The CBI's report on tax - 'Tax and British business: Making the case' - is a gift that just keeps giving.

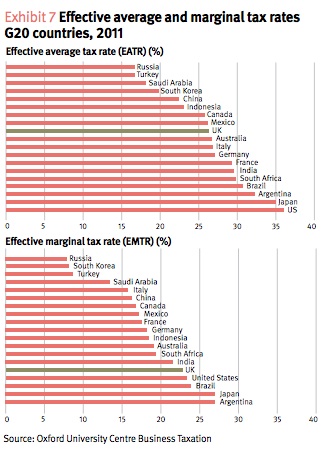

Look at this table, included in it:

I was surprised the effective rate of tax is shown to be so high - just a little below the headline rate. As a result I smelt a rat so I went to the Oxford Centre for Business Taxation report on which this is based. They define effective tax rates as:

There are numerous ways of constructing measures of effective tax rates. Here we define the effective tax rate (ETR) as the tax charge as a percentage of profit as measured by earnings before interest and taxation (EBIT). EBIT clearly differs from taxable profit as it does not include financial flows. However, for a number of reasons we believe that this is a more reliable measure than the alternatives. For example, financial flows can include large intra-group transactions, which can produce misleading estimates if holding companies, or more generally, the unconsolidated accounts of the headquarter companies, are not included in the dataset.

I could argue about EBIT, but won't here. The effect is unknown.

What I will argue about is that they use the tax charge in the accounts as the measure of the tax paid by a company. This is just financially illiterate! Deferred tax is just an accounting entry and has literally nothing to do with tax that is being paid now. As the CBI report itself says:

Deferred tax accounting .... seeks to deal with the mismatch due to timing differences. It is based on the temporary differences between the tax base of an asset or liability and its carrying amount in the financial statements. Where tax relief is obtained in advance of the charge against accounting profit, the tax base will be lower than the book value and so there will be a deferred tax liability. Where tax relief comes later — for example where a loss is to be carried forward to use in a later tax period —there will be a deferred tax asset.

Now, if one of the main purposes of tax avoidance activity is to defer the time when tax is due by, for example, hiding profits in tax havens or seeking double allowances for tax or by postponing the recognition of income for tax in multitudinous ways (and I can assure you that this deferral is one of the main motives of tax avoidance because this deferral very often triggers extra payments under executive bonus schemes - linking this issue and excessive pay, inextricably and so explaining why multinational corporation directors are so dedicated to tax abuse) then to include the deferred tax charge in a company's accounts (itself one of, if not the most subjective number in any set of accounts) in the tax charge is to ignore the fact that this accounting is precisely designed to disguise the fact from those lacking curiosity (like Oxford tax academics) that this tax avoidance is going on by suggesting a tax bill exists when there is none, and may not be for some considerable time to come, if ever.

What this means is that given that the tax gap is entirely about tax not being paid then basing an analysis of effective tax rates on a measure that deliberately and knowingly ignores the fact that tax is not being paid by including an accounting entry that disguises that fact as if it were tax paid when it is no such thing is to candidly, blatantly and knowingly distort the resulting data presented on effective tax rates and the tax gap. It can't be anything else.

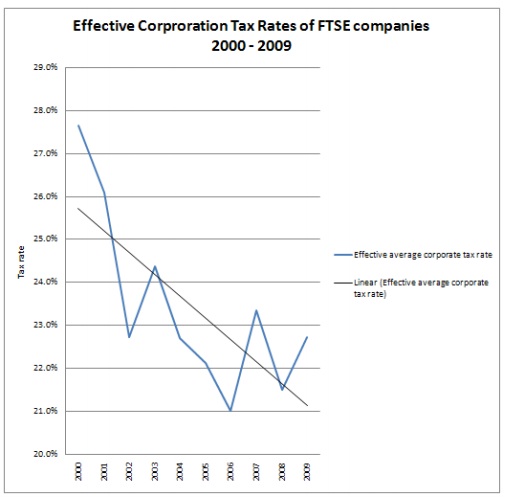

I have looked at this issue in my work for the TUC. To make sure I calculated tax gaps properly I went into the accounts (something Oxford seemingly never do - they rely on databases, not doing something so sordid as seeking to understand the source data by actually reading it) and extracted the figure for current tax due - which eliminates the deferred tax charge or credit as this is just accounting mumbo jumbo - as the only thing that matters when considering tax gaps is what is likely to be paid now, or not. As a result in my 2010 TUC study I showed the following:

When you actually look at tax to be paid - as I did - effective tax rates are nothing like 26% as Oxford says, but more like 21% and falling as the corporation tax.

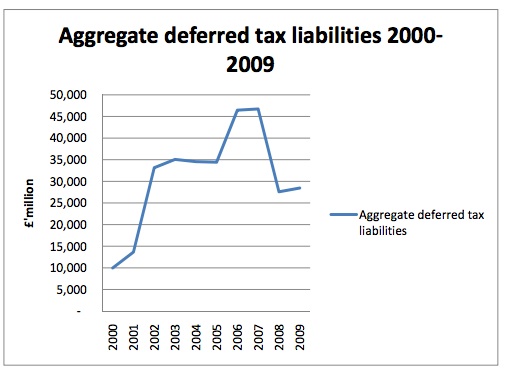

And why is that? Well one reason is because of movements in deferred tax, which I noted from my FTSE sample were:

The sheer scale of deferred tax - that is tax unpaid and hidden in the accounts of large companies - is apparent, as is the fact that the scale of it has grown enormously over the last decade. The reason why the fall in tax rates was also arrested in 2009 is also apparent - the banks saw their deferred tax provisions fall dramatically because of the scale of the losses they made - few of which were real however, and all of which went through deferred tax charging. They almost singlehandedly explain the fall in net deferred tax provisions because their losses created deferred tax assets which reduced the overall level of net deferred tax liabilities.

The CBI must have known this, as did Oxford, but the put out grossly misleading stats that glossed over it instead. It delivers no credit to either that they did so - and shows that both are in the business of supplying misinformation on tax. Thankfully, some of us aren't. No wonder the CBI are losing the debate with the Tax Justice Network.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I found this by the historian Ross McKibbin: “But, of course, objective reckonings matter little in the outcome of British general elections, and ‘failure’ has several definitions: even from failure many gain, or think they gain, which is why the political system devised by the Conservatives in the Eighties will long outlive Mrs Thatcher.”

He was writing in 1991.

And here we are in 2012.

Simply excluding deferred tax from the calcuation is ridiculous. Simple things like difference in accounting depreciation and capital alowance for taxes cause significant timing differences. The whole point of deferred tax is to present a more accurate view of the accounting reality, not the tax reality.

As for management using tax avoidance to boost bonuses, surely then they wouldn’t want to use deferred taxation at all, as that reduces the profit levels on which bonuese are based.

And surely your using of current tax due isn’t correct as it is the balance sheet amount of tax owing, which would include arrears or prepayments.

But since the tax gap is about the taxing reality using data distorted by accounting that can be used to hide tax avoidance – and does – is just blatantly wrong

But you are comparing tax reality to accounting income so it is not Apples to Apples, we all know accounting income is full of things which bear little relation to reality. In fact management have every incentive to overstate accounting income in terms of their remuneration and share value, rather than understate it for tax purposes.

Undoubtedly some element of tax avoidance is done by companies, but we simply can’t estimate it from accounting income without a lot more detail and we ceratinly can’t ignore timing differences which will reverse at some point.

Respectfully – on the basis of your claim no one would ever analyse accounting data

Maybe that’s what you would wish for

But it is a ludicrous suggestion