I have just posted this thread on Twitter:

The Bank of England's going to increase interest rates today. It may be by 0.25%. It could be by 0.5%. But the question is, why are they choosing to increase the price of money when we already have an inflation problem? A thread to explain…..

The Bank of England (BoE from now on) believes in what might best be called conventional economic theory. This says inflation is caused by too much money chasing too few goods available to buy, which they say means that prices are then bid upwards.

The BoE believes as a result that its job is to reduce the amount of spending power in the economy. It thinks that if it does so then there will be less money available to people to spend, and so the pressure on prices will fall.

The reason that there will be less to spend is, of course, because those who are borrowing will have to spend more in interest payments and as a result will have less to spend out of their incomes on anything else.

The BoE also believes - as indicated by Governor Andrew Bailey's appeals to people to accept below-inflation pay increases earlier this year - that if only real wages can be reduced during a period of inflation this too will reduce inflationary pressure.

The thinking behind this claim - which is clearly spilling over into government pay offers of well below the rate of inflation - is that cutting real wages does again reduce the amount available to spend in UK households.

There are many problems with this thinking. Bear with me whilst I work through them in turn. I think you probably need to know this stuff because there's a very good chance you will be a victim of the BoE's deeply mistaken logic.

Firstly, this approach to inflation assumes that UK households have too much money to spend. That is why the BoE thinks some spending power must be taken away from them. But this is nonsense. 20% of all UK households are already struggling to pay bills and many more will soon.

The problem that most people in the UK economy has is that they do not have enough money to pay basic bills like rent, gas, electricity, the mortgage, water, council tax and broadband. It's not that they have too much money. They don't have enough.

So the first and fundamental problem with this policy is that the BoE is prescribing a cure for a problem that very clearly does not exist. For most UK households there is a shortage of money right now, and not an excess.

How can people paid so much money to do such an important job get something so wrong? That is easy to explain. Precisely because these people are all very well paid they simply do not understand the world of those who cannot make ends meet. Everyone that they know can.

That brings me to the second fundamental problem with this policy. It is that it does not recognise that the UK is made up of two countries. They are the ‘haves' and the ‘have nots', and they behave quite differently economically.

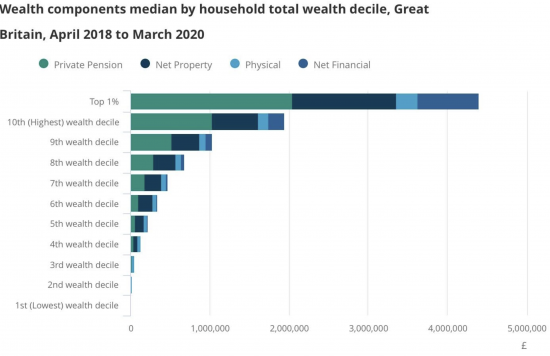

This chart is on the allocation of wealth in the UK between ten equal groups in society (so-called ‘deciles'). It also shows the breakdown of the wealth that those in each group have, on average. The data comes from the Office for National Statistics.

Now note that outside the top 10% the amount of financial wealth that any group has is small. Many groups, admittedly, have very little at all. But almost all those outside the top 10% have most of their wealth tied up in houses, pensions and things like cars. Savings are low.

The ‘haves' that I have described are those with savings. The ‘have nots' are those with small or almost no savings. The split is roughly 10% ‘haves', and 90% ‘have nots', although the ‘have nots' could be a bit bigger than that because the top 1% have so much.

This matters when it comes to the Bank of England's policy of raising interest rates. The 90% or so of ‘have nots' are likely to pay more interest as a result of the BoE interest rate rise. They have few savings and quite a lot of borrowings on their properties and other loans.

On the other hand, the ‘haves' gain from the BoE policy. They by and large have few if any borrowings and they stand to gain from earning more on their savings after the BoE has raised interest rates.

Now it just so happens that there is one group in society who do have too much money, as the BoE assumes right now. They, unsurprisingly, are the ‘haves'. Their savings can cushion them from the blows of price increases. They have money and other assets they can fall back on.

Times are not hard for the ‘haves' right now. And the BoE is just about to make it easier. They will actually have more to spend because of the BoE interest rate rise. No one else will.

What this means is that counter-intuitively, the one group in society where there is a real need to reduce spending power because they are the one group who can push up prices in the way the BoE thinks happens are precisely the one group who will not be punished by BoE policy.

But all those groups who do not have the spending power to increase prices are exactly the ones that the BoE is going to punish with it policy. They could not have got things more wrong if they tried.

Unless, of course, they have not got things wrong and what they are actually doing is seeking to ration the availability of goods and services in society in the most perverse rationing system ever invented, where those with most need get least and those without need get most.

There is a third reason why the BoE policy will not work. It's not just the assumption that people have too much to spend that the BoE get wrong. They have actually totally failed to identify the proper cause of this inflation.

The inflation we're suffering is the result of shortages of oil, gas, fertiliser and food, in the main. Some of these are real (food, in particular). Others are being stoked by speculators who are profiting from them, which is why oil companies are declaring such big profits now.

Almost none of those issues arise within the UK. The causes of short term inflation that existed last autumn, like the shock of Covid reopening, have almost all been solved now. Instead, almost all of these causes of inflation arise directly or indirectly outside the UK.

As a result there are three things to note. First, the BoE and UK government have little influence over them. Second, they are in no way impacted by anything the BoE does by changing interest rates. Third, inflation will not be stopped as a result of the BoE interest rate rises.

So, in conclusion, the Bank of England has misread the economy; it is prescribing the wrong policy; it is going to make all the ‘have nots' in the UK worse off as a result, and the ‘haves' better off, and it's going to achieve nothing with regard to inflation.

But it will succeed in making life very much harder for up to 90% of the population, and for a significant part of those people nigh on impossible. What I want to wish is that this is not its aim. But I can't think that. I think this is deliberate.

And it's the fact that the BoE is doing this knowing that people will suffer that sickens me. They actually want that suffering to happen because they think that is required if they are to indicate their intention to eliminate inflation, even though they have no clue how to do so.

That they are also indifferent to the hundreds of thousands, if not millions, of people who will also lose their jobs as their employer's fail because of increased interest costs is almost incidental when considering this callousness, but it has to be mentioned.

Rarely in the history of economics will so much damage be caused by so few to so many and all in the interests of pursuing economic dogma when economic reality demands something very different.

What would that difference be? Restoring zero per cent interest rates is what the BoE should do. In the face of this inflation crisis it is their job to cut the cost of money.

And then they should be saying that the government must tackle the excess wealth of the ‘haves' in the top 10% of wealth holders.

And that the government should be directly assisting those most impacted by this crisis with additional support.

Will the BoE do that? No, of course they won't. They'll be raising interest rates instead. They want the misery to begin.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thank you, Richard, for your sharp analysis. I’ve read a few of your blog posts to try and learn and understand the dire state of the UK, politically & economically.

Thanks

I suspect people at the BoE and the MPC are all in the haves sector.

Again the actions of the BofE show the appalling nature of the economists and Money Men.

How on earth do they end up so warped?

Thanks for the excellent analysis. I am not always 100% in agreement with your views (I value your blog in challenging my assumptions and quite often persuading me out of them). This time, I can’t see any arguments against what you are saying.

Impressively clear explanation, Richard.

I hear stories of people’s rents being increased-above the rate of inflation.

https://www.theguardian.com/business/2022/jul/14/private-rents-in-uk-reach-record-highs-with-20-rises-in-manchester

Some shareholders are enjoying rises. Yet salaried or hourly paid workers are accused of being ‘selfish’ or even ‘holding country to ransom” by pay claims which will only just about keep up with inflation.

It does seem there is ‘one law for the top decile’ (so to speak) and one law for the rest. That is the modern Conservative party.

The chap who sells me petrol usually gives me his assessment of current affairs. ‘When they are preaching to the dinosaurs of the constituency associations about tax cuts, they aren’t talking about you and me. A penny off the income tax for someone on average earnings is less than a pound a day. They are talking about less tax for the really well off.’

I suspect he may have a point.

There is no intellectual or moral justification for fighting inflation with inflation.

Or using petrol to put out a fire.

Yet interest rate rises are the equivalent of the latter for sure.

So now its a choice between paying off your debt, eating and heating. I know that there is mythology that markets like to promote choice but what sort of choice is that?

Your post is spot on as usual. All this does is help the creditors get their share of the inflation benefits that some of the producers are getting. They get their noses in the inflation trough.

Disgusting.

Will the BOE continue to raise rates even while finally admitting we’re headed for a bad recession and that they can’t control energy inflation.

I suspect so….

A most impressively clear and succinct explanation which surely anyone with half a brain should be able to comprehend. Here’s hoping it gets the attention it deserves on twitter and elsewhere.

At least the Guardian seems to agree with you (yesterday’s editorial):

https://www.theguardian.com/commentisfree/2022/aug/03/the-guardian-view-on-the-economy-a-mess-the-bank-is-making-worse

That editorial was good

And thanks

One of the comments to the editorial suggested they’d got it wrong. The interest hikes were necessary to support the value of the pound, thereby reducing the cost of commodities priced in dollars. It sounded rather dubious to me but probably got some people thinking along the wrong track.

The problem with lowering interest rates to stimulate the economy is that it encourages the build up of too much private debt. Later on, if there is a perceived need to slow it down, rightly or wrongly, raising them converts a high level of private debt into a high level of bad private debt.

Bad debts create other bad debts. In the worst case, and also the most likely case if we carry on like this, we’ll see another 2008 style meltdown. The same level of interest rate rises are happening in Europe and the USA so it won’t be confined to the UK. It will be a global crash.

Ah, so you’d rather we lived in misery than take the risk of managing some debt

I don’t get it

@ Richard,

I thought I was agreeing with you albeit looking at the issue from a slightly different perspective. I’m saying that monetarism isn’t the right way to attempt to regulate the economy.

OK, I misread you

Hi Richard, would a progressive wealth tax on the top 1% be part of the overall solution? I’d be interested to hear your views.

Yes

But there are much easier routes

I’d be interested to read your opinion.

Regarding landlords owning multiple properties, my clever son suggests that taxes should increase progressively, the more properties are owned, the higher the tax. At one point it would not be viable to get more properties.

But the Tories will never implement such an tax.

That could work

But there again, I would simply go for an investment income surcharge if 15% – 20% on income from investments

That only levels up for national insurance not being charged on it and would;d be very simple to do

Simple taxes are good

In time, more “deaths of despair”.

Scottish research (Allik et al, 2020) says: “To reduce deaths of despair [from drugs, alcohol, suicide], action should be taken to address social determinants of health and reduce socioeconomic inequalities.” These deaths “are seen to stem from unprecedented economic pressures and a breakdown in social support structures.”

Research (GCPH) finds that the underlying causes of deaths of despair across the UK are the same but the impact on Scotland, particularly with regard to drug and alcohol deaths, is strikingly higher. The underlying causes are socioeconomic. Many Scots are more vulnerable because of ” a toxic combination of adverse historical living conditions and waves of detrimental national and local government policymaking…”

Research by Minton and others says, ” economic and other policy decisions during the 1980s created rising income inequality, the erosion of hope amongst those who were least resilient and able to adjust, and resulted in a delayed negative health impact.

.

UK government policies, the past still working through, still causative for the future, are clearly at the root of deaths of despair.

Just seen Danny Blanchflower on Channel 4 news. He forecasts a screeching hand brake turn by the Bank.

I think that likely

And I’d add that a lot of QE is going to be needed to

Ian Stephenson: Thank you for pointing out this forecast by Mile-End-Road-Economist Danny Blanchflower. I hope he is right, apart from everything else, for my daughter, a Mile-End-Road-mortgage payer. And I’m glad to see you agree, Richard. Outstanding post, with your usual utter clarity, which I will be sharing.

Looking at the UK yield curve data (from the BoE website), the market is pricing in a reversal of policy in about 9 months.

[…] This, perhaps, is where Bailey may prove to be a fool as well as a liar. Because, as Richard Murphy argues: […]

So C4 had Blanchflower – but non of the mulitple economic voices on BBC r4 even hint that there might be an alternative view – they are all – ‘yes interest rates have to rise’ – minor differences as to when and by how much.

British Government Broadcasting Propaganda Corporation.

Great summary. Thanks.

Richard, you have the absolute knack of encapsulating and clearly explaining difficult economics in plain English. You make it easier for lay people like me to understand.

It is appalling what is being done intentionally to the majority of people in this country by those who are very far removed from what it is like to live in poverty. They have no understanding, no empathy and probably no lived experience.

What they are doing is beyond criminal. Yet we are powerless. What can we do about this?

See this morning’s long post…..

To add to the confusion of the above, on Radio 4 this morning Andrew Bailey was effectively asked about the capitulation of the Bank to the treasury. He attempted to rebuff this by talking about having discussions with the new government. I’m presuming that the tory leadership candidates have hinted at their displeasure with the Bank in which case we are in very dark days indeed.

A superb assessment of the situation..why do every central bank disagree with you? Why do they think the money supply is linked to inflation? What a totally bizarre thing to think. I agree with you we can print as much as we like and can all enjoy the benefits unencumbered by any negative consequences.

But that is not what I am saying in any way

And I suspect you know that

@ Paul Sykes,

Sarcasm can be a useful weapon but you need to be better at it than you are. We all agree, including the BoE’s Andrew Bailey, that the issue at the moment is mainly one of a reduction in supply. The question, therefore, is how can an increase in interest rates increase that supply? Are the big oil and gas producers going to export more just because we’ve put up interest rates?

If they aren’t then why should we do it?

We all know that wealth doesn’t trickle down, but it seems that inflation does.

I have to agree with you that the present trend of actually increasing inequality is deliberate. It certainly seems so.

It would be some comfort if there was vociferous opposition from the Labour Party, but I’m not hearing it.

Well reasoned article as always. Wrong policies for the wrong reasons that will cause the wrong outcomes!

Great analysis, thanks. How does this hold from a business perspective? Traditional economics says higher interest equals less money meaning they will have to pay less for their inputs leading to lower inflation. I know a lot of the current inflation is external, but will this have an effect? What proportion of overall inflation could this relate to?

This is going to kill sales and increase costs

Doubling unemployment happens because businesses will fail

Richard Murphy. As I understand it the BoE believe that increasing interest rates will eventually in the mid to long-term reduce inflation by reducing personal borrowing by making it more expensive. The damage to the economy by the deeper and more prolonged recession that this will cause will be borne by those already in debt throwing people on the dole and worsening poverty. They will be told Tina.

But it seems to me this policy is like using a hammer to crack a nut. I read that the principle origin or cause of our current inflation is supply side shortages partly due to Brexit, COVID impact on China production lines for chips for example, and energy prices. I note the impact of the war is apparently only just being felt.

So if inflation is mostly due to supply side factors, it doesn’t seem the correct medicine to take money out of the system. Instead shouldn’t we be putting money into the system to produce the goods and services that are in demand and to overcome the supply chain problems? Has the BoE got it totally wrong?

You are essentially right

its never ceases to amaze me ,how educated people wreck country’s with an over estimate of their knowledge and an underestimation of the job in hand ,i am un educated 63 year old ship yard fitter with not 1cse ,and even i know that the economy,s have consumed themselves and become cheap digital money driven by bank profits leading to the UK been loan obese ,compound this for the UK with Brexit UK diminishment and walking away from trade & citizens rights with our closest trade neighbor and little or no political leadership apart from the od bling sound bite to gain attention of the other wise engaged politically rudderless directly effected masses ,I am from Hull,i live in Spain ,my council tax is £7 pwk,my water is £3 pwk and my electric is £15 a week ,the resident Brits have been getting over charged for years,and it looks like its about to go all 1980,s again on the day to day ….and although i am not an accountant 2 plus 2 normally ends up at 4 so as we say in Yorkshire …..trouble at mill/pit

I have no way of assessing the authenticity of this comment

i am very authentic Richard i have read you blog for years and enjoyed reading it,i have only taken part now because i am wondering what comes next for UK PLC ,i was brought up in the 1970,s in an AUEW closed shop ,i then went into business in the early 1980,s when Norman Tebbit told us all to get on our bikes and find/make work ,my PM was lady Thatcher ,and I can tell you all now as an ex shipyard fitter with uk interest’s that did very well from a non CSE start ,hell can freeze over befor i vote Tory Again after the economic

Brexit shambles the ERG has launched us into

Regards to All Steve in a very hot 35 degre Almeria spain

Thanks

Whilst that article is correct in many spheres particularily that those in power be it MPC or in Government have incomes that mean they are immune from and have no comprehension of how ordinary people live .

However within what is described as ” the haves ” are those who back in the 1950s knew incredible poverty and who saved every penny they could, in the 1960s they went without in order to raise the deposit on a tiny house and get married …they lived on baked beans on toast and everyones hand me downs for many years during which time they too struggled with mortgage rates of 12 or even 15% …for them there was no free childcare or indeed any other benefit inc Child allowance , HRP etc ….the men may well have been lucky enough to work for a company that meant a pension ….neither of them ever earnt enough to pay more than standard rate tax …fast fwd they are now late 70s and have a nice house , very elderly car and savings that have earnt nothing since 2008 plus a company pension ….to call them the haves who should be taxed out of existance is insane …they likely also cared for elderly parents and may have received an inheritance which attracted a huge IHT bill thanks to Gordon Browns mean minded limit ….i think someone needs to face reality and start listening to this segment of society who still cannot by any stretch of imagination be called ” Haves” but have more sense and experience than any of todays ruling classes yet using the logic from above should be taxed out of existance

Let me promise you, the6 are the decided ‘haves’ – and it was inflation and not hard work that gave them that status

You are very wrong

And I am a baby boomer

You have absolutely no idea just how wrong you are …its being ultra careful , working hard and saving that has put them in the situation ……inflation has absolutely nothing whatever to do with it

That is the nonsense trotted out by Mark Carney

Sorry, but I watched my parents made rich by inflation and my children denied access to housing because of that

Now, politely, take your drivel elsewhere

One thing is very certain …you have learnt no manners and most definitely did not grow up in the extreme poverty of 1940s that i know in technicolour…..its the actions and IHT levied under G Browns reign that has denied you and especially denied your children any chance of buying a home .

Good manners require telling the truth

You don’t

Very well put.

However, I believe that it is not just the BofE which does not appear to understand. The Government and particularly the two current contenders for PM are more interested in winning the next election than solving key issues. The talk of reducing taxes (even if it can be afforded), will not address, the major inequality in the UK, unless they are very specifically targetted. Very little personal tax is paid by the most seriously “not haves”, as they do not earn enough to meet the thresholds, whilst “freezing” of tax bands only makes the the position worse more this group. Reductions in taxes like VAT etc. could help, provided they are targetted, and reductions not pocketed by greedy businesses to fund dividends and top level pay. What is really required is a “Robin Hood” approach, but this is probably akin to getting “Turkeys to vote for Christmas”. Finally clearly communicated, coordinated short and long term plans, replacing “knee jerks” would at least demonstrate if there is any real understanding of the issues experienced by the “have nots” masses. Is this too much to ask?