I have just been interviewed by the Isle of Man Press because of the furore I have caused in the Isle of Man with stories published here. I gather the Isle of Man Treasury are furiously briefing against me. As is usual, their briefings are disingenuous. So let’s get some facts straight.

The claim I have spun the data

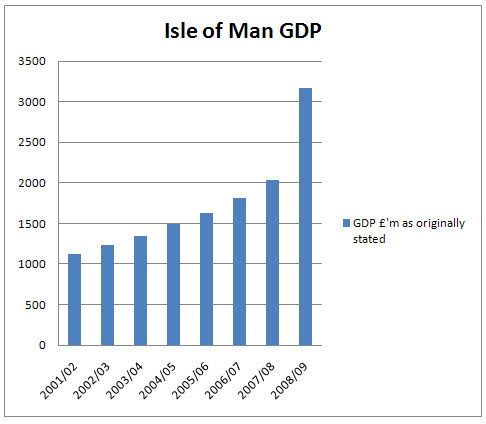

The Isle of Man Treasury are going along with the line that I have spun the data on IoM GDP when publishing this graph:

Bluntly this is an untrue allegation. I used their data — published by them on their web site and I make clear that is exactly what I did! It’s the left hand column here.

I used the original GDP data announcement because what we have for 2008/09 now is the first published GDP announcement — no doubt to be revised in due course. But since it is the first announcement it should be compared with other such announcements — which is exactly what I have done. I sought and found a consistent and comparable set of data and used it. To do anything else would have resulted in a comparison of inconsistent data. That is not acceptable.

The allegation that I have spun is not just false — it is blatantly wrong.

I am wrong to say income increased by 27% in 2008/09

Treasury are saying I am wrong to say income increased after restatement by 27%.

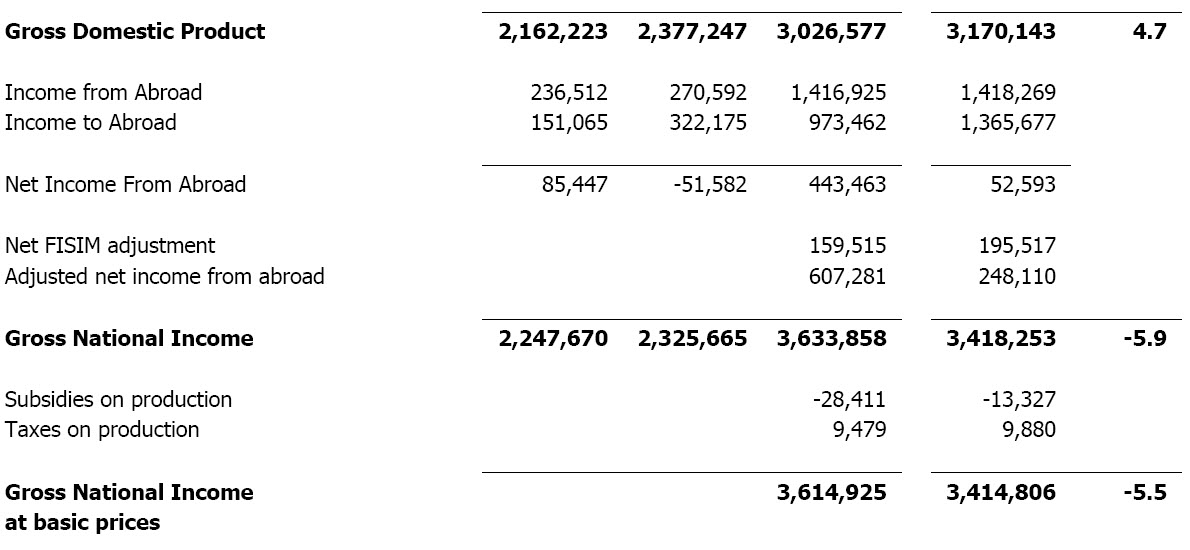

This is again utterly disingenuous on their part. The relevant data comes from table 2 on page 5 here and looks like this:

The data columns are 2007 original, restated and new method and then 2008/09 new method.

Treasury are saying income fell 5.5% in 2008/09 so the VAT share will go down compared to 2007/08. But this, to put it kindly, is utterly misleading. First, their own story put out for consumption in the IoM is of significant GDP growth — odd that they can spin it both ways! And then there’s the fact that this ignores the restatements in 2007/08. Note I used as my base for estimation the £2,377,247 figure, not the original lower number and compared it with £3,026,577 and this is a 27% jump. So to then say it fell in 2008/09 is absurd — the base increased by at least 27% in 2007/08. My mistake, if I made one was to use GDP as the denominator so I could pick the smallest inflator I could (because I’m a reasonable man). If I’d used GNI instead — as is relevant for VAT the increase was 56% in 2007/08. On that basis the VAT reclaimed will be over £120 million almost the whole sum lost in October 2009 by strange coincidence

The ONS say the data is right

The IoM Treasury is saying the ONS approve of what they are doing.

I haven’t said otherwise.

But I have pointed out that saying you’ve consulted with someone is not the same as having the consultant say they approve what you have done.

If the ONS say this data is right get them to put it in writing before using their support as an argument, I say. I once advised the States of Jersey on tax after all. I told them they’d got it all wrong. They could have said they’d consulted me when pursuing their plan. It would not have meant I had approved their plan. So please — if this claim is justified, prove it is all I am saying.

This is all about an argument on data

Well, yes it is. And no it isn’t. leaving aside the fact that my arguments on data are correct, and those of the Isle of Man Treasury are blatant spin and note that this is not just an argument on data. Even if the data is right the reality is that the use of this new data now, less than a year after the UK government removed a VAT subsidy (and rightly so) to reclaim what will — using the GNI comparative I note above — amount to all the sum lost in 2009 is a cynical political move by the Isle of Man government to which the UK must react.

The reality is, as I noted here, that the IoM government is now saying GDP per head in the IoM is £38,500 a head when the UK equivalent is £23,000 or so. And they are saying for VAT calculation purposes income per head rose from £28,890 to £45,141.

My point is a simple one: there is no way on earth that the UK can, because the Isle of Man has just realised that it’s people are not 25% richer than people in the UK but are actually 96% richer as a result justify giving the Isle of Man a vastly bigger tax subsidy. This is the logic of the mad house! People in the UK are going to see service cuts, falls in benefits, declining pensions and more and the Isle of Man is demanding a subsidy form the UK to be a tax haven which undermines UK tax revenue and all because that, notionally, means the people of the Isle of Man are nearly twice as rich as the UK population as a whole. Politically, economically and ethically there is no justification for this, at all.

And I believe that this claim has been cynically manipulated by the Isle of Man government now - whether the data is precisely right or wrong does not matter — less than 12 month after the UK made an adjustment to stop that subsidy precisely so that the subsidy from the poor of the UK to the rich of the Isle of Man can be restored. And my argument is that this crude political manoeuvring has to be responded to bluntly and straightforwardly with a demand that the Common Purse agreement with the Isle of Man be brought to an end. This is the issue all commentators in the Isle of Man want to ignore. Well, I can assure you it won’t be in the UK.

But the Isle of Man collects more VAT than it keeps so cancelling the Common Purse Agreement won’t pay the UK

This line is spun by the Isle of Man Treasury — and it’s wholly untrue.

If the VAT data they are referring to is right — and I’m not arguing with it — then it means that companies based in the Isle of Man for tax reasons (let’s face it: there is no other reason) are making sales into the UK on which VAT is charged greater than the sum that the Isle of Man government then gets back from the Common Purse.

But that is only possible because of the duality of this situation. In other words, these companies locate in the IoM to be outside the UK for corporation tax and income tax but to be in it for VAT. If the Common Purse was cancelled and the Isle of Man had to charge VAT itself under its own rules then there would be no VAT charged on exports from the IoM to the UK and the VAT would instead be charged ion import into the UK — meaning that this VAT would not then be paid in the IoM but in the UK where it is due. So to claim it is recovered now in the IoM is simply wrong: it isn’t.

And let’s be clear not a lot of VAT would be paid in the IoM if the Common Purse was cancelled. Transport which has grown enormously is largely VAT free. So is finance. So two big industries would contribute nothing in the IoM. In fact VAT yields in the IoM would tumble because VAT is paid on domestic consumption and the truth is that actual personal GNI per head in the IoM is, I suspect, nowhere near £45,000 a head — or £180,000 per family of four. That GNI is largely corporate profits — and VAT is not collected on them. So the data is blatantly wrong in such a distorted economy as the IoM’s to use for VAT apportionment. And it is so obviously wrong that UK civil servants looking for every cut they can will be reading this blog (I suspect — because they do)and thinking ‘it’s time to renegotiate again’ I think. Why not? It’s painless for the UK to do so — because we’d get more VAT in the UK as a result and pay the IoM a lot less.

The IoM had better have some very good arguments to hand, I suggest, because it looks to me like you’ve just shot yourselves in the foot with this crude move. I suspect the Common Purse will be over sooner than you think.

What do I think the Isle of Man should do?

I could say it’s not my concern, but I was asked it none the less by the journalist. I’m simply concerned that the UK is being cheated and that a massive reallocation of state funding due to people who need it in the UK will instead be sent to the Isle of Man if no action is taken.

Do I care if this leaves the Isle of Man with a problem in funding its public services? Well, actually, no, not a lot. Why not? Because you are according to your own data 96% richer per head than the UK. You can fund your own services very comfortably on that basis. You just have to pay tax. That’s all. Like we do. And you have to stop free riding off the UK. That’s all.

If it drives business away from the Isle of Man, so be it. You can take a 50% cut in earnings before I need worry.

If your rich have to actually pay tax — so what? So they should.

If companies who abuse other states by using the ring fences you (illegally under EU law) offer have to pay tax — so what? So they should.

All I’m saying is simply this: stop cheating; stop abusing; stop claiming what is not yours; stop demanding the poor of other countries support you; stop demanding state subsidies (which is what you are doing now); simply stand on your own feet if that’s what you want to do.

But right now you do want to live off the state: the UK state. And that’s not acceptable. In fact, it’s game over — and I’m suggesting your attempts to make unacceptable claims for benefits to which you are not entitled might have ended your culture of living on UK state hand outs for good.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard

How you find the time to write this kind of in-depth rebutal to the nonsense coming out of the IoM at very short notice (on top of your normal range and rate of blogs) I don’t know. But good for you that you do.

As you rightly point out, free-riding off the UK state was bad enough before the cuts, but to try to pull a fast one at the expense of the UK taxpayer now is inexcusable.

Still, I dare say many of the wealthy inhabitants of the IoM actually took Gordon Gecko’s ascertion that ‘greed is good’ at face value, instead of registering the actual moral and ethical message of the film Wall Street.

Keep up the good work.

@Ivan Horrocks

There is a rumour I don’t sleep

And that I don’t have a birth certificate, just a maker’s plate

But like claims about the Stig neither is true

I just get annoyed about social injustice

And I do a day job in top of the blog….

Mr Murphy,

You really have no basis whatsoever for what you are saying over either your original £68 million figure or your now claimed £120 million

The Manx economy has not grown by 56%, no one other than you are saying this.

When the VAT agreement was made the economy was the size it was. If you measured it with methodology A (apples) it would be say £2 Billion, if you measured it with methodology B (oranges) it would be say £3 Billion.

Methodology A missed out all sorts of data — Owner Occupier Household Consumption, Financial Intermediation Services Indirectly Measured (FISIM) etc.

The statisticians knew this when they compiled the data — they are quite definitely not saying now they are using the new methodology that the economy has grown and therefore the IOM needs to claim more VAT.

How the VAT pot is shared out in each year depends upon the relative growth of the IOM and UK economies from a base year. You could measure that growth in Apples or in Oranges, and over the short to medium term these would not diverge significantly — they both capture the general functioning of the economy.

In 2008/9 GNI shrank — measured by the new methodology it shrank by 5.5% in real terms at basic prices. Mr Murphy is trying to claim that the IOM are saying it grew by 56% so they can get another £120 million from the VAT pool – only he is making that claim and it has been repeatedly pointed out to him that this is incorrect and he is comparing apples with oranges and cannot do this.

Based on the figure they have published, the IOM Treasury will report to the UK that the IOM should receive a smaller proportion of the VAT pool (assuming the UK hasn’t contracted more). Mr Murphy is totally twisting this, using non-comparable data into them demanding a vast increase.

The increase Mr Murphy has identified is not growth in the economy and will not be used in any VAT calculation. Certainly the old methodology has been much improved with the new figures capturing much more nuances within the economy, but the differences between the two figures should not be seen as growth — that can only be captured by using a constant methodology between different years.

All that has changed is the methodology for calculating the size of the economy. What will be used for calculating the VAT pot is the relative change year on year of the IOM economy verses the changes in the UK economy. Changing methodologies does not significantly affect this, most definitely not by the 56% Mr Murphy is claiming.

His figures of £68 million and £120 million have no basis in reality and are confusing how two different methodologies capture the size of the economy with growth within it. A very poor error.

Chinahand

The IoM did not get such a VAT windfall.

They changed the calculation formula, and recalculated one years previous such that they had a year to compare for growth, and hence the VAT agreement rose by 4%. You can’t compare figures when the models have changed, and I’m not sure what’s so difficult to comprehend.

Perhaps I should not speculate, but are you waiting for a newspaper to run with this story on your current (but incorrect) assertations? If so, lets just hope that the editors aren’t stupid.

I’m waiting for the ‘we are right’ Right Wing fantasists to jump in and attempt to ridicule this analysis.

Strangely quiet.

Sometimes things are as they are, hmm?

Meanwhile, back in Guernsey; King John is handing out ice creams?

All gut, ja?

Richard, As usual a well researched, in depth analysis. Excellent. Hopefully as we now have such an increase of GDP here on the Isle of Man the Government will get around the addressing the issue of first and second class old age pensioners and pay the Manx Pension Supplement to all those who have been resident on the Island for ten or more years as per their own commissioned Chislett Report

@Paul

It is odd how such a rich state is impoverished, isn’t it?

@Chinahand

I will reply in full later

@Chinahand

I am intrigued by your comments, and I repeat the suggestion made previously that I am sure you actually work for the Isle of Man Treasury. There are three reasons for thinking so. First, you speak with an assuredness that would be hard to have without doing so. Second, you are clearly familiar with the underlying principles, but third and most important the way you write on the issue suggests that you are so familiar with the issue that you have lost sight of the absurd claims you are actually making.

Let’s deconstruct what you are saying. You accuse me of comparing apples and oranges when plotting the graph of Isle of Man GDP that I plotted — based openly, honestly and appropriately on data published by the IoM Treasury. And yet it’s not me who s doing that — it is you!

But if what you say is true then what the Isle of Man now proposes to do is ignore its new measure of GNI, so carefully produced and trumpeted. It will instead base all VAT claims on GNI for 2006, as updated by percentage annual movements since then.

To understand this — you claim — I have to go back to the sample calculation. That’s here. http://www.taxresearch.org.uk/Documents/IOMGST.jpg And even though this says “obtain latest published national income data” you say that’s not what it means, at all. No, it means 2006 income data is the benchmark for good. And relative change from then are all that matters.

So, for 2008/09 the right data for VAT calculation purposes will not be GNI of £3,414,806. It will be the figure of £1,944,910 as per the sample calculation updated by real growth from 2006/07 as shown by the old method of calculation of perhaps 12.2% as published here http://www.gov.im/treasury/economic/data/income.xml column 4 and then, having utterly ignored the rebasing of 2007/08 what then happens is that the figure for 2007/08 ( £2,183,723 from column 4 in the previous link, presumably) is then adjusted by the decline of 5.5% recorded in the latest figures to give a figure of GNI for the purposes of Vat apportionment calculations alone — which is wholly made up, and according to your new data utterly wrong — for 2008/09 of about £2,063,618 even though the actual number you publish is £3,414,806 — in this case 65% higher?

Is that what you’re really saying?

That’s not, of course, what the sample calculation implies — it says start with the latest data note — and I have relied on that — but if the Treasury in the Isle of Man says it really will be using make belief data of the type you suggest will be used as calculated above — based on a baseline figure which they now say is incorrectly calculated but which you say they are still willing to use albeit that changes will now be measured in oranges even though the original was measured in apples, then of course I have to concede IF they say that that then the Isle of Man will not be claiming any additional VAT from the UK.

But get them to say that categorically first.

And then I’ll say the following:

1. Using wholly artificial data calculated on inconsistent bases, which have changed since the agreement was first reached, is no basis on which to take forward the Common Purse Agreement. So it should be renegotiated.

2. The IoM Treasury spin that there was real growth in the IoM in 2008/09 was misleading — and the people of the IoM should know that — and I’ve done them a service by drawing this to their attention. The economy actually declined in size significantly in the year.

3. Those same people should know that in hard times their government has spent a lot of money producing data which is firstly misleading and secondly so unreliable it can’t be used as the basis for agreeing international obligations with the UK.

4. However, that new data now shows that the people of the Isle of Man are so well off that the remaining subsidy that I have shown still exists in the Common Purse Agreement must be withdrawn by the UK. So the Isle of Man’s spin on this issue will prove to be wholly counterproductive.

5. My exposure of this issue will have been wholly justified in securing a statement from the Treasury which would confirm they will not seek to use the new data to support quite unjustified VAT claims which might otherwise have not been able to protect the UK from such claims.

And without that statement from your Treasury I’ll say something quite different. Which is, of course, that I am almost certainly right and you are planning to make such inappropriate claims.

It’s up to you. Get the Treasury to issue the statement and you can say I got the claim that the IoM will make an excess claim wrong. But then I show how absurd your behaviour has been, and have the satisfaction of taking credit for ensuring you can’t make that claim in future. Don’t issue it and I’ll say you’re going to make that claim.

Which is it going to be? I don’t mind. I win either way.

[…] received a comment yesterday evening on this blog suggesting |I have got the basis of calculation for the Isle of Man […]

Mr Murphy,

I don’t work for the IOM treasury.

All your conjectures are based on the sand of your erroneous opinions.

I love the way you think you are doing a service to the Manx people by uncovering … what that Manx GNI shrank … that information is actually highlighted as the 3rd bullet point in the Treasury report! Thanks for your sevice, but I think people are capable of finding that information on their own.

Neither you or I know what the UK and IOM Treasuries will do concerning the GNI estimates. Here’s the agreement – http://www.gov.im/lib/docs/cso/sharingarrangementsfurtherrevisionoc.pdf maybe you are right – but believe me the idea you are raising issues that the IOM or UK Treasuries are not aware of and dealing with is very very unrealistic.

Chinahand

@Chinahand

” believe me the idea you are raising issues that the IOM or UK Treasuries are not aware of and dealing with is very very unrealistic.”

I think many things were said like that by your politicians the last time I last drew attention to these issues

And I was proved right, and they wrong, of course

But you’re right it need not happen that way again

But now we know that you don’t know and can’;t prove what you say

But in contrast I have a sneaking suspicion …..

However, also see the comments I will make to Iliam Dhone on a later thread for more observation here http://www.taxresearch.org.uk/Blog/2010/10/09/the-isle-of-man-you-decide/