I watched the Tory leadership debate last night. I almost wish I had not. It was unedifying, and the BBC questioners failed to ask questions on Brexit, Rwanda and Northern Ireland but did allow far too much time on earrings, suits and the imagined failings of education in Leeds in the 1990s, which nonetheless got a deeply embittered Truss into Oxford.

Let me, however, concentrate on just one issue, which was the discussion on debt. Sunak claimed the UK credit card is maxed out, and it is deeply un-Conservative to borrow. The usual nonsense about grandchildren having to repay the debt was rolled out.

Truss argued instead that we could wait three years to start repaying our debt, but that she would start doing so then.

Both claims are nonsense. As regular readers will know I have been monitoring UK debt performance for years, most recently in June 2021.

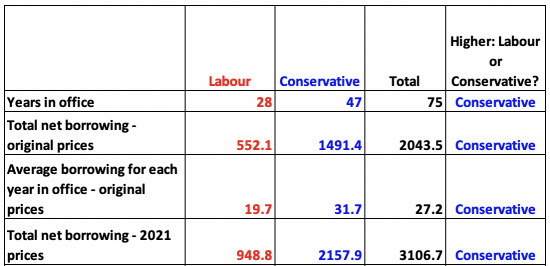

As I showed then, Tories have borrowed vastly more than Labour since 1945, both absolutely and per year in office:

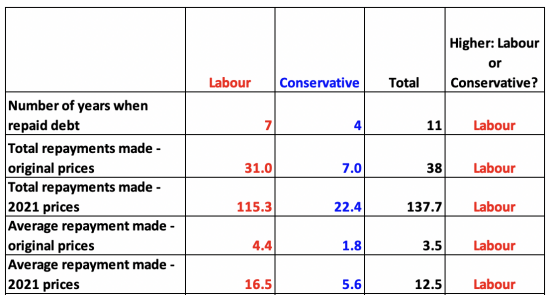

And when it comes to repaying debt, the Tories are dismal failures:

To put this in context, the Tories are the party of big borrowing, and when it comes to repayment of debt they have in 76 years repaid £22 billion - a sum less than the tax cust Truss now proposes.

On all counts, Labour is more prudent when it comes to borrowing and more consistent when it comes to repayment of debt than the Tories.

Truss and Sunak need to be careful: their claims are groundless when it comes to debt. The only thing they know about is borrowing.

Now I happen to have no problem with that. But they do. They'd be wise to shut up.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I see Sunak rolled out the phrase ‘unfunded borrowing ‘ again. Maybe they should have pushed him for a definition.

https://fullfact.org/news/bbc-conservative-leadership-debate-sunak-truss/

Full Fact on the case. Do you think they got it right?

Unlike you, I didn’t watch it. Couldn’t bring myself to.

Given the clams made were so weak it’s hard to fact check them, imo

It would be interesting to see those debt figure since 1979. After all, the modern Tory Party emerged with the election of Thatcher. What is their record of debt creation and repayment since then? The fact is, the Tories raid the magic money tree as and when it suits them to do so. It’s just that they waste the money (i.e. the track and trace fiddle) rather than use it productively (a comprehensive green energy plan) because they hate the idea of the state being seen as doing something good.

Labour need to learn this lesson rather than trying to out-Tory the Tories. I fear that Starmer is fighting the battles of yesterday as he desperately tries to keep the two party system alive. His refusal to entertain any alliance with the SNP shows he is living in the past. News for Labour, you are dead as an electoral force in Scotland. The Tories don’t need it and don’t care. Wake up and smell the coffee that FPTP is no longer your friend Labour.

Here are some numbers for you – see page 6: https://researchbriefings.files.parliament.uk/documents/SN05745/SN05745.pdf

There was positive borrowing each year from 1979/80 (indeed, from 1971/72) to 1988/89. Small net repayments for two years, in 1988/89 and 1989/90, were followed by borrowing of substantially larger numbers through to 1996/97, a smaller number in 1997/98, and then net repayments in 1998/99, 1999/2000 and 2000/1.

Public sector net debt rose from £98.2 billion in 1979/80, to £151.1 billion in 1990/91, and then £347.0 billion in 1996/97.

Annual interest payments were £7.6 billion in 1979.80, £19.5 billion in 1990/91, and £27.6 billion in 1996/97.

Thanks

I hope it’s OK to reprint the extract below from an article in Bella Caledonia ‘The Conservative Party and National Debt’ written by John Warren, a frequent and eloquent contributor to this blog:

‘What are the key interpretative problems of the national debt for Conservatives? For as the “most successful political party in the world”, as they smugly tell us over and over again, it is because most of the time, they run the country; for around fifty of the last seventy years: it is, therefore largely the Conservative National Debt. As a matter of plain fact, in 1918, at the end of WWI the national debt was over 180% of GDP (note that absolute debt levels do not represent meaningful comparisons over very long time periods, which itself carries an economic significance politicians typically fail to recognise), and did not fall below around 120% of GDP by WWII in 1939. In 1945, at the end of WWII, the national debt was over 240% of GDP (and critically, but still under-recognised, a relatively high proportion was now held in foreign hands – notably the United States, a function of wartime requirements for necessary material resources). The Debt did not fall below 100% of GDP until around 1960 (and was at least 100% of GDP continuously for around 45 years from early in WWI). This, however was not new. In the great days of the British Empire and commercial, trade, and money power, British national debt was often above 100% of GDP, between the period around the United States revolution in 1776, until the 1870s; over a century. The Empire was built on Debt’

Indeed. And yet, somehow, in the immediate aftermath of the Second World War, with the so-called “national debt” at record levels – really just an accounting record of how much had been spent collectively, indeed invested in the nation’s future, as what was the alternative? – we somehow managed to create the NHS and the welfare state, to build houses and schools and new towns, and nationalise coal, electricity, gas, rail, and steel,

This is what Keynes was saying in 1942, and it is just as true now as it was then: “Where we are using up resources, do not let us submit to the vile doctrine of the nineteenth century that every enterprise must justify itself in pounds, shillings and pence of cash income, with no other denominator of values but this. … Anything we can actually do we can afford. … We are immeasurably richer than our predecessors. Is it not evident that some sophistry, some fallacy, governs our collective action if we are forced to be so much meaner than they in the embellishments of life?”

With enough imagination and determination, we can make things better. It does not have to be this way. There is *always* an alternative.

So very true

As with the criticism of Truss and tax a few days ago, doesn’t this argument merely perpetuate the misunderstanding that tax and borrowing both precede government spending.

The debate last night and the Labour Party responses only make sense in a world framed this way

As a supporter of MMT you know that the world does not work like this. Spending proceeds both tax and borrowing. Despite this being true it is a marginal narrative in the current debate and most likely the next election (sadly)

Shouldn’t we be doing everything we can to ensure that the framework for debate is the correct one rather than perpetuating (deliberately or otherwise) a false view of government spending?

MMT demands a strong tax system to control inflation

Are you ignoring that?

Not at all

I am suggesting that we should not allow a false narrative of how modern monetary systems work frame our own responses. They are forcing “you” and others to play “their” game.

This election and the general election that will follow will still be framed by mistaken conventional macro thinking. We saw that clearly yesterday. We should be fighting that not surrendering to it.

I have to disagree

I am writing a book too explain why

Look forward to reading it.

But it’s not a question of disagreeing it’s a question of playing the game by the correct rules. That is not happening

Plus we would not be having this debate if we simply remembered (1) that government debt is not debt in the traditional sense and (2) it is simple the part of the net wealth of the non-government sector that has been deposited in savings accounts called “government debt”. Once we remember this the false debates on TV can be seen for what they are

I am a pragmatist

I used some of these figures on another website shortly after you last posted them.

The site, although of interest to me, is largely followed by people on the right wing of politics. Anti-European, pro Brexit, hostile towards immigrants and so on.

There is often no point challenging any of the beliefs but whenever budget cuts to defence are highlighted the only arguments seem to be that Labour would be much worse and that they, Labour, have a bad record of borrowing. So I posted some of the figures you have posted. The contortions used to avoid these truths were extraordinary but mostly limited to saying they only had more word that they were correct. Misinformation was mentioned, false flags (whatever that means) was another. I advised them to do their own research via the ONS but it would seem it was fingers in ears and la la la time. Of course this happens a lot, COVID scientists know this well, but unless I am wrong these figures are not hypotheses or interpretation of complex data but facts. Actual historical data, tidied up and targeted by Richard. All that is left is a denial of the facts themselves. Where does that leave us when debating any point?

Somebody once told me that there was no arguing with faith.

The last is true…..

Being on holiday we studiously avoided the ‘debate’ and went for a walk.

Your analysis chimes with a number of accounts of the Thatcher era that I have read and is thus reliable.

And it is also a tragedy that too many Labour governments have had their own policy ambitions curbed by Tory wastefulness.

More’s the pity that too few people will be aware of this. What it sounds like is that the Sunak and Truss believe their own Tory party mythology. A mythology that really got going when Thatcher tried hard line monetarism and then quietly disowned it.

The Tories from 2010 think now that Thatcher was too soft and should have ploughed on. As usual it was our fault – not the Tories failure to grasp reality – that made Thatcher fail. The thing is these modern Tories just don’t get what Thatcher got back then: that those monetarist polices just did not work. That is why SRB was created and all that – to try to revive the cities with investment and try to prevent other Toxteths and Brixton’s.

I see only widespread social unrest putting a stop to this nonsense like it did in the early 80s. But that is still too high a price to pay.

I’m glad you brought this historical debt thing up again as a couple of things came to mind recently which might make the Tories look worse. For example in recent history the Tories sold off Royal Mail and presumably that money went back into the exchequer to cook the books, make them look better (the deficit smaller) – I’m just about old enough to remember the don’t forget to tell Sid, Thatchers British Gas selloff. My privatisation history is weak but I’m sure there are others. All money in, selling the cow to buy the milk which made those debt figures look better at the time (and maybe ramifications down the line?). I also thought that the Tory governments have had the lions share of income from the juicey North Sea Oil income to also make their books look better than they otherwise might be. I’m assuming Labour spent more on infrastructure in their short time in office (but have no data to back that up!) and clearly they spent more on public services to make their figures look worse. I just wonder if there is any mileage in adding in those extra billions into the spreadsheet and see what comes out.

Never play with the data when the story is already just fine as it is

I suspect their puny repayments (was it the equivalent of 7 billion since the war?) have probably been eclipsed significantly by their state asset selloffs and if so your being way too charitable!

Just literally after typing this late at night, about to go to sleep, a quick web search on North Sea oil revenues came up with this interesting article….

http://www.scottishenergynews.com/how-did-britain-miss-out-on-400-billion-worth-of-n-sea-oil-revenue-compared-to-norway/