It has been some time since I last presented an estimate of the national debt here. Yesterday afternoon, for reasons that were not even completely obvious to me (but which I now realise may have been Covid fuelled), I decided to revisit this issue, sensing that it was appropriate to do so.

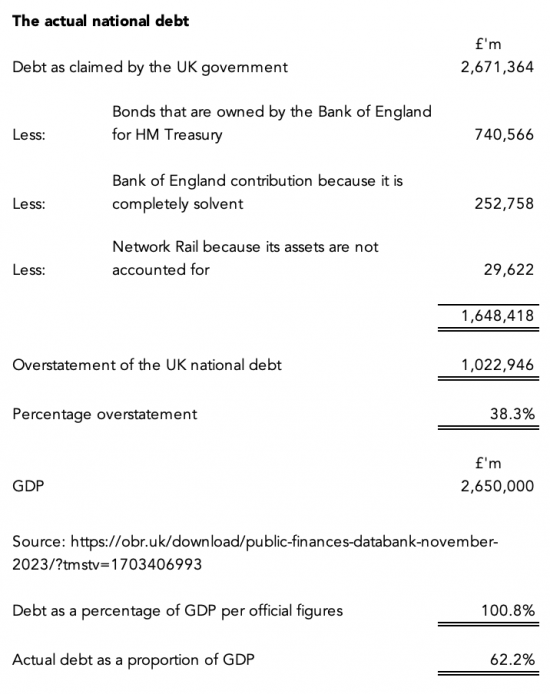

As a consequence of my calculations, I would like to offer the UK a Christmas present. It is a reduction in the UK's national debt of £1,023 billion, or just over £1 trillion.

To put this in proportion, that is 38.3 per cent of the total sum that the UK government claims that it knows, which cannot be due to anyone or is miscalculated, and which cannot, therefore, be considered to be debt.

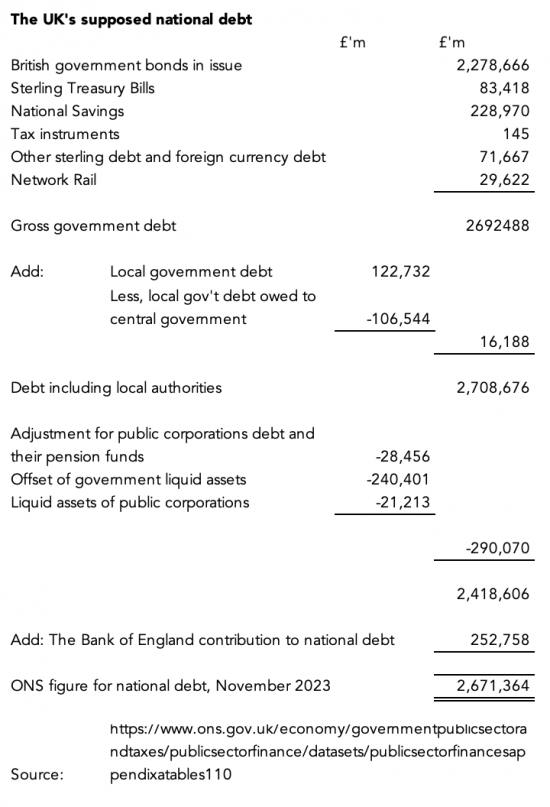

As I have long suggested on this blog, working out just what makes up the UK national debt demands that a person have a perverse knowledge of the spreadsheets published by that office each month when they announce this figure. They themselves never provide a clear supporting calculation. Since, over the years, I have acquired that knowledge and know how to link together the necessary spreadsheets to achieve the total that they claim, let me summarise their figure for the supposed national debt, which is calculated as follows:

The figure of £2,671,364 million (or £2.67 trillion) is the sum that the Office for National Statistics says is the UK's national debt.

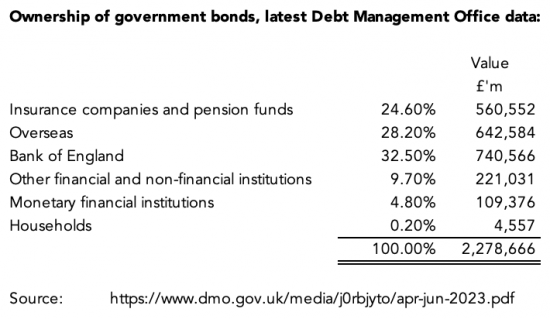

This, however, is not true. The following data comes from HM Treasury's Debt Management Office and shows who owns UK government bonds (or gilts) in issue. I have used the latest data available. That for November is not available as yet.

<

<

You will know that I have not only shown percentages but have also attributed values based on the figure for total government bonds in issue in November 2023, as noted above. As is apparent, £740,566 million of bonds (£741 billion) of supposed bonds in issue, according to the Office for National Statistics, are owned by the UK Treasury via a Bank of England subsidiary company that the Treasury, rather than the Bank, controls. And, since you cannot be definition owe yourself money, to claim that these sums are outstanding as part of the national debt makes literally no sense at all. That sum had been cancelled. So, the debt has to be reduced by this sum.

Let me then suggest that there are some other adjustments to make:

Of these two further adjustments, one is easy to explain. Including the debt of Network Rail whilst ignoring the assets it owns is utterly illogical. You could call it spurious accounting if you like. So, I do not count it. Single-entry accounting of this sort, which the Office for National Statistics is proud to do, does it no credit at all.

Then, there is the Bank of England's supposed contribution to the national debt.

As is apparent, the Office for National Statistics claims that the Bank of England contributes over £250 billion to the U.K.'s national debt. There is only one logical response to this suggestion, which is to say that this is complete nonsense.

As a matter of fact, the Bank of England is a completely solvent company. That means it is not in net debt to anyone. What is more, there is no debt on its balance sheet that looks even vaguely like the figure that the Office for National Statistics claims is its contribution to the national debt. That is unsurprising. The ONS have fabricated this number.

The figure is made up of two components, in essence, although the way in which they publish the data does not make any of this clear. One part is the loss that the ONS claims could arise to the Bank of England if it holds the gilts that it bought under the QE programme from now until their maturity. That loss arose because those gilts were notionally bought by it from more than their face value. That is undoubtedly true. There are, however, good reasons for dismissing this as part of the national debt.

Firstly, those guilts are effectively owned by the Treasury and not by the Bank of England. That is because in exchanges of letters between the two, the fact that the Bank acts as a mere nominee for the Treasury in these transactions is made clear. So, this debt, if there was one, could not belong to the Bank of England. To claim it does is just factually wrong.

Second, because the gilts acquired were actually bought by the Treasury that issued them they have, effectively, been cancelled. The idea that they can be held until maturity is, therefore, fanciful. If there was a loss on acquisition it has already happened, but there can be no debt owing as a result. After all, who would it be payable to? At best the Treasury would be paying itself, so we are back into fantasy accounting, again.

The reality is that the Treasury suffered a loss when undertaking QE. That is what should be accounted for. But what never happened was that a debt was created: that was impossible given the agreements in place, which the ONS is ignoring.

The other reason why the National statistics claim that the Bank of England contributes to debt is that it says that whilst it can take all potential sums owing by the government into account when working out this sum at their maximum possible amount, it cannot recognise any sum owing to the government as an asset if it is payable more than one year after the date when the national debt is calculated. As a matter of fact, UK commercial banks still owe the Bank of England around £100 billion in respect of loans given to them prior to and during the Covid crisis. In its wisdom, the Office for National Statistics has decided that it cannot recognise these sums as owing to the Bank of England in the national debt calculation.

As a result of these two absurd, and wholly false, claims the ONS claims that the Bank of England contributes to the national debt, which can only be true if facts regarding the relationship between the Bank and the Treasury are ignored and if the Office National Statistics has decided that all our commercial banks are going to go bust, in which case, we have a much bigger problem to worry about.

In summary, there is no Bank of England contribution to the National debt. The figure used can be described as make-believe accounting.

Now let me deal with the issue that will be raised in response, which is that in lieu of the noted balances, the sums supposedly owing by the Bank of England to the UK's commercial banks on their central bank reserve accounts should be taken into account.

Let me, first of all, make clear that these amounts are taken into consideration when I say that the Bank of England is completely solvent. In other words, allowing for them, the Bank does at present make no contribution to the national debt.

Then let me add another point. That is that these sums cannot be debt. A thought experiment proves that. If every UK commercial bank and financial institution that has a central bank reserve account simultaneously asked the Bank of England to make payment to them of the money owing on their central bank reserve account then, first of all, the Bank of England could always make payment of it, because it would simply create the additional currency required to ensure that payment could be settled, and then the banks and financial institutions in question would then be required to deposit those sums back in their central bank reserve accounts, therefore, reinstating them at the value that they had before the repayment took place. That is because the payment would be of base money and that can only exist in those accounts, and nowhere else in the economy.

It is, therefore, impossible to describe the central bank reserve account balances as a debt, because they aren't debt: they are money put into circulation by the government for use in the banking and finance system to ensure that it has the liquidity that is necessary to operate in the interest of the overall UK economy.

What I would suggest is that the Office for National Statistics knows this. They do not want to recognise the existence of central bank reserve accounts because they know that, technically, it is impossible to describe them as debt. As a result, they pretend that they do not exist, when they do, and instead claims that gilts are in existence when they are not. Yet again, this is make-believe accounting.<

Adjust for these items, and as you will see, just over £1 trillion of debt, representing £1,023 billion, or £1,022,946 million of the supposed UK national debt simply does not exist. It is either not owing to anyone, or it cannot be paid to them because it represents base money. However, and despite this, we are told that the UK has debt almost equivalent to its GDP, when in practice it has supposed debt that is no more than 61% of GDP. What is more, those people who own that actual debt really are very keen to maintain their ownership because it is a valuable asset that they wish to have in their savings portfolios.

If politicians understood this then three things would follow.

First, there would be no need for austerity.

Second, we could release funds for the necessary investment that is essential if we had to deal with the social problems in the UK and to tackle the problems that the climate transition creates.

Third, we could manage the economy without having to resort to lies, which would totally transform the relationship between the people of this country and their elected politicians.

This, then, is my Christmas present. I offer a simple reworking of the calculation of the national debt based on truth rather than lies, which shows that we have no problem to worry about.

Peace on earth, I say.

Please note that I wrote this whilst suffering from Covid. Please forgive any typos. I will add more references soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Brilliant!

Thank you!

“Please note that I wrote this whilst suffering from Covid.”

A truly heroic feat..

I wanted it done

I hate the lies told about debt that are being used to oppress people

What a fantastic description of reality and a fantastic dissection of the way politicians want us to believe it really is.

Fantastic Richard. Thank you. Can you please see if you can get it published by the Guardian and publish it in your column for the National.

I will see

So quite simply, the government is gaslighting us. Who would have thought that you can’t trust the government to be open, transparent and honest? Also seems that you can’t trust the Bank of England and the Office for National Statistics.

So a covid-ravaged man (sorry) produces better figures than two multi-million-pound-funded government departments. I wonder who produces better value for money?

Looking forward to your end-of-year address

I’m snoozing now…

And thanks

Bravo Richard for another important piece of myth-busting. As you demonstrate we are indeed being gaslighted by the UK Gov’t, by the ONS, and by the Bank of England (as Ian suggests). But why? What is the point of them deluding the media, the public and possibly even themselves? We all know that decisions made on the basis of faulty premises are bound to be unreliable and that such decisions made in any sensible business would result in dismissals and, potentially, legal proceedings. If the UK Gov, ONS & BoE know they are deliberately issuing false information and that the sole reason for so-doing is to justify a policy decision – austerity – which will inevitably cause colossal and life-threatening hardship to the people of the UK and destroy large sectors of the business community, surely we need the offenders to be punished by dismissal and prosecution for wilfully misleading the nation? Once again a proper Constitution would come in handy.

I can’t see the UK Tory Gov rushing to create legislation to limit their options to lie to us, but your article might be the means by which some leverage for change might be initiated. Could it be summarised in a way that the wider media might be able to get it out to a wider audience and, if even a small percentage of that audience take the trouble to understand it, it’s a positive step closer to a positive outcome? At the very least the article should be in your ‘Mythbusters’ collection.

I will revisit and edit it this week.

Thank you. It’s important to keep stating this.

My only concern is your treatment of Network Rail. It’s bonds are government guaranteed; if it were financed by borrowing directly from the Government that then, in turn, issues gilts (bought by the private sector) then they would be included in National Debt.

However, your point about the asset side of the balance sheet IS correct…. and needs to be extended!

This is important. When a government sells off an asset it is “balance sheet neutral” – ie. any debt reduction is mirrored by a reduction in assets. Currently, it seems that any asset sale is just seen as “free money” with no “loss (of asset)”.

AND crucially, when Water and Rail is taken into State ownership and everyone whinges about the debt taken on we need to recognise the value of the assets, too.

It is also important when looking at international debt and tax “burden” comparisons. Our Debt includes most of the health and school estate; our taxes deliver health and education free at the point of use. This is not true in many other countries so any comparison must take account of what we get for our taxes and what assets we own (relative to other countries).

Thanks Clive

“When a government sells off an asset it is “balance sheet neutral” ”

Interesting. Does this mean that the opposite is true when it acquires an asset?

I am not sure either us wholly true

It depends on the set and its use to society e.g in terms of multiplier effects.

I use “balance sheet neutral” not in any technical sense….. merely to make the point that if we take on more debt to acquire an asset then it is not a burden…. as long as the asset is something we want/need.

The issues should always be:

Will the asset be more productive/beneficial under State ownership or not?

Is it being acquired at a sensible price?

In the example of Water, the assets will be better under State ownership; financing costs will be lower and the business managed for ALL stakeholder, not just shareholders. Sensible price?? (Virtually) zero for the equity, 20% for sub debt, 60% for senior debt would be my suggestion…. but I know Richard thinks me overly generous!!

Spot on

Given that QE as you describe it is essentially money printing by the government, the question is how much cumulative money could the government print (and not subsequently cancel through taxation) before the FX markets took fright, the value of the pound collapses and inflation runs away? Clearly there is a limit (as many countries around the world have previously found), but the question is what is it?

The limit is gainful full employment.

No economy has frightened markets by achieving that

And markets don’t matter, as QE proved. We actually don’t borrow them while FX is based on productivity and investment would improve that. What are you frightened off but nonsense myths?

I thought Quantitative Easing (QE) was more like a government loan: the Bank of England purchases securities putting money into the economy, but at some point, the securities are sold back Quantitative Tightening (QT), removing money from the economy.

“Printing money” would be when a government spends into the economy paying jobs, or investing in infrastructure. This must be dependent on the available labour (and resources available) available. Maximising this is always desirable as reduces employment (and benefit payments), and produces something of benefit for the community.

There re three stages in QE, and then QT.

Stage 1 is deficit spending by the government funded by the BoE.

Stage 2 is issue bonds to supposedly cover the deficit.

Stage 3 is QE – the Treasury buys the bonds back under cover of the BoE who it indemnifies as its agent when doing so

Stages 2 and 3 are a complete sham – neither was ever needed.

QT is a way of withdrawing cash from the economy to keep rates high unrelated to any of this. QT could get dine with new bonds. It is sham again that old ones are supposedly reissued.

“…. those guilts are effectively owned by the Treasury”.

Sorry, Richard this is definitely wrong. The guilt has to be shared around equitably, notably with the ONS.

🙂

Sorry – I knew there must be typos but I was knackered by the time that was done

No, Richard your inadvertence was an insightful, unconscious serendipity.

🙂

Who am I, of all people to point to the tiptos (sic) of others……?

Tiptoes, John.

Even your jokes have typos 🙂

Was about to highlight the “guilts” typo. Though I do love the implication too. Maybe we need to rename them so.

No….

They have a role

Please forgive my naivety, but why are they (the UK government) lying, and why are the opposition not calling it out? Whose interests does it serve, and how?

Seasons greetings btw, I’ve been following you for years, but perhaps not paid enough attention.

Excellent questions

The Tories want to stop government friending. Labour seem to want to do the same thing.

“Friending” – Funding?

I suspect so

I will edit it, but not today

This is quite a feat this post, with some sub editing here and there it would make a fine article for publication elsewhere. It should be sent to the Labour Party for a start. To me it reads like a manifesto.

A fine Christmas present. Thank you.

It reminds me why there have to be so many lies about these issues.

First and foremost, the position of wealth would be put in its true place. We would see that we do not need ‘their’ money and that taxing them was actually quiet useful to actually curb their power and make our democracies stronger again.

Sovereignty would also be restored to nation state currencies as we would axiomatically not be dependent on the largesse of the rich to help us to be wealthy and stable. This piece disembowels that notion and destroys their false status in the orthodox narrative we suffer under.

It is also consistent with the true reforming spirit of Jesus at this time of the year, and why he was sent here which was to show us that it was possible to bring heaven to earth in the here and now and not have to wait until death for this. In short it show us how to value and curate life.

This piece also reminds me that even Covid can’t keep a good man down and indeed that is what you are Richard.

Thanks

I will sub edit and start sharing after Christmas

I agree with all your points, Pilgrim, especially the last one.

f only Labour would take this up. I don’t seriously believe Starmer is a conscious Tory plant as many say. I do think he has been recruited and persuaded by the City /banker class. ‘Turned’ as they say in spy novels. Like Ramsey MacDonald in the 1931 crisis he thinks there is no alternative. Possibly makes him more dangerous?

My Christmas prayer is that some of the many Labour Party people who want a better country and world, will take note of alternative views led by this blog and start the process of change.

My name sake Robert Louis Stevenson said it was often better to travel than to arrive. Things never stay the same so maybe there is no fixed destination. But I do hope we can arrive at a better place before I leave this world.

Thank you so much for all this, Richard; especially given your illness, from which I hope you soon recover.

May peace, happiness and good health be with you and yours.

Thanks Russ

There is another possible explanation of why Labour seems to accept not only this inherently conservative National Debt mythology, but also the whole conservative narrative of ‘taxpayers’ money’, ‘public spending’ (rather than investment), etc… It is that this narrative, this whole conception of what government, money, etc, really are, is so ingrained as to be the ‘common sense’ of the status-quo, the establishment, and challenging it through detailed, complex, reasoning, however true, would be met in the UK media with the sort of ‘magic money tree’ ridicule that substitutes for evidence and reason in this post-truth soundbite political era.

You may be right

Thanks for all the hard work you have put into this analysis. Outstanding work and I consider it to be a great Christmas present.

Tim Rowe

Thanks

Thank you for that clarity.

Excellent stuff and a great Christmas present – thank you.

Every accounts program in the world runs on compulsory double entry.

Do the ONS, BoE and Treasury not employ accountants?

Or only perhaps economists?

If they do employ accountants on what basis do they renounce double entry?

Best wishes for a speedy recovery and a better Boxing Day

They seem to pride themselves on not doing double entry

It is bizarre

A few years ago Anne Pettifor, who is usually on the side of the angels, decried MMT as “accounting not economics “.

To quote Keynes: “When the facts change I change my mind. What do you do sir?” If you are a mainstream economist you will either ignore the facts or assume them away. Because we cannot have basic things like facts (or double entry bookkeeping) disrupting our fairy tales can we

I think Steve Keen has persuaded her otherwise now

I left him to do the hard work.

I’m wondering how the UK compares with other countries in assessing its debt? Do they all follow the same principles or is the UK the exception? Ignoring the Eurozone of course. Or maybe not…

There are meant to be standard rules

Experience suggests there are margins for interpretation

True, and the problem we have is that the Bank of England is rapidly converting the gilts it purchased under QE into real debt (by “selling the gilts” back to the markets) and then cancelling out the sums received, in order to destroy the QE created money (which cripples public finances and, as you point out, makes it impossible for our government to reverse austerity or deal effectively with the climate emergency), i.e. “Quantitative Tightening” (QT)

(See for example: https://gezwinstanley.wordpress.com/2023/09/29/dont-destroy-trillions/ or https://gezwinstanley.wordpress.com/2023/01/07/the-quiet-plan-to-add-an-extra-trillion-to-public-debt-and-justify-eternal-austerity/ . Both those blog have links to sources including primary ones at the BoE is anyone wants to check this out for themselves).

Even worse, when the Bank of England is challenged on QT, it just accelerates it further. So those two blogs are now out of date because they state that the Bank is destroying public funds at the rate of £80 billion a year, but now the Bank has increased that rate to £100 billion a year (source: https://www.investorschronicle.co.uk/news/2023/09/25/why-the-bank-of-england-needs-to-rethink-its-bond-sales/#:~:text=In%20last%20week's%20monetary%20policy,45bn%20over%20the%20past%20year).

We need to stop QT now.

Agreed

Very good blog by Gez Winstanley. Who is he? No biog given.

He commented, at length on Richard’s blog titled ‘Why we need a national debt’ ….. in July.

I have just realised that I have mutated into an anorak. I need to lie down….

My question as well. He is clearly very knowledgeable in the area.

Reference to Gerrard Winstanley of the Levellers I suspect

Para 7 last sentence “….. the debt has to be decided by this sum…”. Typo? “reduced”?

Yes

Done

Great article!

Happy Christmas and get well soon.

Hi Richard, have you looked at the market value of those gilts?

It’s interesting to note that when discussing the debt-to-GDP ratio, Conservatives often reference the Maastricht ESA 10 debt figure, which is a key ratio in their arguments. However, given that GDP figures are adjusted for inflation, wouldn’t it be more consistent to use market values for the numerator in these calculations? And if rates follow inflation, then the present value of debt is also lower.

I have looked at this but do not use it as an argument in general because of the risk of additional complexity in an already complex area.

For my clarification and edification,

in the debts, there are listed 262m of government assets, which, if i understand it correctly, offset some of the debt.

If I am correct in this thought, then what a pity that the UK only owns 262m worth of assets.

What would happen, if for example, the UK government were to buy back and re-nationalise our water systems (or infrastructure, rail, etc.)?

These assets would cost money (say £50bn, but they would have value (say £50Bn) which would offset the cost. And then over time, these assets would generate income. Further, these assets, would offset a portion of the national debt.

(or maybe I am wrong).

The ONS will only count assets in the form of cash and capable of being truned into cash within 12 months.

Those assets are essentially short term funds used to cver deposits at NS&I, which is in itself quite absurd and itterly unproductive.