I liked this cartoon in the Guardian yesterday (deliberately small, click here for original):

The sentiment is spot on: Cameron and Osborne talk tough on tax but let Vodafone off tax on its gains and at the same time a Tory organised filibuster (in which a minister took part) talked out the UK Corporate and Individual Tax and Financial Transparency Bill on Friday which is designed to tackle tax avoidance and tax abuse by greater transparency of the exactly the type Cameron claims to support, but which he clearly does not.

As the Observer noted on Sunday (echoing comments I have made, many times) that the UK has provided a:

crescendo of tax reforms that can be traced back 14 years to the then Labour government and the abolition of advance corporation tax, followed later by measures such as the introduction of SSE, and by further tax breaks on dividends (2009) and on foreign branch companies (2011).

More recently, George Osborne has been presenting corporate tax accountants with yet more sweeteners. These include more generous tax deals for research and development companies in the UK; a special low-tax regime for patent-owning businesses; and a fresh, multinational-friendly approach to offshore finance subsidiaries.

Add to that the chancellor's staggered reduction of the main corporation tax rate — scheduled to tumble to 20% by April 2015 — and the cumulative effect is starting to turn the heads of business leaders around the world.

It amounts to the creation of tax haven UK - form which move, it should be noted, Labour was not exempt, as I argued in 2007.

Ad the Observer also notes:

[T]he blossoming appeal of London to foreign multinationals has not gone unnoticed in Washington.

What particularly angers Americans is seeing David Cameron join German and French leaders on the G20 stage on Friday to high-mindedly champion international tax co-operation initiatives, through the OECD, aimed at halting big-businesses tax avoidance.

Cameron and the UK are increasingly part of the tax problem, not the solution, the Americans privately grumble. Justifiably so. Cameron and Osborne need to be more honest about their aggressive tax competition policies.

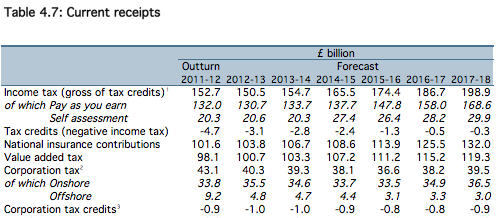

Absolutely right. And this is, of course, why the tax yield from corporation tax is forecast to fall in real terms in the UK over the next few years even as recovery is predicted. This is the table of forecast tax receipts from the March 2013 OBR projections:

Income tax increases by 30%, PAYE by 27%, self employed income tax by 47% (as more people are forced into marginal work, no doubt), national insurance by 30%, VAT by 22% and onshore VAT 9the bit excluding the offshore North Sea element) by just 8%.

That's not chance. And that's not flatline growth either or self employed income would not rise so much: no, this is the result of policy, tax cuts and incentives given to capital - none of which have produced a penny's return for the UK as yet, which is why Osborne has been reduced to creating a housing boom instead.

This is tax haven UK.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

A bit unfair to say they ‘let Vodafone off tax on its gains’. That’s just rules they inherited. I suspect they’re not minded to change the rules, but that’s another matter.

R&D and patent box … Hmmm … Something I am learning about fast at the moment in my job ….

The rules, as far as I can make out, were introduced to a large extent to appease/help certain industries and a few large UK plcs were pushing for it.

I can understand a desire to compete with overseas fiscs (Dutch 5% regime for example) but it seems to me the UK scheme is extremely generous as regards the activities it covers. And if your profile fits, then the regimes will reward pre-existing activity. And rationally, why should pre-existing activities get an incentive – Surely an incentive should target/reward new activity and investment only.

Unless examples are given points cannot be made

It would be like opposing slavery without mentioning slaves otherwise

Not 100% sure what you mean.

I was meaning that the patent box regime is extremely generous. And it’s not really an incentive scheme.

It is certainly easier to fit into the UK Box than it is into the Dutch box. For example, in the UK you only need to have licensed in patents whilst in Netherlands you have to actually own them in Netherlands. The conditions around activities you have to undertake are also (it seems to me) more generous in the UK scheme than the Dutch scheme.

And what I was suggesting is wrong about the UK regime (and probably the other EU regimes too) is that if you have a pre-existing business that owns (or licenses in) patented products and you are doing all the things that meet the various conditions, then all you effectively have to do is tick the box and hey presto you get a 10% tax rate.

Conceptually (to me) that is not an incentive, which is what I thought the idea of the regime was – an incentive to encourage investment into the UK. To me all it is, is a relief and/or a very low tax rate – i.e. tax haven UK. To my mind an incentive should encourage investment and so should only apply to new activity/investment coming into the UK.

I can imagine some companies may change their business models to benefit from eth regime, so the regimes may be adding some benefit. But if Big Pharma plc suddenly goes from paying tax at 20% + down to 10% on its current business model, without changing anything then where’s the incentive in that? That’s just giving them a very nice tax break.

Alternatively, if you were asking me to name and shame the industries and/or plcs who helped push through the patent box regime, then I don’t think I need to do that it’s pretty much a matter of public record.

If I have missed the point entirely, then apologies. If you elaborate I can address it ïŠ

I get your point now