The far right have always liked to argue that my work on the tax gap is wrong because I categorise tax avoidance as part of the tax gap. But this argument is entirely wrong.

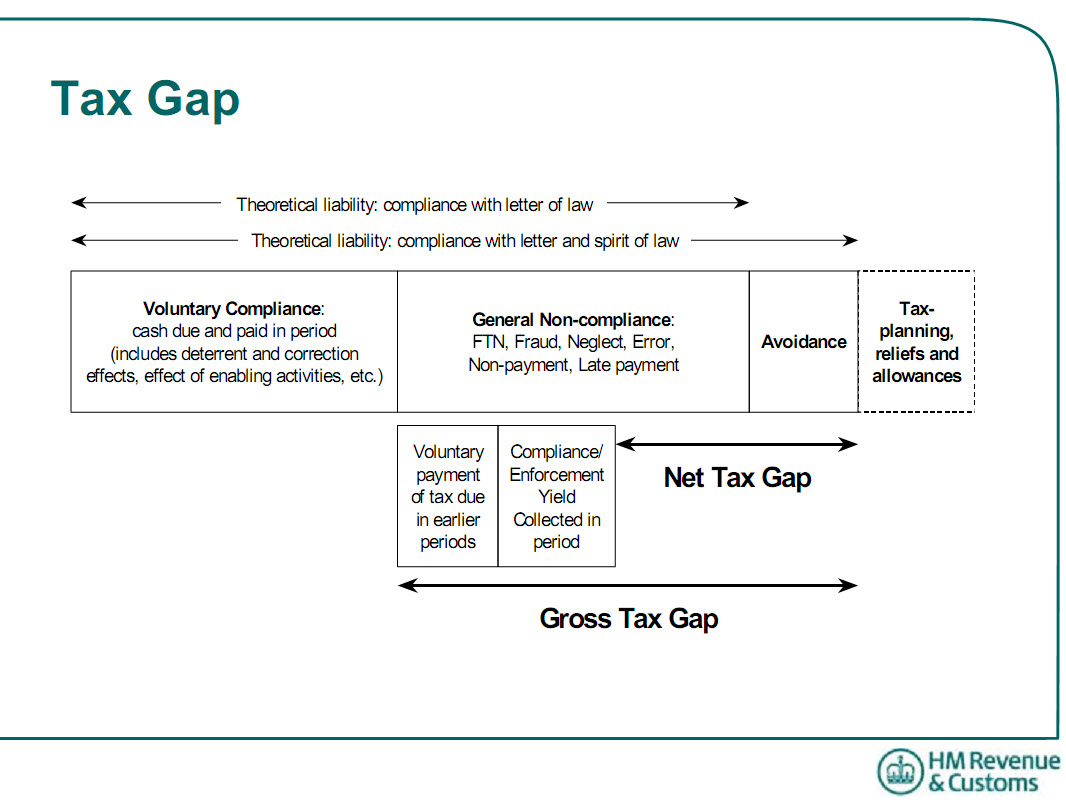

First, let’s refer back to the Revenue definition of the tax gap. It is this:

Note that the Revenue quite categorically say that tax planning — that is using allowances and reliefs provided in law for the intention that parliament considered appropriate (in my lexicon, tax compliant behaviour) is not part of the tax gap. I completely and utterly agree. I have never once suggested otherwise.

And note that David Gauke MP, the minster whose comments I am criticising, did in his speech on 16 June say:

One of the largest factors contributing to the tax gap is avoidance. Tax avoidance is estimated to contribute around 17.5%-around £7 billion-of the total tax gap. It is worth making that point at the beginning because, although those contributing to this debate today have not fallen into this trap, there is sometimes a conflation between the tax gap, which is a considerable figure, and tax avoidance, which is still a considerable figure but is only part of the £40 billion figure. None the less, £7 billion is a substantial sum, and this Government are determined to reduce it as far as possible.

That, incidentally is a sum £2.2 billion higher than HMRC suggest, but let’s ignore that right now and note instead that he is explicitly including the abuse of legitimate tax allowances and reliefs in his definition of the tax gap. There is not a whisker to be found between us on this point.

Therefore all those who wish to argue otherwise are straightforwardly wrong. Worse than that, they are deliberately peddling misinformation. It is, of course, a standard ploy of far right politics. If in doubt read this book.

But let’s also return to the real issue. The only area where this can have any consequence for my work is with regard to corporate tax avoidance. With regard to personal tax avoidance, as noted in my latest work, even the Chancellor has clearly dismissed the figure produced for personal tax avoidance by HMRC as being wholly unrealistic — having suggested during his budget speech that all of it can now be completely attributed to some specific capital gains tax abuses, which makes clear how significant an underestimate the Revenue offered when publishing their own latest estimate in December 2009.

On corporate tax avoidance though, as I have noted in my report issued yesterday, new data does suggest that there is reason to now go back and reappraise my estimate, but that is because HMRC appear to have responded to the debate which they acknowledge I and the TUC created by publishing new information.

But, having even said that, it is readily apparent first of all that HMRC do consider companies are tax avoiding abusively using the definition I use — because they acknowledge that fact and suggest that the abuse amounts to at least £3.4 billion a year. I, of course, suggested it to be £12 billion year on the basis of an assumption that the abuse I detected in large companies might be extrapolated to small companies. The new HMRC data suggests that this extrapolation may (and I strongly emphasise the may) not be appropriate. However as that would lead to the paradoxical situation where small companies are paying tax at a rate that almost exactly accords with the anticipated rate — which my hypothesis suggests they should — but large companies are paying instead at almost exactly the rate my work for the TUC predicted this still leaves an enormous range of questions unanswered — and my basis hypothesis clearly extant. That is hardly an indication that I got my work wrong. And however interpreted the new data does not support the HMRC estimate of the loss to avoidance: that would be about £7 billion on this basis — assuming that is that the avoidance I’m finding is not hidden undetected (as it may well be) in the Revenue’s measure of taxable profit.

In other words, the maximum likely adjustment that might now be required to my original total estimate (and I have not accepted this is necessary as yet) may be £5 billion.

That’s £5 billion in a total estimate of £120 billion and for reasons wholly and utterly unrelated to the claims far right commentators make. Given that any estimate of the tax gap is just that — an estimate — I’d be very happy with that outcome even if this variance is proved justified — which it has not been as yet.

So, let’s summarise this: it is clear that the far right have no idea what they’re talking about, clearly can’t do statistics or appraise them, do not understand what tax avoidance is or, alternatively, peddle straightforward incorrect information for their own political purposes.

Actually the “or” in that last sentence is probably misplaced. It seems very likely it should be an “and”.

Either way: they’re wrong. And like all pedlars of myths should be ignored.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“Note that the Revenue quite categorically say that tax planning — that is using allowances and reliefs provided in law for the intention that parliament considered appropriate (in my lexicon, tax compliant behaviour) is not part of the tax gap. I completely and utterly agree.”

So why do you include such reliefs and allowances as part of the tax gap? By multiplying profits by x% and comparing them to the total tax take that’s precisely what you’re doing. And you’ve never once answered this point. Instead, you write something else which has got nothing to do with the point being raised – which, I’ve noticed, is a standard tactic of yours when faced with an irrefutable point.

Given the difficulty of obtaining this data (because this is stuff that the non-taxpayers would be keen to hide), plus or minus £5Bn or (£10 Bn even) seems a perfectly reasonable level of accuracy to me. It’s enough to make a material difference to the health of the country’s balance sheet.

Surely even rightwingers should be keen to address this, since from their point of view, cutting the tax gap could enable reduction in tax rates for everyone!

This comment has been deleted as it did not meet the moderation criteria for this blog specified here: http://www.taxresearch.org.uk/Blog/comments/. The editor’s decision is final.

This comment has been deleted. It failed the moderation policy noted here. http://www.taxresearch.org.uk/Blog/comments/. The editor’s decision on this matter is final.

@Peter

Because as I’ve shown time and again, I’m not

But even if I was, as I’ve shown, time and again, the result would be immaterial to the finding.

The MIAXIMUM difference is £8 bn in $120 bn

And I’d argue that maximum is much smaller than that

So you and your colleagues are making fatuous points to deny the fact that a massive problem exists

It will be noted that several comments have been deleted. Those who are abusive do not get their comments on here.

One who was profoundly abusive suggested I had made an error in calculations by ignoring double tax relief and that if taken into account the tax figures make sense.

My reaction is that anyone who believes that is utterly gullible. This claim is dependent upon an extraordinary claim of assumptions. The first is that foreign income is correctly calculated. I doubt this and think it a major cause of tax abuse. Second it assumes foreign tax is paid. Third it assumes that all other elements in profit have no avoidance inherent in them – which as I make clear I doubt – as does the minister, I would add

In other words – I reiterate my point that new HMRC data issued since I did, and no doubt because of, my initial work does require consideration in future revisions to my estimates. But equally it makes clear that allowances and reliefs are being used to claim deductions in UK tax bills which may not be justified. Nothing I have seen changes that view, but I will return to this issue later this year -0 looking, as is appropriate, at economic substance and not form (the HMRC figures dealing with the latter, of course, and therefore missing the point of the exercise)

In the meantime the froth generated is designed to do one thing – which is to detract from the facts. These are:

a) the tax gap is much bigger than HMRC estimate

b) w will never recover it all

but

c) massive action on this could eliminate the need for a wide range of cuts – cuts that those who write in abusive form want to impose because they wish to inflict that pain on society

Remember one thing – cuts aren’t needed. That’s the message they are denying

And maybe double tax relief is something we really need to look at again…….

@Richard M

I suggest that the next time you talk to HMRC you ask them about their Settlement and Litigation strategy. This is their key driver on whether they take action and ultimately litigate matters. They will only take action and/or litigate where there is a strategic risk to the UK tax base (in their judgement) or where they think they can win the case. There are still ridiculous examples where HMRC attack genuine commercial arrangements where their technical arguments are 1) tenuous at best and 2) the amount of tax at stake is minimal. If they want to change things they have the power to do so – if they can’t be bothered, it’s because either they think the tax take is small or (and sometimes and) it’s too much trouble to do so.

I also refer you to Bill Dodwell’s recent article in Tax Advisor highlighting some of the actions that HMRC have pursued that can, at best, be described as questionable.

@Richard

You are really asking to take your comment seriously when you quote Bill Dodwell as a source?

Turkeys don’t vote for Christmas

Bill Dodwell of Deloitte does not like HMRTC challenging his tax planning

You will really have to do better than that

@Richard Murphy

Regardless of your views of Bill Dodwell, I still urge you to read the recent article in Tax Adviser (it was in one of the last three three months). I think you will find that he quotes from publicly available sources about how HMRC have pursued taxpayers in distressed circumstances. I ask you, in the spirit of impartiality, to read the article and ask why yourself why these cases were pursued?

As the official journal of the Chartered Institute of Taxation and the Association of Taxation Technicians, you may not agree with all its contents, but you cannot argue that it is the pre-eminent journal for all tax professionals (HMRC included) that would not print speculation or unfounded rumour

I am obviously very naive. All the way through these arguments I don’t understand why the source of income; the labour used to produce the raw material; the extraction industry workers, both who work under tremendous physical human circumstance, and those that realise these naturally, or indeed, unnaturally wrought material resources, are treated like in a fashion that we; on the products of their toil can have arguments about whether or not they should be paid paid a fair wage, should have the countries where their labour are endured, where the whole process is environmentally mismanaged, can argue about the trifles of how numbers apply to bits of paper.

Really, we are a backward civilisation that thinks the propogation of these ideals are worthwhile.

Sure, we need the processes:

Human develeopment requires entrepreneurialism. It does not require exploitation….

It requires intelligence, not belligerence.

Human self-consciousness is precious, and needs needs nurture, not the idea that the fastest plants are the best plants in one’s garden.

Japanese Knotweed. That’s what the majority seem to prefer.

The first para ending got lost in system slowing edit dilemma, but the meaning is there i hope. CbC is the only way to start. After that more.

@Richard Murphy

Should tax advisors take you seriously?

What we seem to have here is two faction: the taxpayer/tax advisor alliance who are all charlatans and spend their time thinking of ways to cheat the fiscus and rob the hardworking but poor – but all legal. Then we have Richard Murphy and his organizations who detest taxpayers(and particularly their advisors) who do not pay tax in accordance with what Murphy, TJN, TUC and others deem to be proper, even if within the law. They are probably regarded as odd by the Big 4 (although I haven’t seen it in print.

Both sides are agreed that there are flaws in the tax system in the UK, and both have a lot to offer in one form or another. However, comments about a tax policy head of a Big 4 in the manner in which they were made is hardly going to move the debate forward now is it.

@Richard Murphy

the article to which i refer is in the June edition of Tax Adviser (Inside Track, page 7).

@JayPee

Oh come on

The FSA thinks these people failed in their public duty with regard to auditing http://www.taxresearch.org.uk/Blog/2010/06/30/auditors-failed-when-signing-off-bank-accounts/

And I can say, very happily, they do so time and time and time again with regard to tax

Richard, there appears to be some confusion (at least for me) about the difference between ‘tax planning’ and ‘tax avoidance’.

I understand that tax planning is taking advantage of tax benefits specifically legislated and indeed encouraged (e.g. for a particular type of investment). Tax avoidance is doing something else that is permitted by legislation but which (???). This is the point where I am lost.

If the difference is that the latter is somehow unintended by Parliament, then isn’t it entirely Parliament’s fault? The tax legislation is entirely its baby. It has the freedom and resources to legislate whatever it wants, whenever it wants, so if ‘unintended consequences’ arise, isn’t it Parliament’s responsibility to fix it? And if it doesn’t do so, doesn’t the fault lie squarely in the lap of Parliament with no excuses?

And if the unintended consequence becomes widely known and Parliament does nothing about it over an extended period, why can’t we draw the conclusion that Parliament endorses (or at least tolerates) the arrangement?

One question for you if I may: on a scale of 1 to 10 (1 being worst), how would you rate the Parliament in producing tax legislation. I am not referring to this (or any particular) Parliament, given that tax legislation is the product of work over decades. It is a general question about the standard of drafting as we have it.

The fact you want a General Anti-Avoidance Provision suggests to me you have indeed little confidence in the ability of Parliament to provide clear, comprehensive laws. Is this in fact your position?

My own view: Parliament generally is absolutely rubbish at writing legislation (not just tax legislation, though that is about the worst) — and the problem crosses party lines so I am not making a partisan point. I am a contract lawyer so I have some experience in judging clear drafting that avoids unintended consequences.

There is a very human nature side to the gap between the two tax gap estimates. As a tax authority you are measured by how much of the gap you are able to eliminate. If the tax gap is estimated to 40B, after you have recovered 20B (? I do not know the UK numbers), you are doing a fairly good job eliminating one third of the original gap. On the other hand, if you estimate the gap to be 120B after you recovered 20B, there must be some really really big fish swimming out there that you do not have the slightest clue how to catch. Working for the tax authorities, I would not portray myself like that. Would you?

I would not have included the nominal value of late payment in the tax gap. An estimate of NPV maybe.