As I noted yesterday, the UK’s HM Revenue & Customs have decided not to publish an Annual report on their performance this year. We’re going to have to make do on their accounts alone.

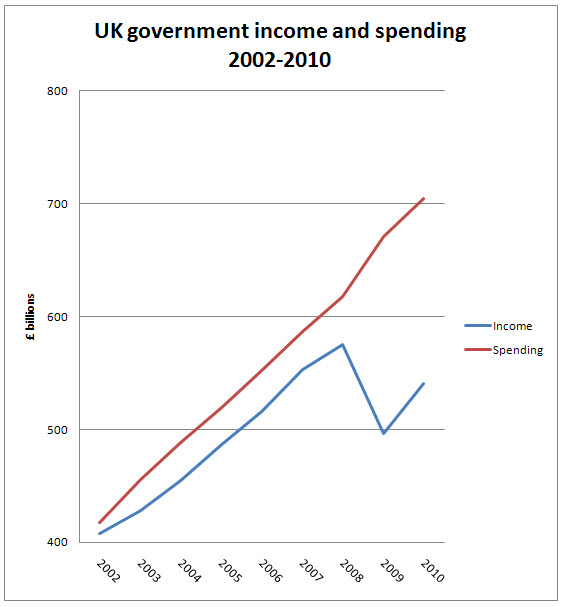

Now I think that’s a shame. I’m not alone, I suspect, in noting we’re a bit short of tax revenue right now. The graph looks something like this:

That’s a whacking great shortage of income the UK faces — and not the overspending everyone claims.

That means HMRC should be under some pressure to tackle the Tax Gap. And they admit they are. They say in their accounts (page 4 — it’s that important):

The economic climate continues to pose a challenge to our business and our work on closing the tax gap. It affects attitudes to compliance. It has led to increased levels of criminality resulting in reduced cash flow to the Exchequer. It contributes to more payments being made late, with existing debts more difficult and costly to collect. We continue to deploy resources across a full range of interventions to disrupt fiscal crime and abuse and to level the playing field and provide assistance to honest businesses and individuals.

Note:

increased levels of criminality

and

resulting in reduced cash flow to the Exchequer

So, given that mighty big hole in the cash they’re failing to collect what would you expect any rational tax authority to do? Indeed, what would you expect any reasonable business to do to make sure its top line came in? Yes, you’d expect them to take on more people. Like it or not debt recovery comes down to people, phone calls, working cases, knocking on doors and getting heavy at the end of the day. So too does tax recovery.

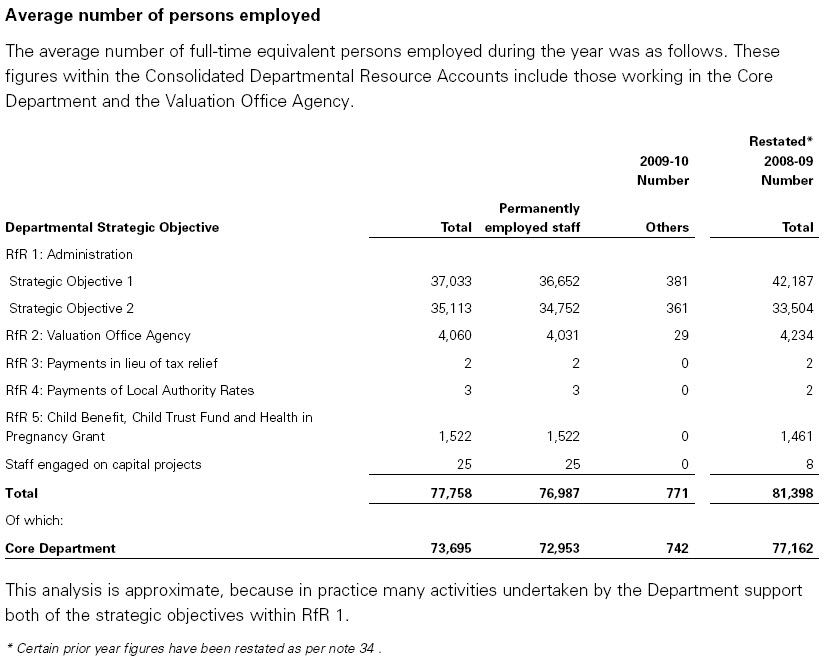

What did HMRC do? This is the employee number note in the accounts (note 10):

It helps to know (because it’s not noted anywhere near this note) that Strategic Objectives 1 and 2 are:

Strategic Objective 1:

Improve the extent to which individuals and businesses pay the tax due and receive the credits and benefits to which they are entitled.

Strategic Objective 2:

Improve customers’ experience of HMRC and contribute to improving the UK business environment.

Which makes clear that 5,154 staff dedicated to ensuring that tax was collected lost their jobs in 2009-10. That’s 12.2% of the total. Sure, 1,609 were employed making us feel better about it — but front line staff hitting the target of collecting tax revenue fell by one eighth in a year when the highest economic priority in this country was collecting more tax.

The saving as a result was, at most, £124 million (also note 10 to the accounts).

And the result was the tax gap got bigger. How much bigger is a question I will return to in other blogs, but lets use HMRC’s own estimate for now (page 100)

Latest estimates suggest that in 2008-09 the tax gap grew by £2.3bn from the baseline year 2007-08. £1.6bn was due to an increase in debt as cash flow slowed during the recession. Indications for 2009-10 are that the VAT gap is reducing but has not yet returned to 2007-08 levels.

In other words, the tax gap increased when the target is that it should have reduced by £7 billion. debt is not being recovered, criminality is rising, cash is being lost, and to save £124 million at least £2.3 billion has been lost (give or take — I note the timing lags). So, again, give or take it seems that for every £1 saved £18.50 has been foregone or be borrowed at a time when we’re told the quantum of borrowing is also threatening our well being.

And this is before ConDem cuts come into play.

None of this makes any sense at all. So my questions are:

- Why in the face of the need to collect every single pound of tax owing to HM Treasury did HM Revenue & Customs cut one eighth of their staff engaged on tax collection in 2009-10?

- Why did HMRC reduce front line tax collection staff by 5,154 in 2009-10 with a total saving of £124 million when they admit that during the course of that year there were increased levels of criminality and resulting reduced cash flow to the Exchequer?

- Why in the light of increasing tax debt in 2009-10 did HMRC reduce the umber of staff engaged in tax collection?

- When will HM Revenue & Customs achieve its objective of closing the tax gap?

I’m sure more questions will occur in due course, but this makes no sense at all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

In the context of one of your other postings it makes perfect sense.

Remember that government thinks benefit fraud is regarded as 624 (I think) times more important than tax evasion. And now take a look at http://www.telegraph.co.uk/news/newstopics/politics/7933357/Iain-Duncan-Smith-receives-timely-boost-from-David-Cameron-over-welfare-reform.html

[…] But HMRC sacked 5,000 last year. […]

[…] course Hartnett has to be pragmatic — he’s one of the Board of HMRC who got rid of one in eight of their front line staff last year who were likely to tackle tax avoidance. Of course he has to be […]