Yesterday was HMRC tax gap day - which is the day when they admit how much tax they did not collect, in their estimation.

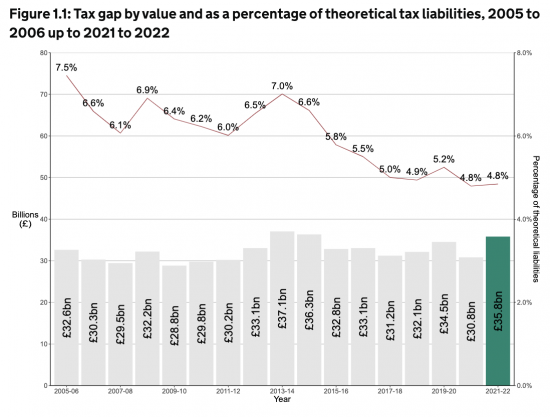

My standard joke of the last decade has been confirmed yet again. Whenever I am asked about HMRC's tax gap (which I used to be often, because I did extensive work on this issue from 2008 to 2015) I joke that it's a number very close to £32 billion, whatever the true number might actually be. And so it was again this year:

That figure is not even remotely correct because of the limitations within the methodologies that HMRC use, about which I have written many times in the past.

I would also note that it is statistically implausible to get this outcome.

I have argued before for an Office of Tax Responsibility to properly appraise the work of HMRC, the tax gap and now tax spillovers. It hasn't happened. But a government that was serious about this would be putting one in place. All the time they don't, we have to assume that they're happy for the tax abuse to continue, and that begs the question, why is that?

For a proper understanding of what we need to do I recommend a chapter I wrote on this issue a while ago.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Dire.

I think I have commented here before (when I was not yet a retired member of HMRC staff…) that the main point of this measurement, from the point of view of the politicians and HMRC senior management, is to attempt to justify the mantra “more from less” – ie. that as government shrinks the department it still manages to collect as much, if not more, of the revenue due to the crown.

What is particularly implausible about the most recent figures is that HMRC moved significant numbers of staff from traditional compliance activities, to examine potential fraud on Covid support schemes, and this, amazingly, does not appear to have had any detrimental effect on traditional compliance yield compared to 2020/21.

I share your cynicism