As a result of yesterday's thread on the relationship between banking, banks and the UK's central bank - the Bank of England - a number of challenges have been made to my claims. I think there are thee injections, in essence.

The first is that money is not debt. The second is that money is not created ‘out of thin air' and the third is that the Bank of England does not create the balances on the central bank reserve account deposits that the commercial banks have with it. I think each needs to be addressed. I am going to do so using arguments published by the Bank of England in 2014. On these issues there is sufficient alignment between my position and that of the Bank for me to use their suggestions to support my own.

Money is debt

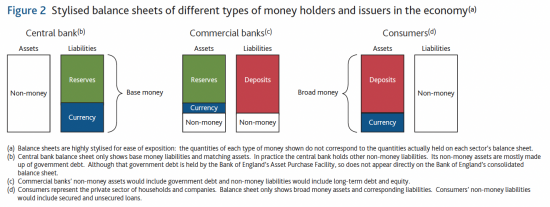

This chart was published by the Bank of England in 2014:

As they added:

Money in the modern economy is just a special form of IOU, or in the language of economic accounts, a financial asset.

Or, in other words, money is just debt. That is all there is to it.

That includes notes and coins too: they are just a tangible record of the debt the government incurred when spending them into the economy, because they do not give them away.

Anyone who wishes to argue money is not debt is welcome to, but please take it up with the Bank of England. And if the claim is that this is not what you were taught, note that the Bank says:

The reality of how money is created today differs from the description found in some economics textbooks.

The textbooks are wrong.

Money out of thin air

The same 2014 publication from the Bank of England notes that:

In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower's bank account, thereby creating new money.

That is how money is created. In a modern economy there is no other way to do it. The consequence, as the Bank of England also notes, is that:

Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

In other words, savings are redundant to the process of lending and banks are not intermediaries between savers and investors. The only use for bank deposits from customers as far as banks are concerned is to provide them with very cheap capital: in effect the banks treat deposits as if they are money that they might lose, a fact aided by the government guarantee for all customer deposits to £85,000, which means the banks know that they have no responsibility with regard to such sums.

Why don't banks lend without limit then? As the Bank of England says:

Although commercial banks create money through lending, they cannot do so freely without limit. Banks are limited in how much they can lend if they are to remain profitable in a competitive banking system. Prudential regulation also acts as a constraint on banks' activities in order to maintain the resilience of the financial system. And the households and companies who receive the money created by new lending may take actions that affect the stock of money — they could quickly ‘destroy' money by using it to repay their existing debt, for instance.

That last point is very important. What it says is that loan repayment destroys commercial bank-created money.

To summarise:

- Banks do not lend other people's money. They create all the money they lend;

- The money created in this way is how bank deposits are created;

- Repaying loans destroys money.

The central bank reserve accounts

As the Bank of England says in the same 2014 document:

A different definition of money, often called ‘base money' or ‘central bank money', comprises IOUs from the central bank: this includes currency (an IOU to consumers) but also central bank reserves, which are IOUs from the central bank to commercial banks. Base money is important because it is by virtue of their position as the only issuer of base money that central banks can implement monetary policy.

The central bank reserve accounts are the only depositories for this base money created by the Bank of England. The suggestion that it might come from elsewhere is wrong, although it can be destroyed by the government increasing the demand for tax or borrowing - when commercial money is used to destroy the base money in the central bank reserve accounts by the settlement of debt owing with regard to tax or bond purchases.

What, however, is never true is that the commercial banks can create base money: they can only be recipients of it. In that case if the central bank reserve accounts increase it is because the government via the Bank of England (and they are not in any way independent of each other) has decided that this should happen by:

- Spending more money into the economy

- Repurchasing government debt (QE)

This money injection, which requires no decision or active engagement by the commercial banks, inflates those commercial banks' balance sheets - hence my suggestion that the money is gifted to them.

The Bank of England summarise this in this chart:

Thye no money assets of the Bank of England are treasury bonds, in the main.

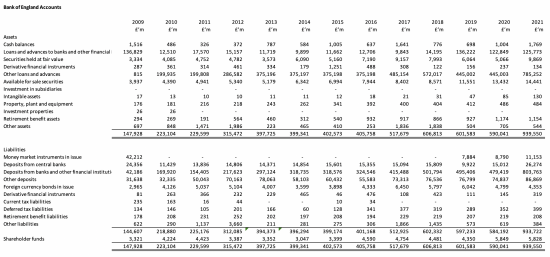

I have summarised the balance sheets of the Bank of England as follows from 2008 to 2021 (the latest available)(click the image twice for a larger version):

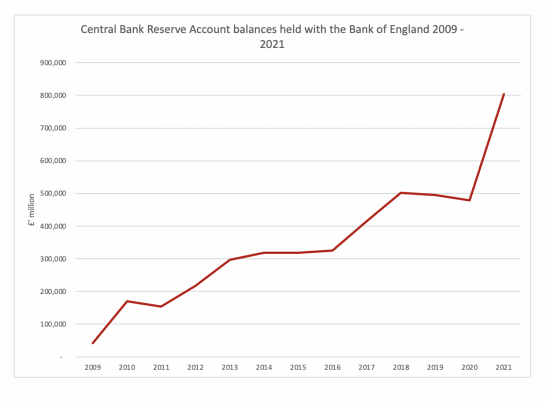

The central bank reserve accounts rose like this:

The match to QE is not perfect: other funds flow through these accounts, but it is close.

I hope this makes all these issues a little clearer, but I am not much inclined to discuss the rights or wrongs of this explanation: as far as I and the Bank of England are concerned, these are facts.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It never ceases to amaze me that folk still dispute the most basic part of this – that loans create deposits. Especially since the Bank of England and other central banks have publicised this.

As far as I can see Richard, you’ve not blogged your original (very coherent) tweet thread – might you do this now?

Which tweet thread – from yesterday? It is on here

Apologies, I did miss it.

Well done Richard. I admire your persistence in the face of heavy trolling from unpaid opponents or otherwise. I hope you manage to get some rest sometime.

A very simple point on the subject of Debt and Financial Assets.

For years I ran a Business course that included a very basic introduction to Accounting. Of all the concepts I had to teach the idea that debt owed to you was a financial asset was always the one that met with the most resistance from the “common sense” of the class.

For them, some with their own business, people owing you money always carried the threat of non-payment, whereas a financial asset always represented security. Rather than being the same they saw them as opposites.

Eventually, most understood why debt and financial assets were the same thing but I strongly suspect that this remains a stumbling block for many people when it comes to understanding the true nature of money.

Accepted

Thanks for the further explanation.

A couple more questions – which probably reflect my (and most peoples’) difficulty in coping with features of macro-economics that don’t correspond to familiar household accounting.

First, the idea that commercial banks cannot themselves influence the amount of their reserve accounts at the Bank of England. I had thought that inter-bank payments happen via those accounts, in which case the reserve account of any particular bank could be increased or reduced depending on the transactions taking place. And I don’t see why they can’t add or reduce the nominal value in other ways, I can’t help thinking of them like the savings account I have linked to my current account. Is that a false analogy?

Second, the concept of non-money. You say most of the BoE non-money assets are gilts, but since gilts represent a promise by the government (which is the same as the BoE) to redeem at some future date why are they not a liability? And as a consumer myself I am unsure what my non-money liabilities are. I have a few monetary liabilities (such as credit card expenditure since my last payment) but I don’t have any concept of owing “non-money” and certainly not in the volume that balances any assets as deposits.

Sorry to keep bugging you, but knowing you are writing a book I hope that being aware of readers’ confusions will help you come up with explanations that resonate for everyone.

1) This is base money, not other money. This base money can only be paid to other banks and the government but only the government can reduce the sum in the system so it can be argued that the use if it is limited, I accept – but it pays well now!

2) The gilts on the BoE balance sheet are an asset because they are a liability of the Treasury. Of course, consolidate them and take the view of the government as a whole no these binds simply cancel out – as the Whole of Government Accounts show

“Base money is important because it is by virtue of their position as the only issuer of base money that central banks can implement monetary policy.”

The element that the BofE do not bring out, is that in needing to establish the concept of “base money” they are drawing attention to something they do not discuss: the hierarchy of money. All money is debt (there is a promise to pay), but not all debt is money, in all circumstances; because the hierarchy of money allows debt to act as (if it was) money at one level, which is clearly only debt when observed from the perspective of a higher level. It is relativist system. Only the sovereign issuer and taxer of money provides debt that always is money, no matter what; the issuer, banker, lender and dealer of last resort. We only find out this fundamental truth in a major crisis; financial crash, war, pandemic, depression.

The modern problems of the over-complexity of the money system, and its operational weakness revealed by QE, and the hierarchy of money (that has effectively sidelined the general public and especially the poor and allowed unbridled asset bubbles to develop), is because the Sovereign government uses a central bank to distribute its policy solutions to a closed system of exclusive commercial banks, dealers and their privileged clients; and in a digital fiat monetary system, provide a system that resorts to notes and coins less and less; allowing ‘base money’, instantly to be turned by banks instantly into a transferable system of rent-creating debt. The free circulation of instant promise-to-pay-the-bearer guaranteed ‘money’ accessible easily and widely to the public (notes and coins – the traditional way for the sovereign issuer directly to reach everyoe) is now vitiated by the insertion into the system of unavoidable and privileged rent-seeking debt providers, led by the commercial banks.

To explore the hierarchy of money, read Mehrling. It is fundamental.

Thanks

If you don’t mind me saying John, you explain Mehrling better than Mehrling himself does.

I’ve understood his points ever since you’ve explained them.

https://ieor.columbia.edu/files/seasdepts/industrial-engineering-operations-research/pdf-files/Mehrling_P_FESeminar_Sp12-02.pdf

Clear enough explanation.

Thank you

Yes

But also curiously historically confused

I suppose that thinking that money has intrinsic value and is not created from thin air (strokes on a keyboard by a BOE clerk) stems from the time of the gold standard when every pound was supposed to be backed up by gold stored in Threadneedle Street vaults and the time that traditional “classical ” economic theory held sway. Also, Theresa May’s assertion that there is no “money tree” is so embedded in mainstream media, government, and commentators’ psyche, that it is hard to remove. I think the public will gradually appreciate your monetary analysis but it may be a long haul.

I am prepared for that

The same 2014 publication from the Bank of England notes that:

In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.

That is how money is created. In a modern economy there is no other way to do it. The consequence, as the Bank of England also notes, is that:

Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

In other words, savings are redundant to the process of lending and banks are not intermediaries between savers and investors. The only use for bank deposits from customers as far as banks are concerned is to provide them with very cheap capital: in effect the banks treat deposits as if they are money that they might lose, a fact aided by the government guarantee for all customer deposits to £85,000, which means the banks know that they have no responsibility with regard to such sums.

Why don’t banks lend without limit then? As the Bank of England says:

Although commercial banks create money through lending, they cannot do so freely without limit. Banks are limited in how much they can lend if they are to remain profitable in a competitive banking system. Prudential regulation also acts as a constraint on banks’ activities in order to maintain the resilience of the financial system. And the households and companies who receive the money created by new lending may take actions that affect the stock of money — they could quickly ‘destroy’ money by using it to repay their existing debt, for instance.

That last point is very important. What it says is that loan repayment destroys commercial bank-created money.

To summarise:

Banks do not lend other people’s money. They create all the money they lend;

The money created in this way is how bank deposits are created;

Repaying loans destroys money.

This is all true until 4.30 in the afternoon. When a bank must balance its books. So, you lend out money during the day. Some will, of course, also be repaid during that day. Money creation and destruction if you like.

Then comes balancing the book. At 4.30 pm your loan book must be backed by deposits plus equity. That’s just the way the system works. So, if you’ve lent out more money that day than you’ve taken in then you must find some further deposits so that the books balance.

This is what the interbank market used to do. This function largely being done by those central bank reserves these days.

What Professor, Professor, Professor Murphy is doing is looking at the short term – the deposit base does not determine lending – and thinking that’s the long term outcome. When, in fact, if you cannot attract the deposits to cover your loans you, as a bank, are bust – at 4.30 in the afternoon you are.

Which is exactly what happened to Northern Rock.

A highly disingenuous commentary you have produced Richard

There is no mention of 4.30 by the BoE

Nor in their representation of a commercial bank balance sheet

The balance is the CBRA – which they made big enough to ensure the banks could nit fail

You have completely misread everything they say. It can only be deliberate

But the odd thing is, in the process you in many ways actually agree with me and don’t even seem to realise

I’d say ‘try again’ and see where the BoE refers to 4.30 or drop it

He may be thinking of the Consolidated Fund? A Government clearing (?), but how he ties that to commercial banks is not clear?

Another left-field, unsourced assertion by someone with all the authority of an anonymous commenter who claims to be a ‘banking analyst’, ehich is presumably intended to sprinkle some authority on his or her claim.

What is your source please?

It’s the difference between operating in the business and the real world or not having practical knowledge or experience and just relying on a textbook

That’s very amusing

As the BoE notes, it is the textbooks that are wrong and you are following them

And you have clearly not read my cv

But trolls always make things up

Allow me to develop the point. See Berkeley, Ryan-Collins, Voldsgaard, Wilson; UCL ‘The Self-Financing State’, para 3., pp.14-16:

“Under the ‘corridor’ reserve management system (described in Section 2.2) which was in operation when the DMO was established, the impact of the Exchequer position on the banking sector would risk influencing the policy-targeted short-term interest rate in the inter-bank market and undermine the bank’s monetary policy objectives. As such, the Exchequer aims to accumulate no cash balances or debt on its accounts at the BoE by the end of each day, as these would reflect an equal and opposite impact on the banking sector. The DMO’s remit is, therefore, by the close of business each day, to drain any reserves which have been added to the banking system on days of net spending, or to return reserves which have been removed from the banking sector on days of net revenue. This is achieved by way of the trading of government securities in quantities which reflexively match the (anticipated) NEP [Net Exchequer Position].”

The end-of-day consolidation is known as the ‘Pyramid sweep’. This gives a Government/central bank end-of-day position in the Consolidated Fund. This is the only reference, but the odd thing is that until UCL, as the writer’s say: “Despite their central importance to government accounting, the functioning of the Central Funds are not widely known or understood by the general public and rarely, if ever, mentioned by economic or media commentators.” (p.9)

“If ever”. So where has this come from, and how is the leap made to the actions of banks? Again we are given no sources, adequate evidential support for assertions, and have to provide all the leg-work. Where is the substance? It is as if the weird left-field comments are still trying to reconcile money creation with fractional reserve banking.

Agreed

‘Banking Analysis’

You seem to miss out the Central Bank Reserve Account which is in actual fact the ultimate ‘last man standing’ guarantee to pay in the banking system (given that no one trusts the banks anymore).

It seems to me to be beyond you to accept that that ultimate power belongs with a State institution.

Because you are using the State’s currency after all – aren’t you?

Get over it and deal with reality will you? For once?

Precisely

Odd, isn’t

As if the BoE is not underwriting the whole show

Your description of what money is and how it comes into existence is accurate and very clear.

Reserves and interest paid on reserves is, I think, a bit more complicated…..

For sure, any money created by QE (government spending it into existence) MUST end up as reserves held the Commercial Banks at the BoE – where else can it go? But, for (almost) every pound they hold at the BoE as reserves there will be a liability to a depositor (who was paid by the Government at some point).

For monetary policy to work the BoE must pay interest on excess reserves (reserves over and above those needed to oil the wheels of the payments system). Suppose (for some bizarre reason) that you want policy rates at 3% – ie. you want to raise the cost of credit to the real economy to restrict investment etc.. Then you must pay interest on reserves (or sell gilts) at 3% – ish otherwise banks will end up lending their unrenumerated reserves at (say 1.5%) because it is better than zero. and your policy objective of 3% is not achieved.

Of course, interest on reserves is good news for the banks but ONLY because they do not pass that interest rate on to savers. So, if we are concerned about banks making windfall profits then we should still pay interest on excess reserves…. but seek to either force banks to pass it onto savers or tax it.

PS I am NOT advocating higher rates….

Clive

I get the issue re monetary policy – nit that I think it works

BUT what is wrong with tiered reserves? Not all £900 billion needs to have base rate paid on it for this to work

Richard

I agree with you about the limitations of interest rate policy. We also agree that higher policy rates reward banks for doing nothing as they earn that policy rate on reserves and do not pay it to depositors. We also agree that there is no legal (or other) requirement for the BoE to pay interest on reserves.

I guess all I am saying is that there may well (at some time in the future) be a need for higher rates and that for this policy to be transmitted to market rates may mean that paying interest on reserves makes sense. We need to keep open a variety of possibilities to manage credit, interest rates, bank profits etc. Tiered rates on reserves would certainly be one tool – NO interest rates on a big chunk of reserves needed to facilitate the payments system seem pretty obvious place to start. Rewarding banks for “good business” and taxing “bad” business through rates paid on reserves might also work.

What IS clear is that the old view that there is ONE tool and ONE tool only – a single “policy rate” that the BoE has to apply everywhere is nonsense.

Much to agree with there

Thinks Clive

Good post Richard.

I suspect that “Banking Analyst” might be rhyming slang.

Btw. youv’e got a couple of typos there:

“I think there are thee injections” (1st paragraph) and

“Thye no money assets of the Bank of England are treasury bonds”, 3rd last paragraph, (above balance sheet).

Thanks

‘What IS clear is that the old view that there is ONE tool and ONE tool only – a single “policy rate” that the BoE has to apply everywhere is nonsense.’

Sorry to be so ebullient on a Sunday morning but on reading this I could give you a big hug. Richard Douthwaite in his book ‘The Ecology of Money’ (2000) raises this issue and as soon as I read it I felt he was asking the right questions and I totally agreed with the lack of creativity and blunt instruments that orthodox monetarism advocates.

‘The Ecology of Money’ – a pocket battleship of a book – blew my mind when I first read it and opened it up to these fundamental questions which I found to be mostly ignored in economic discourse.

Until I came here of course!

Thank God.

“One tool to rule them all ” (no, not Johnson but interest rates) is a relatively new idea that became fashionable only in the late 70s and 80s. The idea that controlling the price of money could solve everything was nonsense and prior to that period any self respecting Central Banker would have been familiar with tools like FX controls, credit controls, reserve requirements, QE (but not that name) and, yes. the level of interest paid on excess reserves.

We are just having to get the world to re-learn what was once widely understood.

Indeed.

Richard, Thank you for this. As I understand your work, behind the complexity, all £s are Government-backed IOUs. They are either “printed” by the Government when it spends, or by banks when they make loans. They are cancelled by tax, or repayment of the loan. Obviously, if too many £IOUs are printed, it will make them less valuable and lead to inflation. Debt fetishists get worked up about this. However, I think there is a point that gets missed (https://sussexbylines.co.uk/the-mysterious-case-of-the-burnt-banknote/). Some £IOUs will be destroyed, some will go missing, and some will be locked way. The Government is off the hook for these £IOUs. This is just another way of saying that in the long run a Government cannot and need not ever “balance the books”. I suggest that missing money is an under-explored component of the financial system. It would take someone cleverer than me to work out how important this pathway is. My suspicion is that it may often be minor, but at times of crisis it becomes critical.

I think lost banknotes irrelevant due to their immateriality – nites and coin make up 3% at most of money

Change in the velocity of circulation of money matters much more – and it has fallen, dramatically

Yes, the missing banknotes are trivial, as is the Bullingdon Club member burning a £50 note. But I worry that so much bank lending is secured against the nominal value of an asset when the asset only has value because it is not realised. Where does the money go when an asset bubble bursts?

I worry too, whether the velocity of money means anything, if most money is moving is in rapid transactions in the financial sector. What does it matter if a multi-million derivative changes hands a dozen times in a day?

Is there a spectrum between the money spinning round in futile financial games, and the immobile money locked in assets with a nominal value which cannot be realised?

Is there a way of measuring the small proportion of money in the middle that is actually doing anything useful?

You are asking a relevant question

I am working in an answer

But it will have to wait

Sorry

As I discovered 50 years ago Economics is no a science. It only invented people with the Behavioural stuff. Before that there were no people only levers and automata

The BoE Q1 2014 Bulletin is straight from the horse’s mouth and cannot be denied unless the level of conspiracy is institutional.

Or ignorant.

Probably both.

The BoE Working Paper No 529 is also worth study as it seems to say that Central Bank reserves are created out of nothing in response to that commercial bank “lending” (money creation) out of nothing.

This is logical considering the overall model.

Thanks

And true