As noted yesterday, HM Revenue & Customs have dispensed with their annual report this year as the Cabinet Office say they don’t need one and so we must make do with the HMRC annual accounts alone.

Those accounts provide some quite bizarre reading. Take as example, the statements from the report on DSO indicator performance on page 100.

First you have to find what DSO indicators are. DSO indicators are explained on pages 14 and 15 of the accounts and on page R15 of the National Audit Office appendix to the accounts to be Departmental Strategic Objectives. The difficulty is that the accounts say there are six of these DSOs and the NAO say there are two. It’s not a good start. Who is right? Who knows? It seem the additional four are voluntary — but are they DSOs then? I really don’t know. I do know that there seems to be no reporting against the additional four; just the first two get mentioned when it comes to assessment of outcomes — so why are they referred to by HMRC in the their preamble to the report then? Again, I don’t know. The confusion is typical of these accounts.

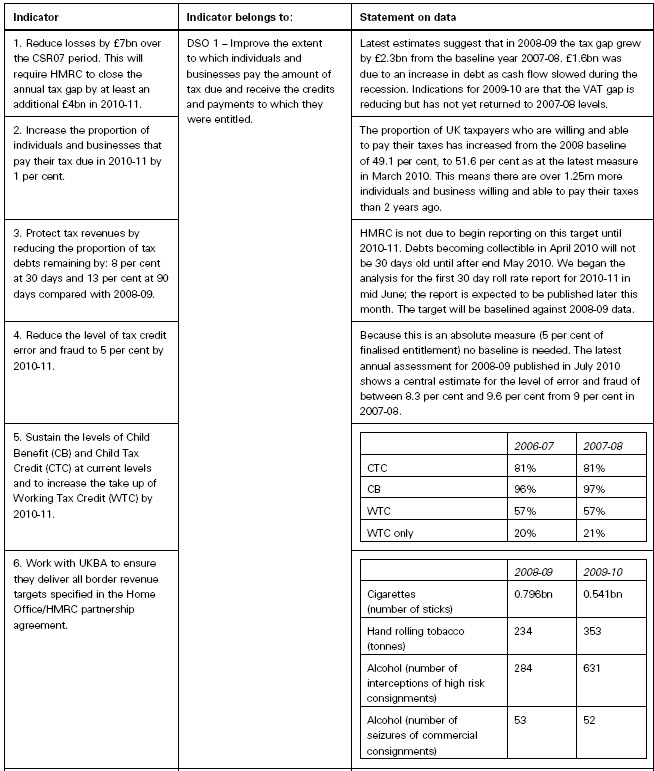

Nor am I enlightened by these statements on DSO 1. That DSO is, according to the National Audit Office:

Improve the extent to which individuals and businesses pay the amount of tax due and receive the credits and payments to which they are entitled

And these are the outcomes:

I’ve already noted that the tax gap grew — and that this must be the result of cutting front line staff.

But let me for now look at statement 2. I might get to the others in due course. The wording of the objective is bizarre in itself:

Increase the proportion of individuals and businesses that pay their tax due in 2010-11 by 1per cent.

I would assume that this relates to tax evasion. It’s hard to see what else it might mean.

But the response clearly implies something else:

The proportion of UK taxpayers who are willing and able to pay their taxes has increased from the 2008 baseline of 49.1 per cent, to 51.6 per cent as at the latest measure in March 2010. This means there are over 1.25m more individuals and business willing and able to pay their taxes than 2years ago.

Take the bizarre extrapolation first. An increase in compliance (whatever that means here) of 2.5% apparently translates to 1.25 million individuals and businesses. It is that this implies there are 50 million taxpayers in the UK. And yet there aren’t anything like that number. According to HMRC there were 30.2 million individual taxpayers in 2009-10. There were also 1.94 million VAT registered business and according to Companies House something like 2.6 million companies. Add it up how you like you can’t make 50 million. So what do the HMRC accounts mean?

And what too does it mean that of all these individuals and registered entities only just over half are willing and able to pay their taxes? How do HMRC know? Are the others on tax strike? is the tax gap actually near enough 50% of total potential revenues as a result?

I’d love to know because right now this information is incomprehensible to me.

So, let’s go for some more potential parliamentary questions to which I’d love to see answers:

- How does HM Revenue & Customs define a willing and able tax payer in the context of its Departmental Strategic Objective 1?

- How does HM Revenue & Customs assess the number of willing and able tax payers in the UK?

- HM Revenue & Customs says that only 51.6% of all UK individuals and taxpayers are willing and able taxpayers. Does this mean the others are unwilling, but able to pay their tax or willing but unable to pay, or both? Can the figure for those not willing and able be split down into these categories?

- HM Revenue & Customs suggest, by implication of their analysis of willing and able taxpayers in their annual report for 2009/10, that there are 50 million potentially willing and able taxpayers in the UK. Can they provide an analysis of this total figure split by whether the taxpayer in question is an individual or a corporate body and by the type of tax HM Revenue & Customs believes they are responsible for paying?

- If HM Revenue & Customs believes that 48.4% of UK taxpayers are unwilling or unable to pay tax in the UK why does it only send tax returns to about 9 million people a year?

- If only 51.6% of UK taxpayers are willing and able to pay tax why aren’t the remaining 48.4% willing and able to do so?

- How does HMRC’s assessment that 48.4% of the UK population of taxpayers is unwilling or unable to pay tax impact on their assessment of the tax gap, which presumably approximates to that proportionate figure as a consequence? If not, why not?

- If almost half of all UK taxpayers are unwilling or unable to pay their tax why is HM Revenue & Customs cutting the number of overall number staff engaged to persuade them to do so, and aren’t those cuts tantamount in the light of this evidence to accepting that many of these people will never pay tax as required by the law?

- What action is HMRC taking to increase the number of people in the UK willing and able to pay their tax?

That will do for now.

I think you get my drift.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The decision by HMRC not to publish an annual report really is appalling. I wonder if there’s any way of forcing a judicial review of this decision? Is there anything in current UK law which mandates HMRC to produce publicly available information to a certain standard?

The Fawcett Society has recently launched a legal challenge to George Osborne’s emergency budget on the grounds that it didn’t include any analysis of gender impacts, and hence was in breach of the equality laws. Maybe the government’s decision not to publish an HMRC annual report is in breach of regulations? I’m not a lawyer so I have no idea of the technicalities – but this line may be worth investigating.

Three probloems that i see Howard

a) Time

b) Money

c) Are there better ways to get the data

I haven’t got a and b so I am opting for c if possible

It’s very strange – what on earth can that “willing and able” figure mean? It surely isn’t suggesting that almost half of taxpayers are evading tax, or in default? But what else can it mean?

FOI application or Parliamentary question would seem the easiest ways to go.

[…] to them. So let’s take another one, this being objective 3 against DSO 1 (to understand the jargon, go here). DSOI 1 says HMRC must: Improve the extent to which individuals and businesses pay the amount of […]

I’d be interested in seeing how many people they asked to get these results. I don’t recall anyone asking me if I was ‘willing and able’ to pay my taxes and if they did, it would have been a firm no to the first and a reluctant yes to the latter. I think the system is fair so I can’t imagine how people who are paying taxes are struggling to do so.