accounts.

If the profit margin in the UK is the same as for the rest of the consolidated accounts, we would have PBT of around £175m for the UK. That would mean corporation tax of around £40m would become payable.

£40million compared to £4,327 – clearly quite a difference!

http://investor.fb.com/annuals.cfm

Well written Matt. I bet the unexpected endorsement you’ve just had from this blog has put you off your stroke.

“If the profit margin in the UK is the same as for the rest of the consolidated accounts, we would have PBT of around £175m for the UK.”

A totally meaningless statement as I doubt they do a font big enough to do enough justice to how important the IF is in the sentence.

Why on earth should the profit margin be the same? Different companies in different countries undertake different activities. They are going to have different profit margins. Facebook UK Limited doesn’t do what Facebook Inc. does.

So they won’t have the same profit margin.

It’s the same business worldwide

The assumption is right until proven otherwise in my opinion

Atm’s length pricing would suggest tgat is the right comparable

Eileen, Facebook has CHOSEN to attribute its turnover and costs into the UK, and that resulted in a loss. Do you really think out of £8bn sales, the UK only should be allocated £100m? That is only 1.25% of Facebook turnover is made in the UK? Facebook are clearly taking the Micky!

It is absolutely appropriate to tax the company on the sales and profits attributable to the UK, based on the whole consolidated turnover, and the consolidated profit.

The UK tax laws have to change. It cannot be that difficult.

One of the reasons why those share payment costs are clearly not tax allowable is they also clearly do not relate to the UK trade the company is accounting for

It’s pretty clear to me.

There’s £7m of underlying profit.

RSUs have been issued to staff, giving a charge of £35m, which has been taken to P&L. This is not deductible for tax purposes.

£35m has been received to reimburse the company for the £35m P&L charge. This has not been taken to P&L, but has been taxed anyway (presumably as a capital contribution which is treated as a gift).

A deduction has been taken for RSUs which have been settled – this tax deduction is less than the accounting expense, probably because there are a lot of RSUs outstanding, and you only get the tax deduction when they’re settled.

The remaining trading profit has been sheltered by losses made in earlier years.

Broadly, therefore, the taxable profit (ignoring small items like depreciation) is:

– £28m underlying loss

+ £35m for RSU charge, as it’s disallowed

+ £35m reimbursement of RSU charge, as that’s a separate line item

– £17m tax deduction for RSU settlement

= £25m trading profit

– £25m trading losses brought forward

= £20k of interest

Which, with tax at 21.49%, gives £4k of corporation tax.

There are some other adjustments in there, obviously (like the £2.5m that gives rise to STTDs), but that’s the bulk of it.

In fact, what it resolves to is:

£7m underlying profit

+ £18m RSU charge for which tax deduction is delayed until settlement

= £25m taxable profit

Very simple, really.

And totally wrong

As Matt Usselman has worked out but you have not

Matt Useselman has leapt to a wild unsupportable conclusion.

Will that be enough to get top marks from you when you start marking essays?

His logic is impeccable

It is tgat of unitary taxation

So yes, if the reasoning was given high marks could be awarded

I’m talking about what the accounts are showing, as you were suggesting it was difficult to read them.

The question of whether a company is trading *in* a country or *with* a country is an entirely different one, as you well know.

And I am interested in what the accounts are not showing

You apparently gave no such curiosity

In other words, Facebook UK is billing some other part of Facebook (the location of which is not disclosed, quite extraordinarily and I do wonder whether in contravention of IFRS 8) for the services supplied and that other entity is, presumably, billing Facebook’s UK’s customers.

A mere guess, but a little geek knowhow will tell you Facebook owns a large estate of computer servers in Ireland (which provide access to the “content” of Facebook). Were you to take your admin charges through Dublin and even before shenanigans like the Double Irish and Dutch Sandwich, you would save tidily on tax…

It looks to me as if you are calling for the UK to override all tax law, ignore legal company structures and assess tax on the basis of what someone thinks should be paid. Is that a fair assessment? You want to rob Eire of the tax it earns from Facebook?

The comment is too ridiculous to be responded to

Just go and consider what the OECD has just spent two years looking at

“This is an issue that I cannot address in depth in an already wrong blog.” Should that be “long”?

I have experienced a number of audits (non financial) in my own job role, but they were very light touch. The auditor seemed more happy to talk about his last holiday, his dentist and his wife’s obsession with budgerigars, than the subject he actually came to audit me on. Although we know he is an experienced guy who knows what he is looking for, it does make us question how he can do his job.

Having clearly identifiable standards is essential for a successful audit. One would think that this requirement would be even more stringent in the financial sector, but it seems that the layers of obscurantism are hundredfolds greater. Thank you, Richard, for your clear thinking and sound advice.

It should be long, yes

You clearly were never audited by me!

If you had audited DavidB’s business would you have used accounting rules as they actually are or just made up a load of new ones?

On that matter, which auditing and tax rules did you use when you did still do that work?

There is a true and fair over-ride on disclosure

No one is obliged to make minimum disclosure

“No one is obliged to make minimum disclosure”

Although you make minimum disclosure about your own tax affairs.

Funny how it’s OK for you to and an affront to civilisation when Facebook does it.

I voluntarily disclose the P & L of Tax Research LLP, by far my largest source of income

As ever, you are wrong

The US doesn’t operate under IFRS, I recall that the head of a US accounting body, possibly CPA, said that involving the US authorities in IFRS in an attempt to win SEC approval would be a disastrous move for IFRS.

Matts reasoning and explaining his working would be perfectly valid for an economics essay, but I wouldn’t try to get that approach past and auditor (tax or otherwise)

I am well aware US GAAP is not IFRS

But in some key areas to the argument here, e.g. IFRS 8, it is identical

There is a convergence programme

Not a tax expert here but the key figure for me and the reason little tax is being paid is the using up of previous losses.

The share payments look as if they are added back as not deductible with an adjustment for option timing.

A little snippet about FaceBook: at the time of the IPO, seventy percent of the click-through traffic was known to be bots.

How much of the remaining activity originated in human interaction remains unknown.

Facebook is fundamentally murky: the accounts, are in a sense, a true and fair reflection of the business.

“Facebook is fundamentally murky: the accounts, are in a sense, a true and fair reflection of the business.”

Well the sales figures should be pretty uncontroversial for the whole of the Group. (Unless we have another Enron) If they have a $12.5bn sales in their consolidated accounts, they will have to have sales of $12.5bn from somewhere. That is probably the only figure which they cannot make up, on an audited basis.

They also have consolidated accounts which show a big fat profit margin of 39% (profit before tax) and allocate in their own accounts $2bn to tax. Where this tax is payed, if at all, we do not know, the consolidated cash-flow shows only tax of $180m for 2014, or something.

And about this click-through traffic. That is how Facebook would be paid for advertising, which will make up the bulk of the Facebook revenue stream.

That is perhaps how they should be taxed as well. If 10% of the click through traffic comes from the UK, the UK should be able to raise tax on 10% of the consolidated profits.

The French are exploring such ideas

Having done some work with revenue recognition under US GAAP a few years ago it was (post-Enron) pretty strict, more so that IFRS at the time. In order to statisfy SEC quarterly reporting the auditors may well actually check the revenue figures quarterly and it can be fairly intense and require a lot of paperwork all of which has to be in place.

So yes the revenue number should be reasonably robust, that said either you trust the standards/GAAP or you don’t so you should really accept the rest of the accounts.

Now disagreeing with the selected method is perfectly valid, but doesn’t mean the accounts as presented are wrong, it’s a matter of interpretation not fact.

The EU rules allow Facebook and others (Google does the same) to book all their UK sales through Ireland (or any other EU country come to that), you may disagree with this for many reasons (social/political/economic/fairness), but preparing their accounts on this basis does not make them wrong.

You mean rules can never be wrong? Come on! Of course they can be

And I am saying they are

Yes rules can be wrong, I’ve thought that I would have chosen to do things differently a few times in my career, as I’m sure you and others have, but ultimately as professionals the rules are followed despite personal opinion.

There is a difference though between I disagree with these rules and here is an example why versus saying these accounts are wrong.

Additionally it’s possible to disagree with the rules on many grounds that aren’t always relevant to the accounting, for example you recently highlighted that the old UK standards had a much wider stakeholder definition than current standards. Personally I agree that this is an issue, but it’s a social/political issue not an accounting issue and in many cases would not cause a change to the underlying principles and rules.

In a similar vein some tax avoidance plans may seem unpalatable, but the person (and their advisor) using them is not Doing anything wrong (even if were to wish it was so)

I think it my job to say when rules are wrong and get them changed

You can just acquiesce if you wish

I don’t

I seek to change to world

a 39% profit margin on sales of $12.5bn gives profit of $4.9bn against which they have estimated their tax liability as $2bn.

Which gives a tax rate of 41%, now as you say who is receiving that is another issue, but hard to say it’s a low overall tax rate

Of which 36% was deferred tax not payable: the real tax rate was 6%

Jolyon Maugham did the analysis

I must adnit it is not clear to me where click through sales actually take place. The servers are in Ireland and being accessed from people around Europe. They are in effect choosing to go there by accesssing the server rather than being sold anything where they are located. The fat that they may be unaware of this would seem irrelevant. In this scenario it seems diffficult to state whether the “sale” is where the buyer is located or where the transaction actually takes place.

Thanks Richard for this incisive analysis. I will share it with my final year undergraduate students in class and discuss it as it is set out so clearly.

http://www.thedailymash.co.uk/news/business/facebook-applies-for-housing-benefit-and-tax-credits-20151013102853

Says it all really. Certain large corporates who feel entitled to live off the state, ie the rest of us. No amount of detailed technical argument can avoid that basic point

I don’t think it’s correct to see Facebook as a single company. I think it’s closer to a vertically integrated conglomerate.

From what I can read on the accounts, Facebook UK is little more than a service company to Facebook UK. It’s probably some combination of a development centre plus some marketing/support functions. I don’t really see anything wrong with Facebook running such an operation in the UK on a cost plus basis. This is a pretty standard activity which isn’t very remarkable. No UK entity other than Facebook likely interacts with this company. I don’t see the issue in Facebook owning such a company.

But if you compare Facebook with other media companies I think it’s clear there are really more integrated than most. ITV for example will purchase large amounts of content from other countries. Facebook produces the equivalent of the content itself but mostly in the US (if you think of the content as the IT platform). ITV needs to run a capital intensive broadcast network in the UK. Facebook doesn’t need to do that as the broadcast network is paid by users directly. I think it’s inevitable that a much smaller percentage of Facebook revenues are really linked to UK economic activity. Given EU rules, I think it is reasonable that all Facebook economic activity actually happens in Ireland.

I mean is Facebook more similar to ITV (the distributor) or to Sony (the movie studio). You could argue that the Facebook’s distributor are the telecom companies and that they accrue the economic benefit of distributing Facebook in their books (fully taxed by HMRC).

I mean what about product placement: movie studios get paid by companies to include their product in movies. I doubt such payments get anywhere close to the UK for example. They are most likely income for the producing company in the country they make the movie. Should such movie producers pay taxes in the UK for such revenues? It would be impossible to decide the correct allocation. I think Facebook and Google advertisement is very similar to this and should be treated similarly. I mean you need to argue that you should pay taxes where your client (so not Facebook but Facebook’s clients) gets the benefit rather than where you produce the product. That’s way too complicated to do I think… There would be never agreement between countries on this. You really need a world government for this to work…

You may think all that

Thankfully, by and large the OECD has been persuaded otherwise

“I don’t really see anything wrong with Facebook running such an operation in the UK on a cost plus basis.”

An interesting point.

Were I an independent contractor working for Facebook, being paid £200k a year and paying all my UK taxes, would anyone complain? As work grows more contractors join in and we form an LLP. We all pay our UK taxes. Anyone complaining yet? We form a company and simply pay out in salary all fees received from Facebook. Still all our UK taxes are being paid. No complaints yet?

Now Facebook takes us over becomes our parent company but the arrangement stays the same.

Now you all start screaming that tax abuse must be happening?

I guess some of you just don’t like people having the free will to do what they want.

And being very, very successful as they go about doing it.

I wonder if there is any fax abuse you condemn?

Are you an Argyll Pullman person?

Quick question.

Would the difference between the $35mln share compensation and the on $7mln increase in reserves not be due to option value accounting (an estimate comprising of present and future cost) and the actual cash equivalent cost of not yet exercised options.

Please read what I have written

To expand on Mr Murphy’s comment: there is a specific line in the reserves showing £35m relating to the share options (technically “Restricted Stock Units”, which are automatic grants if you meet performance criteria, not options), which is basically Facebook UK being reimbursed for the cost of the share plan. The unsettled RSUs are already taken account of in the deferred tax.

In a sense it is all down to option value accounting, which is notoriously arbitrary and unintuitive – especially when the impact is so large in proportion to the company’s other results – but not quite in the way you suggest.

To suggest that is the only issue in the accounts is wholly lisle among Andrew

As I have already made clear and about which you are in denial

If as seems to have been reasonably proven Facebook has transferred profits to employees in the form of share awards then shouldn’t we consider the full tax picture. Those benefits will have been taxed agaisnt the employees, either way HMRC is getting a share of the pie. In fact it might be even bigger slice compared to CT.

The sales “to” vs “in” is another issue and more political, especially given EU rules. One of the exemptions I would like to see removed is that warehouses don’t count as a presence, Amazon especially seems to profit from this by claiming no UK presence.

The whole OECD BEPS process has been largely aimed at the type of activity facebook do and some professionals seem in complete denial about it here

Wow. You start by stating on CiF that you can’t see what Facebook does, which is the basis of your complaint. Then you come right out and say BEPS is aimed at what Facebook does. So go then, explain what it is that Facebook does and how BEPS is aimed at it..and how you’ve been able to derive this knowledge from the accounts after all.

Or are you bullshitting again Richard?

I said on CiF that I cannot tell what Facebook does in the sense I have no idea what sales it makes in the UK because it is clear that these are billed from elsewhere

BEPS is aimed at that practice

So I am right, and consistent

And you, as ever, are time wasting, nit-picking and wrong

“BEPS is aimed at that practice”. If you mean selling TO a country online rather than IN a country then, yes, BEPS is concerned with possible base erosion. But that is a legal and transparent practice; you’re not suggesting anything but that. Thank you for admitting this on your Tax Research blog.

I’d suggest to you that i is impossible for accounting and BEPS to be unrelated

After all, country-by-country reporting is at the core of the BEPS solution

And I am asking for country-by-country reporting by Facebook, as well as other disclosures to make its BEPS risk clear

Your comment makes no sense at all

just because sales are analysed on a different basis (let’s say customer location for the sake of argument) doesn’t mean the rest of financial statements and indeed the company structure have to be aligned on the same basis. There’s lots of different ways of analysing information, doesn’t mean that basis is valid throughout the financial statement or that you can segment without making a series of arbitrary allocations and we have already seen complaints about allocations and tax.

But sales data would give us a clear impression on his misleading the rest of the accounts were

But the issue isn’t sales it’s taxable profit and with due respect (specialities exist for a reason after all) if you had worked as a management account in a large MNE you might be more aware of the issues and difficulties.

Even sales represents some problems:

Company A uses a distributor for the EU so all sales are to the Ireland HQ and are shipped to their warehouse in France. Do they account for end users sales (individual countries) or does Ireland receive the benefit of France or a mixture of Ireland and France. What if Company A has a warranty centre in Germany so has costs, should they have matching revenue? What if the distributor outsources AP to another country outside EU?

Company B based solely on UK writes a report for Company C which is a MNE with UK HQ, report deals with structure in 10 countries and recommends changes that impact 4 of them. How does Company B account for country sales, even then if it’s all UK how does Company C allocate the cost?

Have a look at US state sales tax for some real world examples, can be a pain, as an example sale to a subsidary company in another state may have to be recorded as a state transaction if their HQ is in same state as you are and there are still ongoing issues over online transactions, NY in particular has been aggressive over what constitutes a ‘presence’

I have been a practitioner (senior partner), director of numerous companies, campaigner, author, creator of country-by-country reporting and now a professor of politcial economy

And yes, I do understand management accounting

And unitary tackles the issues you note, which are only really a problem in arm’s length TP

Don’t think I’m against this, I agree that tax rules need to catch up with real world changes and situations and better transparency in reporting (including improved stakeholder reporting). Just don’t underestimate how long this could take and what will be involved to make it useable. There’s also the issue that the more complex the system the more ways can exist to game the system. In some ways improving the methods of avoiding sales tax may be more productive, as long as some tax revenue is being generated from economic activity in an area and attributable to that area should we worry about sharing the CT on the profit element.

Everyone always tells me things take forever

I waited 11 years for country-by-country reporting in tax

I can wait a few more

all good things are worth waiting for as my grandparents used to say