As the FT has noted this morning:

UK consumer confidence plunged in February and many measures of spending remained below pre-pandemic levels as surging living costs hit morale even before Russia invaded Ukraine. The consumer confidence index, a closely watched indicator of how people view the state of their personal finances and wider economic prospects compiled by research company GfK, fell seven points to minus 26 in February. It was the lowest score since January 2021 and one of the worst since the start of the pandemic.

The trend is heavy, and marked. The report also reflects what is really happening. Spending on what are called 'delayable items', like clothing and homeware are down, with little sign of likely recovery, whilst spending on entertainment is also running much lower than last November. There is as yet no post-Omircon recovery. In other words, it is very likely that the mood has changed, significantly.

This is hardly surprising. Threatened and real increases in food prices, petrol and diesel costs, energy tariffs and taxation are all casting a very long shadow over consumer confidence for the very good reason that many household budgets are going to be stretched to their absolute limits. And that was before war in Ukraine.

What was already looking to be a fairly grim economic situation is now, in my opinion, looking very much like a profoundly recessionary environment. Petrol prices are now expected to rise to £1.60 per litre. If yesterday's gas price increases are sustained the domestic energy price cap would have to increase to something like £3,000 a year this autumn, which will push many households into an impossible situation when trying to balance their budgets. And, given that both Russia and Ukraine remain major wheat exporters, the price of food is going to rise as well.

And then, just as if things were not bad enough, the Bank of England is still sending out the message that it intends to increase interest rates.

Add all these factors up and the fall in consumer confidence is entirely rational. More than that, we should read it it as predictive. As my fellow Mile End Road economist Danny Blanchflower points out in his research, consumers have been consistently better at predicting recessions than central bankers and economists. They have got the last seven right and I doubt that anybody else can claim that. We should in that case be listening to what they are saying and take heed of it.

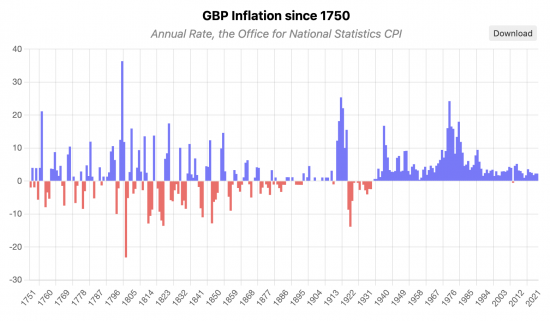

The reality is that although we are not technically at war, and I hope that that remains the case, we will for some time to come be living in something akin to a wartime economy, with all the price implications that this brings. In particular, some realities have to be accepted during wartime eras. One of them is that wartime inflation is inevitable:

The stand out peaks in inflation are due to the Napoleonic Wars, World Wars 1 and 2 and the 197os Middle East conflicts, and their fall out.

To pretend that this war is not going to have such a consequence would be absurd. War changes everything. What it should be changing is the attitude of the Bank of England towards trying to control inflation when there is nothing whatsoever that it can do about it at this point in time. The sooner that this is acknowledged, the better.

The sooner that the government recognises that it will have a duty to protect those who are most vulnerable as a consequence of this change in circumstance, the better too.

Whatever the outcome of the war in Ukraine, and we can but hope for the best at present, the real consequences for the UK economy are going to be very significant indeed. In particular, without dramatic government action to support the well-being of very large numbers of people in the country the growth in poverty is going to be almost unprecedented in scale.

To react, a number of things are necessary. First, really effective measures to control the economy that will also impose sanctions on Russia are required. I discussed some of these a few days ago. Call these wartime controls if you like. I don't really care: the time to take corruption out of our economy has arrived.

Second, there will be an urgent need for economic support for people, and the economy in general. Far from the government standing back, which is its preferred course of action, now is the time for it to take action to prevent very real hardship from arising.

Third, this will require a radical change of approach from the Bank of England. Far from it being in the mood to increase interest rates, I very strongly suspect that these need to be cut and a new programme of quantitative easing will need to be considered to support new plans for government expenditure.

Fourth, the government will need to reconsider very quickly what its taxation priorities are. A very rapid shift in the burden of taxation away from those who are going to be hardest hit by the price pressure that is about to happen, and onto wealth, is absolutely essential if the correct balance of taxation to support the economy at this point of time is to be put in place.

Fifth, this change of policy needs to be very publicly announced to provide people with the confidence that they require so that they might have a reasonable hope of getting through the coming economic crisis which now looks to be unavoidable.

Wartime leadership is nothing like that in peacetime. There is now war in Europe, even if we are not directly involved. To pretend that economic management can stay as the government planned only a week ago would be the most massive policy mistake on its part. I am only hopeful that the dogmatists in the Treasury are aware of this.

Everything has changed.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I doubt very much whether this Tory Government is capable of change. I’m afraid life is going to become very much more difficult for most real people in the U.K. Unfortunately, this situation has happened when we have the most corrupt administration in the history of the British Isles, who in no way, have the best interests of it’s people at it’s heart.

There’s a lot of corruption in wartime economies, quite often incentivised by government doing stupid things like bringing in quotas and price controls.

The trouble is that UK government is daft enough to do this, and still continue to subsidise fripperies like the arts and giving handouts to the richest farmland owners.

The arts are not fripperies- they employ a significant number of people and can do a lot for people’s mental health.

I notice that you have not identified or complained about the massive to subsidises to private landlords whilst failing to provide adequate housing, and subsidise employers who pay their employees at and below minimum wages.

Not only do the arts employ a lot of people, and provide a lot of enjoyment, these “fripperies” are one of the things that we as a species do, and that make life worth living, like science.

And the creative sector as a whole makes a lot of money for the country. You don’t get successful music, film, fashion, graphic design, theatre, etc, without a wide base of creative activity below, from art schools to youth orchestras to local theatres and amateur dramatics. Who knows where the next Damien Hirst or Amy Winehouse or Idris Elba is going to emerge from. And yes, some of that activity needs public funding.

As a former governor and secretary to an undergraduate and postgraduate theatre school that is now part of the University of the Arts, I agree

Apologias AliB. I should have raised an objection to massive subsidies to landlords, public and private, as well.

Despite the point about art having benefits and the misdirection about education, which is not in dispute, I object to the UK government subsidising it during wartime.

That may be when it is needed most: don’t you appreciate the need to understand why we might be at war, which very often only art can explain?

I very much appreciate the need to understand why we might be at war, and art can sometimes explain that.

I object to the assertion that art is frequently the only explanation and that wartime government should be subsidising it.

I think you really do not understand what this blog is about in that case

Besides the other arguments, art is a very powerful tool of communication – not least as propaganda and to maintain morale – and that is exactly why many governments will continue to subsidise it in times of war. Do you think expenditure on war artists is wasted? Or troop entertainment? Is it art in general that you detest, or are there particular types that you object to?

I wish otherwise but I suspect that war will be used to justify austerity.

And I wonder what else the Tories will do under the cloak of this crisis to our society?

The suggestions are mostly common sense – but square very badly indeed with narratives spouted by tory imbeciles concerning “smaller government”. If they continue on that track, then the 2020s and 2030s will make the 1930s look like a cake walk.

There is also the question of government capacity. Local gov has been hollowed out over circa 40 years by assorted toryscum governments. Even a core government competence, collecting taxes, has been hollowed out – as profiled in the blog ad nauseum. (& a knock on effect has been to allow the Russian mafia free reign in the UK-oblast).

Unless Liebore can articulate an alternative (& I question if they have either the intellect or the imagination), things do not look good.

When people advocate smaller government, I do wonder which of the various activities of the government they would like to reduce in any meaningful way, and how.

The largest amounts from the public purse go on pensions and other social security (so what, we let the old and poor fend for themselves, or set up modern workhouses?) , health (we want more sick people to suffer and die?), education (less investment in the young?), defence (already at pretty low levels), the home office (less police, and courts, and immigration controls?). And then everything else – transport, housing, industrial policy, agriculture, the environment – is a small fraction of the whole.

You can’t have Scandinavian style public services with a US size government. It just does not work.

Andrew’s second paragraph neatly sums up why there’s a Scottish Independence movement.

I suppose it very much depends on what you are counting as “government” in the USA context. There may not be much “government ” in the USA dedicated to the provision of welfare/benefits for private individuals in the lower levels of the socio-economic sphere but, if you consider the whole security/ military aspect of the USA government then it looks huge to me.

I’d bit your hand off for petrol/diesel at £1.60 per gallon. That’s about 35p a litre! (in your third paragraph)

On a more serious note, I don’t see this Chancellor taking the necessary economic measures. It’s a shame that he doesn’t understand that he really does have a money tree at his disposal.

Apologies! Age shows…..

I thought the mistake was very funny, but decided to point it out anyway. 🙂

It is such an old habit

I still think mpg

In a wartime economy empty and underused property was requisitioned and put to use for the war effort.

Should we not be thinking of requisitioning Russian oligarch empty property in London to home the homeless?

I hear stories of queues at the pumps

Yes there were queues – as usual the West gets it’s priorities right. We’re so well trained by the market to ensure that getting to work is our first priority in the face of fascism and international aggression.