The Independent has made a bit of a splash this morning on the fact that George Osborne has mislead parliament on the amount of tax recovered by HMRC from its anti-avoidance activities. As they note:

George Osborne is facing calls to apologise in Parliament after the official statistics body ruled he used “inappropriate” figures to trumpet the Government's success in cracking down on tax avoidance in the last Budget.

The Chancellor told MPs in March that HM Revenue and Customs was “collecting twice as much [tax] as before” through new measures to target super-rich individuals and multinational companies, who employ expensive accountants and lawyers to shelter their vast wealth in overseas tax havens.

The claim was eventually published here. And as I wrote at that time:

What we actually have, it seems, are relatively small tax recoveries and massive claims for the impact of new tax legislation in deterring tax avoidance and evasion.

Now the The Independent and Private Eye report that they referred the matter to Sir Andrew Dilnot, head of the UK Statistics Authority, who has now concluded that direct comparisons between past figures and those that George Osborne claimed were similar was “inappropriate”.

I'd go further. I reiterate that the claims made by HMRC were simply inappropriate. Again, as I have said before:

I have no problem with effective new tax legislation — which is why I propose it — but to claim [any saving from new legislation] is the result of tax compliance activity is, to be polite, political fantasy and a PR department's figment of the imagination. That's firstly because legislation is parliament's responsibility and maybe HMRC should remember who it is working for and secondly, it's hard enough estimating tax gaps well (and HMRC are lousy at it) but it's nigh on impossible to estimate the impact of new legislation, whatever HMRC would like to claim. The result is that at best this number is simply made up and the whole basis of this claim is bogus.

In fact, as we now know, HMRC also actually got the figure wrong: it had to be corrected in their annual report for significant overstatement.

But that is still not the point. The point is whether or not the figure had any substance in fact. I did an FoI in June to try to find this out. It's detailed here. HMRC take a very long time to respond, and when they did I was on holiday (yes, I have them, even if you don't notice) and I have been remiss in publishing it. Anyway, now it's time to correct that. Their reply is here.

You will notice that they, in effect, avoided an answer to most of the questions (displaying in the process an alarming lack of readily available facts to support the claims they are making given that it is repeated so many times in their annual report), referring instead to that 2013/14 HMRC annual report as if that alone was a statement of fact for which they needed no furrther supporting evidence.

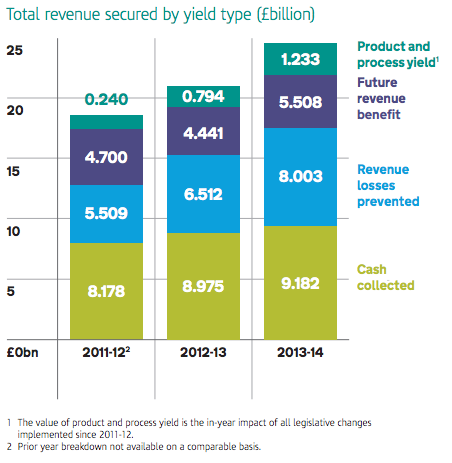

And in that report we find that it is claimed by Lin Homer that there were (page 6):

record compliance revenues of £23.9 billion, against £20.7 billion in 2012-13

and that these were made up (I use the phrase wisely in view of the apparent difficulty HMRC have in explaining this data in their FoI response) as follows:

So what we now see is that actually HMRC collected £9.2 billion, and not £23.9 billion. That's all the revenue they got. Revenue, after all, is cash.

It may be useful to estimate the future impact of current action. I do not dispute that. It suggests the benefit of undertaking it. Again, that's perfectly sound management activity. It's even appropriate to measure the impact of legislation. I would encourage it. But that is not and never will be revenue and to claim it it might be is utterly bogus and a misrepresentation of the facts.

HMRC are lousy at estimating the tax gap, but they don';t have to prove it by firstly making figures up and secondly not having the data to justify reasonable questions after they have done so.

But now we know why HMRC need a service at Westminster Abbey: one hopes they'll be asking for their sins to be forgiven.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard,

What do you think of the IMF’s Technical Assistance Report assessing the HMRC’s Tax Gap Analysis,October 2013? Do you believe it’s a thorough and comprehensive analysis or is it bogus?

Wayne

It’s diplomatic

But actually quite critical

In summary it says they’re not bad at finding errors in returns they get but not at all good at finding anything not reported

So they find the overclaimed motor expenses in self employed tax returns, but not the person who fails to report they are self employed at all

And the latter is the real problem

And remember, they did this as consultants and consultants are never rude to their clients

More in report coming out 23/9