Three weeks ago I suggested that the Isle of Man would be restating its income data when new information was published.

And now that data has been published.

And the Isle of Man has, as I predicted, restated the basis on which its income is calculated. As it says:

The Treasury has released the Isle of Man National Income Accounts for 2008/09.

National income provides a measure of the income generated through economic activity over the course of the year.

The accounts rely principally on data derived from personal and company income tax records and this explains the gap between when the results are produced and the year in which they relate.

This latest report on the accounts takes on a different look this year, a result of some significant changes to how the figures are calculated.

And the consequence:

The 2008/09 accounts reveal that the Island’s economy (as measured by gross domestic product, GDP) grew by 11.6% in current values or by 4.7% in real terms in the year. Other key results are:

‚Ä¢ IOM GDP is over £3.1bn

• there was real growth of 57% in the ICT sector, driven by the development of the e-gaming sub-sector

• the banking sector expanded by over a fifth, despite the onset of the global financial crisis

• there was a 30% increase in the size of the transport and communication sector

• there was growth above the national average in insurance, CSP and professional services

• there was some contraction in engineering and general manufacturing

• it was a difficult year for retailing and for tourism and related industries.

Candidly, much of that data is implausible.

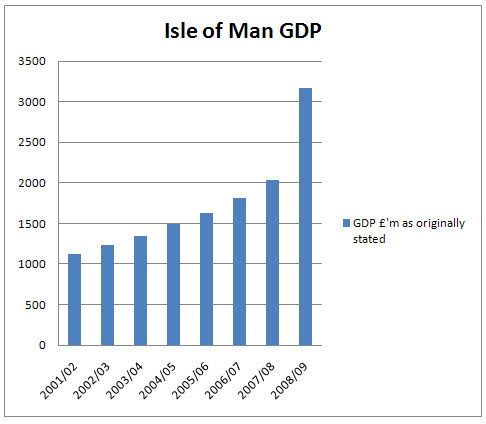

And let’s look at the impact of the change:

That’s a GDP jump of 50% in a year.

And why have they done this? Well, let me remind you of a little problem the Isle of Man has: it’s called its VAT black hole. In October 2009 the massive VAT subsidy the UK gave to the Isle of Man each year, amounting to some £180 million to £200 million a year was reduced by £140 million a year by changing the basis of calculation. According to many, including many politicians in the Isle of Man this happened as a result of my having drawn attention to the issue on my blog — and I’ll unashamedly accept credit for that. I was just about the only person to ever write on this issue so it seems highly likely that this story is true.

But it is important to then note how the split of VAT receipts between the UK and the Isle of Man is calculated: I’ve put the sample calculation on line, here.

The calculation starts by comparing national incomes. So what has the Isle of Man done? It’s restated its national income, not just a bit, but by inflating it enormously. And since the UK’s national income has taken a bit of a hit of late the result will be a massive shift of resources to the IoM.

Broadly speaking the uplift in national income under the Isle of Man’s new method is about 27% inn the year when they have published both versions (2007/08, here). The impact on the sample calculation is massive. Just slotting the 2008/09 data into the sample calculation increases the amount payable to the Isle of Man by £62.8 million.

That is £62.8 million that it is not owed.

That is £62.8 million of lost services in the UK.

That is £62.8 million claimed by changing the books.

And there is only one answer the UK can make in response — and that is to demand another revision to the calculation basis.

As I showed in November 2009, the UK was still subsidising the Isle of Man by at least £40 million a year after the last revision. With the current trickery added in that will increase to £100 million.

When the UK can’t afford universal child benefits the last thing it can afford is to subsidise the wealthier population of the Isle of Man who with this latest change in their system to seek, as ever, to abuse the rules, show how undeserving they are.

This subsidy has to be withdrawn once and for all, now.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

@steponahen

See http://www.taxresearch.org.uk/Blog/2010/10/08/get-the-facts-right-in-the-isle-of-man/

I am suggesting I may have made a mistake

the true number may be £120 million

But again, you don’t appear to be using the modernised data for the previous year to compare like for like. Won’t the actual calculation use the modernised data?

@steponahen

let me explain this very simply

Let’s suppose the income of the IoM was 2 in 2006/07 and that of the UK was 3

Then in 2007/08 it restated its income and what was 2 became 3 but the UK remained 100

And in 2008/09 it remained 3 and the Uk remained 100

The fact is that the claim by the IOM in 2006/07 was 2/102

And in 2008/09 it will be 3/103

That’s near enough a 50% increase

That’s what the IoM has engineered I say by restating data

And your comment makes no sense in that context

The Uk felt the payment was fair to the IoM when the income was stated at 2 and could live with the payment made

I’m saying it won’t live with the payment if you claim your income is 3 when that does not relate to the VAT base

What is so hard to comprehend about that?

And why your fixation with the data?

This is politics – and you’ve made an enormous political faux pas

I wouldn’t say I was fixated, I’m just trying to understand how it works. Thanks for your explanation, I’ll try to digest it. I wasn’t expecting you to be rude in the process. Would you prefer to not be questioned? And what enormous faux pas have I made?

I guess we’ll have to wait and see how much is actually claimed to see if you were right or not.

@steponahen

I don’t think I was rude

If I was I apologise

[…] interviewed by the Isle of Man Press because of the furore I have caused in the Isle of Man with stories published here. I gather the Isle of Man Treasury are furiously briefing against me. As is usual, their briefings […]

I notice that you say that you may have made a mistake and that a truer figure may be £120 million. If you can make a mistake of that order why should we afford any further credibility to your figures?

@Jim

I made the mistake of being too generous to your government

What a crime!

[…] has it that the publicity given on this blog to the blatant attempt made by the Isle of Man to manipulate the agreement in its favour by restating its basis for […]

[…] has it that the publicity given on this blog to the blatant attempt made by the Isle of Man to manipulate the agreement in its favour by restating its basis for […]