It would be easy to say, as some have, that the issues I have raised on Marks & Spencer’s accounts are just a smoke screen. Its total tax charge is almost exactly the headline rate of UK tax, it is quite within its rights to retain profits overseas, its claims for allowances are no doubt entirely legitimate and its disclosure is sufficient given the rules that exist.

And I’d agree: all of that true.

And I’d add two important caveats. The first is I chose M & S because its tax rate is low. But it is only chosen as an example, and nothing more. In other words I am not accusing it of anything untoward. But I am saying that if the system lets it pay a very low rate of tax and means I can’t explain why that is the case then I think there is something wrong with the tax and accounting systems that let that happen.

What I am challenging anyone who wishes to take issue with me to do is to answer the following questions. I can’t, and whilst I’m not for a moment saying that means that others may not be able to do so I suspect that in most cases it will simply not be possible to do so.

In that case my argument is that there are tax policy, accounting policy and political accountability failures that clearly suggest the need for major reform in all three areas. Please understand therefore that this is, if you like, a case study — albeit one that is based on a real set of accounts which gives rise to these real concerns — none of which are, as such the concern of M & S if it chooses to ignore them, but all of which should, I suggest, be the concern of those who engage with the company whether as investors, suppliers, customers, government, civil society or the public.

I’ll group the questions I ask under headings as this will make it easier in due course to offer potential policy responses.

1. Profits

a. What is UK profit before tax?

b. How can that be reconciled with UK operating profit?

c. Where were the finance costs of £214.5 million charged and why is this not disclosed in the accounts when the costs of debt financing are currently considered one of the most important issues in UK tax policy?

d. Where did M&S earn its £50 million of finance income in the year. Why aren’t we told? Why is this not covered by segment reporting data?

e. What is the profit before tax in each and every country in which M & S trades?

f. Why should the UK have an indication of what its operating profit is but no other country does - especially when the impact of M & S's trade might be more material to some other states than it is to the UK?

g. Why is there no indication at all of how profits are reallocated between M & S group companies by intra-group trading? This trade is, presumably, very significant to the group when much of its product is probably sourced out of the UK by M & S buying companies located outside the UK which in turn sell them on to operating companies in many locations were the Group operates. How much internal profit is reallocated by this process of transfer pricing - the other major issue of concern in UK ax at this time?

h. Where are the consolidation journals that eliminate intra-group profits for group consolidated accounts purposes considered to be located for the purposes of presenting segment data in the group consolidated accounts i.e. is the profit eliminated inside or outside the UK for segment reporting purposes, and why, which ever answer is given?

2. Current Tax

a. What is the rate of current tax paid on UK profits before tax?

b. Likewise, what is the current tax rate paid on profit before tax in each of the locations in which the Group operates - that rate to be stated inclusive of that earned in intra-group transactions?

c. How can that current rate of tax in each be reconciled with the headline rate due in that place?

3. Deferred tax

a. Where are deferred tax charges arising, precisely?

b. How can there be so little deferred tax asset or liability outside the UK?

c. When will the deferred tax liabilities arise?

d. What is the probability of the deferred tax liabilities arising? Does management have any clue on this issue, and if not, why is the remoteness of liability not disclosed?

e. What events might trigger a liability being due?

f. What is in the 'other' deferred tax and why is part not charged to the profit and loss account?

4. Tax reconciliation

a. Why is the total tax liability including deferred tax reconciled to the current UK mainstream rate of corporation tax when this gives no explanation as to why the actual rate paid is so much lower than that rate?

b. Does management believe that this reconciliation is useful? Under UK GAAP the reconciliation had to be with the current tax charge. Does management consider that more useful, and if so, why not offer it either in addition or as an alternative?

5. Tax paid

a. To which countries is tax paid and in what amount?

b. The tax account for the company does not reconcile, albeit that the difference is relatively small. Why not? Where has the difference been expenses and to what does it relate?

6. Tax rate

a. What are future current tax rates expected to be?

b. If future tax rates increase how will this impact on investment, borrowing and cash available for dividends?

7. Overseas tax

a. Is the overseas tax rate likely to say as low as it is at present? If not, why not?

b. When will the overseas reserves be available for payment to the members?

I could ask more questions: those will do for now.

Policy Implications

Each implies broader questions of policy, such as:

A. The need for country by country reporting

Tax is due to governments and tax reporting makes no sense at all unless related to profit in a jurisdiction and tax due to a particular government.

Many of the questions noted above arise because of the impossibility of reconciling the tax liabilities of Marks & Spencer to sums due to anyone jurisdiction. Without this information it is not, however, possible to assess:

i. whether the tax liability is fairly stated;

ii. what tax risk there might be inherent within the accounts;

iii. whether or not it is plausible to lay observer to assess whether the company is likely to be fulfilling its obligations in all the states in which it trades;

iv. what risk there might be from transfer pricing;

v. what risk, if any, arises from the use of tax havens;

vi. what risks are inherent within the financing structure of the business, particularly with regard to debt capital.

The disclosure required by country-by-country reporting is outlined here.

B. The need for improved deferred tax accounting

Deferred tax is a complex issue, understood by relatively few accountants, and by even fewer users of accounts.

Deferred tax is best understood as a fictional tax charge which only exists in company accounts and is never paid. Deferred tax does not, as such, exist but the rules of accountancy generally require that income be matched with expenses. If an expense is recognised for tax purposes more quickly than it is for accounting purposes (which is common with much plant and equipment expenditure, for example) this means that the tax cost for the years when this happens are understated. Conversely, when all the tax allowances have been used on the assets there might still be accounting charges to make and the tax cost would then be overstated. To balance this equation a notional tax charge called deferred tax is charged to the profit and loss account in the earlier years and put on the company’s balance sheet as a liability. The liability is released as a credit to profit and loss account in the later years and in theory over the life of the asset all should balance out. It is also possible to create deferred tax assets, these being most common with regard to pension costs where tax relief is granted later than the liability is recognised in a company’s accounts.

The particular problems with deferred tax accounting are:

i. Understanding why the charge is being made because companies are not obliged to make full disclosure in this regard, it being quite acceptable to describe some charges as being for “other” reasons;

ii. Determining if any of the deferred tax charge will ever actually become a real tax charge, there being no requirement at all that companies disclose this;

iii. Working out in which country a deferred tax liability has arisen, since this need not be disclosed;

iv. Determining why some of the deferred tax charge has passed through the profit and loss account and, very often, significant amounts are charged to the Statement of Recognised Gains and Losses, without explanation being offered;

v. Explaining why, very often, adjustments are shown in the deferred tax account note in financial statements without explanation being given (although Marks & Spencer are not guilty of this, it should be stressed).

Given that deferred tax balances are frequently material on a company's balance sheet it is extraordinary that so little information is disclosed with regard to these liabilities, particularly as many may be fictional. Under the rules of the International Accounting Standards Board it is compulsory that all potential deferred tax liabilities the provided for in the company's accounts, whether or not there is any real chance that payment will ever arise for the liability in question. This is wholly irresponsible accounting of the type that is incredibly convenient to the company's reporting using this system. They can, as Marks & Spencer do, report that they have a taxation liability on the face of their profit and loss account that looks remarkably similar to the headline rate of Corporation Tax in the country in which they are incorporated and yet have actual, current, tax liabilities that are substantially different, and usually lower.

It is hard to escape the conclusion that the International Financial Reporting Standard requiring the provision of all deferred tax liabilities, whether or not there was any real possibility of the tax being paid, was little more than a deliberate public relations exercise designed to disguise tax avoidance. The deferral of tax is very often the aim of tax avoidance, complete cancellation of liability being much rarer. In this regard, it must be remembered that the International Accounting Standards Board is effectively controlled by the Big 4 firms of accountants and some of their largest clients; it is not, despite official sounding title, and government or international agency accountable to any international authority.

The following changes to deferred tax accounting would remedy the defects noted and would make the accounts of Marks & Spencer and other multinational corporations considerably more comprehensible:

1. All deferred tax liabilities should be disclosed by the country in which they arise;

2. All deferred tax provisions must be fully explained, with no “other” categories allowed;

3. The date of estimated settlement of liability should be declared for all deferred tax liabilities, and the date of realisation should be disclosed for all deferred tax assets. If settlement or realisation cannot be predicted within the coming ten years then the liability or asset in question should be considered contingent;

4. All tax reconciliations should be to the current tax liability, with an additional note explaining the composition difference between that current tax liability and the full tax charge including deferred tax;

5. All deferred tax movements, whether they be adjustments, or charges made through the Statement of Realised Gains and Losses, must be fully explained in the financial statements.

There are other deferred tax issues in addition to these, but addressing these issues would have significant impact on the way in which disclosure was made and address the problems noted in interpreting the accounts of Marks & Spencer.

C. Tax accounting issues

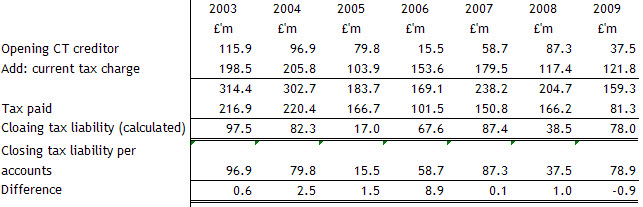

As a matter of fact the tax accounting of Marks & Spencer does not add up. If the opening tax liability for each year has the current tax liability added to it with the tax payment then taken off the following is found:

In fairness this is vastly better than the average company, an issue reviewed in a previous Tax Research report where it was found that in many cases the difference is more than 5% of the tax charge. However, it seems a basic test of credibility that this test be possible in all financial statements and that a reconciliation statement be required if necessary to explain movements not passing through the tax notes to the accounts.

D. Tax policy issues

As a matter of fact:

i. Marks & Spencer has been paying tax at a rate lower than the basic rate of UK income tax for some time;

ii. Pays tax at a rate much lower than that of most UK small companies;

iii. Takes advantages of offshore arrangements probably unavailable to most small UK companies.

All such actions are legal, but each gives rise to policy questions:

1. Is there a minimum rate of tax a comp0any should pay? If so, what is it?

2. Should a large company be allowed to pay tax at less than the small companies’ rate of corporation tax?

3. Why should large companies have preferential aces sot offshore tax arrangements?

These are issues for politicians to consider but they are, equally, a fair response to accounts filed by a major UK based corporation such as Marks & Spencer.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I see you are deleting comments again. Your analysis is very poor.

M&S have quite a few shops in places where the tax rate is low or non-existent (Hong Kong, Bermuda, Middle East, Malta, Ireland). Those are active businesses and the profits are not taxable until brought back to the UK, but since M&S chooses to reinvest those profits in its overseas businesses there is no reason to suppose that the income should be taxable in the UK (yet).

Sainsbury’s, Morrisons etc have little or no foreignoperations, or not in low tax jurisdictions, hence their tax rates approximate the UK statutory rate while M&S’s is slightly but not much lower.

@Alex

Is complaining about deleted comments the best you can do?

No answers I note

Pathetic

I think may case well and truly proven

Maybe 10% of the business is overseas

that does not reduce the tax rate by 60%