It's time to look at yet another piece of gross misinformation provided by the CBI when launching its new tax report 'Tax and British Business - Making the Case' (which it spectacularly failed to do). The CBI claimed:

The long view is a revealing one. In 1982-3, the main rate of corporation tax was 52 per cent and yielded tax revenues equivalent to 2 per cent of GDP. In 2010-11, the corporation tax rate was 26 per cent, half what it was, but yielded 2.8 per cent of GDP, almost half as much again.

The implication was clear, as they said:

The argument that tax competition is a race to the bottom in the long term is not supported.

What they wanted people to believe, very clearly, is that UK business now pays more in tax than it did in 1982. The claim was certainly that the proportion was not falling.

But the claim, as with much else that they have said, is misleading at best. There are two good reasons. First, Nigel Lawson reformed the tax base when cutting corporation tax rates in the 1980s. In the process he eliminated automatic 100% first year capital allowances and he abolished stock relief. As a result taxable profits skyrocketed overnight. It's just not possible to compare tax yields after that radical reform with those before it - corporation tax before and after that event were utterly different, and there were those like John Whiting at the CBI event who knew that. The claim to make a comparison was then severely misleading.

Second, the proportion of profit in the economy has increased dramatically. Now admittedly, I can't find the data tonight and it's tedious to extrapolate it form the ONS web site (which is a nightmare). So I'll quote from Howard Reed writing on this issue for the TUC instead, who looked at pretty much the inverse ratio, the wage share over time:

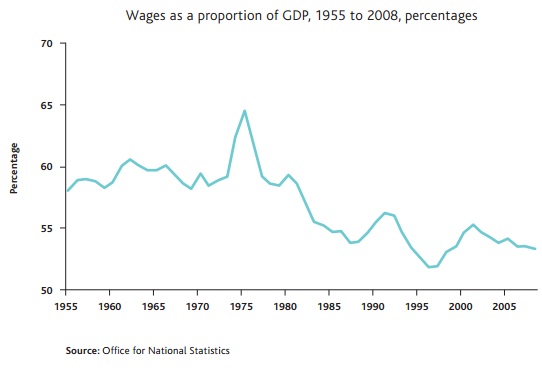

Central to these shifts has been the role of the wage-share. Figure 1 reveals two distinct characteristics of the post-war behaviour of the proportion of national income going towage-earners. First, there is a link to the economic cycle with the share first rising and then falling, with a lag, during recessions. For example, it rose slightly in both 1974—5and in 1990—91 before falling back. This may be because at the onset, profits are more sharply affected than wages. Eventually however, the wage share falls as unemployment continues to rise, firms continue to cut costs and profits recover.

The second and most significant trend is of a sustained decline since the mid-to-late 1970s. The wage share held its post-war level at between 58—60 per cent until the early 1970s and then rose to a high of 64.5 per cent in 1975. It then started drifting downwards reaching a post-war low of 51.7 per cent in 1996, largely as a result of the rise in unemployment in the slump at the beginning of that decade. From then it recovered slightly to reach 55.2 per cent in 2001 before slipping back to 53.2 per cent in 2008 — close to its post-war low in 1996.

Taxes on profits as a proportion of GDP have been broadly static.

But since profits are rising as a proportion of GDP that means tax a a proportion of profit is falling and that does not support the CBI claim - it contradicts it.

The labour share on the other hand has seen its share of tax rise as its share of GDP has fallen.

All this the CBI failed to point out, peddling another pack of misinformation instead and making claims about the race to the bottom that cannot be justified.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here: