One of the arguments that Danny Blanchflower and I are making in our two person opposition to the prevailing establishment thinking on inflation is that the inflation we are now suffering will go away.

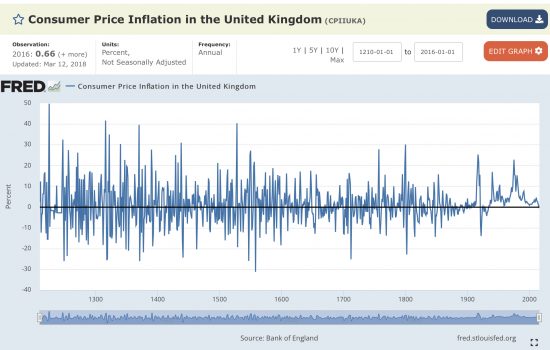

We don't say that this is because of anything the Bank of England, the Fed or European Central Bank might do, most especially when they are getting almost everything wrong right now. We say it simply because it always does. That is an argument that, unlike the irrational claim of central bankers that increasing the price of money stops other inflationary pressures, is backed by data. The data in question comes from the Bank of England but is best presented by the St Louis Federal Reserve Bank, who have a great website when it comes to data. As they display it, this is the inflation data for England and then the UK from 1210 onwards:

Note three things. The first is that the trend in the peaks is steadily downwards.

The second is that deflation has not happened for a century.

The third is that every peak is followed by a fairly rapid downturn.

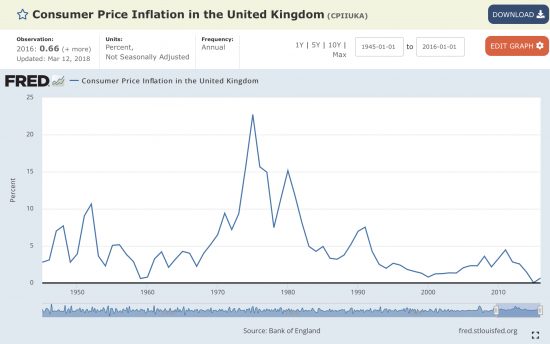

For those cynical about data from 1210 (and I am no more so than I am about that from last week in a great many cases) I have cut the period covered by the data in this second chart:

What is very apparent is how wavelike the pattern of inflation followed by deflation is until the last century.

And just in case anyone still doubts the data, this is the data from 1945:

The relevance of this last one is to show that inflation peaks are usually pronounced, and rarely result in plateaus. Even if they do, those plateaus are of short duration after which the trend is that there is an almost invariable sharp decline.

Politicians can make things worse, of course: Thatcher did in the early 80s, which most people tend to forget, but there are always consequences for deliberately trashing an economy, as she did. These exceptions apart, it is clear that inflation has not only recently, but throughout 800 or more years of history had a habit of correcting itself.

There are three reasons for pointing this out. The first is to suggest that talk of stagflation is just nonsense. That is especially the case when pay rises are way below inflation, and we're facing a cost of living crisis because of a shortage of income right now and not demand-pull inflation because of excess wage rises at present.

Second, if inflation reverses without assistance much of the supposed role of supposedly independent central banks disappears.

Third, the focus of policy during periods of inflation should not then be on tackling the inflation. That will sort itself out simply because the panic buying, or market failings that give rise to it, will always be resolved by the the creation of a ‘new normal' in which sanity is restored.

Fourth, instead the focus of policy during a period of inflation should be to:

a) make sure people survive it i.e. to protect the vulnerable who might otherwise suffer as a result of their loss of purchasing power (which should be the priority now);

b) to prevent the risk of recession because of the loss of that purchasing power creating short term liquidity issues for businesses that cannot see a way through to the other side of the inflationary period as a result, with a resulting loss of wellbeing for all involved. This is especially important right now because unless it happens the current pressure on spending p0wer is going to spillover very quickly into serious unemployment;

c) to address the systemic issues giving rise to the political, economic or social failure that resulted in the inflation. So, in our case:

- address Brexit;

- continue measures to tackle the impact of Covid on society;

- tackle the causes of war in Ukraine;

- address the vulnerability in supply chains;

- reform energy supply and make it more sustainable, and

- address the global crises (I use the plural deliberately) developing around food.

What would you not do? Increase interest rates, for a start, threatening mass homelessness when people cannot afford rents or mortgages out of already crushed incomes, and which force businesses into unmanageable debt, and which force developing countries who borrow in dollars into insolvency, whilst benefiting the financial establishment.

What else would you not do? You'd not sit back and do nothing to reduce the inflation peaks when they can be capped by judicious tax cuts to VAT and duties, which makes any downside of this crisis much easier to manage.

And what you would do is provide very specific support to the most vulnerable (people on benefits, pensions and low pay) whilst taking purchasing power away from those on high incomes and earnings who represent the one part of the economy where demand-pull conditions might exist.

This is a theory of how to manage the situation we are now in based on analysis, not economic voodoo. I fear that no one will listen until the damage has been done, but Danny and I will persist in making our case.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is UK data only. The UK accounts for around 1/50th of world GDP. And the data before the 2nd world war relates to a country that had a significant empire and a different monetary system.

The point I’m making is that this is a very insular piece of commentary. Getting the Thatch in – doof!

There must be lots of data from the modern era of so-called operationally independent central banks across the many territories that now have them. That’s the research angle an internationalist should be looking at.

You may not be aware of this, but currencies are nationally based

Great stuff this – nothing to add.

It is a total lie that Government has its hands tied – they do not.

It’s a case of ‘won’t’, not ‘can’t’.

The simple point with inflation is that it is an increase in prices since last time. It is a first derivative. So a shock can create inflation for a short period, but you only get sustained high inflation if prices continue to rise over a sustained period. Either a series of shocks, or a shock that changes perceptions and expectations, so that prices and wages continue to rise for an extended period in lockstep, like the 70s into the 80s, when inflation was around or above 10% for a decade. Could it happen again?

I doubt it…

“The simple point with inflation is that it is an increase in prices since last time. ”

That is something that I find people geenrally fail to grasp. Inflation dropping does not mean prices dropping, just prices rising less than they did 12 months ago. While that would not really matter when low incomes increase in line with price rises, for the last 10 years at least, they have not done so. So even falling inflation still means that the least well off continue to struggle to survive.

Absolutely spot on

I note in the 1800’s and only in the 1920’s after each spike in inflation there was an immediate negative inflation, but never there after. Why.

The collapse is what matters

Lord King (ex-Governor of the BofE) has now criticised the BofE for issuing too much QE and fuelling inflation.

QE inflated asset prices (the mistake I see was handing QE money to the insiders; banks, dealers and institutions who fuelled the asset bubble – money to the wrong people), but I struggle to see how that fed into the cost of living crisis; on the back of austerity overload for ten years decimating the UK economy, the Covid-19 world pandemic, and the war in Ukraine; all creating crisis shortages of supply across multiple resources with a direct impact on the lives of ordinary people; which seems to me quite distinct.

The more I hear from central bankers, the less convincing they are; and the more unreliable, as sources of economic wisdom they appear.

Indeed the Financial Crash 2007-8 was in significant part their fault; they did not fix it; and now they seem to be trying to repeat the failed central banking policies of the 1930s, after the 1929 Crash and Depression. We are dealing now with the abject intellectual failure of the economics profession and the central bankers; supported by ill-informed politicians. As I thought; much like the 1930s.

The only real thing that is being inflated here is King’s ego – mind you his belly is pretty large from all those City dinners he to (and probably still does).

So, what do we have emerging now – the latest Neo-liberal sourced theory on inflation – and the finger will point at Government and Government intervention. Blame game.

And the conclusion?

Leave everything to the market.

What a surprise!!

These bankers (another term comes to mind inappropriate for a family blog) should take a leaf out of FDR’s playbook of the 1930s. He lost his nerve in 1937, but got it back about a year later. Then war preparations took his fiscal spending into the stratosphere. Unfortunately, we got Bretton Woods under Truman after the war. I don’t know what it is about the neoliberal virus; it seems almost impossible to shake.

Much of Bretton Woods worked at the time

It would not now

As a visitor to your blog from time to time, but without having been indicated to your way of thinking, I kept wondering how you’d respond to your critics who would surely say that inflation was got under control by the recessions that occurred, most particularly the Volker recession. That conforms with the idea that inflation became entrenched over the 1970s and was wrung out of the system by a recession. In Australia the inflation continued till the next recession in 1990. It didn’t go down by itself.

How do you know that destruction destroyed inflation?

Why are you so sure?

Thanks for your reply.

I’m NOT particularly sure and I have no idea why you think I am. I simply asked for you to explain to me why that view is wrong and yours is right.

You’re the one who’s making an argument. I’m quoting what most of the economists I know would say in response. I’m a little taken aback that you don’t seem to feel under much obligation to address the ‘commonsense’ of the profession.

I’m asking because as an economist I know orthodox economic commonsense is often wrong. But if I try to take on economic commonsense — as I did for instance here (https://www.ineteconomics.org/perspectives/blog/how-economics-forgot-its-subject-matter). But when I’m making that argument, I go out of my way to try to persuade people rather than simply assert that I’m right and they’re wrong.

I want to know what your arguments against the standard response are.

And how, if inflation somehow just goes down of its own accord, it didn’t in Australia between 1973 and 1990. The basic story peddled is that it got built into expectations and that from there there was a self-sustaining wage/price spiral. I’d like you to try to persuade me that your way of thinking about the way things happen is more convincing than the orthodoxy.

I admit I don’t deliver arguments on demand

And to suggest I don’t offer arguments when I have written 19,000 posts offering arguments is, politely, a little arrogant on your part.

So why don’t you start with me free E-book pinned to my Twitter account where I offer about 160 pages of argument and then come back instead of expecting a personalised service which I clearly cannot supply if I am also to have a life?

Mr Gruen,

Economics notably fails to do prediction well, or even adeuqately. Every time there has been a major economic crisis, not only does the economics discipline fail to predict it, but economic theory is often responsible for stoking the disaster (I offer the 1929 Depression and 2007-8 Crash merely as base illustations); more often than not economics fails spectacularly. This is simply an inescapable fact. It is this failure that is the warning sign that their scientific methodology is inadequate, deeply unsatisfactory and fundamentally wanting. Experimental economics (the bit that should test economic theory) is quite new and notably undeveloped as a core part of the discipline. No other ‘science’, even most social sciences would become so detached from the test of reality, or develop adequate tools of close observation, or be allowed to fail so consistently, so often and survive.

I invite you to think through the implications.

Why on earth blog for a particular way of seeing the world just to assert it — rather than present your readers with persuasive arguments?

Anyway — it’s a free world. Arrogant little old me ey? Hoping that someone pushing a barrow might deign to explain it to someone who’d like to engage with them on their blog — anyway, I won’t trouble you again.

The arrogance is all yours

I offered you the answers you asked for but what you want me to do is provide a personalised service

It’s a classic troll demand to waste time

No — not a troll

Does the article of mine I included in my comments read like the article of a troll?

Yes

And you use a different url every time you comment – a very sure sign