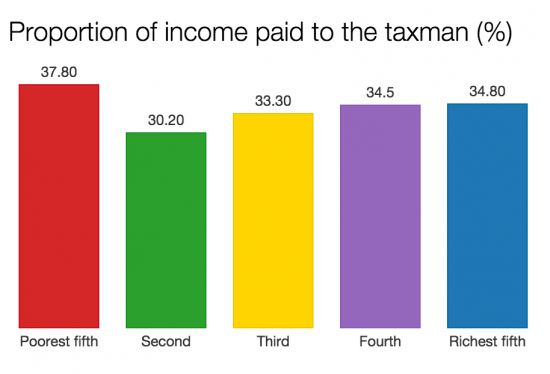

The latest data on household incomes and tax paid produced by the ONS has been neatly summarised in the Independent this morning and I am going to use their graphs here to summarise the message. The first graph is this:

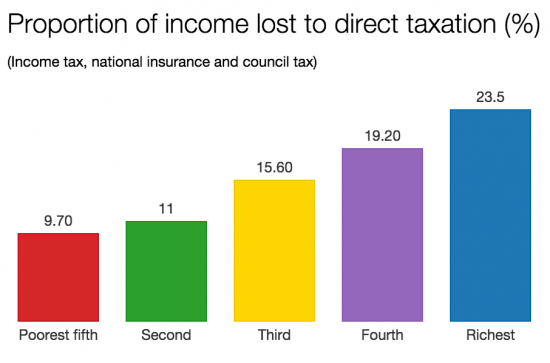

As has been the case in the UK for a long time, those least well off pay the highest proportion of their income in tax. That is not what most people think though. That's because we think of income tax as tax, and that's not true, although it is incredibly convenient for the government to suggest that it is, because this is the income tax data:

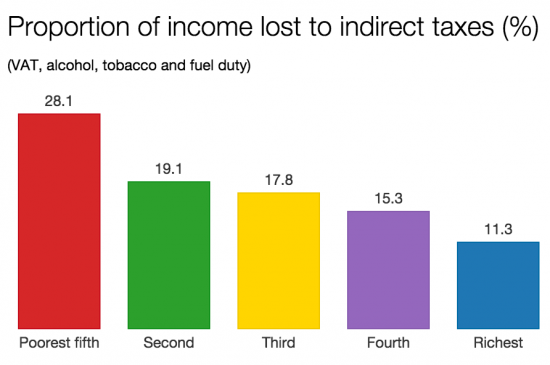

It looks like we have a progressive tax system. But don't be fooled. This is the graph for indirect taxes:

It is the combination that matters, of course.

And the combination is regressive at the lower end of the scale and flat for all practical purposes at the top end of the scale, at best. Despite which there are still calls for more tax cuts for the best off, whilst those on lowest incomes face benefit cuts, none of which have economic justification.

The reality is there is tax injustice in the UK. The question to ask is who will tackle it?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Successive governments have proven themselves both unwilling and unable. An estimated 250,000 people demonstrated in London, in protest of our governments ideological austerity program, which it has been estimated will see a low income family with two children lose £1,600 per year. The governments response to the demonstrators was to announce vague plans to cut in work benefits. Basically what they are saying is “you can protest all you like, we will do what we want,” even though they have no mandate for any of this and just 24.7% of the electorate voted conservative at the recent general election.

Going slightly off topic, but still relevant, our chancellor has announced he plans to sell off our 81% share holding in RBS bank to an Arab wealth fund. Lots of people have claimed this will be at a £13bn loss to the taxpayer, however when inflation and interest payments since 2008 are account for, the actual loss on our £46bn investment will be £32bn. On the 17% share holding in Lloyds bank already sold off, we made a £530million loss.

The only way I can see change happening is through a mass movement of the people towards a citizens convention on the constitution. A national convention involving people from Northern Ireland, Scotland, Wales & England, where we will create the first ever written British constitution. Written by the people, for the people. A peoples constitution.

Bang on Matt, I’ve been saying for months on this blog that a written constitution is way forward, however remote the chance of it happening it is without doubt what the UK needs.

Hi Richard,

Keep up the good work with this fabulous blog.

Have a look at how a journalist at the BBC interpreted the ONS data.

http://www.bbc.co.uk/news/33263496

What are your thoughts on his view of the ONS data.

Safe, in a word

BBC style

Thanks for the compliment

Even Adam Smith would agree : “It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion.”

But what to do. Raise the NI threshold perhaps. Smooth out the drop in the effective rate of income taxation when you cross that threshold around £42k – the one where NI drops from 12 to 2%. Although PAYE rises from 20 to 40, that increase can be deferred with good planning meaning taxes are regressive for some of what is earned above £42k.

The biggest step change though is on indirect taxes between poorest 5th and the next poorest group, so that needs a fuller analysis.

http://classonline.org.uk/docs/2013_Policy_Paper_-_Richard_Murphy__Howard_Reed_(Social_State_-_Idleness.pdf

Since the politicians are all at the blue end of the scales I doubt much can be expected from them.

Although wise people have never expected much from them anyway.

I expect it is too much to hope that a bottomless pit opens under parliament during a three-line whip debate, devouring the entire 650 fools?

I have to say I would preserve some of them

There are a minority of useful people in parliament

very useful, myth busting and simple representation, Richard. I think we should all keep a copy of this on a flash card that we can produce everytime someone comes up with the crap that the rich (poor souls) are paying for everything whilst the ‘poor’ lay supine scrounging of the munificence of these people! maybe a neon lit sign in Picadilly Circus would do the trick.

Richard

Are you genuinely unaware of the flaws in your analysis or are simply trying to manipulate the figures to mislead your audience?

1. Where does most of the income for the poorest decile actually come from?

2. Are you in favour of high taxes on cigarettes and alcohol?

There are no flaws in my argument

There are facts

One is I favour progressive racation

Why don’t you?

Of course there are flaws in your argument. They are so obvious that they don’t even need pointing out.

In which case let’s assume you don’t know them

The bottom 50% of households pay more in tax than they receive according to figures this week. We can change the tax code so they pay zero tax and just reduce their benefits accordingly. Your graphs will look highly progressive if the bottom 50% pay nothing I imagine.

However, after this change the bottom half still won’t be any better off.

Pay tax/receive benefits. It’s just moving money about. Ultimately the people you paint as victims of the system will always be net recipients.

Ah, so the flaw in my logis is wishing to help these least well off?

And you are also using CPS logic – which is itslef just flawed. You ant to cancel all pensions do you?

Nice….

The point is we can fiddle with tax rates and benefits levels and make your figures look far better. Graphs showing that they pay a big proportion in indirect tax don’t change the fact that they are net recipients however you set it up.

Are you saying you wouldn’t rAther that was not the case?

Do you have any clue what that implies?

And what levels of income you are talking about?

Presumably these figures do not include transfers? As mentioned by the BBC, the net income of households in the lowest three deciles is increased significantly if you take benefits (effectively negative taxation) into account.

See figure 4 of the ONS paper – the lower two quintiles receive net benefits of around £9,000 each year, and the middle quintile is £3,500 ahead. All paid for by the net tax burden on the households in the top two quintiles (which is as it should be, of course).

So, direct taxes are properly progressive, but indirect taxes are regressive. What to do? Food is already zero rated, and domestic fuel bears 5% VAT. Increased benefits (so the taxes are outweighed by the benefits – as is already the case)? Lower rates of indirect taxes (cheaper cigarettes and alcohol for the poorest)?

Tax wealth

Reduce allowances for capital

Increase CT

Reduce NIC

Charge higher tax on savings

Next?

Surely the most insidious is NIC which ceases to exist at higher income levels and is proportionately a much higher burden on the low paid. Nothing seems to be done about it as it doesn’t enter into headline tax rate calculation, presumably because these would then show as being higher – but not for the well paid!

Also in the end it is difficult to adjust the proportion of income lost to indirect taxes unless the rich spend much more. It is because they do not/cannot spend as much of their earnings as those who are less well paid that their indirect tax take will always be out of proportion. It is difficult to see how this could ever change except perhaps by making ‘luxury goods’ subject to additional duty or VAT. But that would be difficult to collect I suspect (just look at the amount that is reckoned to be avoided currently on alcohol and tobacco).

So we charepge wealth taxes

And higher taxes on companies and investment income

All these things can be addressed

How do any of your suggestions actually help the poor though, Richard? Only your suggestion on NIC would do anything and that’s only for the working poor. It would also help others up the earnings curve too so is not exactly targeted.

I am consistent on helping the poor

A green new deal is the answer for them, delivering real wage increases

Higher taxes all round, but particularly at the top end? Well, I wish you good luck in persuading a majority Conservative government to implement that. Perhaps in 5 years’ time? (By then, there might be wider consensus on the need to increase taxation of wealth to tackle increasing inequality.)

Richard

Using quintiles is completely distorting, as you ought to know.

You can discern nothing worthwhile about how much tax ‘the richest’ pay by looking at quintiles. Quite clearly and obviously, someone on a salary of £250,000 pays tax & NIC of c£107,000 and so 43% of their income, That is above the top % paid by the lowest quintile before that lucky £250,000 earner has paid a single penny in VAT, fuel duty or anything else.

You are also completely ignoring benefits, effectively a return of tax. Obviously net income, after tax, NIC and benefits must be the important measure.

And those statistics are available. As are statistics showing how much tax etc is paid by the very rich. I guess you do not use them as they do not give you the answer you want.

If you want to use statistics in this way and it makes you and your supporters happy then please do. But intellectually it’s worthless.

I am ignoring nothing

I am using ONS data on tax

Since when were benefits negative tax?

And why in that case are you ignoring so many tax allowances?

As for it being worthless – only for those too contemptuous to consider the issue

Two questions.

1. This doesn’t factor in tax credits which it should as it lowers the tax paid.

2. Why is the level of consumption taxes so high? Greater analysis of why would be useful, particularly as there are choices between zero rated and vat able goods. Particularly foodstuffs.

I am staggered by you,über tartans wish to dictate lifestyles

Well to be frank – and you missed out the tax credit bit- you should cut your suit according to your cloth. Don’t expect to live like a millionaire if you are not one.

Do not expect to have your lifestyle – flat screen TVs, season tickets to a Premiership club, SUVs, and prepared M&S meals- subsidised by people who earn more than you. If you do, then don’t complain about the vat burden. Your choice.

The extent to which people at the lower end of earnings seem to spend on booze and fag tax, petrol tax and VAT would seem to indicate that this a choice issue.

What next, carry a card to qualify people for a lower rate of indirect tax.

Why not make it a star to be worn on clothing?

Do you have any clue at all how vile your ideas are?

You won’t get the chance to respond. I will be deleting your comments henceforth

It’s bewildering that some will defend the tax the rich pay and equate it to the tax the poor pay. That the poor receive the greater proportion of tax benefits, the whole stinking system is designed to keep the rich, rich. That saying, we would have nothing if it wasn’t for the rich, as they are the one’s that create wealth. Rubbish, it’s a combination of business, government and the fight for the rights of the worker that moves the economy forward. If we strike the right balance there will be success for the majority, not just the few. Unions gave the majority a better life, as their influence has all but ceased we see a decline in living standards. The seventies the unions had too much power, imbalance. Today very little, imbalance.

There have been one or two half-cock references to benefits, but none, in the article or comment stream, to the WITHDRAWAL of means tested benefits, which would reinforce Richard Murphy’s argument even if his critics are right, which they are over there being no mention of tax credits.

To cut a long story short, please look at the Basic Income idea.

clivelord.wordpress.com

I have supported such an idea

See the work Howard Reed and I did for Class

Basic income or social dividend? But funded with created money, NOT taxation.

Created money cannot be sued for that purpose

It would make no sense at all and would result in economic mayhem

Please read MMT

Conservative policies are all ideological to keep the power with the few at the top, than what’s best for most people or the economy. Why else would they have done the worst thing imaginable for the economy in a recession by increasing VAT to make everything more expensive to slow down spending, as well as other tax that affects the poor the most like bedroom tax and making disabled people pay council tax from the minimum amount they can live on. Then do nothing with the extra tax except give millionaires tax cuts, while saying there have to be cuts to vital services?

It’s like when the Conservatives were in power before in the 80s, when they stole and sold off everything public owned, then added tax that affects the poor the most like constant VAT increases, the first government to add tax to household bills after they privatised the energy companies, and the Poll Tax where an 18 year old in a bed sit had to pay the same as a lord in a manor.

Then by the late 80s after not spending the money on anything anybody wanted, such as more social housing or the NHS because waiting lists were the longest ever, they said they were broke, giving them an excuse to not put money into what services were left, making them the worst in Europe, still blaming Labour for what the Tories do after 10 years. It was also the Conservatives who turned us into a banking nation with nothing else to fall back on, where people’s credit rating was the most important thing in their life, which all crashes every few years when nobody can pay back the debt they’re encouraged to have. If Labour had put too many controls on all the Tories left us with, the Tories would have been the first to make a fuss, accusing Labour of being too controlling.

Look at how the Tories tried to vote against Labour’s long awaited House of Lords reform, to reduce the number of hereditary Lords. The Tories wanted their upper class friends to be entitled to be paid for going nothing, with expenses and subsidised bars and restaurants. Then when Labour brought in the first ever minimum wage, the Tories tried to vote against that too. Now they’re saying they’re for a minimum wage. Are they saying they lied before when they said that any form on minimum wage would be bad for the economy?

That party never seem with it anyway. On the same show that Boris Johnson said Germany never used chemical weapons in wars, he said an even bigger lie that nobody seemed to notice, as said there wasn’t a vote on the 2nd war against Iraq, when more Conservative MPs voted yes to it than other parties.

They’re managing to convince idiots that getting rid of human rights is about terrorists, when there are already exceptions against national security. That’s why Abu Hamza failed in his case. It’s only about taking away rights from the majority. Look at how the Tories tried to use the police as their personal army against workers fighting to keep their jobs, lying that shipbuilding would go over to third world countries, when it’s now in rich nations such as Japan.

Then when the future generations in those communities feel they have no hope apart from a job in Tescos, the Tories kick them down even more. At least Labour helped to rebuild those communities ruined by the Tories, by promoting more than ever to go to university, but now even to study with the OU it’s 5,000 a year in student loans.

We now have a government where the PM, chancellor and London Mayor all went to the Bullingdon Club, giving each other top jobs, and some think they will act in the interests of many.