There are mortgages to a value of approximately £1.6 trillion (£1,630 billion) outstanding in the UK at present.

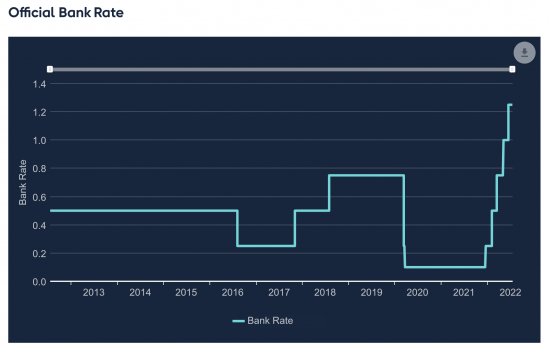

The interest rate on these will be impacted by the 0.5% interest rate rise Andrew Bailey of the Bank of England trailed last night. These will follow a pattern:

Rates are likely to rise by 1.65% in nine months and there is no certainty that they will end there.

I am, of course, aware that many borrowers will be on fixed-rate mortgages. But they come to an end. New deals are now around 2% higher in rate than they were a year ago. That is because it anticipates the currently expected rise.

But let's put this in context. It is costing the banks and building societies no more to service this money now than it was. I am aware that there are those who argue otherwise, but they are the people who think that banks and building societies lend out depositors' funds, and they do not. The Bank of England has confirmed that fact.

So, the reality is that sometime relatively soon banks and building societies are going to be making 2% more on their whole mortgage portfolio. And that is £32 billion a year that they will be paid that they have not earned and which we can be quite sure will not be passed on to savers as there is not the slightest reason for them to do that.

So when is the windfall tax on this unearned profit going to be introduced? That is what I want to know.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“But let’s put this in context. It is costing the banks and building societies no more to service this money now than it was.”

Statements like this just show a complete lack of understanding of the finance world. Where do you think the banks get the money to lend out for mortgages? They have to borrow it from the money markets.

And when interest rates rise, it costs more to borrow.

“I am aware that there are those who argue otherwise”

Yes. Anyone who knows the first thing about banking and finance.

“but they are the people who think that banks and building societies lend out depositors’ funds, and they do not.”

Depositors funds are capital, which may get loaned, but the bulk will come from money markets. Both have a cost of capital, which changes with interest rates.

“So, the reality is that sometime relatively soon banks and building societies are going to be making 2% more on their whole mortgage portfolio.”

No they won’t for reasons given above. If anything, they might make less as the risk of mortgage defaults rises.

So basically what you have said from start to finish is wrong.

I knew an idiot would come along and make this claim

This is exactly how mortgages do not work

Read this https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/quarterly-bulletin-2014-q1.pdf

That is the bank of England telling you that yopu’re the one who understands nothing, and they’re right

You’ve put up a link to a BoE piece about money creation, not mortgage finance.

Let me give you a quick lesson in the latter – you clearly need it.

When a bank offers a mortgage it lends long dated, but needs to supply the cash upfront. Given it is very expensive (typically more so than mortgage rates) to borrow for 25+ years, banks will cover this cash by borrowing in the short term and rolling that borrowing.

Which is the basic purpose of banking – maturity transformation.

This short term cash can come from a variety of sources, but all sources have a cost associated with them, which is linked the the BoE base rate. For example, if the bank borrows in the overnight cash market, that rate will be SONIA based, or if the bank uses it’s own deposits or reserves the cost will be the BoE overnight deposit rate.

So when the BoE raises rates the cost of that capital for the bank increases.

Which means that what you are saying is simply not true. If the BoE raises rates and the bank raises mortgage rates by the same amount, they are not making any additional profit.

If anything the opposite is true. Banks have tended in practice not to pass the whole of interest rates moves on to their customers, and higher rates tends to mean higher defaults and lower profits. If anything the opposite of what you have said is true.

If anyone is an idiot, it is you. Making totally wrong and false claims which show up you complete lack of any real knowledge or understanding. You are incompetent.

This is my last response

As the BoE say, the loan is made without reference to anyone else’s money

The mortgage offer creates new money and new deposits

It does not require deposits

And as they say, the ideas that you are p[resenting belong to out of date text books

Like you, in fact

Banks are not intermediaries – that is simply wrong

Now, don’t waste my time again

Please could you explain what you mean by ‘money markets’? Whatever they may be are they not also making bigger profits through no effort?

@ Richard

You are just proving the point that you are indeed clueless. In this case by not understanding the difference between base and broad money, money and credit.

Last time I checked we are not talking about the process of money and credit creation either – we are talking about if banks make extra profits from mortgages when rates rise.

Banks can create credit by lending, but they still need to cover that loan. In simple terms they can’t lend what they don’t have, so they borrow to lend.

Which does not specifically require deposits – which you seem fixated on. But as I have already said both borrowing through the money markets and using the banks own capital or deposits has a cost, linked directly to the BoE base rate. Making you claim totally wrong.

“Banks are not intermediaries – that is simply wrong”

They really are. Try getting a mortgage without one. Or see what happens to the money supply when you change how the banking system functions in its intermediary function. Yet another thing you have said which is 100% idiotic.

I just don’t know how someone claiming to be an expert in finance and economics can be this wrong or this stupid. Potentially because you actually have no experience whatsoever, are a self-declared expert and actually your practical knowledge extends to whatever you make up as you go along while sitting in your armchair – not what actually happens in real life.

@ Cyndy

Money markets is just the general term for the where financial institutions borrow and lend money in the short term – typically up to about 3 months maturity.

Banks that need cash can borrow (for example, if they have sold a mortgage and loaned somebody some money) and those that have excess cash can lend. It is also where securities (such as Gilts) are loaned and borrowed short term in exchange for cash. Excess cash in the market is then mopped up by the BoE at the BoE base rate, which acts as a floor on interest rates and is ultimately how interest rate policy is managed.

As the Bank of England make absolutely clear, lending creates deposits

You are wrong

Now, never all again until you have learned banks do not lend other people’s money, ever

Richard,

Are you really this stupid?

Lending may create deposits, but that has NOTHING do do with the case in point.

Let me ask you very clearly a few simple questions, so you can answer them very clearly and stop trying to evade the question (and your obvious ignorance). I will take any evasion as a sign that you admit defeat, or your ego is delicate to admit you are simply 100% wrong.

1. When an individual bank lends, where does the money come from? Does it have to find that money from somewhere, either using it’s own capital or borrowing from elsewhere?

2. When lending, does the cash loaned out by a bank have a cost of capital?

3. If there is a cost of capital, is it linked to interest rates? If those move, does the cost of capital change?

4. If there is a cost of capital linked to interest rates, do banks make more money from mortgages when interest rates go up, given that mortgage rates move the same (or less) amount?

I await your answers – which will no doubt be totally wrong – with interest.

The money to lend is created out of thin air by the Bank

Read what the Bank of England says and stop making yourself look very stupid

If that is the case, why did Northern Rock go bankrupt?

https://en.wikipedia.org/wiki/Northern_Rock

“On 14 September 2007, the bank sought and received a liquidity support facility from the Bank of England, to replace funds it was unable to raise from the money market.”

It abused its regulatory base capital and other banks realised and refused to extend credit to them – so it failed

That is why the central bank reserve accounts being inflated after 2008

Not sure where or how they abused their regulatory base capital as there is no mention of that anywhere, but what you are saying is that they couldn’t borrow from other banks.

Which is exactly what other people have been saying banks need to do to cover the loans they make for mortgages and the opposite of what you’ve been saying, that banks can just create money out of thin air.

If they could, and you are right, Northern Rock wouldn’t have gone bankrupt would it?

Yet they did, didn’t they?

You do not know banks can’t operate without inter-bank credit, don’t you?

I suggest you read what I have posted on central bank reserve accounts

You are saying that banks can just magic money out of thin air, and don’t need to borrow to cover the cash put out on mortgage lending.

If that is the case, why do they need inter-bank credit?

If that is the case Northern Rock wouldn’t have needed to borrow from other banks and wouldn’t have collapsed.

You can’t have it both ways.

Read what I have written and stop being stupid

Richard,

have you ever had the pleasure of talking with any BoE policy makers and asking the questions you’ve put here many times. If so what were their answers?

I there anyone in the BoE who talks any sense?

Why don’t they see that wage increases are in response to uncontrollable circumstances that interest rates will not solve and that most wage increases aren’t going to cover the inflation spiral.

When do you believe UK inflation will peak?

Could the UK Government do more to control inflation ie: change the fuel duty to a fixed upper cost rather than percentage, reduce VAT or in the extreme nationalise gas industry?

Whilst it’s nothing more than reorganizing the deck chairs on the Titanic which of the potential next PMs is the least useless.

They don’t invite me to their press conferences and that is fair enough

But Richard – that’s just not how it works old chap!!

Don’t you know?

(With a large dose of sarcasm and resignation since no one else seems to ask the same questions).

🙂

Richard, you also need to add in the tens of billions they will be getting as Base Rate interest we pay out of Public Funds on their BoE Reserve Account balances. The HoC Library dug out the BoE Press Release for me so the BoE never in its history paid interest on Reserve Balances prior to 18th May 2006. The press release describes this as a new voluntary arrangement to encourage banks to increase their reserve balances and to help the BoE provide a ‘more consistent and transparent’ environment for managing short term interest rates. The Bank was going to assist the process by buying some (small compared to what happened later) amounts of gilts off the banks and thus converting those gilts into base money in the Reserve Accounts.

That numpty above is completely wrong. Deposits are a liability on a bank balance sheet. How are they possibly ‘capital’ when they can be withdrawn at any time? If we look at an actual bank such as the 2019/20 accounts for RBS Plc (the Scottish part of Natwest Group), then loans due are less than 5% of the balance sheet, and most of that is due to Natwest Group. So borrowing on the ‘money market’ is nil. The rest of the liabilities are deposits and the balance is equity and shareholder funds. On the asset side the bank had £27bn at the BoE out of total £92 bn assets, so about 30% reserve cover.

All noted

We need a windfall tax on the assets bought with those mortgages as well. Houses are worth 9% more than last year, there’s £15tb of houses in the UK, that’s £1.5tb that could be put to more productive use.

Richard,

I’m afraid to tell you that EG is essentially correct. I say this from experience of working in the mortgage finance arms of a couple of large banks.

As a rule of thumb, a typical mortgage will be funded by around 5-10% bank capital/deposits and the rest sourced through short term borrowing, from the money markets.

It is not economically viable to borrow long term to finance these mortgages as bank borrowing is typically 100-150bps over Gilts. So for 25 Gilts yielding 2.65%, the bank would borrow somewhere around the 4% mark. Meaning any mortgage based off such borrowing would either be unprofitable or uncompetitive.

We will then typically hedge out some of the interest rate risk for the fixed mortgages, and hedge some of the optionality out of the book.

The end result of this is that when rates rise, the cost of capital to the bank for those mortgages rise (as short term borrowing costs rise and the cost of capital of deposits rises). Because of the prevalence of fixed rate mortgages, bank mortgage books actually tend to become less profitable rather than more so, though interest rate hedges offset this somewhat. Even the variable rate mortgages don’t suddenly become more profitable, as rate rises are typically contractually linked to the BoE base rate.

You also see more remortgaging (which is a cost) and more default (likewise) when rates rise.

You do sometimes see a boost in profits in the short term as rates tart to rise, as people rush to mortgage at favourable rates, but this should not be confused with an increase in profits in the way you have described.

Fundamentally though, your claim that banks make more money directly because of interest rate rises is simply not true.

And I do not believe you

Nor does the Bank of England

What you’re actually describing is the game of trying to manage maximum return on money – which has however nothing to do with the mortgage debt

But if you want to debate this tell us your full name, the bank you work for, your role in it and send a CV. And then explain how money is created if not out of thin air by lending

Richard,

The Bank of England is describing the general process of credit creation, in simple terms for the general public. I wouldn’t use that paper as a guide to real world banking and finance – it is heavily simplified.

You seem to miss a key point. When a bank lends, it physically has to pay out cash, which has to come from somewhere. Not out of thin air.

In accounting terms, the creation of a new loan has both asset and liability attached to it. If banks could create money out of thin air, it would be asset only, which breaks the basic rules of accounting, as well as reality.

What the Bank of England describes is credit, not money. New loans can potentially create new deposits, but not in the same place, so the bank creating that loan needs to fund it somehow.

Which means that a mortgage book has a series of long term assets (the loans) against a series of short term liabilities/borrowings (bank assets, deposits, money markets).

You seem to think that mortgages are self-financing on the bank side, because you claim mistakenly that banks can create money out of thin air, which they can’t.

I am not sure why you are asking for my CV, but if we are going down that route…. I can see from yours you have no experience in banking or finance, or even for that matter any formal experience in economics. For the most part you have worked in a small accounting firm, then for yourself as a tax campaigner. I am not sure it is wise to claim expertise in things you simply have no experience or qualification in.

You guys ability to read very selectively is astonishing – including of my cv

As for what the BoE said, there were no qualifications. The suggestion was universal with regard to all bank credit

Oh, and ll money is credit. There is literally nothing else

I suggest you read my ebook Money for nothing and my Tweets for free

Also read this https://www.taxresearch.org.uk/Blog/2022/06/17/how-are-the-central-bank-reserve-accounts-created/ and this https://www.taxresearch.org.uk/Blog/2022/06/21/the-double-entry-behind-the-money-creation-in-the-central-bank-reserve-accounts/comment-page-1/

I can supply a lot more

But essentially you do not understand double entry, money creation or banking come to that. You really are deeply embarrassing yourself. No wonder you won’t say who you are. And yes, the Bank of England were targeting people just like you when they said understanding was out of date

Richard,

I looked at the CV you post on this very website. You did an undergraduate degree, then practiced as an accountant in a small firm till around 2000, at which point you reinvented yourself as a tax justice campaigner. If this is the case, you have no experience in banking or finance.

As for what the BoE says, there are many qualifications. As the BoE themselves allude to.

Money and credit have separate identities, though are similar. If not, why are they measured in the money supply differently?

The crux of the matter though is that when a bank extends credit, it generates a loan asset but a cash liability. Given that cash is not able to be created directly by a bank, it needs to source that from elsewhere. Another poster above has alluded to this when talking about Northern Rock, which failed because they could not borrow to support their loan book through the money markets.

I have read your other links. I won’t go into detail, but what you do say is heavily simplified and more often than not totally wrong.

Having spent almost 30 years in banking, mostly in treasury roles, I am pretty confident I have a good understanding of what it entails. Certainly more than someone who claims to be an expert in the field of banking, finance and economics yet whose experience seems to revolve around working as a small firm tax accountant and then for himself. You literally have no experience in any of the fields you claim to.

Even your accounting is awful. How do you think a bank would function if it’s cash balance was negative, which would be the case if your logic were true, and banks could lend without covering that cash in the open market or elsewhere? Even at this most basic level you don’t seem to be able to get it right, even in a field (accounting) you actually have some marginal experience in.

I am beginning to think there is something deeply wrong with you, given your need to perpetuate the fraud of calling yourself an expert when you are clearly no such thing.

Now tell me, why did the BoE said every bank text book that described banking as you do was wrong?

Justify it, or don’t try again

And don’t try any more ad hominems, tell me what is wrong with my double entry

What is clear is you don’t know and you must definitely do not understand money

Which is ad, but typical for a banker -as the BoE, again, notes

So, cough up or shut up

Are you perchance getting confused about the capital and liquidity requirements mandated by Basel III*? Certainly, that results in inter-bank lending happening, but it doesn’t materially influence the amount of lending, which is just a function of credit worthy borrowers.

* https://en.m.wikipedia.org/wiki/Basel_III

The Bank of England Bulletin linked to further up is very comprehensive and makes it absolutely clear that everything normal people refer to as money is being created by banks as needed simply with balance sheet entries. They have regulatory obligations around capital requirements and liquidity, but the money they lend is entirely created from nothing.

Banks cannot create money for themselves to satisfy their regulatory obligations, so they need to acquire liquidity by borrowing reserves between banks, hence the problem with Northern Rock. There’s a subtle point here, which is that reserves banks need are not the same “money” as bank money, and the BoE has a monopoly on reserves. Banks acts as the intermediaries between BoE reserves and the “normal” money system. Most people live entirely in the bank-money system, which is pegged to the reserves system by the Sterling Monetary Framework.

You get it

It’s glaringly obvious

Except to the bankers

Oh dear me.

It seems that we must all suffer because of the ignorance that is called Sagrie, EG etc.

They seem to be confusing macro with micro concepts of money – too often one might add. And they have no concept of looking up stream. Have they heard of the CBRA, and why it exists?

My understanding has been that the total number of savings has been well exceeded by the available credit for years if not decades. So how can savings be the only source of loans? What a bizarre claim.

Richard, Two points I think your critics may be missing:

1) It makes no difference if the bank takes out a short term loan to make a payment. The lender to the lender to the bank will still be using the original mortgage as collateral

2) If they were right, and there was only one source of money, the boom in house prices would be draining money from the functional economy. A buoyant house market would be guaranteed to induce a recession.

🙂

Looking at the exchanges on this part of the blog – reminded me of a recent video conf; me, and some European Commission people, some that dealt with energy and one who is an economist & who at one point lectured in economics at Harvard Uni. The high point was when an engineer (at the Commission) started explaining economics to the economist. It was wonderful, “pull up chair, open pop-corn and watch somebody dig a big hole” (the engineer – & not me – I was just a spectator). Some people have pre-conceived ideas on “how things are” and no amount of arguing will change their mind, BoE report or not (read it – thought it was good – even watched the HoC debate on the subject – 1st in circa 100 years). Banking license is, literally a license to print (well… leverage) money. By extension a raise in interest rates will, inevitably, lead to higher profits

On a related note: one of the problems of the 2008 banking crash was leverage – capital bases to low, leverage too high. QED.

There are plenty of economists that need things explaining to them.

As an ignoramus on these matters the consensus on Northern Rock was that it went bust because it was lending long and borrowing short.

This was, if I recall, before any official BoE guarantee.

But it now looks to me as though they were actually speculating for enhanced profits on top of and as well as the core basic lending – I wonder if this is the the case?

They failed because there was no credit left – and they needed credit before the CBRAs were inflated

By over extending their mortgage offering there was no credit left with other banks

I’m going to ask this here again – if banks don’t need to borrow money before they lend for a mortgage, and they can magic money out of the air, then why does Northern Rock’s credit with other banks matter?

Peter May is right – Northern Rock were borrowing short and lending long – as all mortgage banks do – and couldn’t cover the cash.

Which means that what you have been saying is garbage, and EG and Sagrie are right.

Because the other party has to believe your promise to pay

Money creation cannot be with yourself if you bothered to note the issue

People ceased believing Northern Rock’s promise to pay

Which is why the Central Bank Reserve Account was subsequently enlarged.

The real truth about the 2008 crash was not that we ran out of money (although in one sense the much smaller CBRA at that time means that there was less cash to cover what was the real operations of the banks then) – it was that whatever trust there was in the system that oiled the wheels just evaporated because no one was sure where all the toxic assets were – which bank held them and was no longer credit worthy and where you might lose your intra bank loan. And therefore the banking system froze which is I think where QE – Government printed money – had to be injected (plus a number of the more highly exposed banks had to go under) to clear the decks and resuscitate the system.

The banks knew that someone was holding the toxic assets as they were busy selling these worthless or much reduced value assets to each other right up to the crash BTW!

What a fantastic system eh?

But Richard is right to point out that simple human trust makes the banking world go around. But never has such a simple human quality been wasted on such a den of thieves.

You keep answering questions of your own making.

If Banks can create money out of thin air to lend for mortgages, and they don’t have to borrow to finance those mortgages, then why does a banks credit worthiness matter at all as in your world it doesn’t have to borrow from other banks at all?

“Money creation cannot be with yourself if you bothered to note the issue”

Or have you let slip the problem with everything you have said here? If you can’t create cash like you say you do, you do actually have to borrow it and what EG and Sagrie were saying is right all along?

They have to be able to pay the funds to another bank

That requires credit because all money is credit

If a bank can’t get credit to do inter bank clearing it fails

The CBRAs were inflated to prevent that happening again

What is so hard to understand?

Northern Rock weren’t technically bust in terms of their balance sheet, they were illiquid due to the fact they couldn’t borrow to meet their short term obligations (though I suppose I’d call myself bust in that situation).

EG and Sagrie are correct in the narrow sense that all assets need to be financed by liabilities. If a commercial bank makes a loan that loan becomes and asset and the current account of the borrower where the money is deposited becomes a liability. Indeed, they are also constrained in what they do by capital and liquidity requirements meaning that they can’t lend for 25 years and finance it in the interbank money market – there has to be some equity capital and some term funding both of which cost more that overnight funding.

However, in practice, net interest margin rises as interest rates rise – that has always been the case. Ask any bank equity analyst and they will tell you that rising rates are good for banks.

Why? Because banks have huge amounts of money on deposit with them that does not earn interest or earns at a rate below the policy rate. The idea that bank profitability is unrelated to the level of rates is clearly nonsense.

So, in a tough times are we content to see bank profits rise merely as a result of rising policy rates? Probably not… so that leaves two solutions (a) force banks to pay savers more (b) tax their profits more aggressively.

But lending creates the asset and liability Clive

So the only issue is CBRA credit

Absolutely – and bank receives interest on the asset and pays interest on the liability. Profitability depending on the spread between these two rates.

In theory, the interest paid on the liability could go up by the same amount as that on the asset and bank profitability would be unchanged. In theory, the newly created money will flee unless it is paid interest at a market rate.

In practice, it doesn’t and that is why the banks make more money.

The issue here is, ultimately, the same one as interest paid on excess reserves.

Agreed

@ Clive

In general terms you are correct, but there is some nuance to the points you are making in real world terms.

“all assets need to be financed by liabilities.”

Totally correct. And all liabilities have a cost of capital. Normally linked to rates.

“they are also constrained in what they do by capital and liquidity requirements meaning that they can’t lend for 25 years and finance it in the interbank money market ”

Mostly correct. As you say there will likely be some reg/equity capital and some term financing (though typically small) but for most banks the bulk of financing comes from the short term/money markets. Which is why you have Lehman type events when money markets freeze.

For most banks though, the financing comes from the money markets, meaning the cost is tied directly to the BoE base rate.

“However, in practice, net interest margin rises as interest rates rise”

Sort of true. In practice it is not the outright level of interest rates that matter most but the shape of the yield curve. Inverted curves are bad for bank profitability for example. Banks make profits (on lending) through the maturity transformation of lending long and borrowing short – when this spread widens they make more. To be fair you do say this in your next post.

“Because banks have huge amounts of money on deposit with them that does not earn interest or earns at a rate below the policy rate.”

Partly true again, depending on a variety of factors, depending on if the banks pass through interest rate rises to the customers or not. That said, retail deposit accounts are a cost to banks in pure profit terms, a loss leader. Most retail accounts are free, the cost of operating and maintaining them is not.

The initial point however was Richard’s claim that banks are set to make billions more on mortgages purely because of rising rates.

Given he seems to think that banks can just print money, the inference being that banks don’t have to worry about the liability side of the transactions, you can see why he got to this totally incorrect statement.

All he has done is simplistically equate interest rates to profitability directly, because he thinks that there is no cost of financing for mortgages.

Clearly he is wrong on both counts and his various statements point to his lack of any real experience or understanding of the matter.

Let me summarise

You are really very thick

The bank lends £100k. That is the debit, an asset

And there is double entry. The deposit is a liability. Either in the same bank or a CBRA

That’s the whole funding issue solved

Now what is your problem?

Apart from your unbelievable rudeness, what you say actually proves my point and shows the claims you have made are wrong.

“The bank lends £100k. That is the debit, an asset”

So far so good.

“And there is double entry. The deposit is a liability. Either in the same bank or a CBRA”

Also correct.

“That’s the whole funding issue solved”

Except that funding is not free – the bank has to borrow it. Deposits have a cost, as does funding from money markets. Which are tied to interest rates.

At which point, if your asset return increases in line with interest rates, and the cost of your liabilities increase by interest rates, then your claim that banks are making more money on mortgages because of rising interest rates is false.

Clearly, it is not me who is very thick here – I am not the one who made a totally false statement (and from hearing a bit more about you, it’s not the first time you have done so).

Just to be clear:

“It is costing the banks and building societies no more to service this money now than it was.”

Is totally false.

“So, the reality is that sometime relatively soon banks and building societies are going to be making 2% more on their whole mortgage portfolio.”

Is totally false.

“And that is £32 billion a year that they will be paid that they have not earned”

Is totally false.

Literally everything you have written is wrong. Yet you call me the idiot.

So, we make progress

Money is created by double entry out of thin air

Thank you

Now tell me why the bank has to make the credit entry? On loy because bankers want to screw the rest of the world

But of course they don’t: that liability is what the rest of us call a bank deposit and let’s not pretend aby bank is paying anything significant on any of its borrowing, but it is putting up the price to end surers

So, now you have totally agreed with me

I really think you should re-learn your supposed job

.

Thank you – so simple, but yet so little understood!

(For anyone reading, CBRAs are Central Bank Reserve accounts)

You’ve missed a part about profits. You’re correct to say that no existing money is used to create the mortgage. It’s created fractionally and is deposited into the account as brand new money.

However you have to think about what happens to that money. The simplest way is to pretend that the house buyer and the seller have accounts at the same bank.

The bank will be charging x% to the buyer but when the seller deposits the money in their account the bank will be paying y%.

If both rates go up, they are charging and paying more out in interest.

The profit is the difference between these after operating costs.

It’s a two way street so you’re kinda right.

I have no idea what the relevance of this is

And there is nothing fractional to it

That’s nonsense

Thanks for publishing critical comments, Richard, even when they insult you!

As someone who has no background in banking or accountancy, following the conversation in the comments is always a useful starting point for looking things up, though I admit it only takes about 5 mins of reading (sources other than your blog ofc ) before my eyes glaze over.

Firstly, if we look at most UK banks at the moment then their loans from the ‘money markets’ are pretty much zero. Taking RBS Plc accounts for 2020 (the Scottish part of Natwest Group) then it had zero loans apart from a small amount to the parent Natwest Group. Most of the £92 bn assets were matched by £75bn of deposits. It also had £27 bn in the CBRA at the BoE. That means nearly 30% reserves. Before 2008 banks were often running with only 2% or so reserves.

Secondly, when a bank grants a loan such as a mortgage, then it only needs to bother about what percentage of that loan may leave this bank and be transferred to another bank. That is heavily influenced by how big the bank is, as the bigger the bank the less likely the money is to get moved to another bank. If the mortgage is used to buy a house and the seller uses the same bank then the money stays in the bank and just switches accounts. The effect on the CBRA (i.e. the bank’s own money) is nil. If the seller uses a different bank it will all leave and thus the CBRA will fall by the full amount of the new mortgage. Meanwhile the same thing happens at other banks so their new loans may well end up as deposits in this bank. So at the end of the day it is only net changes in the CBRA that are relevant. At the moment the Reserve Balances are huge by historic standards (£952 billion at end of May 2022) so the scope for new lending is probably far larger than the supply of credit worthy borrowers.

Thirdly, as a thought concept, if there was only one commercial bank then its ability to create money would be unlimited as it would never need to worry about any of that new money being deposited anywhere other than in one of its accounts. So it would be in a similar monopoly position to the central bank.

So in conclusion, large banks have much more scope to create new bank money than small banks. A small start up bank will be highly constrained by the fact that most money it creates will move to another bank, thus putting pressure on its reserves. That is one of the main reasons we see such concentration in banking and why there have been so few new banks in the UK. The same issue applies to credit unions who are also likewise constrained in how much they can lend.

Thanks Tim

And as you say, virtually costless

And m ost of it still so

While I understand MMT perfectly, and its no criticism of Richard, I have to say that Money is without a doubt one of the oddest things I have ever tried to get my head around. Makes particle physics simple by comparison.

Perhaps instead of my ‘Revenge of Schrodinger’s Cat’ T shirt that I am wearing at the moment I should have ‘The Revenge of Schrodinger’s Pound’ that is simultaneously in several places at once?

No money ever goes needs to go anywhere in any of the transactions stated above, every single bit of it is clearly just accounting legerdemain.

The critical part of this accounting legerdemain and in particular in the case of Northern Rock was in the Ninja style sub-prime nature of the business, because even although no money necessarily has to go anywhere, the liability has to be paid back to zero out the double book entry.

As soon as it becomes clear that the liabilities on the books can’t be repaid the bank or whichever institution holds the liabilities ceases to be viable, simple.

The fact that Northern Rock, controlled by some truly unscrupulous individuals and laying bare very publicly the unscrupulous nature of banking, made it the poster boy victim of the crisis, the perfect scapegoat, but essentially no worse than any other of the players in the market.

It wasn’t only Mortgages, Auto Loans, Corporate Takeovers, Start Ups, SME’s any sort of crazy lending you can think of, and only possible where money is created out of thin air!

People are repelled by the thought of the Magic Money Tree, because they have been conditioned for generations into believing in the scarcity of Money, Jesus new otherwise 2000yrs ago and look what happened to him, and going by this thread it is clear there are still people willing to crucify others for daring to speak the truth and go against conventional so called wisdom!