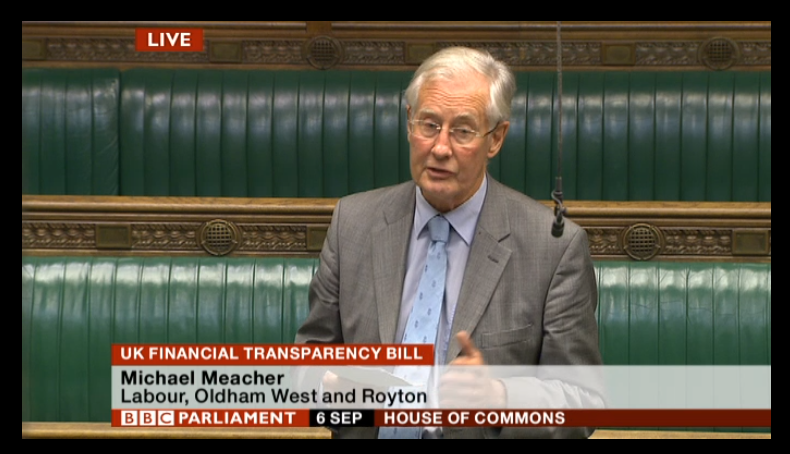

Michael Meacher (who is speaking on the subject of the UK Corporate and Individual Tax and Financial Transparency Bill in the House of Commons as I write) had this letter published in the Guardian this morning:

Despite the budget deficit not reducing over the last three years, the government has still not tackled the huge black hole of tax avoidanceand evasion (G20 expected to sign off tough anti-evasion pact, 5 September). That's why I am promoting a bill to ensure that the tax liabilities both of the wealthiest individuals and the biggest corporations are made public and that the beneficial owners of companies who hide behind nominee shareholdings are also made known. Such tax enforcement could raise tens of billions of pounds for the exchequer.

First, the bill tackles the secrecy shielding the tax affairs of both large companies and wealthy individuals by requiring the tax returns of the top 250 in each group to be put on public record. That data would enable the tax abuse currently costing the country at least £35bn a year to be effectively addressed for the first time.

Second, multinational corporations have hitherto hidden their activities behind complex and often secret corporate networks which conceal their tax liability, especially if a subsidiary is incorporated in a tax haven. The bill requires that any UK multinational corporation must publish the accounts of all its subsidiaries on public record.

Third, the bill requires that companies identify their beneficial owners and pass these details to Companies House. To ensure they do, banks will also be required to report the information they collect under money-laundering regulations to Companies House which will then publish it, including the real trading address of a company, who its directors and beneficial owners actually are, and where they're located.

Fourth, the bill would then grant HMRC the power to access a company's bank account data so that estimated tax assessments could be raised if the company had refused to supply accounts, and the directors and beneficial owners would then be responsible for paying the tax. The bill would also extend all these obligations to the tax havens in UK crown dependencies and overseas territories.

Michael Meacher MP

Lab, Oldham West and Royton

I did, of course, write this Bill.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Hi Richard,

what is the best (and simplest) way to define ‘taxation’?

I’m thinking “a legal obligation”.

What do you think?

Thanks!

A legal obligation to make payment imposed by law for which there is no direct exchange of value

Thanks for that.

Do you think there is any sort of reasonable private-sector analogy for taxation? A means-tested club membership fee (a membership that your children automatically inherit) perhaps?

No

Sometimes we should accept there is no market equivalence – and that is OK

I ask because I occasionally come across the inevitable internet “libertarians” on my journeys through cyberspace.

Don’t we all

Back in 1973 at the time of economic and political mayhem I note that former colonies set out to be tax havens quite openly and to all intents and purpose with the agreement and support of the UK government. Just why in this post Imperial period did our government, already in financial difficulties, cheerfully allow so many dependencies and former colonies to embark on tax avoidance strategies that could on only make the UK’s problems eventually worse?

Short term thinking by an unconnected government that thought that this would get the cost of them off the Foreign Office’s books

Then came foreigne exchang controls and Section 765 to try to limit people/companies moving money out of the UK – I think, my history is a little unclear on timing.

Section 765 was a great tool for HMRC to capture tax plans prior to implementaion – Not all of then, but many. And it had real teeth – criminal liability. Now who repealed that I wonder …

I think I must have missed something. Surely this policy will not show up the to 250 tax dodgers, because they have successfully disguised their wealth. Will it not simply show the top 250 rich honest people and companies?

Hang on – read the detail

That’s very unlikely the way I have written it

I’ve just read Michael’s bill was talked out. He mentions Jacob Rees Mogg talking out the bill. I’d like to know who the four Tory MPs were who did the filibuster before which only gave Michael an hour to present the bill.

I wonder on whose behalf the Tories were trying to kill the bill?

Their City funders I expect. Yet we shall hear more about undemocratic unions whatever the result of the Falkirk enquiry.

Blog soon

I heard last night on Radio 4 news that the bill had failed due to lack of time.

Now what happens? I can’t find any news anywhere on the web about it failing. Anyone know where to look?

I’ll blog soon