The IMF published a paper yesterday highlighting some of the impacts of inflation.

Some were totally predictable:

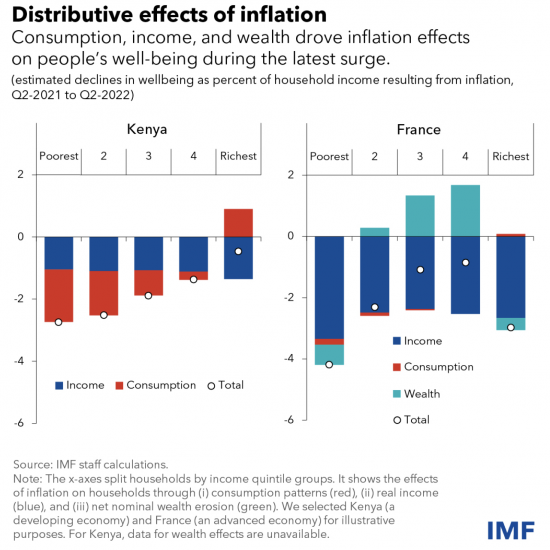

It will be no surprise to anyone that the biggest negative impacts of inflation are on those in the poorest groups in society and that relatively speaking those in higher-income groups do much better.

This is partly as a result of policy measures:

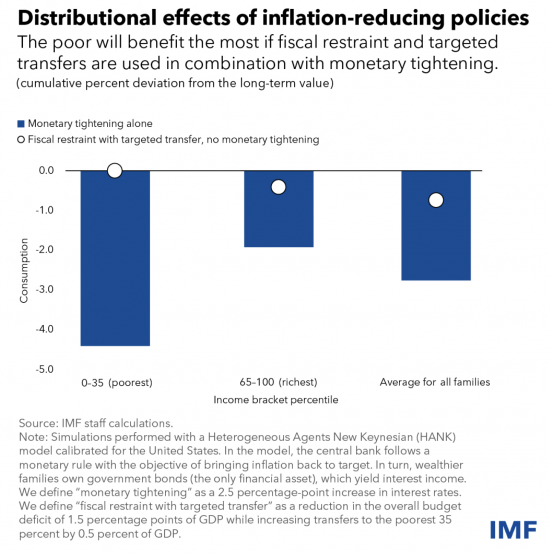

As the IMF notes, austerity combined with tight monetary policy hits the poorest hardest. There is no surprise there. Of course, this could be countered. As the IMF notes:

To safeguard the poor—who benefit more from public services—tax hikes or cuts in lower-priority spending must be combined with larger transfers. This strategy results, by design, in no drop in consumption for the poor, but also in a lower decline in overall consumption.

This is not happening sufficiently in the UK.

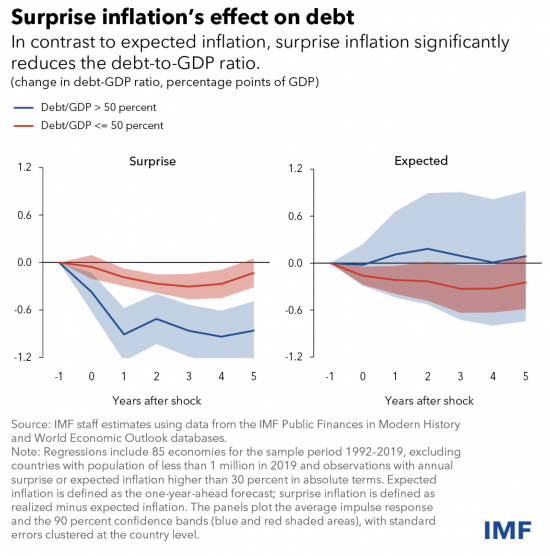

But there is what the IMF call a surprise outcome for governments:

Government debt-to-GDP ratios fall so long as inflation is constrained after breaking out. That is because the government wins at the expense of its bondholders, which s currently true. Of course, governments will claim this fall in debt-to-GDP ratios after inflation is a policy success. Actually, it is the result of their policy failure. In due course, that will need to be said.

As it will also need t be said that the gain should be spent to address the problems inflation has created, but you can be sure governments will ignore that.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting paper.

Controlling inflation through higher rates “makes the rich richer” (well, at least relatively speaking). Given that the rich are receivers of interest and the poor are payers this should not surprise us…. and perhaps explains the neo-liberalist view that inflation should only be tackled with monetary policy and not fiscal policy (which the paper demonstrates leads to a more evenly spread pain).

Friedman famously said said “Inflation is everywhere a monetary phenomenon” – which justified money supply targeting. But the truth is that “Inflation is everywhere a “price hike” phenomenon” – and that inflation can and should be tackled directly with fiscal measures like price caps, excessive profits taxes etc. (alongside monetary measures where appropriate).

Exactly how does a fall in debt-to-GDP ratios result from the government’s policy failures? I’m afraid I missed that.

Inflation increases GDP but leaves the redemption value of bonds fixed and so the ratio of debt to GDP falls

Does this take account of index linked public debt?

Yes

It is an increase in *Nominal* GDP surely, other things being equal.

And a great many bonds are index-linked now for good reason – in previous eras lenders lost money.

Nominal, yes, but that is how this is stayed

And the majority of gilts are not index linked

The IMF is right

A slightly different outcome if the unpaid (until redemption), indexed interest was instead expensed off over the life of the index linked bond; but probably not a material effect on the overall outcome; but the interest cost saving now would be material; at least that is my ‘top-of-the-head’, on-the-hoof guess-timate (roughly in line with the method of current gold-standard economic forecasting).

But that impact is one off the way they account for it

The rise in gdp is permanent

Richard do you think inflation was generated deliberately by the neoliberals to purposefully increase inequality?

No

They aren’t that clever

Truth if ever there was any on the paradoxes that exist in these situations. It still seems to me that the Tories are saving up a warchest of tax breaks to bribe the electorate that no doubt their media with fawn over.

[…] By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK […]