There are moments, I admit, when I wonder whether it is appropriate to talk about past achievements. There is always the risk that doing so sounds like bragging. On the other hand, ignoring what has been achieved is to deny the fact that change is possible. I think it is important to take courage from the evidence that it is.

In this context, I note that the Tax Justice Network (TJN) held an event yesterday to celebrate the fact that it has been in existence for 20 years. In the circumstances, it was slightly odd that they failed to invite John Christensen, Prem (Lord) Sikka, and myself to the event given that we were the three people behind its launch event in March 2003.

On the other hand, perhaps that is not surprising, in view of the fact that all three of us have now broken our association with the organisation because of our concerns about its current governance structures and the direction of its policy, which we think wholly inappropriate. Those concerns are summarised here and here.

That said, the current leadership of TJN commissioned a report to appraise its success over the 20-year period. I got sent a copy of that yesterday because I was interviewed during its production. It is also on the TJN blog, although without the prominence that you would expect. That, though, might also be unsurprising. First of all, I read it (all of it). Then I did a few name checks. John Christensen came out highest, with 17 mentions, as is entirely appropriate. I came next, with 16. I doubt that this is the message TJN wanted to hear.

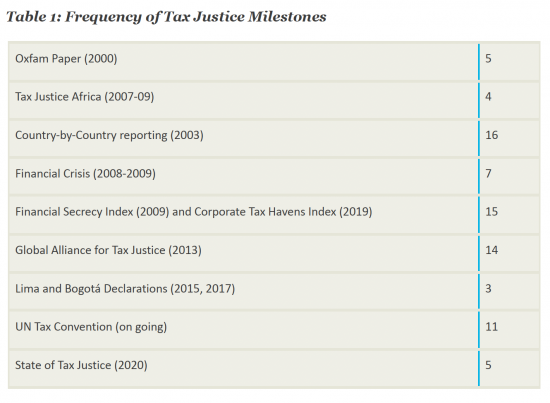

I also noted this table of the supposedly significant events in TJN's history.

I do not agree with it entirely. Three significant events are omitted. The first was the launch of TJN's conference right at the outset of its existence, which was basically a joint imitative by John, Prem and me and which was always held at Essex University. This was enormously important in creating interest in what we were saying from 2003 onwards.

Then there was the publication of the first version of ‘Tax us if you can', written by John, Christensen and myself in 2005, which pretty much established the tax justice agenda that is still being pursued now. This was pivotal to the creation of the movement.

The other one is the redefinition of tax havens as secrecy jurisdictions, which I did as part of the foundation work for the first financial secrecy index, published in 2009. I am not sure that this is even on the TJN website anymore, but this not only changed the language used about tax havens, most particularly at places like the OECD, but also changed the policy focus for addressing the problems that they created. Tax ceased to be the priority, and instead secrecy took its place, because that was what facilitated the tax abuse.

That said, I did take quiet pleasure from this table. As the report acknowledges, country-based country-by-country reporting was my creation. And, whilst I do not claim all credit for the financial secrecy index, I did create its structure and the direction of travel that it has pursued ever since when directing its first iteration. I can certainly claim a fair portion of the credit for its success. Or, to put it another way, despite the TJN's desire to whitewash John and me from its history, the evidence suggests that this is a mistake on their part. We played a very big role in what TJN has achieved, including on automatic information exchange, which is curiously ignored, from which the EU Tax Observatory noted this week has reduced offshore tax abuse by more than 60%.

Unfortunately, there is little, if any, chance of this success continuing. TJN, and almost every other organisation in the tax justice movement, has now given up campaigning on any tax-related issue. They are, instead, almost entirely focused on moving responsibility for work on international tax from the OECD to the UN, despite the fact that the OECD is the only organisation that we have in the world that is capable of delivering anything approximating to tax justice.

It is their claim that as a product of the 1950s, the OECD is a rich-country club dedicated to maintaining post-colonial power to oppress developed countries. That there have been elements of truth in that on occasion is undeniable, just as criticism of the IMF and World Bank has also been appropriate on occasion. What I would, however, suggest is that all three are hearing the criticisms and are in many cases responding appropriately.

What is most certainly inappropriate is to argue that all tax activity should now be moved to the United Nations, for three reasons.

The first is that the UN has more developed country power embedded within it, through the working of the veto in the Security Council, than has any of these other organisations. From the outset, and without substantial reform, the UN is clearly the wrong place to deliver a new tax justice agenda from. In many ways, it is much worse than the OECD.

The second is that the UN simply does not have any capacity to take on this task, and it would take a great deal of time and effort to create it, which time is not available.

Third, this whole policy ignores the fact that the OECD has delivered. Automatic information exchange is a success. Country-by-country reporting is a success. The global minimum tax rate is a success. Moves towards better disclosure of beneficial ownership are beginning. Tax haven secrecy is being broken. And, yes, I can add that in every single case, the progress is not as great as I would desire. But pragmatically, of course, it is not. I want the best possible, and achievement happens in the real world, which is something the current round of tax justice campaigners appear to wish to ignore.

John Christensen and I had a simple goal when leading the tax justice movement. It was to provide simple, pragmatic, and deliverable policy suggestions that were based upon a deep understanding of the issues being addressed with which our opponents could not, eventually, disagree, however much they wished to do. As a result, we were, by and large, successful. On the way, we talked to and compromised with many of those whom those on the left would say we should never have accommodated, including the IMF, World Bank, OECD, the big for firms of accountants, and others. By doing so, however, and by recognising that they had a right to be at the table, we made progress.

The trouble for the existing leaders of the tax justice movement is that they deny that there is any table around which they are now even willing to sit. In the process, they guarantee that they cannot succeed. Simultaneously, and let me be cynical about this, I suspect that they hope that they can perpetuate their own employments in their current tasks. TJN in particular has simply become a job perpetuation exercises without any reason for existence that I can now identify.

I am proud of what the tax justice movement achieved. But as it stands, it will not be going further any time soon. Its leadership has driven it into a dead end from which there is no way out whilst offering no solution to anyone. It troubles me to say so, but this anniversary requires that this be recorded.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

John Christensen, Prem Sikka, and yourself achieved a great deal. Would I right in thinking the measures you three managed to negotiate have benefited the Exchequer by as much as let’s say, scrapping non-dom allowances?

I hope it impresses the politicians when you try to convince them to implement your suggestions on taxing wealth.

Probably quite a bit more……