I campaigned for automatic information exchange from tax havens for a long time. Perhaps my most important paper on the issue was published in 2009. It was written after a meeting at the Treasury where I was told data exchange from tax havens would not happen in my lifetime and I set out to explain how it could, and how the data in question might be used.

We eventually won automatic information exchange. The OECD driven Comprehensive Reporting Standard began reporting in 2016 and has been fairly effective on a widespread scale since 2018. It takes time for reform to happen: this is one that can be very largely attributed to pressure from the Tax Justice Network during the era that John Christensen and I ran it.

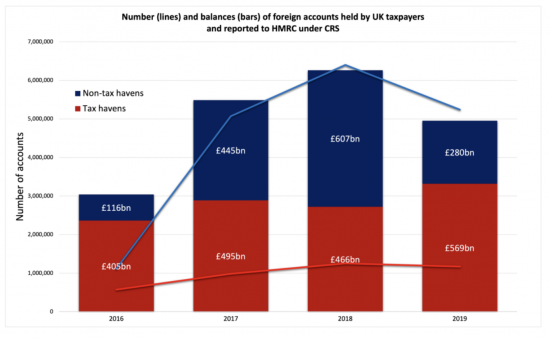

Now Dan Neidle has secured data from HMRC on the level of funds held offshore. The data looks like this:

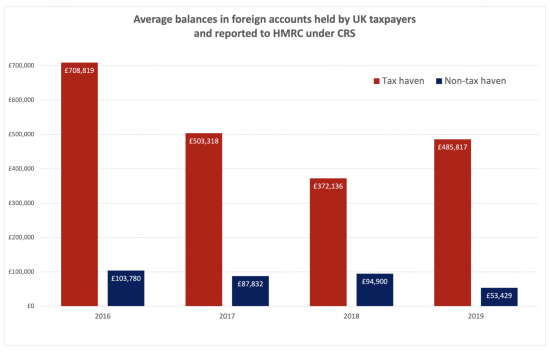

He has also secured data on average balances held split between tax haven and non-tax haven locations:

So, we now know we were right to be concerned. Around £570 billion is held in tax havens. You might expect that to yield a useful tax return each year, split between tax on income and gains.

But, as Dan Neidle discovered, HMRC has no idea how many of these accounts are properly declared, and nor has it sought to find out. It's as if they don't care. Instead, they are actually offering excuses, suggesting for example that most such accounts are probably held by non-doms and therefore not a concern, when in itself that is simply not true.

As Dan correctly points out, it is not possible to be sure what tax is lost as a result of this indifference by HMRC. It is their job to work this out. But we can be quite confident most of the accounts are not held by non-doms: there are just not enough of them.

So, what to conclude?

First, HMRC is not trying to collect tax owing.

Second, there is no one holding them to account for that.

Third, no wonder we have growing inequality in the UK.

Fourth, no wonder too that we have a tax gap that is out of control.

Fifth, there can be no political direction on this. Clearly, ministers have never asked.

I hope that pressure is brought to bear as a result because right now it is apparent that HM Revenue & Customs really do not want to collect tax from the wealthy.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Politicos set the tone for the “civil service”. The tone over the last 42 years is that “loads a money” is good and successive “governments” (I use the term losely – “rabble” might be more pertinent) have gradually emasculated a key function of the state (collecting taxes), not just in terms of manpower, i.e. boots on the ground to investigate and collect (eroded as it is by the insultants/tax dodgers recruiting from HMRC – basically using them as a training organisation), but also in attitudes which seem to have changed to “it’s all too difficult” & let’s go after the small fry – its easier & more fun (for years HMRC chased a friend – an ex BT engineer – for utterly trivial stuff).

That said, even back in the 1980s, HMRC/Inland Revenue were pretty incompetant & had rings run around them even then.

If a fiat currency is (partially) founded on the ability to collect taxes – what happens when that ability erodes? or is distorted to the point of a “them & us” society? Step forward the French revolution.

The last point is key: efficient tax collection is vital to sound macroeconomic policy

Well done Dan Neidle, always appreciated his work..

As I recall, a person with your name was one of the most significant stumbling blocks to securing data of this sort

Too many Andrews! That was not me.

I’ll admit, I was always sceptical that there would be political will for BEPS and the CRS to be implemented widely, but FATCA showed the way on the latter. The more recent OECD plans appear to be having some difficulties, but we’ll see if Pillar 1 and Pillar 2 ever happen and whether they make any difference. I doubt the UN would be able to do any better.

HMRC has been starved of resources for far too long. It is madness, when on any view, collecting the tax that parliament has legislated to collect is important. That is a political choices of course, just like the choices to cut benefits, and cut spending on all manner of public services.

I know it was not you

I know who it was

Hence my comment

I agree with you re Pillar 1 and 2. The UN would do worse though

I most agree on HMRC

Is anyone really surprised in this Decadent State?

The effectiveness of Neoliberal Conservatism has been far less dependent on legislation (often merely enacted to display ideological purity to supporters who wish to feed on ‘red meat’); than on the much easier, cheaper and most effective solution: ensure the Government does not provide the resources to enforce or protect the legislation that already exists. This failure to govern has the dual advantage for Neoliberal Conservatives over opponents, in being much cheaper to provide than any opposition government could match (save, of course that their indifference to government disguises their very, very expensive incompetence – or worse that always cost us far more); and at the same time being highly effective in ensuring the freedom to the public to exploit the vacuum; including the many crooks and charlatans that infect and plague our society. Nobody can turn piracy into ‘privateering’ and ‘buccaneering’, like the British.

It isn’t just organic viruses that bring us down; neoliberalism is a particularly toxic social virus.

Agreed

Perhaps someone needs to remind the electorate, as they celebrate this Jubilee, that taxes (and customs duties) are collected in the name of Her Majesty, not a government department.

It would pile righteous opprobrium upon the heads of evaders – or speed the march of republicanism, perhaps. It could even improve the spread of the MMT gospel.

Just a fantasy, you understand, but I can dream.

Richard

Seems like Dan is now campaining for Tax Justice – are you surprised? Perhaps you and Dan should join forces and/or do a podcast together?

I know you guys have had a twitter spat/fall-out in the past and argue about and disagree on many things about taxation so in some respects he’s an advesary of yours.

However, I admire that you have absolutely no issues with highlgihting, quoting his blog and referring to and bringing to people’s attention his work.

I can get on with people I don’t always agree with

“HMRC has been starved of resources for far too long. It is madness, when on any view, collecting the tax that parliament has legislated to collect is important. That is a political choices of course, just like the choices to cut benefits, and cut spending on all manner of public services.”

As an employee of HMRC I’ll defend it/us precisely on the above basis. HMRC staff would love to police tax havens and smart-arse avoidance schemes, if we were given the resources to do so. But not only has the department been shrinking for years, just when we were beginning to get more recruitment due to Brexit and Covid to replace lost staff, along comes the lunatic proposal to cut 20% of the CS in the next three years!

And that’s on top of the vindictive, bullying anti CS tone set by this government and it’s lackeys in the press. I happen to know that some people who’ve been applying to be homeworkers for very good personal reasons are being turned down , usually by poor managers, because of the ‘get back into the office’ nonsense we’ve had thrown at us.

On the issue of austerity and public service cuts, I allowed myself a grim smile this morning. The Today program was interviewing people who’ve been hit by all the delays at Mancheter airport. Principally due to staff shortages. Which, according to the GMB union representative, is partly caused by the jobs becoming increasingly poorly paid and insecure compared to other jobs in the area.

And also because when they recruit new staff, due to all the security requirements around air travel they have to go through stringent checks. But these checks are taking four months, and as the union bloke put it, people on UC or similiar aren’t going to wait that long for a wage packet so they take other jobs. And why do these checks take so long?

Because the government department doing them hasn’t got the staff due to cuts, according to GMB. Bingo! This was the point I allowed myself that smile. This, tory party, and tory voters, is where you’ve got the country.

You couldn’t make it up

But it’s happening…..