It is HMRC tax gap day - which is the day when they admit how much tax they did not collect, in their estimation.

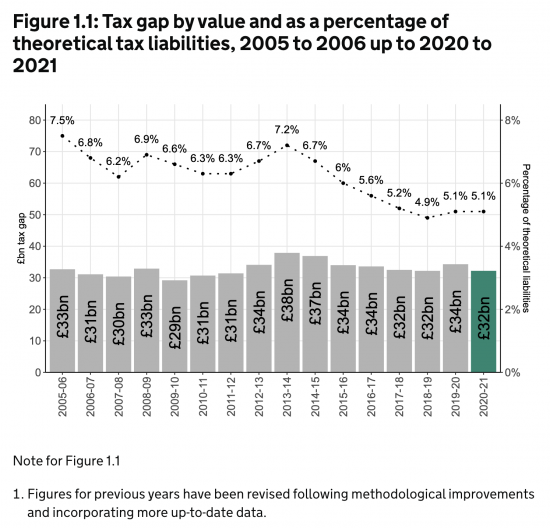

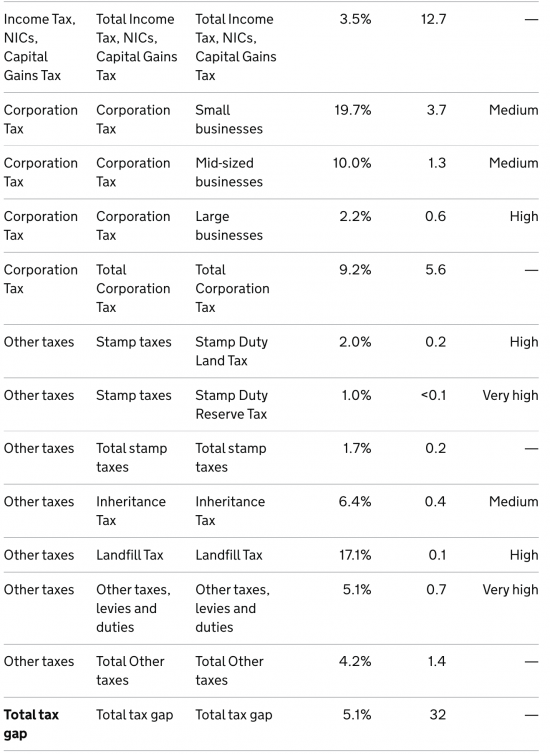

My standard joke of the last decade has been confirmed yet again today. Whenever I have been asked about HMRC's tax gap (which I used to be often, because I did extensive work on this issue from 2008 to 2015) I now joke that it's a number very close to £32 billion, whatever the true number might actually be. And so it was again this year:

With the greatest of respect to HMRC, they mark their own homework when it comes to the tax gap and it is simply impossible that the answer is always the same.

That is especially true when it comes to a year when Covid fraud was rampant - but apparently, this had no impact on the tax gap (although they do discuss the issue).

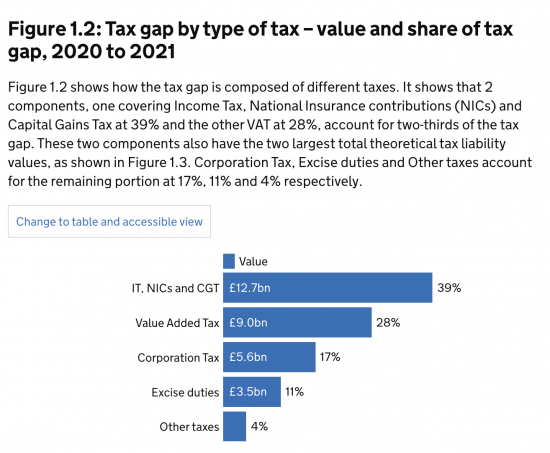

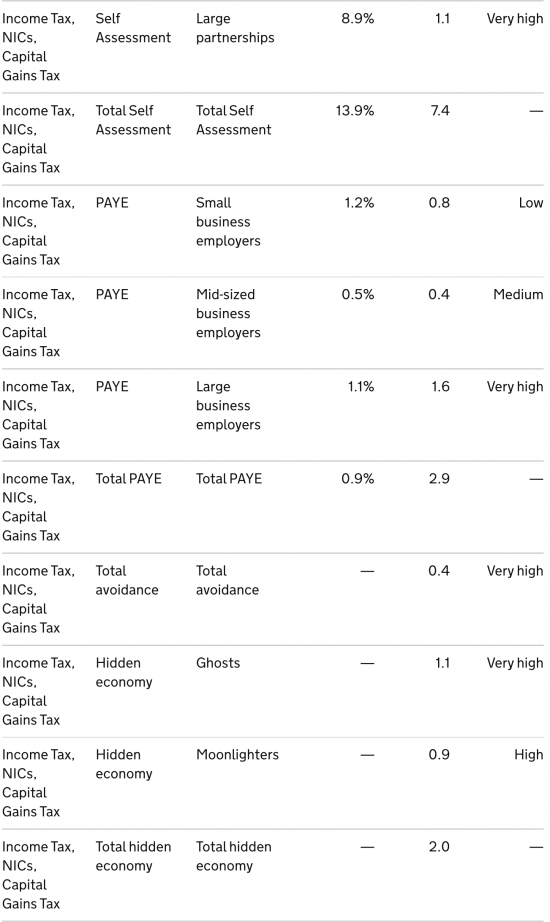

Breaking the figures down they suggest these are the taxes impacted:

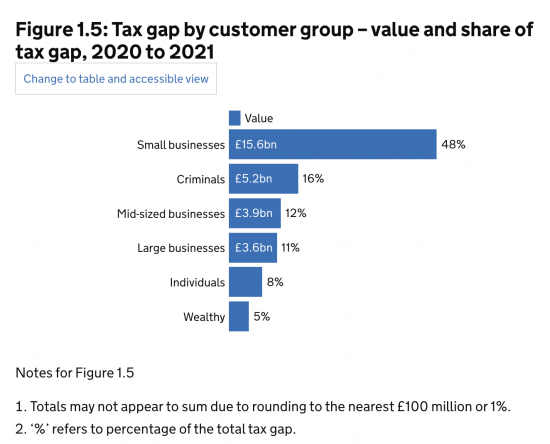

And these are the HMRC 'customers' (I hate that term) who caused the loss:

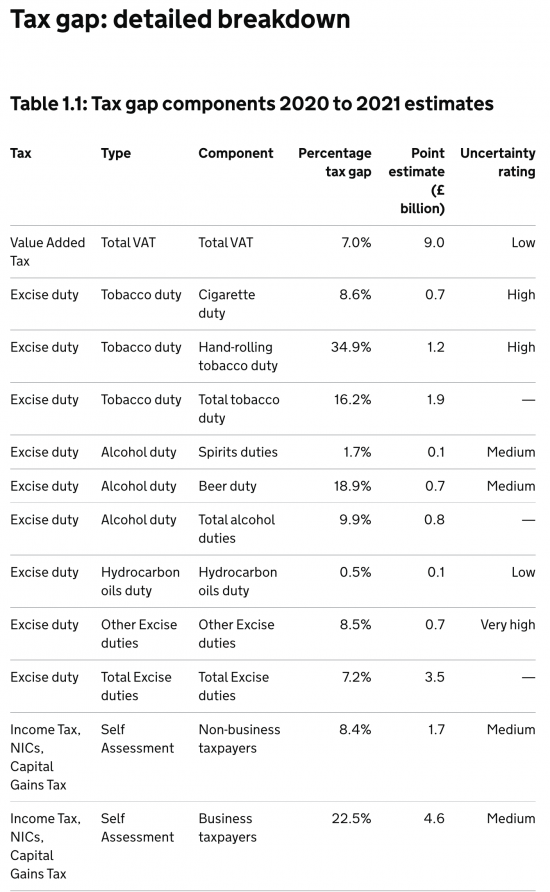

No surprise there then. But all the flaws I have mentioned in earlier years remain. In particular look at some of the detail and the risk assessment linked to it:

There are some absurd claims in here. That VAT is subject to low risk is ridiculous: this is impossible when overall small business makes most of the errors. It also suggests that HMRC knows the exact size of the shadow economy, and I am quite sure that they do not.

I am very curious to know why large partnerships are high risk when smaller businesses are not: again, whatever games large partnerships might play I simply do not believe this.

And the chance that just £2 billion is lost a year to tax evaders - out of £635 billion paid - is utterly ludicrous. That's a 0.3% evasion rate.

I have argued before for an Office of Tax Responsibility to properly appraise the work of HMRC, the tax gap and now tax spillovers. It hasn''t happened. But a government that was serious about this would be putting one in place. All the time they don't we have to assume that they're happy for the tax abuse to continue, and that begs the question, why is that?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

As an HMRC employee working in the SME segment of the economy chasing down VAT evasion in SE England I’m pretty sure you’re right Richard. Deliberate (or “possibly” accidental ha ha) underdeclaration of sales is very common in certain sectors. And despite the decline in use of cash there are still plenty (e.g hand car washes) of cash only businesses around.

As you say, given the level of fraud in the business loan schemes, these figures do look very dubious. But then again, given the contemptuous treatment of civil servants by the disgusting tory party, it’s hardly surprising that HMRC doesn’t get everything right. The ludicrous 20% cuts that Johnson suddenly produced via the Daily Hate are hardly going to help when we already could do with employing more people, not less.

And I know that the permanent home worker status granted to me very quickly back in 2020 is now being denied to people who’ve got very good reasons for wanting it purely because of this vile government’s vindictive ‘get back to the office’ campaign.

Which is why I’m 100% behind all those going on strike this summer.

Thanks

And agreed

And I hate the term ‘customers’ as well. Do people have a choice of tax authorities to deal with? Do they even want to!? The people I deal with would rather not, on the whole. That’s because the ‘customer’ is nearly always wrong, often by choice.

Of course, co-opting the language of the private sector to describe public sector activity is part of the right wing nonsense about the ‘superiority’ of private sector to public sector activity. Hence we talk in HMRC of the needs of the business, and of business streams.

Well done for being noticed, I see that a news story based on quotes from this blog is near the top of the Guardian’s website.

It needs saying.

Indeed